In response to widespread inflation and rising gas prices, House Democrats plan to consider legislation in mid-May that would empower the President to declare energy emergencies and the Federal Trade Commission (FTC) to enforce against “excessive” increases in gas prices. Unfortunately the “Consumer Fuel Price Gouging Prevention Act,” as the legislation is called, fails to define what constitutes an “excessive” or “unconscionable” price increase and fails to place limits on the President’s ability to declare energy emergencies for indefinite periods. The negative consequences of this legislation for consumers, taxpayers, and the exercise of federal government power could be far-reaching, in the short term and the long run.

The Problem in Context

Rising gas prices are indeed a problem weighing on American voters’ minds. According to a recent Center Square report that covered (paywalled) Rasmussen polling, “82% of surveyed likely American voters are concerned about the rise of gasoline and energy costs.”=

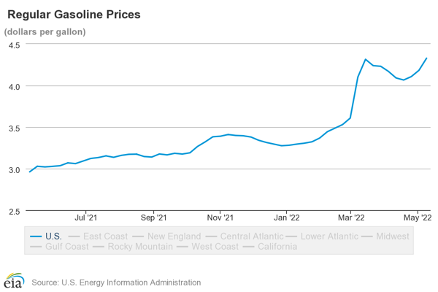

The Energy Information Administration (EIA) tracks weekly gas price averages in the U.S. As of May 9, the average gas price was nearly $4.33 per gallon, which is a staggering 46 percent (or $1.37 per gallon) more than the price at this time last year. Gas prices fell from mid-March to mid-April, but have risen $0.26 per gallon (6.4 percent) in the past three weeks.

Progressive lawmakers such as Sen. Elizabeth Warren (D-MA) and Sen. Bernie Sanders (I-VT), as well as Democratic Congressional leadership including Speaker Nancy Pelosi (D-CA) and Senate Majority Leader Chuck Schumer (D-NY), have blamed “big oil” companies, with many of them claiming these companies are “profiteering” off inflation and the volatility sparked by Russia’s invasion of Ukraine.

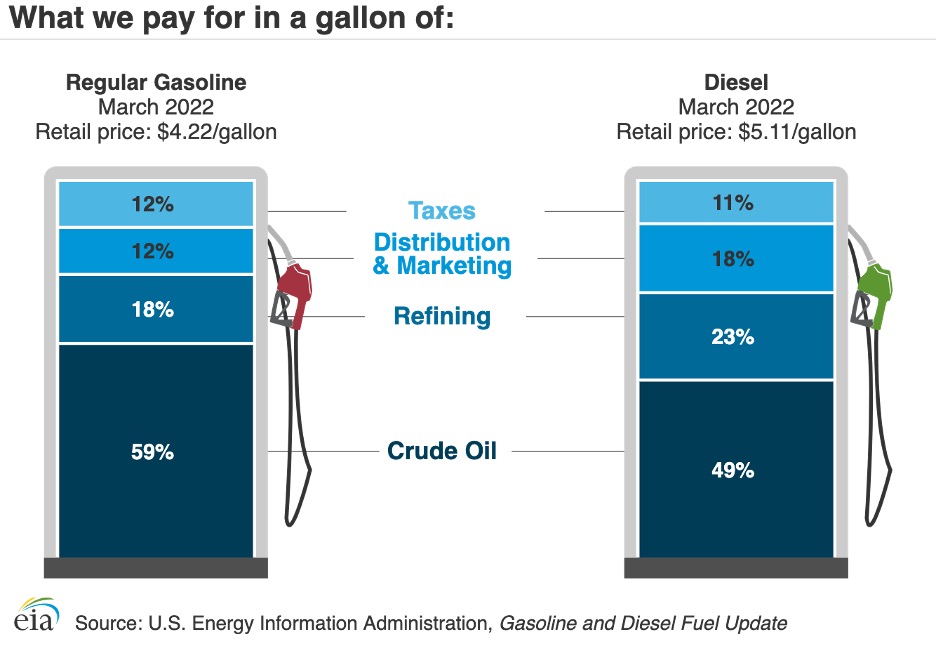

As is often the case with politicians’ statements, the situation is more complicated than that. EIA points out that less than 60 percent of the price paid for a gallon of gas actually comes from the price paid by downstream sources for crude oil. Nearly one in every five cents for a gallon of gas goes to refining, around one in every eight cents goes to distribution and marketing, and an additional one in eight cents goes to federal and state taxes.

