Dear Chair Pascrell, Ranking Member Rice, and Members of the Subcommittee:

On behalf of National Taxpayers Union (NTU), the nation’s oldest taxpayer advocacy organization, I write with NTU’s views on the important Subcommittee hearing you are holding today regarding “Taxpayer Fairness Across the IRS.”[1] As an organization that has fought alongside Members of Congress and Presidents of both parties to expand taxpayer rights and due process for over 50 years, we hope our research and reform recommendations are helpful to you and your colleagues as you consider the future of the Internal Revenue Service (IRS), its budget, and its practices in the months ahead.

The May 17 Government Accountability Office (GAO) report from James R. McTigue, Jr. that accompanies this hearing is an important contribution to ongoing legislative branch discussions of IRS audits and enforcement activities.[2] GAO’s research and conclusions should give Members of Congress considerable pause when considering proposals that would vastly increase the IRS enforcement budget, or significantly expand the scope and scale of IRS monitoring and enforcement.

Even before GAO’s report, Democratic lawmakers and President Joe Biden had expressed great interest in significantly expanding IRS enforcement capacity. President Biden proposed $80 billion in additional enforcement funding in his American Families Plan in April 2021, promising the increased funding would focus on “large corporations, businesses, and estates, and higher-income individuals.”[3] House Ways and Means Chair Richard Neal (D-MA) framed the $80 billion funding increase as an “invest[ment] in tax fairness.”[4]

While President Biden and other policymakers claimed this IRS budget increase would yield around $700 billion in tax revenue for the government[5] – an incredible $8.75 return for every $1 invested – subsequent analysis from the nonpartisan Congressional Budget Office (CBO) determined that the return on investment was closer to $2.59 for every $1 invested, or less than 30 percent of the Biden administration’s estimates.[6]

NTU and NTU Foundation put out research and analysis throughout last year that called into question 1) White House and lawmaker proposals for additional IRS enforcement funding and 2) additional tax reporting burdens on American individuals and businesses.[7] In particular, we often raised concerns about how additional enforcement – and new information reporting requirements affecting Americans’ financial accounts – could have a pernicious impact on low- and middle-income households.

In August 2021, NTU Foundation’s Demian Brady warned:

“While tax cheats are the focus of the proposal[s], there are lots of cases where taxpayers and the IRS disagree over the nature of financial transactions and how they should be treated under tax law. Due to the complexity of the tax code and respective business or accounting arrangements of certain taxpayers, many filers get mired in audits, investigations, and legal cases over the proper interpretation of financial arrangements under the law. … These cases can be drawn out for years.”[8]

In October 2021, NTU Foundation’s Brady and Andrew Wilford wrote:

“All told, based on these numbers it’s likely that somewhere in the realm of 60-70 million Americans would be affected by the IRS’s reporting requirements. Though the Biden Administration has pitched their proposals as targeting the wealthiest Americans, those making over $400,000 per year, only about 2.8 million taxpayers fall under that category. By any measure, IRS reporting requirements would rope in far more than that.”[9]

And, writing on claimants for the Earned Income Tax Credit (EITC) specifically in February 2022, Wilford noted:

“It’s naive to imagine that any increase in financial disclosure or enforcement funding would reduce the number of audits that low-income taxpayers face. Refundable credits are prone to abuse and even honest mistakes, and more enforcement capacity would only empower the IRS to seek out more improper payments.”[10]

Much attention has been paid on Capitol Hill[11] and in the media[12] to the difference in audit rates between wealthy taxpayers and low-income taxpayers. Democrats on the House Committee on the Budget claimed in late 2020 that “[t]he burden of painful tax audits has shifted unfairly onto lower-income people who work for a living.”[13] These claims deserve further scrutiny.

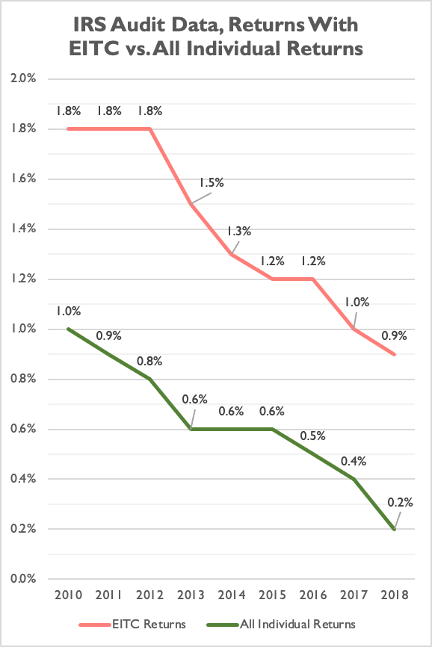

According to IRS data, audit rates on EITC returns were, indeed, higher than the audit rate for all individual returns from tax years 2010 through 2018.[14]

