(pdf)

Introduction

- The Child Tax Credit (CTC) has undergone several changes since its inception in 1997. Most recently, the CTC was made more generous and widely available through changes in the American Rescue Plan. However, these changes are temporary and expire after 2021. As part of the $3.5 trillion budget reconciliation package, a priority for Democrats is extending the expanded CTC. The length of the expansion will likely depend on the pay-fors and budget scoring, but the legislative text approved by the House Ways & Means Committee would provide a four year extension.

What Is the Purpose of the Child Tax Credit?

- The CTC allows taxpayers with a qualifying child to reduce their federal income tax liability. Multiple studies point to the CTC as a valuable tool to reduce child poverty, and the expansion of the credit under both a Democratic and Republican controlled Congress points to its popularity with the public.

- The CTC also reflects the high cost of raising a child. Child care, food, health care, and other expenses can come with high costs to families. A report from the Federal Reserve found that 40 percent of Americans would not be able to pay a $400 emergency expense without needing to borrow money or sell something. Child-related expenses can surface unexpectedly, and targeted tax provisions can help ensure Americans are more adequately able to meet the financial needs of their family. One study by the United States Department of Agriculture estimates that the cost of raising a child from birth to age 17 for a middle-income couple (before-tax income between $59,200-$107,400) was $233,610 (in 2015 dollars). The CTC aims to reduce the burden on families.

How Did the Tax Cuts and Jobs Act Expand the Child Tax Credit?

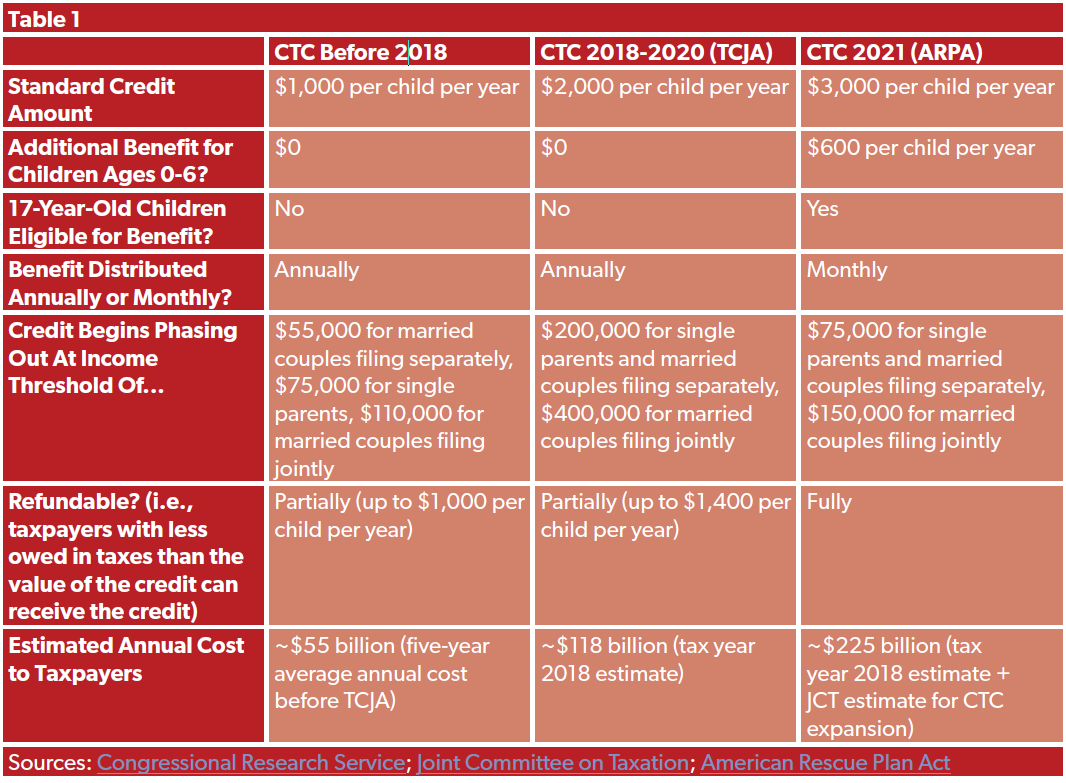

- The Tax Cuts and Jobs Act (TCJA), tax reform legislation signed into law in 2017, made several changes to the CTC, including:

