Moderate Democrats in Congress may have won a key concession from progressives on the “Build Back Better Act” social spending plan advanced by the Biden administration: significantly cutting the topline spending in the bill, potentially by trillions of dollars. However, policymakers and taxpayers should be wary of tried and true timing tricks that may make the Build Back Better Act (BBB) appear less expensive than $3.5 trillion.

If it’s a major priority in BBB, chances are Congressional Democrats are proposing ending it after two or three or four years, rather than enacting these policy changes on a permanent basis. While this will bring down the headline amount of spending in BBB,[1] potentially fitting the agenda within a lower topline spending number, the practical impact of so-called program ‘cliffs’ is to create enormous political pressure to extend the programs.

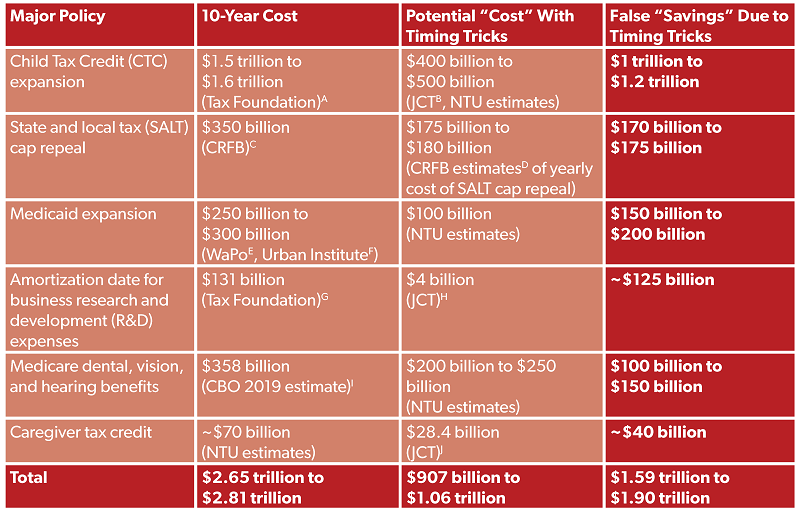

A few prominent examples include:

- The Child Tax Credit (CTC) expansion: Since day one of President Biden’s American Families Plan proposal, policymakers at the White House have proposed a four-year extension (from 2022-25) of the CTC expansion passed under the American Rescue Plan (ARPA).[2] This is not because policymakers want to pilot the program and see how it works; on the contrary, they are aggressively touting the impacts of expansion. But the CTC expansion is enormously expensive, with a budget impact of more than $130 billion per year from 2022-25.[3] The relative budget impact will be even larger after 2025, since Republicans scheduled their boost to CTC (under the Tax Cuts and Jobs Act, or TCJA) to expire after 2025. Even at just four years, the CTC expansion has a budget impact of over half a trillion dollars. To cut the topline spending number in BBB, Democrats are even considering reducing the expanded CTC extension from four years (2022-25) to three years (2022-24). The political reality, though, is that the CTC expansion is very popular among Democratic lawmakers, and there will be significant pressure to extend the expansion whenever it expires. Tax Foundation has estimated that the 10-year cost of extending the expanded CTC is nearly $1.6 trillion over 10 years. A three- or four-year extension could mask the cost of expanding CTC on a decade-long basis by anywhere from $1 trillion to nearly $1.2 trillion.

- State and local tax (SALT) cap suspension: Some members of Congress are extremely eager to repeal the current $10,000 cap on the state and local tax (SALT) deduction, an itemized deduction that overwhelmingly benefits wealthy taxpayers in high-tax states. The Committee for a Responsible Federal Budget (CRFB) has estimated that repealing the cap for four years[4] would cost about $350 billion, or about $85 billion per year. Some lawmakers have discussed suspending the cap for two years instead. This could mask around $170 billion to $175 billion in 10-year costs, if the SALT cap were subsequently suspended for another two years.

