(pdf)

Examining so-called “tax expenditures,” special provisions in the tax code that reduce revenue, is difficult. Multiple government agencies, such as the Joint Committee on Taxation (JCT) and the Treasury Department, regularly provide listings of tax provisions that differ from someone’s definition of an ideal tax base. While these lists are immensely helpful, analysts and policymakers must be careful when using them to design policy changes. Not all tax expenditures are created equal: some are truly distortionary and worthy of elimination, while others ensure that the tax base is properly structured. Simply eliminating tax expenditures without understanding their role in the tax code could be ineffectual.[1]

Tax debates are especially contentious surrounding tax provisions related to energy production. Policymakers on both sides allege that the way the tax code is structured for energy policy amounts to “subsidies” without examining the structure’s broader context. Not all energy provisions should be demonized. Many relate to the expensing of capital investments or the limiting of double taxation, two worthwhile goals. Those provisions are necessary features of any tax code, and their elimination would be economically destructive.

This shouldn’t be understood to stay there are no harmful energy subsidies in the tax code; there are many. This paper seeks to provide policymakers with a roadmap on which energy tax provisions are a key part of the U.S. tax code and which should be considered for repeal.[2]Eliminating unneeded or duplicative tax provisions has two benefits. First, it would improve economic efficiency, increasing economic growth. Second, it would provide revenue to finance future tax reforms.

The analysis will examine three broad groups of energy tax provisions discussing their relation to ideal tax policy, providing policymakers with a roadmap on their inclusion or removal from the tax code.

The Scale of Energy Tax Provisions

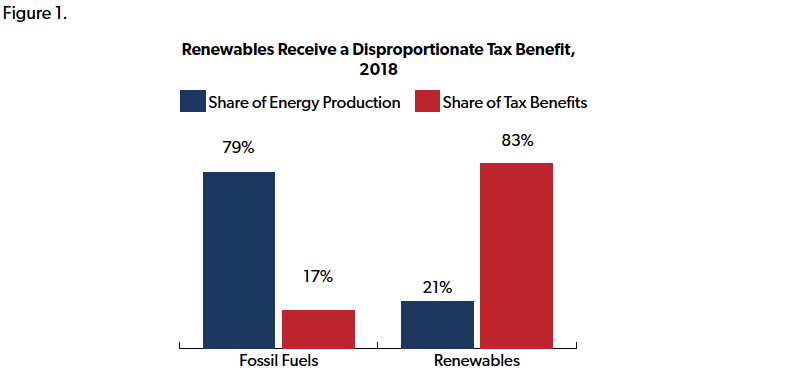

The Joint Committee on Taxation lists two pages of energy tax provisions in their tax expenditure list. The provisions span every type of energy production, including oil, natural gas, wind, geo-thermal, coal, biomass, and hydroelectric, among others. JCT estimates that these provisions reduced federal revenues by $18 billion in 2018.[3]Of those provisions, the vast majority—83 percent—benefit renewable energy sources, such as wind, nuclear, and solar. The remaining 17 percent benefit fossil fuels, a stark contrast.[4]

The gap between provisions benefiting fossil fuels and renewables is even larger once their relative energy production levels are assessed. In 2018, fossil fuels produced 79 percent of energy in the U.S., compared to only 21 percent for renewable. So while fossil fuels produced 79 percent of the nation’s energy, they received benefit from only 17 percent of the total energy tax expenditures.

However, the analysis should not stop there. Simply equalizing the value of energy tax benefits received to the amount of energy produced isn’t the correct approach. Instead, policymakers should evaluate the expenditures individually to understand whether the provision is a necessary part of the tax code.

Examining Provisions In Depth

Cost Recovery

A large number of energy tax provisions relate to a concept called “cost recovery.” In the U.S. (along with many other countries), businesses are taxed on their net income, or their revenues minus expenses. To arrive at net income, the tax code allows businesses to deduct their expenses.

Tax expenditure reports can be misleading here.[5]When a business hires a worker, it gets to deduct its labor expenses. This deduction is not considered a tax expenditure. However, if the company decides to invest in capital, such as a machine, it only gets to deduct a portion of its capital expenses immediately. The remaining expense is deducted over a series of years. This process is known as depreciation.

This creates a bias in the tax code; investing in labor is more valuable than investing in capital simply because of different tax treatment. To illustrate this point, imagine a company has $100,000 to invest in its operations. It could hire another worker, creating a $100,000 deduction for labor costs. Or, it could invest the $100,000 in a new machine. The business, under the second scenario, would only get to deduct a portion of the $100,000 in the first year. The remainder would be deducted slowly over a series of years.