There are also important reasons that oil and gas prices don’t always move perfectly in tandem, as explained in this excellent thread by Dallas Federal Reserve energy economist Garrett Golding:

"Oil prices are down, so why aren't gas prices?"

— Garrett Golding �������� (@gjgolding) March 16, 2022

This question is all over the place right now. Unfortunately there is a lot of misinformation and half-truths being spread in response. Most of my [few] followers are experts, but this thread is for those who are not. 1/

The Consumer Fuel Price Gouging Prevention Act

This brings us to the legislation the House will consider the week of May 16, the Consumer Fuel Price Gouging Prevention Act.

The key provision of the legislation is that it makes it illegal for companies to sell gas – at the wholesale or retail level – at an “unconscionably excessive” or ‘exploitative’ price, so long as the President has declared an energy emergency for a particular gas or fuel product in a particular area of the U.S. However, the legislation:

- Provides no definition for what makes a price “unconscionably excessive,” and offers no references to other parts of the law that may define the term;

- Provides no definition for how a seller may be “exploiting” the “circumstances” of an energy emergency; and

- Contains no definition for whether sellers are increasing prices “unreasonably.”

The only loose peg for an “aggravating factor” in whether there has been an “unconscionable” price increase is the average gas price in the “30-day period before the date on which the proclamation was issued.” This is a messy peg at best, given gas prices are notoriously volatile and can swing wildly in 30-day periods of time. Otherwise, the bill gives the Federal Trade Commission (FTC) carte blanche to determine any other “appropriate benchmark” for “unconscionable” price increases.

Indeed, with this legislation it appears Congress is punting most of the difficult questions to the President and the FTC.

The President has virtually no limits or brakes on their ability to issue “energy emergency” proclamations:

- There are no limits on the geographic area the President may issue an energy emergency proclamation for, up to and including the entire country;

- There are no realistic limits on the amount of time the President may keep the entire country, or parts of the country, under an emergency proclamation; while there is an official 30-day limit in the legislation, there are no limits on emergency renewals and no explicit Congressional review process in the legislative text; and

- There are no reasonable limits on Presidential decision-making when it comes to emergency energy proclamations; there is no standard the President has to adhere to, or message they have to transmit to Congress; there’s not even a requirement that the President has to determine an emergency “necessary,” just “appropriate.”

Lawmakers would be short-sighted to grant President Biden and all future Presidents this sweeping authority. What’s to prevent the current or a future President, of either party, from declaring an energy emergency in an attempt to artificially hold down gas prices for an open-ended period of time? This could even occur in the leadup to a re-election effort by the President, or a midterm election, in an effort to benefit the President and their political party.

However, a future president is not the only politician who would be able to wield expanded authority under this legislation.

The bill also allows state Attorneys General (AGs) to enforce the bill at the retail level. This is a recipe for abuse. High prices at the pump can galvanize voters, and politicians who want to be re-elected would have a new weapon to use to artificially keep gas prices low.

High gas prices are not only reflective of the costs of production, transportation, and sales, but also the regulatory and tax treatment of these products. For example, could a state increase their gas tax, which would be a cost likely passed along to the consumer, and then use this federal legislation to claim the oil and gas retailers are charging consumers unfairly? The bill could act as a get-out-of-jail-free card for states that have less friendly regulatory or tax treatments for oil and gas companies.

The legislation could also be wielded in response to natural disasters. Hurricane Katrina’s devastation led to high gas prices as it disrupted oil productions. Gas prices increased in response to these disruptions, hitting certain parts of the country especially hard. Events like these are unfortunate, but the price increases are often reflective of the economic landscape. However, under this legislation, State AGs could go after gas retailers for higher prices.

