Ahead of this year’s Tax Day (Monday, April 18), the Government Accountability Office (GAO) has released its latest report on the Internal Revenue Service’s (IRS) performance during last year’s tax filing season. The report, which concerns the agency’s customer service in the second filing season during the COVID-19 pandemic, contains several important and actionable recommendations for both the agency and for lawmakers who oversee the agency in Congress.

Important Facts and Figures From GAO’s Report

GAO’s research indicates that more taxpayers reached out to the agency during the 2021 filing season than before the pandemic, and that these taxpayers had a harder time receiving assistance from the IRS than before the pandemic.

GAO, the legislature’s watchdog for the executive branch, reminds readers that there are four primary ways the IRS conducts customer service with the nation’s tens of millions of taxpayers: 1) over the phone, 2) online, 3) through paper correspondence (i.e., letters), and 4) in person.

All four methods of communication have faced short-term challenges due to the pandemic (and pandemic-related tax law changes) and long-term, legacy challenges due to agency mismanagement and/or inaction.

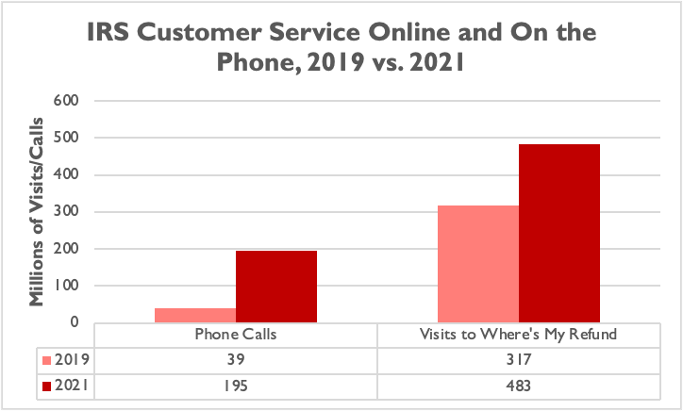

Call volume to the IRS increased five-fold in 2021, relative to 2019.[1] Visits to the popular “Where’s My [Tax] Refund” page on the IRS website also increased, by about 52 percent.

In a vacuum, more visits to the “Where’s My Refund” page might be an encouraging trend. If visits to online, automated web applications were to reduce the agency’s need to answer phone calls or paper correspondence from taxpayers, the agency might be able to devote more resources to improving the quality of customer service and taxpayer experience, upgrading its information technology and data security, and meeting other pressing long-run needs.

Unfortunately, as GAO reports, the “Where’s My Refund” page is not all that helpful to taxpayers right now. For example, the page cannot tell taxpayers if their tax return has been flagged for potential errors, which can significantly delay the agency’s delivery of a refund. What’s worse, the IRS apparently has no current plans to modernize the application, even though it was built in 2002 and hasn’t been meaningfully updated since 2013.

The agency’s phone troubles have been even worse. While the surge in attempted phone calls to the IRS were extraordinary (from 39 million in 2019 to 195 million in 2021), it is unacceptable that the agency only answered 15 percent of its calls in the 2021 filing season (compared to 67 percent in 2019). The IRS has set a benchmark for itself of answering between 70 percent and 80 percent of its phone calls, according to GAO, but has not hit that benchmark since four years ago (during the 2018 filing season).

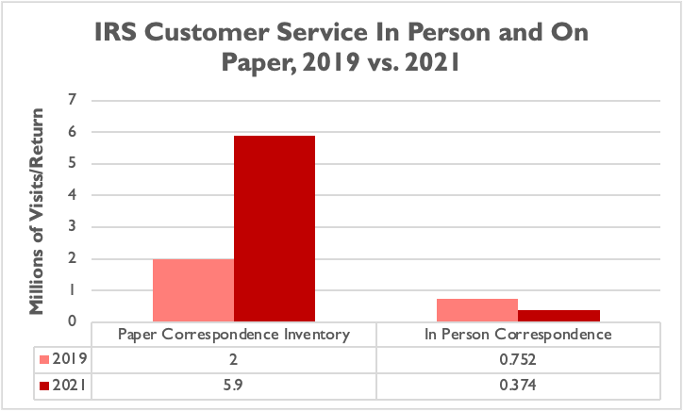

The IRS also had significant challenges with paper and in-person correspondence in 2021. The agency’s paper correspondence inventory grew nearly threefold from 2019 to 2021, while its in-person correspondence was cut in half:

GAO further estimates that the paper correspondence inventory grew to 8.2 million in January 2022. A larger paper correspondence backlog often means delayed refunds and significant confusion for taxpayers, some of whom reach out to the agency multiple times before ever hearing back. A particularly concerning subset of the paper backlog concerns taxpayer identity theft claims, which according to GAO research increased 27-fold from 2019 to 2021.

The decline of in-person correspondence is certainly forgivable, given the unique challenges of the COVID-19 pandemic. However, GAO notes that in-person correspondence has been declining for years, since before the pandemic, and that the IRS has not sufficiently adjusted its long-term customer service planning to reflect this trend.

