(pdf)

Introduction

As of early January 2021, America’s national debt was nearly $27.7 trillion. America’s debt is now well more than its entire gross domestic product (GDP) - around 127.4 percent at the end of the third quarter of 2020, according to the Federal Reserve Bank of St. Louis. This ghastly picture is about to get worse - the Congressional Budget Office (CBO) estimates that the federal budget deficit was a record $3.1 trillion in fiscal year (FY) 2020.

A government that regularly spends 28 percent more than it takes in is fundamentally dysfunctional.1 Though stakeholders across the ideological spectrum have acknowledged that the devastating COVID-19 pandemic required an unusual level of federal spending to support American families, businesses, and health care providers, the government’s poor budget and spending habits have left the U.S. ill-equipped to handle the pandemic and economic downturn. Unless Congress gets its fiscal house in order, lawmakers will remain ill-equipped to handle unforeseen emergencies down the road. Generations of taxpayers will feel the consequences, as net interest on the debt eats up a larger and larger portion of annual revenues, crowds out more productive uses for inherently limited federal tax dollars, and boosts calls from some progressives to raise taxes.

The situation was also dire 10 years ago, and Congress sought to fix some of these problems with the Budget Control Act (BCA) of 2011. The BCA wasn’t a fix to all of the federal government’s spending woes, but it did include some modest caps on discretionary spending. It also included sequestration -- across-the-board spending cuts -- if Congress violated the caps or failed to reach a 2011 compromise on deficit reduction. (They did fail). Compliance with the BCA has been an utter disaster, though -- and a bipartisan one.

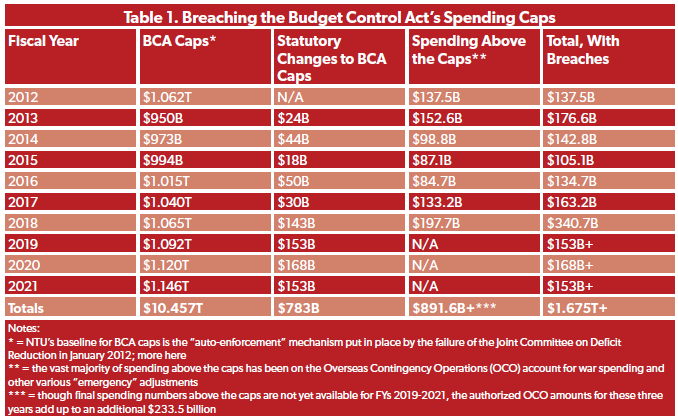

Deal after deal after deal raised the BCA’s original caps, with gimmicky offsets that demonstrated little restraint or remorse on the part of Congress for a nonstop march to higher deficits and more debt. The end result has been $783 billion in cap adjustments over just eight years, with at least an additional $891 billion of emergency or Overseas Contingency Operations (OCO) spending not subject to the caps. Instead of finding $1.5 trillion in deficit reduction over 10 years, as instructed by the BCA, Congress went and found nearly $1.7 trillion in new spending above BCA levels (and counting).

As modest as the BCA was, lawmakers failed in complying with the law’s requirements. Compounding this failure is a breakdown in the Congressional budget process, as well as the decades-long trend of Congress ignoring its oversight and reform responsibilities when it comes to the 70 percent of federal spending that is mandatory (rather than discretionary). Congress needs a new Budget Control Act in 2021, and NTU has several proposals to make this BCA a more enforceable and meaningful one. And while some lawmakers found the original BCA to be far too restrictive for Congress, NTU believes several of the recommendations below would actually enhance lawmakers’ power over the nation’s purse strings while reducing the power held by the executive branch.

Below, we outline the many problems that put the U.S. in its untenable fiscal position, and NTU’s preferred solutions to address each of these problems. To summarize, the problems are:

Soaring U.S. debt and deficits, which will, over time, reduce economic output, threaten national security, and eat up more productive uses for limited federal revenue;

A federal budget that largely runs on autopilot, given more than half of all federal spending is “mandatory” and outside of the discretionary spending passed by Congress most years;

A decade of Congress cheating the BCA caps, primarily in two ways: 1) raising the caps beyond what was set by the 2011 law, and 2) authorizing and appropriating dollars that don’t count under the caps, mostly for the wartime Overseas Contingency Operations (OCO) account;

A variety of Congressional budget gimmicks that appear to reduce deficits but do not actually represent bold, necessary, and permanent spending and budget reforms; and

A completely broken budget process in Congress that serves taxpayers poorly each and every year.