The labor investment is deducted immediately and not considered a tax expenditure, while the machine investment is deducted slowly. If the tax code were modified to allow the machine investment to also be deducted immediately, it would be considered a tax expenditure.

Cost recovery is especially important in the energy sector, where production is exceedingly capital intensive. Firms, particularly in the oil and gas sector, spend inordinate sums of money to extract and produce energy. Allowing them to properly deduct their expenses ensures that the tax code is neutral to their investment decisions.

The tax code contains a number of cost recovery provisions. The Tax Cuts and Jobs Act, for example, allowed for immediate cost recovery for investments in equipment and machines. This provision is available to businesses in all sectors.

But the tax code also contains cost recovery provisions specifically for energy companies. The cost structures for energy companies are different than those of other sectors. For example, one provision, known as intangible drilling costs, allows energy companies to deduct their expenses incurred preparing a well for production. Other industries don’t use wells. So while it seems like the oil and gas industry is receiving a special benefit, they aren’t. They are being treated how other industries are; they are allowed to deduct their capital expenditures.

Depletion is a similar cost recovery provision. Depletion, similar to depreciation, allows a business a deduction to compensate for an asset that is being used. Removing some sort of natural resource from the ground means that it cannot be replaced; that extraction in some sense is a cost to the company.[6]The tax code, therefore, provides a deduction for such costs to oil and gas industries, and indeed any other industry that extracts resources.

It’s important to note that specifically enumerated cost recovery provisions exist for more than just fossil fuels too. The tax code also contains accelerated depreciation provisions for all other types of energy, including solar and wind.

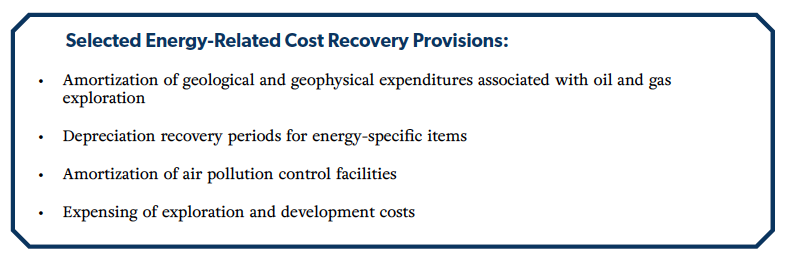

When reviewing JCT’s tax expenditure report, policymakers should be careful when analyzing any provision containing the words “expensing,” “amortization,” “depletion,” or “depreciation,” since these terms often relate to legitimate cost recovery provisions.

Providing Special Privileges

While many energy provisions listed on tax expenditure reports are necessary components of our tax code, there are some tax provisions that don’t survive scrutiny. These provisions provide special privileges, or benefits, in excess of right-sizing the tax base.

Traditionally, these provisions benefit renewable energy sources, falling under two broad sections of the Internal Revenue Code (IRC): Sections 45 and 48. (Inadvisable tax credits exist in many other industries too.)

Section 45 provides tax credits for energy production. For example, companies producing energy from wind receive a 2.3 cent per-kilowatt-hour tax credit for the first 10 years of production. This generous benefit is in addition to traditional deductions for costs, including cost recovery provisions. Providing disproportionate credits to one type of industry creates a bias in the tax code toward favored energy sources over others. The production tax credit (PTC) is available to other industries, such as geothermal and open-loop biomass,[7]but the wind PTC is the largest, representing 94 percent of all revenue spent on PTCs in 2019.[8]

The wind PTC is currently being phased out. Projects beginning in 2017 receive a reduced credit, with the credit eliminated for those beginning construction in 2020.[9]

Additionally, policymakers have provided tax credits for investments in specific energy types, such as solar. The solar investment tax credit (ITC) allows individuals and businesses the ability to reduce their total tax liability by 30 percent. This generous credit reduces the after-tax cost of installing solar panels on your home or to build a commercial solar field.

Similar to the wind PTC, the solar ITC is the largest tax credit of its type. JCT estimates that the solar ITC reduces federal revenues by $2.2 billion in 2019, or 92 percent of all ITCs. Additionally, the solar ITC is set to be phased out. Construction projects beginning in 2020 will see their credit reduced. Starting in 2022, the residential credit is eliminated, while the construction credit will still be available, but at a lower level (10 percent).[10]

Credits are available for other energy-related expenditures too. The tax code provides a credit for plug-in electric vehicles and for investing in advanced energy property, among others.

