This week, Sens. Elizabeth Warren (D-MA), Angus King (I-ME), and Ron Wyden (D-OR) introduced a corporate minimum tax proposal that, in consultation with the Biden administration, they intend to help pay for new spending in the president’s Build Back Better plan. Sen. King estimates the proposal could raise taxes between $300 billion and $400 billion over 10 years.

Sometimes, corporate minimum tax proposals like the one from Warren, King, and Wyden get confused with both the global minimum tax efforts that the Biden administration and Congressional Democrats are pursuing simultaneously. These proposals also get conflated with the corporate alternative minimum tax (AMT), which existed for decades before its repeal in the 2017 tax law.

NTU is here to explain the details of the new Warren-King-Wyden plan, how it differs from earlier proposals by President Biden and Sen. Warren, why some corporations pay less in taxes than their financial statements to shareholders would suggest, and why applying a minimum corporate tax to financial statement or “book” income may undermine important provisions of the tax code that have long enjoyed bipartisan support.

What’s in the Warren-King-Wyden Corporate Minimum Tax Plan

The full legislative text for the new proposal is here, and a one-page summary is here. Starting in 2023, the proposal would restore the corporate alternative minimum tax (AMT) repealed in 2017, albeit in a different form than the AMT that existed for decades prior to repeal. It would assess a 15-percent tax on the book income of any corporation that averages more than $1 billion in book income per year over a three-year period. By book income, the proposal will usually mean the 10-K forms that publicly traded companies must report to investors, shareholders, and the general public on an annual basis.

The updated plan includes some adjustments to the minimum tax that an earlier version of the Warren plan did not include. For example, a corporation can still benefit from general business credits that lawmakers have enacted for specific policy purposes, such as credits that incentivize research and development (R&D) and clean energy investment. Corporations can also reduce their minimum tax liability by foreign taxes paid. And, if a corporation experiences a net operating loss in a given year, they can carry that loss forward and reduce their tax liability in future years when they experience a net profit. That said, corporations could not benefit from some of the full and immediate expensing provisions of the tax code, a major reason for some temporary book-tax differences.

Finally, and perhaps most importantly, the amounts a corporation pays in minimum taxes above what they would otherwise pay without the minimum tax are allowed as a credit against regular tax liability in future years. This was missing from the earlier Warren proposal, which would have just allowed a 33-percent credit against regular tax liability for minimum taxes paid (rather than a dollar-for-dollar credit). This made the earlier Warren proposal function less as a minimum tax and more as a surtax on top of regular tax liability.

Here’s a summary of how the various proposals stack up:

| Biden Book Tax Plan | Warren Book Tax Plan | Warren-King-Wyden Book Tax Plan |

Base | Companies with net book income of $2 billion or more (~200 companies, according to the Biden administration) | Companies with net book income of $100 million or more (~1,300 companies, according to Sen. Warren) | Companies with net book income of $1 billion or more (~200 companies, according to the bill sponsors) |

Rate | 15% of book income | 7% of book income above $100 million | 15% of book income |

Full Credit for Regular Tax Liability? | Yes, regular tax liability reduces book tax liability dollar for dollar | No, regular tax liability reduces book tax liability by 33 cents on the dollars (i.e., companies receive a 33% credit for regular tax liability) | Yes, regular tax liability reduces book tax liability dollar for dollar |

Credit for Business Tax Credits? | Yes | No | Yes |

Credit for Foreign Tax Credits? | Yes | No | Yes |

NOL Carryforwards Allowed? | Yes (via Urban Institute analysis of then-candidate Biden’s plan) | No | Yes |

Book Tax Allowed to Offset Future Regular Tax Liability? | Yes, but “credit [can] not reduce tax liability below book tentative minimum tax in that year” (via Treasury’s Green Book) | No | Yes |

Estimated Revenue Impact | $148 billion to $184 billion over 10 years (Treasury Department; PWBM) | $700 billion over 10 years (Sen. Warren estimate) | $300 billion to $400 billion over 10 years (Sen. King estimate) |

Why Do Some Corporations Pay Little or Nothing in Taxes in a Given Year?

NTU has previously covered this question. Headlines about major U.S. corporations paying little to nothing in corporate income taxes in a given year often generate frustration and anger among some lawmakers and advocates. The Institute on Taxation and Economic Policy (ITEP) has an influential annual series on corporations that reported paying no federal corporate income taxes in a given year.