What can an energy company do if they are deemed to be in violation of this legislation? Not much.

The only recourse for oil and gas companies deemed to be in violation of this legislation is to argue before the FTC that the prices charged reasonably reflect additional costs incurred or risks taken by the company. Rather than the government proving its case, the burden of proof instead rests with energy companies to prove that they are innocent of ill-defined ‘price gouging.’ This onerous standard, coupled with the startling lack of clarity in the bill, would be an immense bar to reach, especially in front of a potentially hostile FTC.

The FTC has already been pressured by top Democrats to go after oil and gas companies. President Biden wrote a letter to FTC Chair Lina Khan urging the agency to investigate anti-consumer practices by gas companies. In response, the FTC announced it would step up enforcement on oil and gas companies' apparent collusion. Senator Elizabeth Warren (D-MA) and other Democrats have also introduced legislation that would empower the FTC to ban “unconscionably excessive” prices.

The legislation gives huge leeway to the FTC to shoot down any affirmative defense from oil and gas companies and ignore rational economics in the process. In determining if a company is in violation of this bill, the factors considered include whether the change in average costs “grossly” exceeds the costs in the 30-day period before the energy emergency or “another appropriate benchmark period” set by the Commission. Essentially, this would grant the FTC blank check authority to cherry-pick dates to compare and argue that the increases in prices are unreasonably excessive.

The prospects of oil and gas companies successfully arguing their case before the FTC seem extremely small. An affirmative defense is already difficult; the additional flexibility this legislation provides for federal agencies significantly tilts the scales in favor of the government.

Alternatives

A better approach from Congress in the short run would cover ground on at least three major fronts:

- Encourage America’s diplomats and White House officials to pursue a peaceful end to Russia’s invasion of Ukraine that nonetheless respects Ukraine’s sovereignty, and supports the people and government of Ukraine; this is obviously much easier said than done, but policymakers in both parties must acknowledge that Russia’s actions, which are to a large extent outside of America’s control, are driving some of the gas price increases;

- Address some of the ways federal government spending is contributing to inflation, including establishing an end date for the ongoing student loan moratorium and pulling back on domestic government spending where possible; for example, the American Rescue Plan Act (ARPA) may have raised inflation by several percentage points alone, according to the San Francisco Fed, and despite that ARPA spending continues unabated (link paywalled);

- Encourage the Commerce Department to end its investigation of Chinese solar producers, which the U.S. solar industry claims is having major impacts on the domestic development of solar power; a solar trade group “cut its solar installation forecasts for 2022 and 2023 by 46%, or 24 gigawatts of capacity, more than the industry installed in all of 2021”; and

- Broadly reduce and end both Trump- and Biden-era tariffs on imported goods, which could reduce inflation pressures broadly and in the energy sector specifically.

In the long run, Congress should:

- Expand domestic energy production and increase American energy independence, including an all-of-the-above approach that doesn’t favor or discriminate against particular industries; House Republicans have put forward various bills to this end;

- Evaluate regulatory barriers to energy production and how tax treatment can be better calibrated to encourage growth, including permanent full and immediate cost recovery for the energy sector; and

- Repeal the Jones Act to reduce the cost of transporting energy domestically and increase competition among shipping companies; as AEI’s Vincent Smith explains, the protectionist provisions in the Jones Act makes the United States less competitive with other countries and a repeal or suspension of the act would help lower costs.

Even as a messaging bill, which this legislation likely is, it still is head scratching. As NTU Executive Vice President Brandon Arnold explains, President Biden has blamed the pandemic and Putin for the problems Americans are facing at the pump. Apparently, it’s also the fault of private companies now too. It’s certainly a confusing message that the party in control of Washington is powerless to facilitate changes to help consumers. Unfortunately, the message this legislation sends to consumers worried about high gas prices is that politicians in Washington would rather play the blame game than take meaningful action to address the problem.

Rather than waste time with point-scoring, policymakers should examine the short- and long-term solutions outlined above. Consumers are unlikely to be assisted by this poorly crafted legislation, and would be better served by thoughtful and pragmatic solutions. Unfortunately, this legislation offers neither.