However, this analysis should not be misunderstood as arguing that only credits for renewable sources should be eliminated. Some credits are available to traditional energy sources too, such as the energy research credit. Companies that spend on “energy research,” regardless of the energy type, are able to take a credit of 20 percent credit for their research and development costs.[11]This credit is in addition to generally available deductions for research and development (R&D).

Here again, the logic of tax bases is important. Research and development expenses should be deductible, as they are a cost incurred by the business.[12]However, an additional credit on top of that is not necessary. It distorts the firm’s decision-making, encouraging an overconsumption of R&D expenses.

Tax credits are valuable. A tax credit reduces a taxpayer’s tax liability dollar-for-dollar.[13]At first glance, a 30 percent credit might seem limiting, but it’s actually quite generous. An individual with a $5,000 tax liability would see it shrink to $3,500 with a quick stroke of the pen.

Policymakers have taken a big step forward in beginning to phase out these generous tax credits, but there is already pressure from favored industries to extend the credits, pushing the phaseouts further into the future.

Limit Double Taxation

The JCT report is not exhaustive. There are many other provisions in the tax code that are used and available by energy producers that do not fit the traditional definition of tax expenditures. One of the most important is a provision known as dual capacity.

A fundamental tenet of tax policy is to limit double-taxation - the number of times that the same income is taxed. To limit double taxation, the tax code allows individuals and businesses who pay tax in another country a tax credit against their U.S. tax return. Foreign tax credits play a different role in the tax code than other tax credits, like the aforementioned PTCs and ITCs.

For taxpayers in the oil and gas industry, this process is not easy.[14]Oil and gas companies pay income taxes for their foreign production in the foreign jurisdiction, but often other countries also assess royalties on companies that extract resources. For example, Norway imposes a corporate income tax of 22 percent, with an additional tax rate of 56 percent on oil and gas extraction, bringing the total marginal tax rate to 78 percent. Dual capacity rules ensure that the company gets a foreign tax credit against the full 78 percent tax paid to Norway.

Eliminating dual capacity rules would result in double taxation for a specific industry.

Conclusion

Eliminating so-called tax expenditures is important. Doing so reduces tax code complexity, simplifying the tax-filing process for individuals and businesses. Neutrality is improved, eliminating biases toward a favored industry or activity. And it can provide necessary revenue to finance broader tax reforms.

However, eliminating tax expenditures should be done carefully, and the tax code’s treatment of the energy sector is a prime example of the challenges that policymakers face. Many energy tax provisions ensure that companies are able to properly deduct their capital expenses. Eliminating those provisions would be problematic. At the same time, the tax code does contain a number of tax credits that provide special privileges for specific industries.

Policymakers looking to eliminate expenditures in the energy space should be careful to ensure that the correct provisions are slated for removal.

[1]For a longer discussion about so-called tax expenditures and their role in the tax code, review Kaeding, Nicole, “Understanding So-Called Tax Expenditures,” National Taxpayers Union Foundation, October 14, 2019.

[2]This paper is not exhaustive and will not consider every provision impacting energy production, but instead provides a useful framework for evaluating these provisions.

[3]Joint Committee on Taxation, “Estimates of Federal Tax Expenditures for Fiscal Years 2018-2022,” JCX-81-18, October 4, 2018. Many of these provisions do not have a specific revenue estimate, because JCT notes they are worth less than $50 million. Fiscal year 2018 was used, instead of 2019, due to data availability regarding energy production.

[4]Author’s calculations based on “The Value of Energy Tax Incentives for Different Types of Energy Resources” from the Congressional Research Service, R44852, March 19, 2019.

[5]Kaeding, “Understanding So-Called Tax Expenditures.”

[6]Joint Committee on Taxation, “Description of Present Law and Select Proposals Relating to the Oil and Gas Industry,” JCX-27-11, May 12, 2011.

[7]26 US §45(c).

[8]Joint Committee on Taxation, “Estimates of Federal Tax Expenditures for Fiscal Years 2018-2022.”

[9]26 US §45(b)5.

[10]26 US §48(a)6.

[11]26 US §41.

[12]Kaeding, Nicole., “Correcting the TCJA’s Mistreatment of R&D Costs,” National Taxpayers Union Foundation, October 8, 2019.

[13]Kaeding, “Understanding So-Called Tax Expenditures.”

[14]Using foreign tax credit is quite complicated in other avenues as well, such as under the new Global Intangible Low-Taxed Income provision of the Tax Cuts and Jobs Act. See broadly: Kaeding, Nicole, “More Changes are Needed to GILTI’s High-Tax Exemption,” National Taxpayers Union Foundation, October 4, 2019.