Key Facts:

- Former presidents are very wealthy and continue to earn millions from books, speeches, and media deals, yet still receive over $5 million a year in taxpayer-funded pensions and perks for offices, staff, and supplies.

- Budget data for FY 2026 show that Biden’s office and expense perks will exceed those of the other former presidents. He also is eligible for a generous congressional pension for his time in the Senate.

- Senator Joni Ernst’s Presidential Allowance Modernization Act would cap pensions, limit expense allowances, and cut perks for wealthy ex-presidents to save taxpayers millions.

Introduction

Former President Joe Biden recently landed a $10 million book deal for his presidential memoir—just one of many lucrative opportunities available to former presidents. Yet, despite his private-sector earnings and personal wealth, Biden is receiving more taxpayer-funded perks than any other former president.

By virtue of his time in the Senate and as Vice President, Biden qualifies for an annual congressional pension starting at $166,374. Under the Former Presidents Act of 1958 (FPA), he also receives a presidential pension equal to a Cabinet Secretary’s salary—$250,600 in 2025. Together, these benefits provide him with a taxpayer funded annual retirement income of nearly $417,000, exceeding the $400,000 salary paid to the president.

The FPA also provides additional perks, including staff, equipment, and office space. Since 2000, former presidents have received over $130 million in taxpayer-funded pensions and perks—an average of more than $5 million per year. Budget data for FY 2026 show that Biden’s office and expense perks will exceed those of the other former presidents.

Thankfully, new legislation from Senator Joni Ernst (R-IA) would finally reform these generous benefits to protect taxpayers from subsidizing wealthy former presidents.

Presidential Wealth

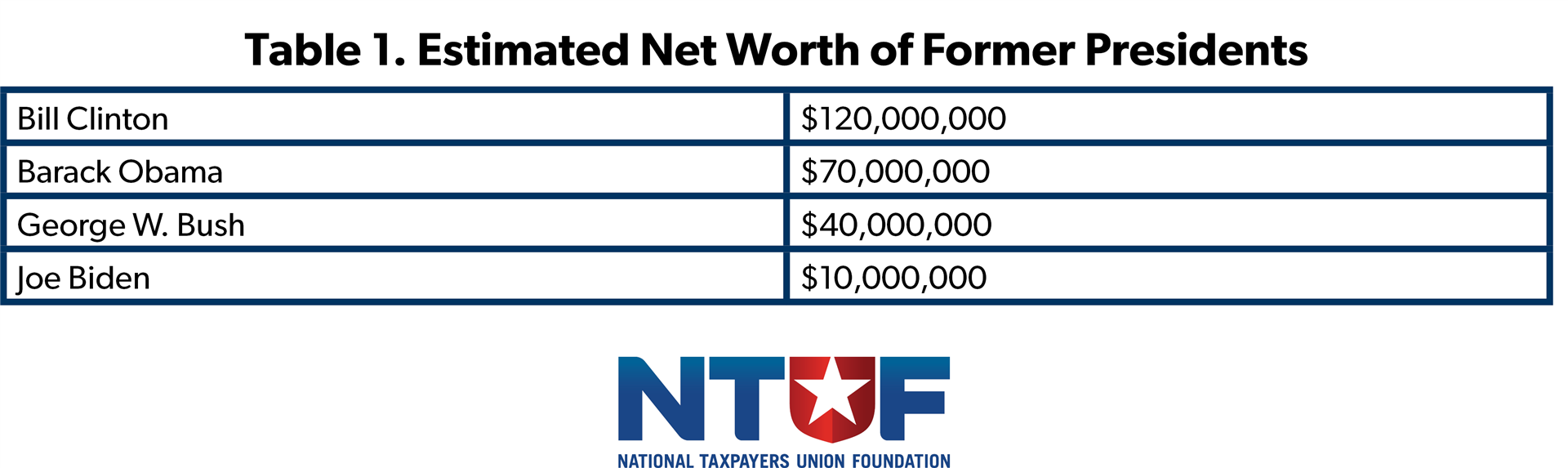

The FPA was passed due to the public’s concern that former President Harry Truman was struggling financially, which decades later was revealed to not be the case. As Table 1 shows, former presidents in the modern era are more than well off. They are able to maintain their high net worth through book and television deals. For example, President Barack Obama landed a book deal for $60 million in 2017 as well as a multi-year production deal with Netflix for an undisclosed amount of money. Ex-presidents also often get paid over $100,000 for speeches and appearances.

Donald Trump’s net worth was estimated at $2 billion before he was voted back into the White House.

Budget Requests Cost Taxpayers

Since 2000, taxpayers have paid out over $130 million to former presidents. Annual budget requests submitted by the General Services Administration (GSA) provide detailed breakdowns of the amounts allocated to each former president, including categories such as personnel, office space, and equipment. In addition, NTUF has compiled historical data from Congressional Research Service (CRS) reports, which offer further insight into past trends in spending on former presidents.

As we highlighted in our previous report on presidential perks, GSA’s estimate for FY 2025 was $5.5 million. This included $560,000 for President Jimmy Carter before he passed away in December 2024. Prior to his return to the White House, GSA had requested $1.1 million for President Trump’s benefits and perks for FY 2025. GSA’s newest budget notes that $5.2 million was appropriated last year, but does not break out how outlays differed from the request.