- Medicaid expansion: Democrats are hoping to extend health coverage to low-income individuals in the dozen states that have not expanded Medicaid under the Affordable Care Act (ACA). The 10-year cost of Medicaid expansion depends on how lawmakers expand coverage -- current possibilities include expanded ACA subsidies for private health insurance, a federally-administered public program, or some combination thereof (such as a transition period with private subsidies and then a permanent public program). The Washington Post previously reported that the 10-year cost of Medicaid expansion would be $250 billion to $300 billion, while the Urban Institute estimated that 10 years of ARPA-level ACA subsidies to the Medicaid expansion population would cost $270 billion. Lawmakers are instead talking about limiting Medicaid expansion to as short as three years, potentially creating a policy cliff where millions of people could lose access to coverage as benefits are cut off at the end of 2025. This could mask anywhere from $150 billion to $200 billion in 10-year costs, should BBB’s Medicaid expansion continue beyond 2025.

- Amortization of business research and development (R&D) expenditures: One tax cut included in the House version of BBB was the four-year delay of a proposed change to the tax treatment of companies’ R&D expenditures (from full and immediate expensing to five-year amortization). While NTU supports full repeal of R&D amortization (thereby allowing businesses to permanently expense R&D), delaying amortization for four years masks the true cost of repealing R&D amortization. The difference could be up to $125 billion over a decade, since the 10-year tax cut in the House legislation is just $4 billion but Tax Foundation estimates full repeal of R&D amortization would cut taxes by $131 billion over 10 years.

- Medicare dental, vision, and hearing benefits: Progressives including Sen. Bernie Sanders (I-VT) have led a push to expand Medicare benefits to cover dental, vision, and hearing expenses. The Congressional Budget Office (CBO) previously estimated that dental care starting in 2025 (and hearing and vision care starting in 2023) under House Democrats’ H.R. 3 would cost $358 billion over 10 years. The majority of that spending - $238 billion - would have gone to dental care. The House version of BBB delays the provision of dental coverage until 2028 (hearing coverage starts in 2023 and vision care in 2022). If dental care costs roughly $50 billion per year (a rough estimate based on CBO’s 2019 cost estimates), then delaying for two or three years (relative to H.R. 3) could mask the 10-year cost of Medicare dental alone by $100 billion to $150 billion.

- Credit for caregiver expenses: The House version of BBB includes a non-refundable tax credit for caregiver expenses of up to $4,000 per year, but the credit expires in 2025. The Joint Committee on Taxation (JCT) estimates that revenue reductions from the credit will total $28.4 billion over 10 years, but if the credit were instead available for all 10 years of the budget window that cost could be as high as $70 billion. Enacting the credit for only four years potentially masks as much as $40 billion in 10-year costs.

Add these (very) rough estimates up, and between $1.6 trillion and $1.9 trillion in 10-year costs could be hidden from the public.[5] CRFB has done similar work, estimating the potential total cost of BBB to be between $5 trillion and $5.5 trillion over a decade, rather than the headline cost of $3.5 trillion, depending on the policy choices Congressional Democrats and the Biden administration make.[6]

Unfortunately, hiding the true long-term costs of BBB may be part of some policymakers’ strategy, now that moderates have negotiated a nominal decrease to the topline spending in BBB. Rep. Alexandria Ocasio-Cortez (D-NY), Congressional Progressive Caucus Chair Pramila Jayapal (D-WA), and White House senior advisor (and former Congressman) Cedric Richmond are among the progressive voices recently suggesting shorter timeframes for programs, which could help lawmakers pass a version of BBB that could win support from progressives and moderates.

The policy choices mentioned above, though, would be tantamount to kicking a multi trillion-dollar can down the road, creating irresponsible policy and spending cliffs in the near future and hiding the true cost of BBB from taxpayers. To be clear, Congressional Democrats and the Biden administration are not the first set of policymakers to contemplate such choices. TCJA, for example, allowed for popular tax cuts on the individual side of the code to expire after 2025, and delayed some unpopular potential tax hikes (which helped offset the bill’s tax cuts) until 2022 or later.

