Reports are emerging that policymakers could dramatically change the composition of tax increases that would pay for new spending under the president’s Build Back Better agenda. Possibly out is a hike in the corporate income tax rate, currently 21 percent. Possibly in are 1) a modified version of Sen. Elizabeth Warren’s (D-MA) wealth tax, 2) a corporate minimum tax, 3) increased funds for IRS enforcement, 4) a stock buyback tax, and 5) international tax changes.

What implications do these five proposals have for U.S. taxpayers? While we are still waiting on the details of the new potential White House proposals, NTU and NTU Foundation has the basics covered.

What’s the Deal With Wealth Taxes?

- Sen. Warren’s plan would tax wealth between $50 million and $1 billion at an annual rate of 2 percent, while wealth above $1 billion would be taxed at a 3 percent rate

- The proposal also includes anti-avoidance provisions that include an enormous $100 billion cash infusion into the Internal Revenue Service (IRS), a 30 percent minimum audit rate, and a 40 percent exit tax rate on taxpayers subject to the tax leaving the country

- A major reason why countries generally avoid -- or have repealed -- wealth taxes is the difficulty inherent in assessing the value of non-liquid assets

- Warren’s plan, like most other wealth taxes, would also establish perverse incentives when it comes to investment decisions

- NTUF has documented how past wealth tax proposals could carry unintended consequences, one major one being the impact on entrepreneurship

What’s the Deal With Book Minimum Taxes?

- Book income is a form of financial reporting that adheres to Generally Accepted Accounting Principles (GAAP)

- According to the Joint Committee on Taxation (JCT), the primary purpose of book income (used interchangeably with “financial reporting” throughout this brief) is to “provide information about a company to investors and creditors”

- There are several ways book and taxable income can differ in a given year for a given company; some differences are temporary and some are permanent

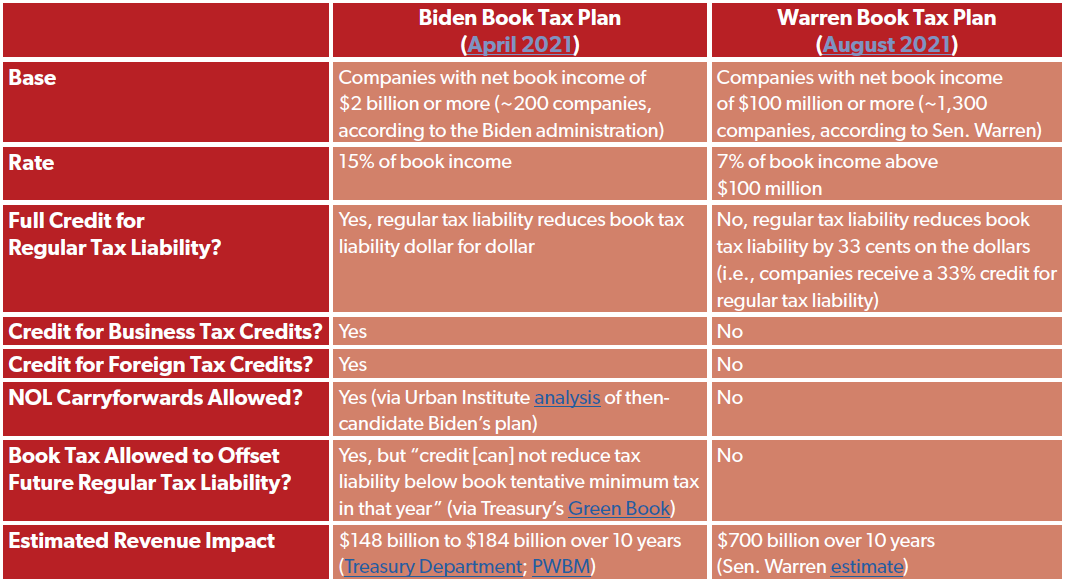

- The two major proposals to tax book income come from President Biden and Sen. Warren; here are the details of those plans:

Read more here from Andrew Lautz: “What’s the Deal With Book Taxes?”