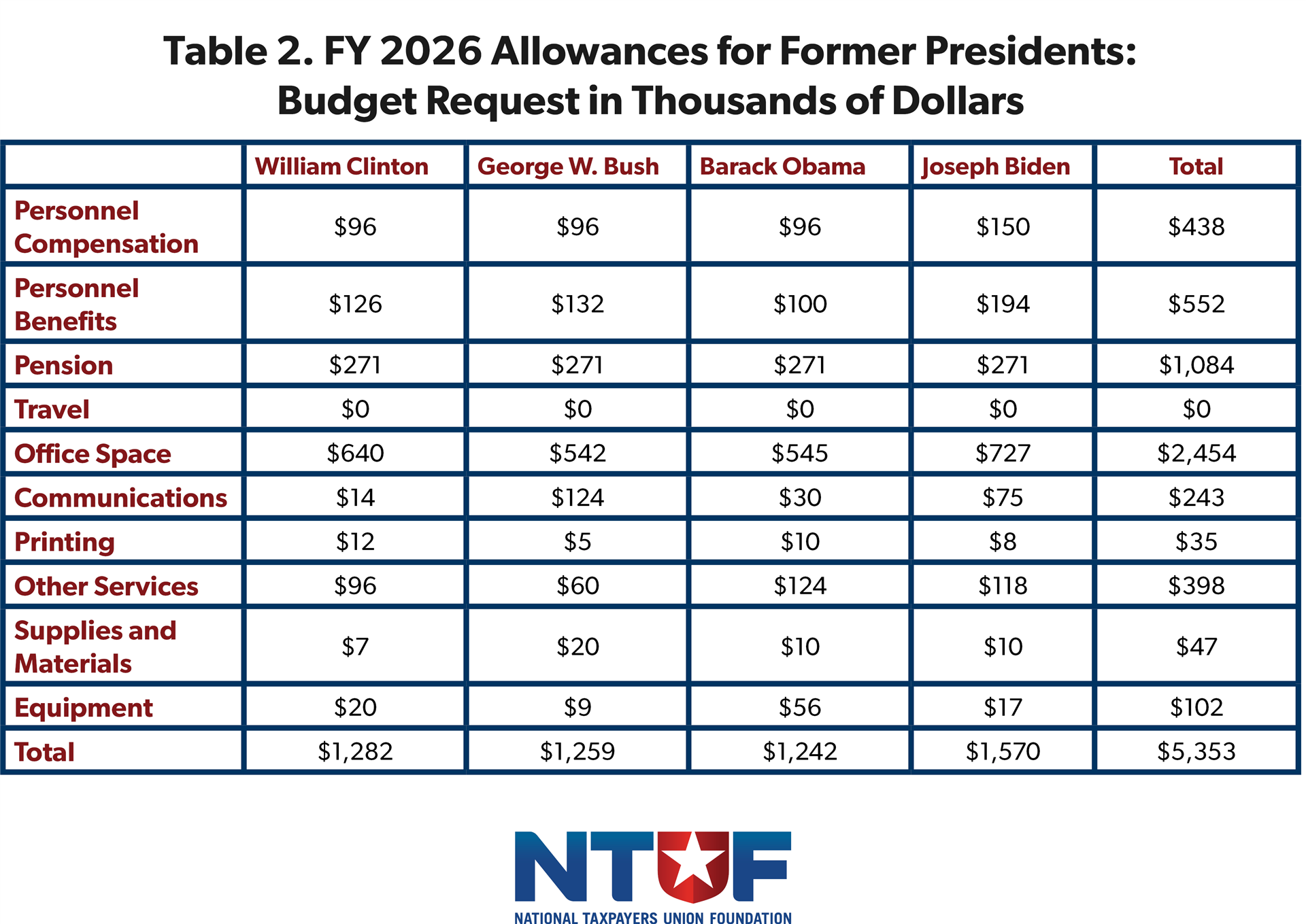

Table 2 lays out a detailed budget request for FY 2026.

According to GSA’s FY 2026 budget request, the rental payment allowance for former President Biden’s office totals $727,000—significantly higher than the amounts allocated for Clinton ($640,000), Bush ($542,000), and Obama ($545,000). While the exact location and square footage of Biden’s office space are unclear, the cost discrepancy is notable. In addition, his personnel compensation allocation is $54,000 higher than those of the other former presidents.

Reforming Perks for Former Presidents

Sen. Ernst introduced the Presidential Allowance Modernization Act of 2025 (S. 534), which would limit the pension a president could receive to $200,000 annually, with the amount being indexed to inflation. It would also limit the cost to taxpayers for expenses such as office space and leases, furniture, and supplies.

The allowance for former presidents would be reduced dollar for dollar by the amount that a president’s adjusted gross income exceeds $400,000. Former presidents would still receive current healthcare benefits and Secret Service protection. Surviving spouses are limited to an annual allowance of $100,000, which is about half of what they can claim from the FPA.

A previous version of the Presidential Allowance Modernization Act (H.R. 1777) passed Congress in 2016, but it was vetoed by Obama three months before the end of his term.

Conclusion

With the federal deficit at nearly $2 trillion and former presidents sitting on personal fortunes, it’s time to trim back the pension and perks provided under the Former Presidents Act. These wealthy former presidents don’t need the extra income, and taxpayers need relief.