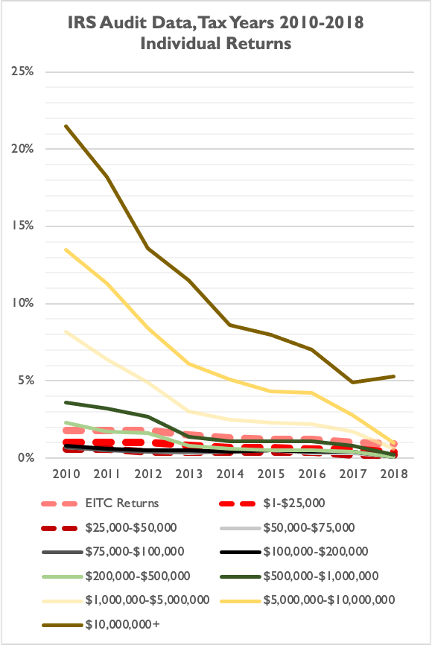

However, EITC audit rates from 2010 through 2018 are still low compared to audit rates for taxpayers reporting $1 million or more in income, as are audit rates for taxpayers reporting between $1 and $50,000 in income.

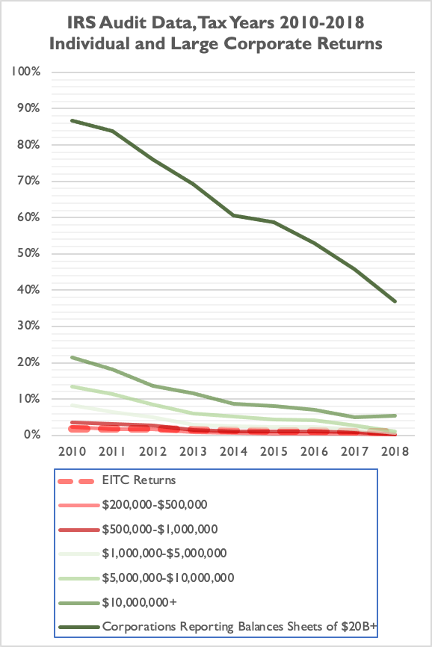

And even though audit rates for large corporations (those reporting balance sheets of more than $20 billion in a particular year) have fallen over the past decade, those rates were still 184 times higher in 2018 than audit rates for individual taxpayers – and around 41 times higher in 2018 than audit rates for EITC claimants.

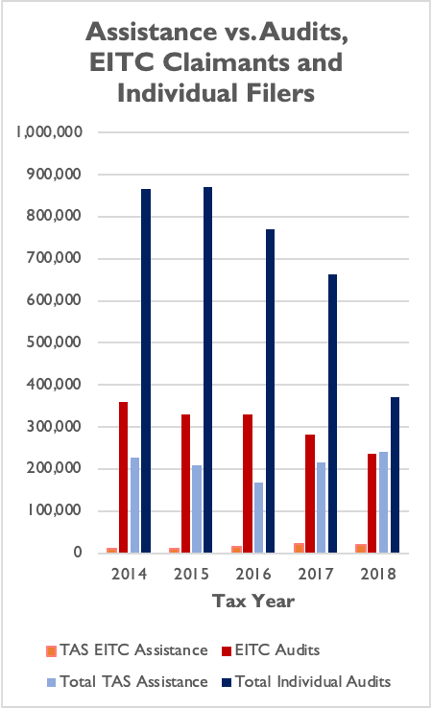

Of greater concern to lawmakers should be that the IRS appears to audit far more EITC claimants than they help through the Taxpayer Advocate Service (TAS) each year. That trend is mirrored by TAS assistance to all taxpayers, when compared to the amount of individual taxpayers audited by the IRS in a given year.[15] While measures of post-filing assistance are not a perfect proxy for how many EITC claimants turn to the agency for help, the data do demonstrate that only a fraction of the EITC claimants being audited each year are receiving assistance from TAS.

The IRS has recently asked lawmakers to grant it significant amounts of additional funding[16] and has complained about a lack of resources,[17] but the agency’s actions and decision-making should lead lawmakers to prioritize exercising significant oversight over any additional agency funding and bolstering taxpayer rights as a hedge against additional abuse.

