President Trump recently proposed a 10 percent annual tariff collar around the U.S. economy. It would be more accurate to call this massive tax increase a noose.

- Based on 2022 import volume, a 10 percent tariff would cost taxpayers $322.6 billion in year one. As President Trump observed, this is “a massive amount of money.”

- In real dollars, a $322.6 billion tariff hike would be the largest tax increase since the conclusion of World War II.

- This would equal an average of $2,600 per household in new taxes in a single year.

- For comparison purposes, over 10 years this tax increase would be more than twice as high as the tax reduction provided in President Trump’s signature Tax Cuts and Jobs Act, which lowered taxes by $1.456 trillion over 10 years.

- This regressive tax increase would undermine efforts to get inflation under control. For instance, nearly all of the shoes and clothing purchased by Americans would be subject to the 10 percent tax.

- This regressive import tax would be especially burdensome for those households that are least able to afford it. Unlike income taxes, which impose higher rates on high-income taxpayers, import taxes are regressive, costing lower-income households a greater percent of their income than their well-to-do counterparts would have to pay.

While these estimates are reasonable based on the given assumptions, the real-world impact of such a radical change is more difficult to predict. Because trade volume typically increases every year, the revenue raised by new tariffs could be even higher. Since 2012, for example, U.S. goods imports increased by 42 percent. On the other hand the tariff hike would lower imports by making them more expensive, reducing the amount of revenue raised. A catastrophic global trade war would reduce tariff revenues even further.

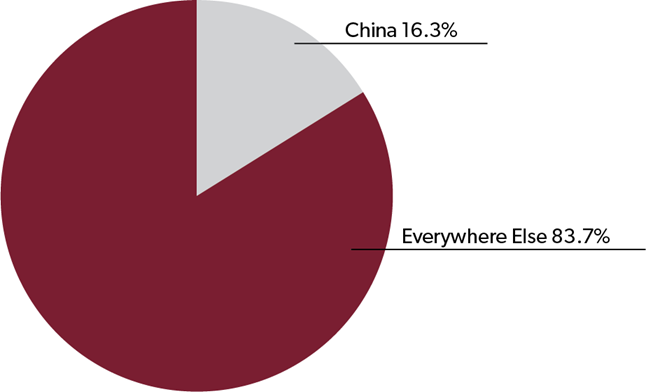

President Trump’s tariff comments are a good reminder that if you scratch a China hawk, beneath the surface you’ll often find an old-fashioned protectionist. Trump’s proposed tariff hike would largely hit Americans importing goods from our friends and allies – not China.

Figure 1: U.S. Imports (2022)

Source: U.S. International Trade Commission

In his interview, President Trump suggested that U.S. tariff hikes might cause other countries to lower their tariffs. History shows the more likely result would be trade retaliation against American exporters and economic devastation far exceeding the initial tariff costs.

In addition to his 10 percent tariff proposal, President Trump called for matching “retribution” tariffs to equal foreign tariffs. The flaw with this plan is that if the U.S. government added a new 10 percent tariff we would have one of the highest tariff rates in the world, leaving just a handful of countries to seek retribution against. Instead, nearly every country in the world would be seeking retribution against the United States.

If there’s any doubt about whether the ring-around-the-country tariff is a good idea, imagine the response if the threat to surround the United States with a tariff noose came from China’s President Xi Jinping instead of from Donald Trump. Either way, it’s a ludicrous and destructive idea.