Policymakers should strive for a more honest approach, though, and ensure that voters and taxpayers understand the full cost of BBB. A better approach for fitting policymakers’ agenda into a smaller BBB topline would be to cut proposed new programs entirely or target expensive programs at Americans who truly need taxpayer-funded assistance. Trillions of dollars could be on the line.

[1] Headline amounts of spending (or tax cuts, for that matter) are often expressed in terms of their costs over a 10-year window. These are the estimates that the Congressional Budget Office (CBO) and the Joint Committee on Taxation (JCT), lawmakers’ budget and tax scorekeepers, regularly provide for proposed legislation.

[3] We refer to “budget impact” because CTC is neither just a tax cut nor just a spending increase. A portion of CTC is a tax cut, because it reduces the tax liability owed by many parents to as low as $0. Beyond reducing tax liability to $0, the expanded CTC is refundable. This means parents can receive more in CTC dollars than they owe in taxes for a given year. The refundable portion of CTC counts as increased spending (rather than reduced taxes), so we refer to the “budget impact” of CTC as the combined effects of the tax cuts and spending increases.

[4] The SALT cap expires in 2026, when other individual provisions of the Tax Cuts and Jobs Act (TCJA) expire.

[5] Unlike most of the policy options mentioned above, delaying the provision of dental care under Medicare until 2028 would not create a spending or policy “cliff.” Instead, this masks the long-term costs of Medicare dental benefits by only providing them for only four years out of the 10-year scoring window estimated by CBO and JCT (see footnote 1).

[6] This is relative to the previously stated topline spending number of $3.5 trillion. CRFB’s analysis also covers more programs than those covered here.

[A] York, Erica and Li, Huaqun. "Making the Expanded Child Tax Credit Permanent Would Cost Nearly $1.6 Trillion." Tax Foundation, March 19, 2021.

[B] Joint Committee on Taxation. (2021.) "Estimated Budgetary Effects Of An Amendment In The Nature Of A Substitute To The Revenue Provisions Of Subtitles F, G, H, I, And J..." Retrieved from: https://www.jct.gov/publications/2021/jcx-42-21/

[C] "SALT Cap Repeal Would Be a Costly Mistake." Committee for a Responsible Federal Budget, September 10, 2021.

[D] Ibid.

[E] Roubein, Rachel. "Democrats Clash Over Cuts to Make the Party's Health Care Pledges." The Washington Post, September 29,2021.

[F] Holahan, John and Simpson, Michael. "Filling the Medicaid Gap with a Public Option." Urban Institute, July 2021.

[G] "Options for Reforming America's Tax Code 2.0." Tax Foundation, April 19, 2021.

[H] Joint Committee on Taxation. (2021.) "Estimated Budgetary Effects Of An Amendment In The Nature Of A Substitute To The Revenue Provisions Of Subtitles F, G, H, I, And J..." Retrieved from: https://www.jct.gov/publications/2021/jcx-42-21/

[I] Swagel, Phillip L. (Director, Congressional Budget Office.) Letter to: Rep. Frank Pallone, Jr. (Chairman, Committee on Energy and Commerce, United States House of Representatives. Re: Budgetary Effects of H.R. 3, the Elijah E. Cummings Lower Drug Costs Now Act. Congressional Budget Office, December 10, 2019. Retrieved from: https://www.cbo.gov/system/files/2019-12/hr3_complete.pdf.

[J] Joint Committee on Taxation. (2021.) "Estimated Budgetary Effects Of An Amendment In The Nature Of A Substitute To The Revenue Provisions Of Subtitles F, G, H, I, And J..." Retrieved from: https://www.jct.gov/publications/2021/jcx-42-21/