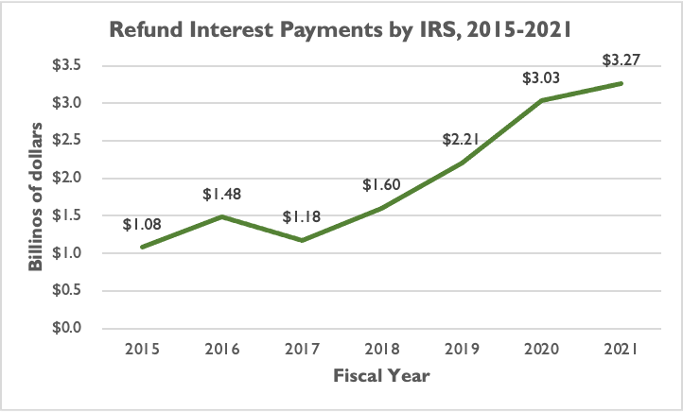

One impact of these overlapping customer service challenges is that the IRS is paying out a significantly higher amount in interest payments to taxpayers when they are late providing them with their tax refunds. The refund interest payments made by the agency increased nearly 50 percent from fiscal year (FY) 2019 to FY 2021, and have increased more than three-fold since FY 2015:

GAO reports that the agency is not tracking the different reasons why they are paying out interest on refunds to certain taxpayers. The IRS has also provided an effective shrug at GAO’s recommendation to track that information more closely. The agency claims that many of their interest payments are required by statute, but GAO has countered that many interest payments are due to processing delays at the agency. The IRS also says that these interest payments are proper in many cases, reflecting the time the federal government holds money that is owed to a taxpayer. While this is technically true, refund interest payments represent additional burdens on the nation’s taxpayers as well, and the agency should explore what proportion of refund interest payments may be due to agency flaws or delays that can be corrected.

5 Takeaways From GAO’s Report

Ultimately, GAO makes six recommendations for agency action at the IRS. While the IRS says they agree with four of these recommendations, their disagreement with two of the most important recommendations – and the agency’s woeful track record on customer service, taxpayer experience, data security, and more – merit some important takeaways for Congress as it conducts oversight and considers IRS reforms in the months ahead.

1. Call the Agency’s Bluff on “Where’s My Refund”

The IRS agrees with GAO’s recommendation to modernize the “Where’s My Refund” page, but told the watchdog that modernization would require additional funding. Congress should call the agency’s bluff and narrowly fund improvements and updates to the “Where’s My Refund” page – and require the agency to think proactively about what “Where’s My Refund” should look like in 2023, 2025, 2030, and so on.

The agency should of course consult with stakeholders inside and outside of government before it commits taxpayer dollars to modernization of “Where’s My Refund;” for example, there’s a need to balance ease of access and improvements to the information available on the application with privacy and data security considerations.

However, the return on investment for such an effort could be significant if an improved “Where’s My Refund” app reduces the phone calls, letters, and in-person visits taxpayers attempt to make or send to the agency.

2. Focus on Improving Online Applications

GAO’s statistics and findings in this report point to a broader need for the agency to improve and update its online applications. Of course, this is no new phenomenon for the agency – the Taxpayer First Act report from the IRS to Congress is littered with suggestions and recommendations on where the agency would like to take the digital and online taxpayer experience in the 2020s and beyond.

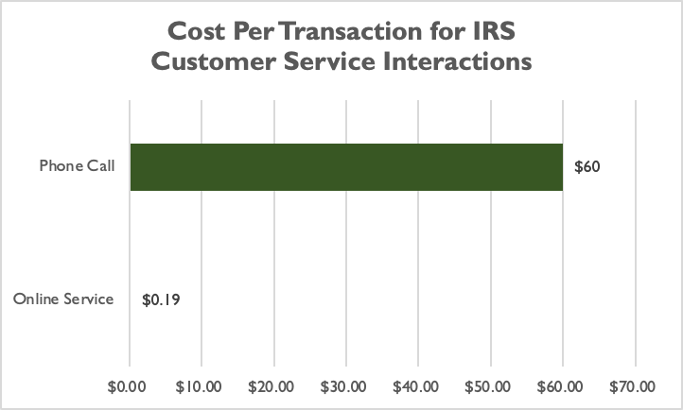

One statistic in particular, though, drives home the potential ROI for the agency and the federal government if they significantly improve the online experience and/or automated customer service for taxpayers.

The cost of the average online service transaction at the IRS, according to GAO, is about 19 cents. The average customer service phone call, on the other hand, costs the agency about $60. In other words, customer service on the phone costs about 315 times more than a customer service interaction online.

While there will always be some taxpayer questions and tax filing issues that need to be sorted out over the phone or in person, the more the IRS can send taxpayers with questions to meaningful answers or assistance online – and away from the phone – the better off both the agency and taxpayers will be.

