(pdf)

What Is Book Income?

Book income is a form of financial reporting that adheres to Generally Accepted Accounting Principles (GAAP)

Publicly-traded companies are responsible for reporting book income to their investors and shareholders

GAAP standards are developed by the Financial Accounting Standards Board (FASB), a private sector non-profit organization that is “recognized by the U.S. Securities and Exchange Commission as the designated accounting standard setter for public companies”

According to the Joint Committee on Taxation (JCT), the primary purpose of book income (used interchangeably with “financial reporting” throughout this brief) is to “provide information about a company to investors and creditors”

This is notably different from taxable income (or “tax reporting”), which may differ significantly from book income (or “financial reporting”) because taxable income is determined by lawmakers and regulators through the Internal Revenue Code

How Do Book Income and Taxable Income Differ?

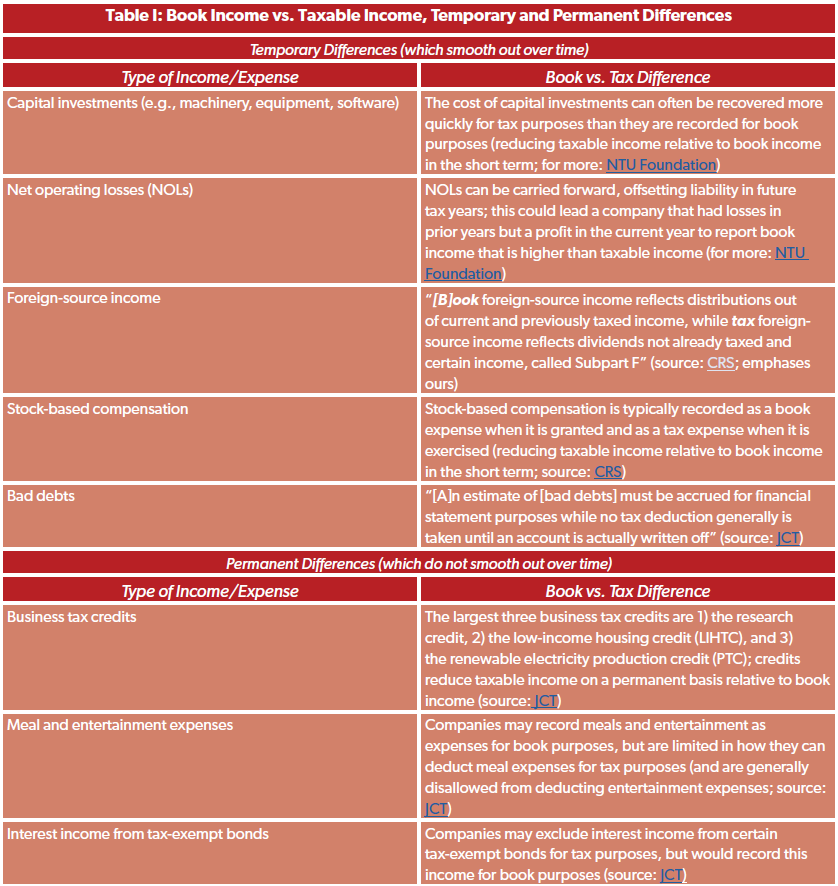

There are several ways book and taxable income can differ in a given year for a given company; some differences are temporary and some are permanent

The following table includes some major book-tax differences but is not an exhaustive list by any means:

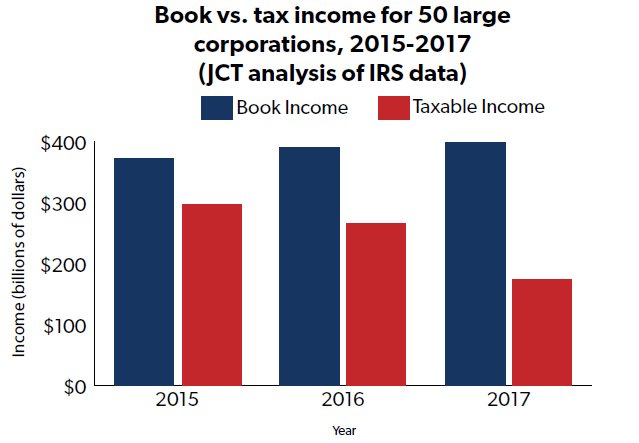

- Book and taxable income differences can be significant; the following chart illustrates book-tax differences for 50 large corporations from 2015-2017, according to JCT analysis of IRS data:

Of note, the significant changes to corporate taxation under the Tax Cuts and Jobs Act (TCJA) could account for the significant reduction in taxable income in 2017

Or, as CRS has written, TCJA “changed the tax treatment of multinationals, which may explain the significant book-tax difference in 2017, the year before many of the law’s changes went into effect. Firms may have recognized commitments to larger dividend payments from foreign affiliates for book purposes but delayed paying those dividends until 2018, when dividends became exempt.”

Why Do Some Policymakers Want to Tax Book Income?