NTU’s proposed solutions are:

Another decade of discretionary spending caps, which starts by freezing discretionary spending at FY 2021 levels for five years and then only increases caps at the rate of inflation for the next five years;

Stronger incentives against (or disincentives for) cheating the new spending caps, which includes eliminating the OCO account, tightening the Congressional definition of “emergency” spending, and strengthening the mandatory sequester;

Offering real spending reduction proposals, totaling $1.7 trillion over 10 years, all of which are recommended by either the cross-ideological NTUF-PIRG “Common Ground” report or the non-partisan Congressional Budget Office (CBO);

A real and robust Congressional effort to tackle the mandatory programs that drive U.S. government spending growth, with an ideal model being Sen. Mitt Romney’s (R-UT) TRUST Act;

Congressional budget process reform, with an ideal model being the Bipartisan Congressional Budget Reform Act introduced by former Senate Budget Committee Chairman Mike Enzi (R-WY) and Sen. Sheldon Whitehouse (D-RI).

The Problems

To better understand the solution to these problems, a more thorough analysis of Congress’s budget and spending problems is in order. Below are five distinct but interrelated trends that have helped lead the federal government down a road to fiscal ruin.

Soaring Debt and Deficits

As mentioned above, America’s national debt stands at nearly $27.7 trillion. CBO projected in its September 2020 Budget Outlook that the federal government would have an additional $13 trillion in deficits from FY 2021 through FY 2030.

Given the growing interest among some lawmakers in Modern Monetary Theory (MMT), which defends high federal deficits and debt, it’s worth reviewing why high deficits and tens of trillions of dollars in debt are bad for taxpayers, workers, and the U.S. economy:

Interest eats up more productive uses for federal revenue: According to CBO, the federal government’s interest payments on the debt will nearly double over the next decade, rising from $338 billion in FY 2020 to $664 billion in FY 2030. As policymakers continue to pass laws that raise spending, reduce revenues, raise deficits, and/or raise the debt level, mandatory interest payments will eat up a larger and larger portion of the annual revenues coming in to the federal government. The more the government needs to devote to interest payments, the less it has for growing mandatory spending needs and rising discretionary spending demands. It will also reduce policymakers’ slack to respond to disasters (like hurricanes, wildfires, and tornadoes) and public health crises (like COVID-19).

Growing debt reduces economic output: As CBO put it all the way back in 2013, “[i]ncreased borrowing by the federal government would eventually reduce private investment in productive capital, because the portion of total savings used to buy government securities would not be available to finance private investment. The result would be a smaller stock of capital and lower output and income in the long run than would otherwise be the case.” More recent analysis has confirmed these concerns are still relevant.

The debt is a national security threat: Military and national security experts like former Director of National Intelligence Dan Coats and former Joint Chiefs of Staff Chairman Admiral Mike Mullen agree: the debt is a national security threat in both the short and the long term. As Admiral Mullen put it in 2011: “...I think the [worse] situation that we are in as a country fiscally, the likelihood of the resources made available for national security requirements continue to go down is very high.”

Congress cannot spend like this forever, and future budget discipline will be critical to America’s long-term economic growth and to the health of the country’s social safety net programs.

Putting Spending on Autopilot

Although NTU has opposed almost every disastrous budget deal to raise the BCA caps on discretionary spending over the past decade, it must be noted that these deals only covered about 30 percent of the government’s spending pie in FY 2019. Another 60 percent is comprised of so-called “mandatory” spending, which mainly consists of Social Security and federal health programs (including Medicare, Medicaid, the Children’s Health Insurance Program, and the Affordable Care Act (ACA) subsidies), and the remaining 10 percent of the pie is set aside for net interest on the debt. By FY 2030, this balance is projected to be roughly nine percent for net interest, 66 percent for mandatory spending, and 25 percent for discretionary spending.

Any serious effort to reduce America’s debt and deficits must tackle growth in mandatory spending -- which is essentially on autopilot (more on that below) -- but unfortunately Congress has been taking this trend in the opposite direction. For example, last summer Congress passed the Great American Outdoors Act by wide bipartisan margins and sent the bill to the President’s desk. The legislation permanently transitions the Land and Water Conservation Fund (LWCF) from discretionary spending to mandatory spending. This adds around $900 million per year to the federal government’s mandatory obligations, and adds LWCF to a long list of mandatory federal programs whose funding levels should instead be assessed, debated, and reassessed as discretionary spending from year to year.