What’s the Deal With IRS Enforcement?

- As Democrats continue to mull over a smorgasbord of tax hikes to pay for their planned $3.5 trillion spending spree, they claim they can rake in $780 billion in new revenue over a decade by beefing up the Internal Revenue Service’s (IRS) budget by $80 billion over that same time period and requiring banks to report on account flows to the IRS

- The main thrust of the enforcement initiative is to increase the IRS’s capacity to scrutinize taxpayers’ information, increase the number of audits, and to increase collection of taxes

- While it is important to make sure that people are obeying the laws and not cheating on their taxes, NTUF recently pointed out enforcement is no silver bullet to eliminate the tax gap and would impose huge administrative and privacy burdens on taxpayers

Read more here from Demian Brady: What’s the Deal with IRS Tax Enforcement and the Federal Budget?

What’s the Deal With Stock Buyback Taxes?

- Stock buybacks are when publicly traded corporations use spare cash to buy back shares of stock from shareholders

- A business that buys back shares does more than improve its stock price

- It also provides itself room to reissue these purchased shares at a later date when it does need to finance new investments

- One 2017 study by the Federal Reserve Board of Governors found no relationship between the level of share buybacks and dividends and investment expenditures

- An excise tax would reduce the return to investors by not only the two percent that would go to the Treasury Department instead of shareholders, but by reducing the incentive for corporations to perform buybacks in the first place

Read more here from Andrew Wilford: What’s the Deal With Stock Buybacks?

What’s the Deal With International Tax Reform?

- U.S. corporations with foreign subsidiaries they control (controlled foreign corporations, or CFCs) pay taxes on 1) subpart F income and 2) Global Intangible Low-Taxed Income (GILTI)

- A small portion of U.S. corporations paid taxes on GILTI in 2018, the first year GILTI was in effect; according to IRS data from tax year 2018, there were 9,127 U.S. parent corporations with 83,632 CFCs that had GILTI (out of 6.6 million total U.S. corporations overall)

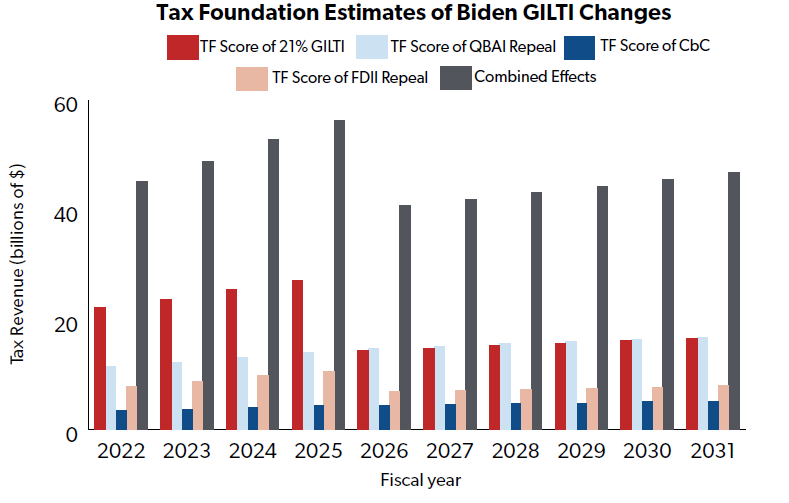

- President Biden has proposed doubling the GILTI rate from 10.5%-13.125% to 21%-26.25%; requiring companies to calculate GILTI liability on a country-by-country basis, rather than allowing them to blend foreign taxes owed and paid on a global basis; and repealing the deduction for Foreign Derived Intangible Income (FDII)

- The below chart shows Tax Foundation’s scores for President Biden’s GILTI and FDII changes

Read more here from Andrew Lautz: What’s the Deal With International Tax Reform?