3. Fund Customer Service With an Eye Toward the Mid- and Long-Term

NTU Foundation’s Andrew Wilford, Pete Sepp, and Joe Bishop-Henchman noted in February of this year that the IRS may need to increase funding for taxpayer services:

“While Congressional funding for increased enforcement should be out of the question, the IRS would benefit from increased funding for its taxpayer services account. This would allow the IRS to hire more agents and customer service representatives to reduce the backlog of unprocessed returns and paperwork and respond to taxpayer and tax preparer inquiries. It would also pay dividends for compliance and longer term enforcement workloads, as taxpayers would get the help they need to file a correct return in the first place.”

GAO’s findings also make the case that Congress should be funding customer service – and that lawmakers should be funding customer service with mid- and long-term reforms to the agency in mind, not just meeting immediate 2022 filing season needs.

The watchdog notes in their report that, for both the paper backlog and the surge in phone calls to the agency, the IRS has relied primarily on 1) overtime for current employees, 2) training current employees to fill in on customer service and addressing the paper backlog, and 3) hiring additional staff.

The former two strategies are not sustainable for the agency or its workforce in the long run. The latter strategy is a good start to addressing backlogs, but as GAO notes it takes about 14 weeks to train new customer service representatives. Having a larger customer service workforce trained and in place before filing seasons begin, rather than hiring and training masses of new employees as filing season is taking place, is key to addressing the agency’s customer service challenges in the long run.

4. Study Root Causes of Taxpayer Errors When Filing

One GAO recommendation the IRS rejected was the suggestion to more closely identify and analyze the causes for taxpayer errors on returns. IRS disagreed, claiming that they already study internal agency errors on tax returns, whereas GAO countered that the agency’s current work does not account enough for different types of taxpayer errors.

Congress should override the IRS’ disagreement with this key recommendation, and require a multi-year study on the main causes for taxpayer errors while filing. This study could be conducted in collaboration and/or partnership with the Treasury Department, Congress, GAO, and outside stakeholders. The IRS could gain valuable insight from enhancing their dialogue with tax practitioners, especially, including those who work at Taxpayer Assistance Centers (TACs), Low Income Taxpayer Clinics (LITCs), and for- and non-profit tax filing organizations.

More importantly, Congress should carefully consider the results of such a study, and then even more carefully consider expanding the agency’s authority to make corrections for certain common errors on a case-by-case basis – so long as taxpayers have reasonable courses to appeal or protest an IRS correction made on their behalf.

5. Exercise Caution Before Expanding the Agency’s Mission

Perhaps the most important takeaway for Congress from this GAO report is that the agency is struggling so much with its core mission that lawmakers need to exercise caution before greatly expanding the agency’s mission.

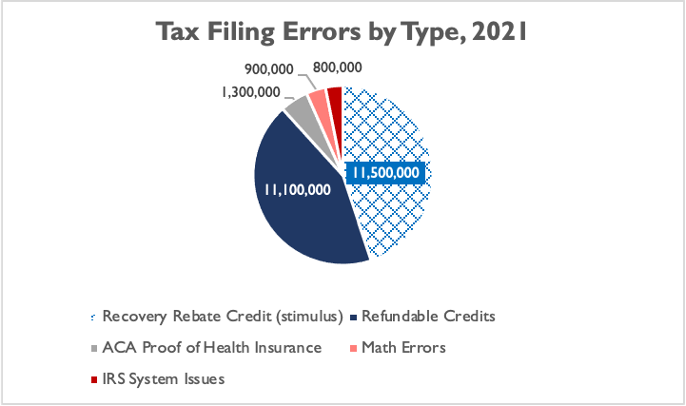

Of the 35 million returns flagged for errors in 2021 (86 percent more than the 2017-2019 average), nearly a third (11.5 million) were due to stimulus check claims from COVID-era relief legislation in Congress. The below chart illustrates this phenomenon, underscoring that the large volume of stimulus check errors were due to significant, one-time Congressional expansions of the IRS mission.

The agency was also asked to send out tens of millions of stimulus checks in spring 2021, administer a monthly advanceable Child Tax Credit for the first time in July 2021, and manage several new and expanded programs tied to the pandemic’s economic challenges (e.g., the Employee Retention Tax Credit and expanded net operating loss provisions) – all the while managing (and struggling with) its core mission.

Congress can still contemplate an expanded role for the IRS in delivering payments or credits to taxpayers. However, the agency’s particularly large failures in the pandemic era signal that lawmakers should exercise more careful thought and consideration when contemplating significant, new, and resource-intensive jobs for the IRS.

IRS struggles also point to the foolishness of the proposed $80 billion in additional enforcement funding for the agency under the Build Back Better proposal. The agency may need targeted, increased funding in areas like customer service and taxpayer experience – along with IT modernization and data security – but Congress should not give the IRS a consequence-free, 11-figure pot of cash strictly for increasing taxpayer audits and enforcement activities. If this GAO report is any indicator, much of that money would not help taxpayers and could ultimately go to waste.

[1] GAO compared many customer service metrics for the 2021 filing season to the 2019 filing season rather than the 2020 filing season, since the 2019 filing season took place before the COVID-19 pandemic.