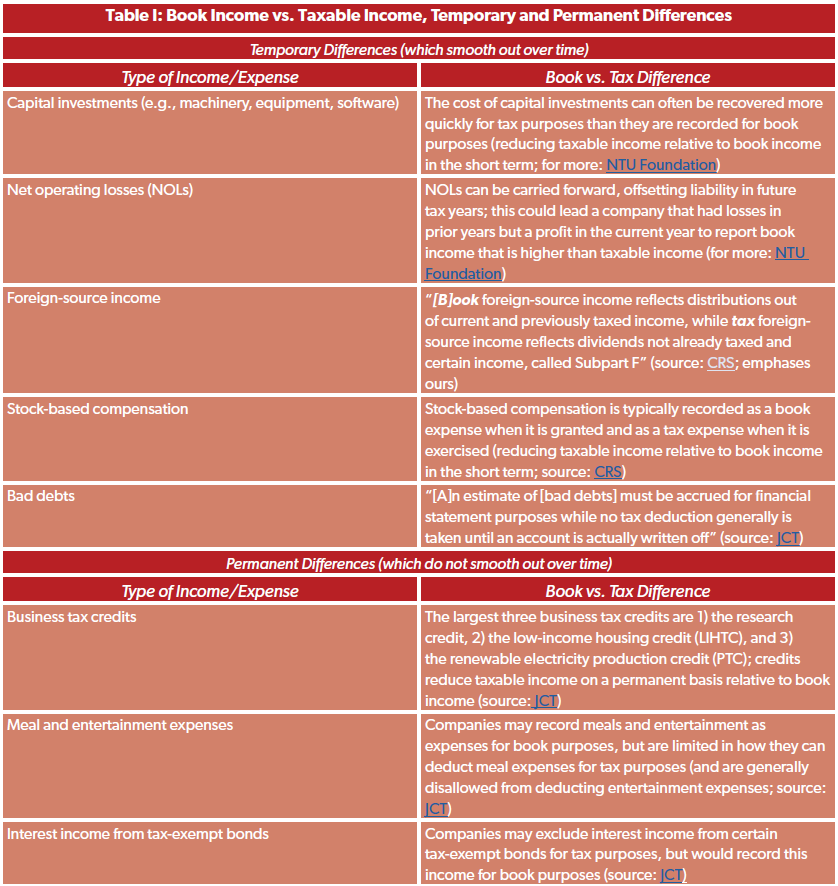

These lawmakers and advocates often fail to paint a complete and clear picture explaining why some corporations report large “book” profits but pay nothing in taxes in a given year. There are several ways book and taxable income can differ in a given year for a given company; some differences are temporary and some are permanent. NTU summarized a few of these differences in a previous explainer on book taxes:

Unfortunately, some proponents of a corporate minimum tax paint all of these so-called book-tax differences as “loopholes” that big and wealthy corporations are taking advantage of to escape “paying their fair share” in taxes. But many if not all of the above tax provisions that account for book-tax differences have enjoyed bipartisan support, and indeed many of the features are important parts of a fair and growth-oriented tax code, such as expensing for capital investments and carryforwards for net operating losses.

Even the lawmakers behind this latest minimum tax proposal implicitly admit that some book-tax differences are appropriate, given the proposal allows for certain tax credits, foreign taxes paid, and net operating losses to reduce minimum tax liability in any given year. What this proposal will do is undermine the existing tax provisions that Warren, King, and Wyden do not account for in their proposal, such as differences that arise from stock-based compensation to employees and the ability to fully and immediately expense capital investments for tax purposes. This could negatively impact U.S. companies’ ability to invest in their workers -- and the companies potentially affected by this proposal are major employers in the U.S.

A Tax Foundation estimate of the earlier version of Sen. Warren’s book minimum tax found the tax would reduce gross domestic product (GDP) by 1.9 percent, wages by 1.5 percent, and the number of full-time equivalent (FTE) jobs by 454,000. While one could expect smaller negative effects from the updated Warren-King-Wyden proposal, given it raises taxes on corporations by $300 billion to $400 billion instead of up to $700 billion, it is still very likely this proposal comes with significant negative impacts on the American economy and American workers.

Beyond the economic impacts, the book minimum tax would make the U.S. an outlier among its economic peers, might not solve the underlying problem of companies using “aggressive” accounting positions to reduce tax liability, and would outsource tax policy to a non-profit, privately-run organization (the Financial Accounting Standards Board) that consists of unelected officials.

Read more on corporate minimum taxes from NTU here.