Even though the BCA included a sequester (across-the-board cut) for mandatory spending, the long list of programs exempt from the sequester renders the cuts somewhat moot - at least from a political perspective. This report from the Congressional Research Service includes a list of exempt mandatory programs, which on its own runs two pages long.

Cheating the Caps

As mentioned above, Congress has cheated the original BCA caps to the tune of at least $1.7 trillion over the decade. It has done so through two primary mechanisms: 1) striking bipartisan deals to raise the budget caps in upcoming fiscal years, and 2) authorizing and appropriating emergency funds above and beyond the caps. Here’s how those two breaches have worked in practice:

As the table shows, the cap adjustments have become more and more egregious over the years. NTU wrote of the latest budget deal, which raised caps for the last two fiscal years in the BCA’s 10-year window, was a “final nail in the coffin to BCA reforms.” Spending above the caps has generally become worse over the years, too. Around three-quarters of this category of spending goes to the OCO account, which NTU and other advocates across the ideological spectrum have long derided as a Pentagon slush fund. In May 2020, NTU published an issue brief with ten OCO reform options, including a recommendation that Congress eventually draw OCO down and out. More appears on those reform options below.

This $1.7 trillion in breaches translates to real, material losses for taxpayers, to the tune of nearly $14,000 per American household. And though Congress has made a less than half-hearted attempt to offset some of these breaches, it often does so through a variety of budget gimmicks and scams. More appears on those below.

Budget Gimmicks

NTU Foundation’s Demian Brady has written extensively on Congress’s use of gimmicky offsets in bipartisan budget deals to raise the BCA caps.

In July 2019 he wrote about two offsets in the Bipartisan Budget Act (BBA) of 2019 that were “suspect and problematic for a number of reasons”:

The first is an extension of Customs User Fees assessed on commercial vessels, trucks, aircraft, and passengers arriving at ports of entry to cover the cost of certain customs services. The Government Accountability Office pointed out that there is a misalignment between the custom inspection activities and the statutory uses of the customs fees: “not all of the activities that may be funded from the customs fees are associated with conducting customs inspections, and not all customs inspection activities are reimbursable (i.e., can be covered by funds from the user fee account).” The fees are only available to fund a limited list of inspection activities and also for deficit reduction.

BBA 2019 also extends Merchandise Process Fees under section 503 of the U.S.-Korea Free Trade Agreement Implementation Act. As described in a committee report on the enacting legislation, these fees are intended to “offset the salaries and expenses that will likely be incurred by the Customs Service in the processing of entries and releases.

To make matters worse, extensions like these often occur at the very end of a ten-year budget window, meaning Congress is hoping to pay for increased spending eight or nine years from the time that increased spending is put on the taxpayer’s credit card.

This is how each of Congress’s five mandatory sequester extensions have worked. The BBA of 2013 extended the sequester two years (FY2022 and FY2023) and a subsequent law extended the sequester to FY2024, the BBA of 2015 extended the sequester another year (FY 2025), and the two most recent BBAs extended the sequester a total of four years (FYs 2026 and 2027 in BBA 2018, and FYs 2028 and 2029 in BBA 2019). These changes would have collectively “offset” spending by somewhere in the neighborhood of $150 billion, but this pales in comparison to the $783 billion in statutory changes to the caps. These gimmicks also represent a complete lack of fiscal discipline - rather than “I’d gladly pay you Tuesday for a hamburger today,” it’s “I’d gladly pay you one-fifth the price of a hamburger by fiscal year 2029 for a hamburger today.”

NTU Foundation’s Brady also points to additional gimmicks over the years that have promised savings at the time but are eventually eroded or repealed by Congress. One notorious example is the “Sustainable Growth Rate” in Medicare, which Congress enacted to attempt to rein in provider payments:

The Balanced Budget Act of 1997’s Sustainable Growth Rate to check the growth in Medicare physician payment rates. However this resulted in a ritual of passing regular “Doc Fixes” to prevent the cuts from taking place, until it was replaced in 2015 with automatic increases for all doctors through 2019 (succeeded by a Merit-Based Payment Incentive System).

Many of the ACA’s “pay-fors” have also gone out the door since its passage in 2010. While NTU has opposed some of the law’s onerous taxes, it is worth noting that the taxes in the ACA have gone away - often repealed on a bipartisan basis - while the law’s spending provisions have remained in place.