- Doubling the maximum amount of the credit from $1,000 to $2,000 per qualifying child;

- Increasing refundable portion of the credit, sometimes referred to as the additional child tax credit (ACTC), increased from $1,000 to $1,400;

- Indexing the ACTC to inflation;

- Lowering the income level a taxpayer could receive the ACTC from $3,000 to $2,500 and

- Increasing the income level where the credit phases out from $75,000 to $200,000 for single filers and $110,000 to $400,000 for married joint filers.

- A taxpayer with little to no federal income tax liability would likely be eligible for little to none of the nonrefundable portion of the CTC. Instead, they may be able to claim the refundable portion of the credit, the ACTC, by using a formula. The ACTC is calculated as 15 percent of earnings (refundability rate) that exceeds $2,500 (refundability threshold) up to the maximum of $1,400 per qualifying child. If a taxpayer’s earnings are below the $2,500 threshold, they are ineligible for the ACTC. By lowering the refundability threshold and increasing the size of the refundable credit, the CTC is more generous to low-income taxpayers. Meanwhile, raising the phaseout threshold also made the credit more available for higher income taxpayers. The changes made under TCJA are temporary and expire in 2025.

How Did the American Rescue Plan Expand the Child Tax Credit?

- The American Rescue Plan Act (ARPA) greatly expanded the credit, but the changes are temporary and expire after 2021. The changes made under ARPA include:

- Raising the maximum age from 16 to 17 years old;

- Increasing the maximum size of the credit to $3,000 per qualifying child ($3,600 for a child age 0-5);

- Making the credit fully refundable, eliminating the ACTC phase-in;

- Paying half of the expected credit in monthly advanced payments and the other half when a taxpayer files their return.

- Raising the maximum age makes the credit available to families for a longer period of time and increases the number of families eligible for the credit. ARPA’s changes to the CTC make the credit more generous to low-income families since the credit is fully refundable. Table 1 shows how CTC differs between pre-TCJA, TCJA, and ARPA.

- The advanced monthly CTC payments are estimated by the Internal Revenue Service (IRS) based on 2020 income data. If a taxpayer receives more in advance payments than they are eligible for due to changes in income, filing status, or number of children, they may be required to repay the excess. However, if the incorrect advanced payment is due to changes in net qualifying children (e.g. a single parent has two qualifying children in 2020 but one child now lives with another parent/guardian), most low- and moderate-income taxpayers are protected by a safe harbor. Safe harbor protections decrease as income increases.

How Much Does Extending the Expanded ARPA CTC Cost?

- According to the Tax Foundation, extending the ARPA version of CTC ($3,000 per child) would cost $101.6 billion alone in 2022, relative to the pre-ARPA version of CTC (in other words, the TCJA CTC of $2,000 per child).

- Also according to the Tax Foundation, extending the ARPA version of CTC for 10 years would cost $1.6 trillion. The annual costs are higher from 2026-2031, because in 2026 CTC is scheduled to go from $2,000 (under TCJA) to $1,000 (pre-TCJA). The Committee for a Responsible Federal Budget estimates the permanent extension of the ARPA version of the CTC to be $1.2 trillion.

- If treated as a spending program, ARPA’s CTC would be the fourth largest spending program in the federal government behind only Medicare, Social Security, and Medicaid. Similarly, a Congressional Research Service (CRS) report notes that the ARPA CTC would likely be the largest cash assistance program for low-income families in 2021, excluding benefits from direct payments.

Who Benefits From the CTC?