While EITC audit rates have fallen over the past five years along with audit rates for all individuals, the proportion of total individual audits by the IRS with an EITC claim has risen dramatically from 42 percent to 64 percent.[18] This could suggest that, as the IRS has become more resource-constrained, it has stepped up the proportion of enforcement activity it devotes to EITC claimants. This could also be due to the IRS devoting more of its resources to correspondence audits, rather than in-person audits — a disproportionate portion of EITC audits are conducted through IRS correspondence.

Or, as GAO writes in its report:

“Audits of the lowest-income taxpayers, particularly those claiming the EITC, resulted in higher amounts of recommended additional tax per audit hour compared to all income groups except for the highest-income taxpayers. IRS officials explained that EITC audits are primarily pre-refund audits and are conducted through correspondence, requiring less time. Also, lower-income audits tend to have a higher rate of change to taxes owed.”[19]

And later in its report:

“Our analysis for fiscal years 2010 through 2021 found that audits of taxpayers claiming the EITC generally had similar average recommended additional taxes per audit hour compared to audits of incomes from $5 million to less than $10 million.”[20]

Suppose Congress were to provide the IRS with substantial new resources for tax enforcement, including funding and reams of new taxpayer information from financial institutions, with a mandate from Congress to aggressively pursue additional revenue to pay for new spending. In this case, taxpayers would be right to ask: would the agency first direct their efforts at expensive, time-consuming in-person audits of wealthy taxpayers and corporations, potentially facing legal challenges in the process, or would the IRS devote its time and manpower to additional correspondence audits from under-resourced low- and middle-income taxpayers?

Without Congressional oversight, recent history suggests the agency would pursue enforcement against low-income taxpayers with particular zeal. These audits can be incredibly time-consuming for taxpayers. For example, according to the National Taxpayer Advocate (NTA), in fiscal year (FY) 2021 “it took an average of 340 days for the IRS to complete an audit of a taxpayer whose income was less than $50,000.”[21]

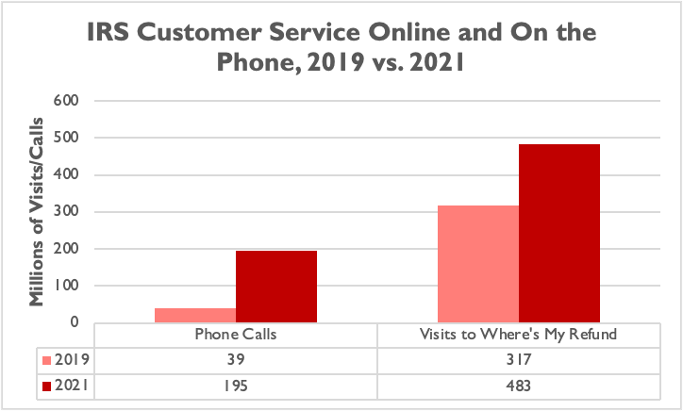

Meanwhile, IRS customer service that could assist EITC claimants, as well as other low- and middle-income taxpayers, has atrophied during the pandemic. Skyrocketing phone call volumes have left millions of taxpayers on hold with the agency, their issues unresolved — just 11 percent of the 282 million phone calls the IRS received in FY 2021. Meanwhile, the popular “Where’s My Refund” online application, despite surging page views from taxpayers in recent years, remains an inadequate tool that cannot solve major taxpayer concerns.[22]

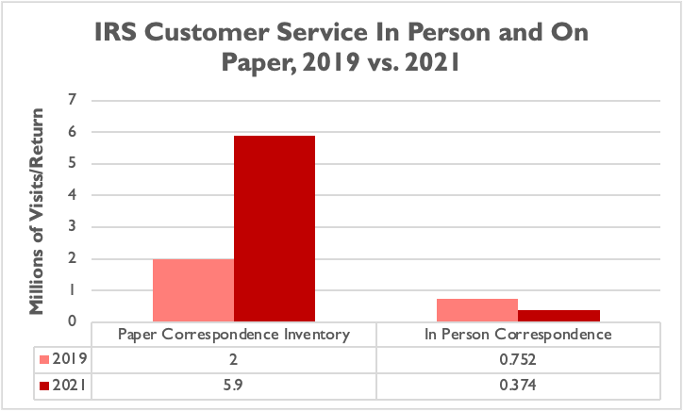

Meanwhile, the agency’s paper correspondence backlog has grown – which may have contributed to an IRS management decision to destroy 30 million paper records in 2021[23] – and in-person correspondence has plummeted due in large part to the pandemic.[24]

NTU encourages this Subcommittee to do the following, as they consider options to increase taxpayer fairness across the IRS:

- Abandon proposals to increase the IRS enforcement budget or require information reporting from major financial institutions, given these proposals if enacted could lead to additional compliance and audit burdens on low- and middle-income taxpayers;