A Broken Budget (and Authorization) Process

One problem running through all of the above concerns is a fundamentally broken budget process in Congress. The Congressional Budget Act of 1974 laid out a Congressional budget process that, when followed, assures Congress passes all 12 appropriations bills in some way, shape, or form before the beginning of a new fiscal year on October 1. That statutory timeline looks like this:

First Monday in February - President submits budget

Feb. 15 - CBO reports to Budget Committees on President’s Budget

Mar. 15 - Authorizing committees submit views and estimates to Budget Committees

Apr. 1 - Senate Budget Committee reports concurrent budget resolution

Apr. 15 - Congress completes action on concurrent budget resolution

May 15 - Annual appropriations bills considered in House Appropriations Committee

June 10 - House Appropriations reports last appropriations bills

June 15 - Congress completes action on any budget reconciliation legislation

June 30 - House completes action on annual appropriations bills

Oct. 1 - New fiscal year begins

The timeline rarely unfolds this way. For example, consider the current fiscal year (2021). The House passed 10 of 12 appropriations bills in July, but got stuck on bitter interparty and intraparty disputes over the Homeland Security bill. The Senate did not pass a single appropriations bill on its own, nor did the Senate Appropriations Committee advance any appropriations bill from Committee to the Senate floor. Congress did not complete action on a concurrent budget resolution. Instead, Congress passed and the president signed a continuing resolution (CR) to keep the government running on auto-pilot until December 11. Congress then passed several more short-term CRs, before leadership agreed to an omnibus spending bill for the remainder of FY 2021. Both chambers of Congress passed the omnibus deal on December 22, after Congressional leadership gave Members of Congress mere hours to read a bill exceeding 5,000 pages.

Congress could be forgiven for much larger priorities last year (including COVID-19 and the economic downturn), but the messy and convoluted process this year is a regular feature of recent Congressional budget negotiations, not a bug from 2020.

According to the Congressional Research Service (CRS):

Congress has enacted one or more CRs in all but three of the last 43 fiscal years (FY 1977 - FY 2019). In addition, in 10 of the last 18 fiscal years, the initial CR—and in some years subsequent CRs—provided continuing appropriations for all the regular appropriations acts.

Some more astounding statistics derived from the CRS report:

In nine of eleven fiscal years from FYs 2011-2021, Congress enacted zero appropriations bills (of 12) before the October 1 deadline; the legislative branch enacted one on time in FY 2017 and five on time in FY 2019.

In eleven fiscal years ranging from FYs 2011-2021, Congress enacted a total of 41 CRs, averaging just under four per year.

From FY 1998 through FY 2019, Congress passed a total of 117 CRs, covering 3,140 days (or 8.6 years); that’s an average of 5.3 CRs per year covering an average of 142.7 total days (or nearly 40 percent of an average year).

NTU has noted before that CRs can be a net positive for taxpayers, at least from a spending perspective. Given the recent, terrible budget deals that raised discretionary spending caps from fiscal year to fiscal year, CRs -- which typically hold spending at a level constant with the prior fiscal year -- can actually represent slight reductions in what would otherwise be appropriated by lawmakers for a new fiscal year.

However, CRs have become a crutch for lawmakers, rather than an occasional backstop over significant funding disagreements. This makes it harder for Congress to exercise its constitutional power of the purse, harder for fiscal conservatives to push for meaningful debt and deficit reductions, and harder for authorizing committees to exercise necessary oversight and scrutiny over federal spending.

This latter issue also extends throughout the fiscal year, and represents the inability of numerous authorizing committees to properly reexamine and reevaluate the successes or failures of federal programs.

CBO regularly reports on expired and expiring authorizations of appropriations, and their latest report from February 2020 underscores that expired authorizations are a major problem for Congress.

According to CBO, 1,046 authorizations from 272 laws expired before the beginning of FY 2020, and an additional 143 authorizations across 30 laws will expire by the end of FY 2020. This covers a total of $332 billion in FY 2020 appropriations, more than a quarter of the total amount of appropriations authorized for FY 2020.

House Committees with the most expired authorizations include Energy and Commerce (282), Natural Resources (160), Judiciary (141), Education and Labor (110), and Foreign Affairs (99). Senate Committees with the most expired authorizations include Health, Education, Labor, and Pensions (234), Energy and Natural Resources (182), Commerce (145), Judiciary (139), and Foreign Relations (98).

When Committees don’t reauthorize programs, they miss out on valuable opportunities to reform or cut spending for programs that are not working as intended. They also miss out on the chance to examine whether any programs have overlapping or duplicative goals. All of this adds up to waste and inefficiency of taxpayer dollars, and points to the need for reform.