- Under the TCJA version of the CTC, an estimated 84 percent of families with children received the credit. Prior to ARPA, the average family received an estimated $2,597 from the CTC. Under the ARPA expansion, an estimated 96 percent of families with children receive the CTC. The average family’s benefit from the CTC under the ARPA expansion is estimated to be $5,086.

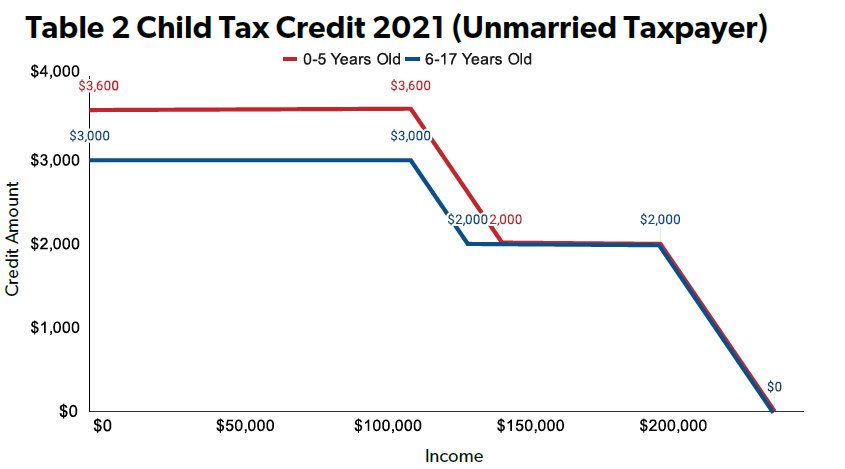

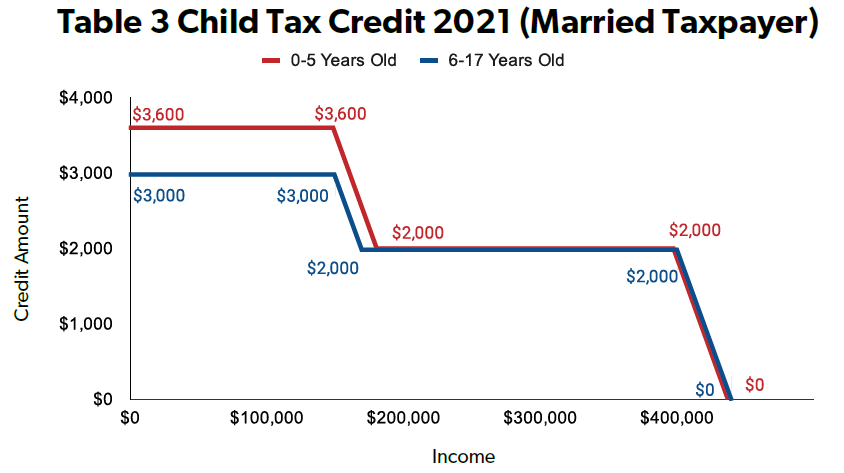

- The changes under ARPA generally increase the amount of the credit for low and moderate-income taxpayers. A CRS report found that, generally, the lower the family’s income, the larger the increase in benefits from the ARPA expansion, due in large part to the full refundability and larger credit size.

- However, moderate- and higher-income taxpayers also receive a larger benefit. A single taxpayer earning $112,500 (roughly six times the federal poverty level (FPL) for a two-person household) could receive the full $3,000 benefit ($3,600 if the child is under six years old). A married couple making $350,000 (13 times the FPL for a four-person household) could receive a $2,000 benefit per qualifying child. Raising the maximum age to 17 could also increase the benefit for moderate- and higher-income taxpayers.

Source: Congressional Research Service

Source: Congressional Research Service

Ways to Improve the CTC

- Address temporary nature of expanded CTC: The expanded CTC, as well as other temporary tax provisions, should either be made permanent or allowed to expire. Temporary tax provisions complicate the tax code and create uncertainty for taxpayers. If lawmakers want to keep the expanded CTC, they should make it permanent and predictable for taxpayers.