- Fund the improvement and modernization of IRS online applications, so that more taxpayers can turn to the web for assistance from an agency that cannot handle the volume of phone calls and written correspondence it currently receives, and rigorously monitor IRS performance with concrete, quantitative goals regarding the digitalization of activities and services;[25]

- Expand funding for taxpayer services, so that IRS agents and customer service representatives can reduce the backlog of unprocessed returns and paperwork, and respond to taxpayer and tax preparer inquiries that are not made online;[26]

- Plan for having a larger customer service workforce trained and in place before filing seasons begin, rather than hiring and training masses of new employees as filing season is taking place;[27] and

- Pass reforms that safeguard taxpayer rights and privacy, both of which are under threat after significant security breaches at the agency. NTU Foundation recently offered 15 actionable pro-taxpayer reforms that Congress and the IRS could undertake immediately.[28]

This is but a topline overview of recommendations from NTU and NTU Foundation for a better, more effective IRS. The issue briefs and policy papers cited in the footnotes provide significantly more detail. Should you have any questions or feedback on our work please do not hesitate to contact me at alautz@ntu.org.

Sincerely,

Andrew Lautz, Director of Federal Policy

CC: Members of the House Ways and Means Subcommittee on Oversight

The Honorable Richard Neal, Chair, House Committee on Ways and Means

The Honorable Kevin Brady, Ranking Member, House Committee on Ways and Means

[1] House Ways and Means Committee. “Oversight Subcommittee Hearing on Taxpayer Fairness Across the IRS.” May 18, 2022. Retrieved from: https://waysandmeans.house.gov/legislation/hearings/oversight-subcommittee-hearing-taxpayer-fairness-across-irs (Accessed May 17, 2022.)

[2] McTigue, Jr., James R. “Trends of IRS Audit Rates and Results for Individual Taxpayers by Income.” Government Accountability Office (GAO). May 2022. Retrieved from: https://www.gao.gov/assets/gao-22-104960.pdf (Accessed May 17, 2022.)

[3] The White House. “FACT SHEET: The American Families Plan.” April 28, 2021. Retrieved from: https://www.whitehouse.gov/briefing-room/statements-releases/2021/04/28/fact-sheet-the-american-families-plan/ (Accessed May 17, 2022.)

[4] House Ways and Means Committee. “Neal Applauds Committee Advancement of Build Back Better Act.” September 15, 2021. Retrieved from: https://waysandmeans.house.gov/media-center/press-releases/neal-applauds-committee-advancement-build-back-better-act (Accessed May 17, 2022.)

[5] The White House, supra note 3.

[6] Congressional Budget Office. “Estimated Revenue Effects of Increased Funding for the Internal Revenue Service in H.R. 5376, the Build Back Better Act.” November 18, 2021. Retrieved from: https://www.cbo.gov/publication/57620 (Accessed May 17, 2022.)

[7] For example, see: Brady, Demian. “What’s the Deal with IRS Tax Enforcement and the Federal Budget?” NTU Foundation, September 15, 2021. Retrieved from: https://www.ntu.org/foundation/detail/whats-the-deal-with-irs-tax-enforcement-and-the-federal-budget; Wilford, Andrew, and Brady, Demian. “A Deeper Dive on IRS Snooping.” NTU Foundation, October 27, 2021. Retrieved from: https://www.ntu.org/foundation/detail/a-deeper-dive-on-irs-snooping; Sepp, Pete, and Lautz, Andrew. “14 Recommendations for Congress and the IRS as They Attempt to Narrow the Tax Gap.” NTU, June 9, 2021. Retrieved from: https://www.ntu.org/publications/detail/14-recommendations-for-congress-and-the-irs-as-they-attempt-to-narrow-the-tax-gap

[8] Brady, Demian. “When Counting on IRS Enforcement Revenues, Don't Forget to Count on IRS Overreach.” NTU Foundation, August 24, 2021. Retrieved from: https://www.ntu.org/foundation/detail/when-counting-on-irs-enforcement-revenues-dont-forget-to-count-on-irs-overreach

[9] Wilford, Andrew, and Brady, Demian. “A Deeper Dive on IRS Snooping.” NTU Foundation, October 27, 2021. Retrieved from: https://www.ntu.org/foundation/detail/a-deeper-dive-on-irs-snooping

[10] Wilford, Andrew. “IRS Scrutiny Is Not Only a Concern for Tax Evaders.” February 16, 2022, NTU Foundation. Retrieved from: https://www.ntu.org/foundation/detail/irs-scrutiny-is-not-only-a-concern-for-tax-evaders

[11] House Committee on the Budget. “Funding the IRS Pays Off: Preventing Tax Dodging by Wealthy Filers Is the First Step to Fixing Our Tax Code.” October 1, 2020. Retrieved from: https://budget.house.gov/publications/report/funding-irs (Accessed May 17, 2022.)