The Solutions

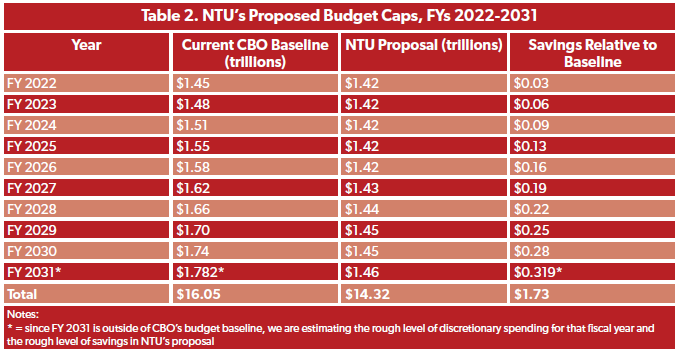

All of the above problems demand bold solutions. NTU believes there should be a new Budget Control Act this year, covering the next ten fiscal years (FYs 2022-2031). However, a new BCA needs stronger incentives against (or disincentives for) cheating discretionary spending caps. NTU’s new proposed BCA spending caps would reduce discretionary spending by $1.7 trillion over 10 years relative to CBO’s baseline, eliminate the Overseas Contingency Operations (OCO) account, include tighter definitions around “emergency” spending, and strengthen Pay-As-You-Go (PAYGO) rules.

NTU realizes it is not enough to merely set a large spending reduction target and ask Congress to do the hard work. Fortunately, NTU and NTU Foundation have a strong and existing body of work proposing real spending reforms and reductions with the potential for bipartisan support. We believe Congress could reduce spending around $1.6 trillion relative to CBO’s baseline through two primary methods:

- Implementing the recommendations in the 2020 Common Ground report from NTU Foundation and the U.S. Public Interest Research Group (U.S. PIRG) Education Fund. This cross-ideological partnership identified $797 billion in spending reductions over the next decade, agreed to on a cross-ideological basis.

- Eliminating the OCO account. As mentioned above, NTU proposes eliminating the OCO account - widely regarded as a slush fund by policymakers across the ideological spectrum. CBO does not officially build OCO amounts into their baseline, since OCO is not currently projected to exist past FY 2021. However, they do assume that Congress’s violation of the caps through OCO will count toward defense spending growth for the next ten fiscal years -- in fact, by FY 2030 CBO projects defense spending will be a staggering $919 billion. If Congress were to eliminate the OCO account, and match the 10-year defense spending outlook to the base budget in FYs 2020 and 2021 rather than the base budget plus OCO cap violations, the savings would amount to roughly $80 billion per year.2 Over 10 years, that represents another $800 billion in savings.

Finally, Congress’s broken budget process indicates that budget process reform is sorely needed. NTU supported the Bipartisan Congressional Budget Reform Act (BCBRA) from former Sen. Mike Enzi (R-WY) and Sen. Sheldon Whitehouse (D-RI), which included many important changes to the Congressional budget process.

Discretionary Spending Caps

NTU proposes reducing spending by $1.7 trillion relative to CBO’s baseline, by holding overall discretionary spending flat at FY 2021 levels ($1.419 trillion) for five fiscal years (FYs 2022-2026), and only then having discretionary spending increase at the average rate of inflation (CPI-U). Discretionary spending under the NTU proposal would be $1.46 trillion in FY 2031, less than the level it is projected to be in FY 2023 under the current baseline.

More important than the caps are the enforcement mechanisms to ensure Congress does not cheat the caps. More details on that below. However, NTU proposes eliminating the distinction between security and nonsecurity spending caps in the next Budget Control Act.

To review, Congress has for decades distinguished between “security” and “nonsecurity” spending in its enactment of discretionary caps. Security spending traditionally included the Departments of Defense (DoD), Homeland Security (DHS), and Veterans Affairs (VA), as well as the National Nuclear Security Administration (NNSA), intelligence community, and international affairs spending. Nonsecurity spending was everything else. Congress pared back the security category to just the national defense budget function (050) starting in FY 2013: DoD, atomic energy defense, and “other defense-related activities” including counterintelligence.

Eliminating the distinction would be a significant reform, given the security and nonsecurity categories have been in place for decades now. The distinction, though, and the desire for “parity” between security and nonsecurity spending, has led to spending increases on both sides of this false ledger, with Republicans typically demanding dollar-for-dollar increases in security/defense spending and Democrats typically demanding dollar-for-dollar increases in non-defense spending. Taxpayers lose as a result.