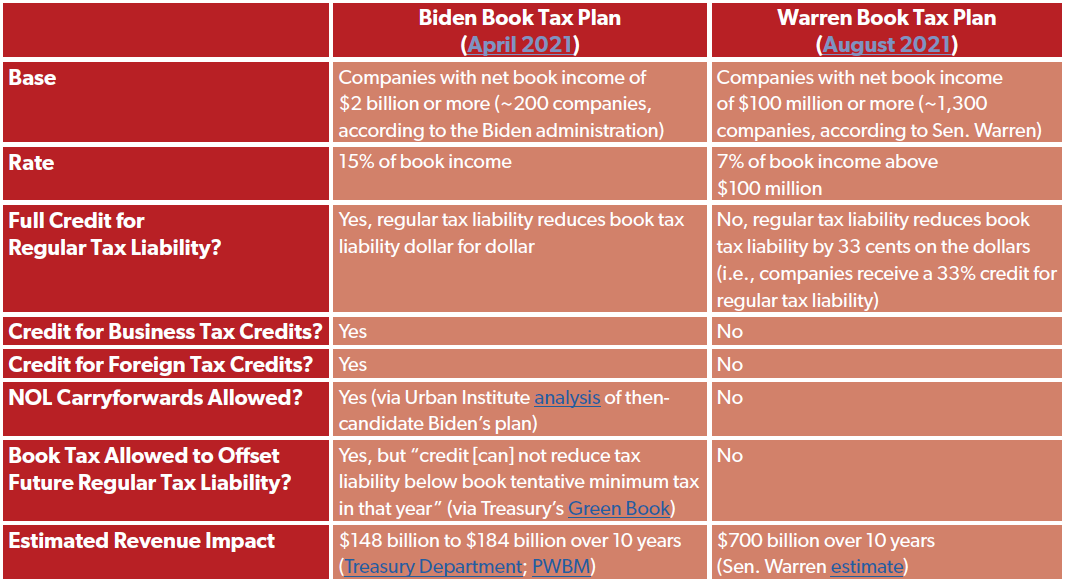

Some leading policymakers, including President Joe Biden and Sen. Elizabeth Warren (D-MA), have proposed either minimum taxes or surtaxes on book income

President Biden refers to “significant gaps in current tax law,” “offshoring incentives,” and “a variety of allowances” under current law which create differences between book and tax income that must be taxed

As noted above, what the President and his administration often fail to discuss is that the “gaps” and “allowances” they critique are often the result of temporary differences and/or provisions of the code that have earned widespread support from policymakers

The Biden administration implicitly acknowledges this by allowing companies to account for NOLs, previous book income taxes, and business tax credits in their calculation of book tax liability (more on the Biden proposal below)

Sen. Warren (along with Sen. Angus King (I-ME) and Rep. Don Beyer (D-VA)) frames the issue as “corporate double dealing” that “exploit[s] a host of loopholes, deductions, and exemptions”

While some book-tax differences could be attributable to “aggressive positions for either book or tax purposes” (more from JCT here), it bears repeating: many book-tax gaps are the result of either timing differences or popular provisions of the code

An influential series oft cited by book tax proponents is the Institute on Taxation and Economic Policy’s (ITEP) series on corporations that reported paying no federal corporate income taxes in a given year. Much like the Biden and Warren critiques, the series paints with a broad brush and characterizes all book-tax differences that are a result of tax policy -- including NOLs, accelerated depreciation, and tax credits -- are “loopholes.”

What Are the Major Proposals to Tax Book Income?

The two major proposals to tax book income come from President Biden and Sen. Warren; here are the details of those plans:

What Are Some Potential Consequences of a Book Minimum Tax?

Economic Consequences

A Tax Foundation estimate of an earlier version of Sen. Warren’s book minimum tax found the tax would:

Reduce GDP 1.9%

Reduce the nation’s capital stock 3.3%

Reduce wages 1.5%

Reduce the number of full-time equivalent (FTE) jobs by 454,000

Note: Tax Foundation modeling does not account for the new version of Warren’s book minimum tax proposal, which includes a partial credit for regular tax liability

A book minimum tax could undermine investment in the U.S., if the book minimum undercuts provisions that allow companies to run a net loss (which can arise from making investments) and to fully expense the costs of capital investment (such as full and immediate expensing for machinery and equipment under TCJA)

Global Consequences

A book minimum tax would make the U.S. an outlier among its economic peers

China, Japan, Germany, the United Kingdom, France, Canada, Russia, Brazil, Australia, Spain, and Mexico are among the high-GDP countries that do not have a corporate alternative minimum tax (AMT); India, Italy, and Korea are among the high-GDP countries that do have a corporate AMT

Combined with the proposed changes to the international tax regime, the Biden or Warren book minimum taxes could make the U.S. a less competitive place for multinational companies to headquarter and/or make investments

Political Consequences

Experts have warned that conforming taxable income to the book income standards effectively set by FASB could politicize a non-profit, privately-run organization (see the following analysis from AEI’s Kyle Pomerleau)

Alternatively, as JCT has written: “proposals which rely on the Congress to set out new accounting standards to be used for both financial accounting and tax purposes would contradict decades of practice in the accounting and auditing fields”

Unintended Consequences

JCT has pointed out that companies that are using “aggressive positions” for either book or tax purposes could continue to do so, if there is no “healthy tension” to report high book income and low taxable income

This could apply to companies that are not publicly traded

This could apply to companies that are not “motivated to maximize profits in particularly profitable years,” because they and/or their investors value steady earnings more

Where Can I Find Additional Resources?

JCT, “Corporate Tax Receipts And Corporate Tax Liabilities,” February 2020

JCT, “Present Law And Background Relating To Corporate Tax Reform: Issues Of Conforming Book And Tax Income And Capital Cost Recovery,” May 2006 (due to numerous changes in the tax code since publication of this report, some analysis in this JCT report is out of date)

Treasury Department, “General Explanations of the Administration’s Fiscal Year 2022 Revenue Proposals,” May 2021

CRS, “Minimum Taxes on Business Income: Background and Policy Options,” August 2021

AEI’s Kyle Pomerleau in Tax Notes Federal, “Joe Biden’s alternative minimum book tax,” October 2020

Tax Foundation’s Erica York and Alex Muresianu, “Senator Warren’s Corporate Book Tax Is Wrong Way to Fund New Spending,” August 2021

Former NTU Foundation VP Nicole Kaeding, “Profitable Companies Aren't Always Profitable,” January 2020