- Pay for the CTC: The CTC should be paid for, ideally with spending offsets. NTU and other groups offer offsets and reforms that should be considered by lawmakers as ways to rein in spending. Lawmakers could also pay for the CTC by reducing spending on duplicative social programs and wasteful spending. A proposal from Senator Mitt Romney (R-UT) suggests repealing regressive tax provisions like the state and local tax deduction and reforming other programs that serve similar purposes like the earned income tax credit or temporary assistance for needy families program. With a national debt of $28 trillion and an additional $3.5 trillion in spending currently being considered, NTU would recommend that any offsets and revenue raisers be used for deficit reduction, but they could be used to make the CTC permanent and paid for.

- Keep full refundability and monthly payments: The full refundability increases the benefits for low-income taxpayers who have little or no tax liability. Framed as an anti-poverty measure, it would be reasonable to ensure that low-income taxpayers receive the greatest benefit from the CTC. The Tax Foundation found the budgetary impact of making the CTC fully refundable to be minimal. Similarly, while the monthly payments may increase the complexity of the credit, NTU believes that advanced monthly payments are appropriate and the benefits outweigh the negatives. Parents do not pay for food, clothing, health care, and other goods and services once a year. Monthly payments more accurately reflect the financial realities for families. A lump sum payment may also be viewed as just that - a lump sum. Monthly payments would separate the CTC from the sum taxpayers may receive after filing their taxes and could lead to more of the credit being spent on child-related expenses.

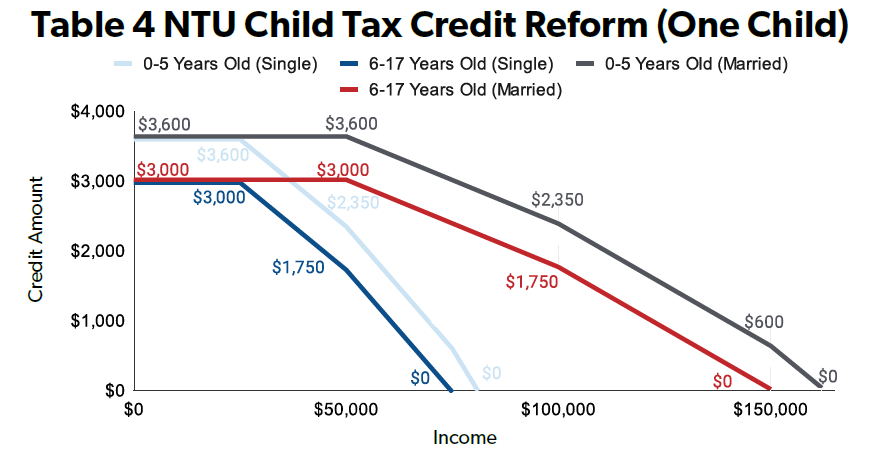

- Lower income thresholds: If the goal of the CTC is to reduce the burden on low- and moderate-income families and reduce child poverty, it makes little sense for a married couple making 13 times the federal poverty level (FPL) to receive a $2,000 credit per child. There are several ways that lawmakers can make the CTC better targeted to families most in need, but NTU has put forward one possible model. Under NTU’s model, shown in Table 4, the phase-out of the credit begins at $25,000 ($50,000 for married couples filing jointly). This would lower the budgetary impact of making the CTC permanent and ensure the benefits of the credit are targeted to those most in need of federal assistance.

Conclusion:

The CTC is well-targeted as an anti-poverty measure, but it can be improved by lowering the income thresholds. Temporary tax provisions are not sound tax policy. Instead of creating temporary tax provisions like the TCJA and ARPA did with the CTC, lawmakers should evaluate options to make the CTC permanent and paid for. This reduces uncertainty and complexity for taxpayers.