Instead, Congress should eliminate the security and nonsecurity designations -- at least for the purposes of setting discretionary spending limits -- and resort to the appropriations process to hash out differences over defense and non-defense spending. This will make life more difficult for leadership in both political parties; but again, taxpayers will win as a result, because it will be much harder for lawmakers to agree to deals that simply raise both kinds of spending.

Stronger Incentives Against (or Disincentives for) Cheating

As mentioned above, the real issue with the BCA of 2011 was not that the discretionary spending limits were insufficient but that Congress kept cheating the caps over and over again. To review, Congress cheated the caps in two primary ways: 1) raising the caps in bipartisan budget deals, to the tune of $783 billion over 10 years; 2) approving $891 billion-plus in spending above the caps, mostly for the OCO slush fund.

Congress needs to make a BCA of 2021 stronger than the BCA of 2011, and NTU proposes the following measures to prevent the two kinds of cheating noted above:

Eliminate the OCO account: As NTU noted in its May 2020 OCO Issue Brief: “The OCO designation did not exist until FY 2011. Congress didn’t even fund Global War on Terror expenses through regular appropriations until FY 2004. Before that, and historically, Congress has relied on supplemental appropriations to fund war activities. Congress could consider phasing out OCO and ensuring that enduring requirements for America’s military engagements overseas (such as the ongoing Global War on Terror) are funded through the regular DoD budget. When unexpected military engagements arise that require additional funding, DoD could approach Congress for those supplemental appropriations and Congress could weigh that request (and any spending offsets to such supplemental appropriations).”

If Congress doesn’t eliminate OCO, it should fundamentally change and tighten the definition of “overseas contingency operations” in the BCA of 2021: CRS notes that Congress never defined OCO funding in the BCA of 2011. This left the Office of Management and Budget (OMB) and Department of Defense (DoD) with defining what constitutes OCO funding, and these agencies haven’t even updated their definition of OCO funding criteria since 2010. The lack of a definition from Congress and the lack of an updated definition from OMB and DoD have contributed to the OCO account’s current status as a slush fund for activities and spending that belongs in the base (regular) DoD budget (competing with other priorities). Two of NTU’s recommendations in its OCO Issue Brief correspond to this problem: 1) requiring OMB and DoD to update their OCO funding criteria, and keep that criteria regularly updated as long as OCO exists; and 2) enforcing the existing definition of a “contingency operation.” That definition is, in part, a military operation that “is designated by the Secretary of Defense as an operation in which members of the armed forces are or may become involved in military actions, operations, or hostilities against an enemy of the United States or against an opposing military force.” Though NTU’s strong policy preference is to eliminate the OCO account, Congress must seriously reform the OCO funding process if it is to keep the account around beyond FY 2021. That includes strictly defining and enforcing what constitutes a “contingency operation” and an acceptable OCO funding request.

Change and tighten the definition of “emergency” spending: The 2011 BCA defines an “emergency” requirement as one that “(A) requires new budget authority and outlays (or new budget authority and the outlays flowing therefrom) for the prevention or mitigation of, or response to, loss of life or property, or a threat to national security; and (B) is unanticipated.” The BCA then defines “unanticipated” as “sudden,” “urgent,” “unforeseen,” and “temporary.” Congress has regularly abused this definition, though, for non-emergencies. Two recent examples from both sides of the aisle: 1) Democrats proposed $20 million for the National Endowments for the Arts (NEA) and Humanities (NEH) as an “emergency requirement” in their HEROES Act, “for grants to respond to the impacts of coronavirus”; this is on top of $75 million allocated under the CARES Act, more than a third of the total NEH/NEA appropriation for FY 2020. 2) Republicans proposed $1.75 billion for a new FBI headquarters as an “emergency requirement” in their HEALS Act. As NTU noted at the time, “a new HQ is neither an ‘emergency’ nor a proper inclusion in a legislative package focused on COVID-19.” Though the issue here may be more about Congressional enforcement of the “emergency” definition than the definition itself, possible changes to the definition Congress could consider are: 1) eliminating the loss of property from the definition of an “emergency” (property losses as a result of natural disasters could be covered under the “disaster relief” category exempt from the caps); 2) expanding the definition to eliminate potential abuses, such as specifying that emergency requirements cannot have been planned or requested prior to a certain date before the emergency (i.e., the new FBI HQ) or capping emergency spending in an existing account at a certain percentage of regular appropriations (i.e., the NEH/NEA). With reforms such as these in place, military emergencies that might have formerly been funded under OCO (along with a great deal of unnecessary spending) could face more prudent tests going forward.