[12] Kiel, Paul, and Eisinger, Jesse. “Who’s More Likely to Be Audited: A Person Making $20,000 — or $400,000?” ProPublica, December 12, 2018. Retrieved from: https://www.propublica.org/article/earned-income-tax-credit-irs-audit-working-poor (Accessed May 17, 2022.)

[13] House Committee on the Budget, supra note 11.

[14] Data retrieved from: IRS. “Compliance Presence.” Updated April 12, 2022. Retrieved from: https://www.irs.gov/statistics/compliance-presence (Accessed May 17, 2022.); Note: NTU created visual representations of IRS audit rates based on publicly available agency data. These data may differ from GAO data, in part because the IRS is working with more up-to-date data than NTU has analyzed here. For example, audit rates for the prior three years may increase because the “IRS can include returns filed within the last 3 years in an audit … [and] within this 3-year period, the audit rate will increase as additional returns are selected for audit.” For more see: McTigue Jr., James R., supra note 2, at page 11 (footnote 16).

[15] For the following chart, we compared IRS data on audits, which is separated by tax year, to IRS data on TAS assistance, which is separated by fiscal year. Audit data adheres to the tax year in the horizontal axis, while assistance data is for the fiscal year that covers the tax year’s deadline (i.e., the tax year 2014 deadline was April 15, 2014, which took place in fiscal year 2015, so the tax year 2014 data for TAS is actually data from fiscal year 2015). These data are not perfectly comparable, but are intended to demonstrate that IRS audits far outpace TAS assistance from year to year, both for overall individual filings and for EITC claimants.

[16] IRS. “Written Testimony of Charles P. Rettig, Commissioner, Internal Revenue Service, Before the Senate Appropriations Committee, Subcommittee on Financial Services and General Government on IRS Operations.” May 19, 2021. Retrieved from: https://www.irs.gov/newsroom/written-testimony-of-charles-p-rettig-commissioner-internal-revenue-service-before-the-senate-appropriations-committee-subcommittee-on-financial-services-and-general-government-on-irs-operations (Accessed May 17, 2022.)

[17] IRS. “Written Testimony of Charles P. Rettig, Commissioner Internal Revenue Service before the Senate Finance Committee on the Filing Season and the IRS Budget.” April 7, 2022. Retrieved from: https://www.irs.gov/newsroom/written-testimony-of-charles-p-rettig-commissioner-internal-revenue-service-before-the-senate-finance-committee-on-the-filing-season-and-the-irs-budget (Accessed May 17, 2022.

[18] IRS, supra note 14.

[19] McTigue, Jr., James R., supra note 2, page 2.

[20] McTigue, Jr., James R., supra note 2, pages 23-24.

[21] Taxpayer Advocate Service. “NTA Blog: EITC Audits Will Once Again Begin; Proactively Responding to an EITC Audit Is Crucial.” April 15, 2022. Retrieved from: https://www.taxpayeradvocate.irs.gov/news/nta-blog-eitc-audits-will-once-again-begin-proactively-responding-to-an-eitc-audit-is-crucial/ (Accessed May 17, 2022.)

[22] Lautz, Andrew. “5 Important Takeaways From Watchdog’s Report on IRS Customer Service.” NTU, April 13, 2022. Retrieved from: https://www.ntu.org/publications/detail/5-important-takeaways-from-watchdogs-report-on-irs-customer-service

[23] Bishop-Henchman, Joe. “Why Did the IRS Destroy 30 Million Paper Records Before Processing Them?” NTU Foundation, May 10, 2022. Retrieved from: https://www.ntu.org/foundation/detail/why-did-the-irs-destroy-30-million-paper-records-before-processing-them

[24] Lautz, Andrew, supra note 21.

[25] Lautz, Andrew, supra note 21.

[26] Wilford, Andrew, Sepp, Pete, and Bishop-Henchman, Joe. “Taxpayers Desperately Need Help with Disastrous Filing Season.” NTU Foundation, February 17, 2022. Retrieved from: https://www.ntu.org/foundation/detail/taxpayers-desperately-need-help-with-disastrous-filing-season

[27] Lautz, Andrew, supra note 21.

[28] Wilford, Andrew, Sepp, Pete, and Bishop-Henchman, Joe, supra note 25.