Strengthen the mandatory sequester: As noted above, the BCA of 2011 included a sequester (across-the-board spending cuts) for mandatory spending programs if Congress did not agree to $1.5 trillion in deficit reductions. Congress did not reach an agreement, so a mandatory sequester went into effect. There is also a sequester for violations of the Statutory Pay-As-You-Go (PAYGO) Act (more on that below). Unfortunately, both the impact of the sequester and the political pressure lawmakers feel from sequestration cuts are significantly reduced by the dozens of programs Congress exempts from the sequester. The Balanced Budget and Emergency Deficit Control Act (BBEDCA) of 1985 includes nearly seven pages of exempt programs, some as large as Social Security and some as small as the District of Columbia Judicial Retirement and Survivors Annuity Fund. The BBEDCA exempts ten overall types of mandatory spending from the sequester; they are 1) Social Security benefits, 2) veterans programs, 3) net interest on the debt, 4) refundable income tax credits, 5) non-defense unobligated balances, 6) military personnel payments (optional exemption), 7) dozens of “other programs and activities,” 8) low-income programs, 9) economic recovery programs, and 10) split treatment programs (like the highway fund). Further, the Medicare sequester in the BCA of 2011 is capped at two percent of direct spending, raising the amount that needs to be sequestered from other non-exempt programs (from 3.9 percent to 5.9 percent, according to CRS). These exemptions are not only unfair to the other mandatory programs and to discretionary programs that are not exempt from sequestration cuts, but they reduce the political pain when lawmakers fail at their job of finding and adhering to spending cuts. The exemptions amount to Congress picking winners or losers. Congress should consider exempting no program or category from sequestration in a future BCA, with the exception of net interest on the debt. Congress should also institute a sequester for any increases in a future BCA’s discretionary spending caps, and should be forced to apply that sequester to the FYs 2022-2031 budget window (rather than extending the mandatory sequester as Congress has done with the BCA of 2011). These changes would reduce the incidence of Congress picking winners and losers, increase the political price for failing to comply with spending caps, and also spread the effect of the sequester more evenly and fairly across the board.

Strengthen PAYGO rules: The Statutory PAYGO Act of 2010 was, according to CRS, “intended to discourage enactment of legislation that is projected to increase the on-budget deficit over five and 10 years.” It did so by requiring the President to issue a sequestration order whenever there is a debit on the PAYGO scorecard at the end of an annual session of Congress; in other words, if Congress enacted legislation during the year that increased on-budget deficits. Unfortunately, the law has not had its intended effect. As NTU Foundation’s Demian Brady noted in December 2017, “[t]o date, there has never been a sequestration order pursuant to PAYGO.” This is because several times over the ten years the PAYGO Act has been in effect, Congress has exempted spending and revenue measures from the PAYGO scorecards. Congress should consider strengthening each chamber’s PAYGO rules so that Congress cannot avoid the PAYGO sequester for particular legislation. Unfortunately, the Democratic majority in the U.S. House just weakened PAYGO rules by exempting two broad categories of legislation from having to comply with the chamber’s PAYGO rules: 1) legislation having to do with the response to COVID-19 and 2) legislation tackling climate change. While these are two important issues for Congress to deal with over the next two years, they are also incredibly expansive and NTU worries about the negative impact on already-weak and insufficient PAYGO rules.

Real Reductions

As noted above, it is not enough for NTU to recommend Congress reduce spending by $1.7 trillion from CBO’s baseline over 10 years without a roadmap for Congress to get there. Luckily, NTU and NTU Foundation have just such a roadmap. In April 2020, NTU Foundation and U.S. PIRG Education Fund released, “Toward Common Ground: Bridging the Political Divide with Deficit Reduction Recommendations for Congress.”

The report contains $797 billion in 10-year deficit reduction proposals, across four broad categories:

“$422 billion from addressing outdated or ineffective military programs” (53 percent of total);

“$170 billion from reforming the operation of entitlement programs” (21.3 percent);

“$143 billion from improving program execution and government operations” (17.9 percent); and

“$62 billion in savings from ending wasteful subsidies” (7.8 percent).

The report is too detailed to share in full here, but a few topline savings recommendations include:

Freezing DoD spending on operations and maintenance for five years, and then limiting growth to the rate of inflation ($195 billion in 10-year savings);

Limiting highway and transit funding to expected revenues ($116 billion);

Reducing quality bonus payments to Medicare Advantage plans ($94.2 billion);

Modifying risk-adjustment policies in the Medicare program ($67.2 billion); and

Reducing funding for naval ship construction to its 30-year historical average ($49.7 billion).

These recommendations have achieved consensus between a cross-ideological pair of research groups, and NTU believes that the same deficit reduction recommendations could achieve bipartisan support in Congress. The ideas are there; what’s missing is the political will to make tough but significant and necessary spending reforms and reductions.

NTU’s second major savings recommendation comes through eliminating the OCO account. CBO currently builds in the caps-cheating OCO account amounts to its estimate of the growth in discretionary defense spending over the next ten years. Eliminating that $80 billion per year boondoggle could save taxpayers at least $800 billion over the next 10 years, assuming defense spending growth were pegged to the FY 2021 base budget (instead of the base budget plus OCO).

The OCO account is barely about actual contingency needs anymore. In FY 2020, total OCO appropriations will likely amount to $79.5 billion, but only $32.5 billion in DoD’s budget request (41 percent) covered contingency needs. The other $47 billion (59 percent) covered base budget requirements, enduring requirements, the European Deterrence Initiative (EDI), and other non-war programming. For FY 2021, Congress has authorized $77 billion in OCO spending but the DoD budget request only covered $28 billion in contingency needs (36 percent). The remaining $49 billion (64 percent) is for base, enduring, and non-war requirements. Contingency needs will likely decrease further if and as America reduces its theater operations in Iraq and Afghanistan. It is time for Congress to retire the OCO account, fund contingency needs through emergency spending legislation (as it did after 9/11), and require the base and enduring programs currently in OCO to compete with everything else in the base DoD budget from year to year.

Additionally, Congress could consider an updated “A to Z” spending cut process that was originally proposed in the 1990s on a bipartisan basis. The idea would be for Members of Congress to devote a set number of floor time hours to debating budget savings. NTU Foundation’s Demian Brady wrote on this proposal in 2010, during the last major debate over spending caps and budget reform.

Checks on Mandatory Spending Growth

Since mandatory spending now makes up 60 percent of the federal government’s annual expenditures, any budget reform efforts need to also address this side of the ledger. The two largest mandatory spending programs -- Social Security and Medicare -- are funded in part by dedicated payroll tax revenue, but the trust funds dedicated to these programs are in serious trouble.

A recent report from the Government Accountability Office (GAO) titled “Fiscal Sustainability Is a Growing Concern for Some Key Funds,” provides more specific information on the health of America’s most critical trust funds. Even though there were nearly 400 active federal trust funds as of FY 2018, nearly half of the total balance in these funds ($2.9 trillion) was under the Social Security Administration (SSA). The Old Age and Survivors Insurance (OASI) Trust Fund in Social Security is projected to be depleted in 2034. Absent reform, at that time SSA will only be able to pay out 77 percent of scheduled benefits, meaning Social Security beneficiaries will see an immediate 23 percent cut in their monthly checks.

Medicare’s Hospital Insurance (HI) Trust Fund, covering Part A of the Medicare benefit, is projected to be depleted in 2026, “at which point projected income is estimated to cover only 89 percent of program costs.”

Under either scenario, Congress could be tempted to make an “easy fix” as it has in the past, by gradually ratcheting up payroll tax rates. This additional regressive burden on taxpayers would badly harm economic growth in the future.

Last year, Sen. Mitt Romney (R-UT) released legislation, the TRUST Act, that would set up joint “rescue” committees in Congress to recommend reforms that stabilize the nation’s most important trust funds, including the OASI and HI funds. At the time, NTU wrote:

The rescue committees, one per trust fund, would feature 12 members of Congress - three each appointed by the Senate majority leader, Senate minority leader, Speaker of the House, and House minority leader. The committees would be charged with four important goals: 1) avoid the depletion of the trust fund, 2) provide for 75-year solvency, 3) simplify the program in question, and 4) improve the program. Recommendations passed by the rescue committees would require bipartisan support (at least two members from each party), and would receive expedited consideration once advanced to the full House or Senate.

...The TRUST Act is a promising step, though, and could focus lawmakers’ attention on the most at-risk social programs. Tens of millions of taxpayers may be depending on bipartisan solutions that put these programs on a responsible path.

Fortunately for lawmakers, there is an existing body of work from CBO on options Congress has to reduce spending in mandatory programs like Social Security, Medicare, and Medicaid. Just five Social Security options in CBO’s 2020 “Options for Reducing the Deficit” would reduce the deficit by $284.3 billion over 10 years. These options are: 1) link the growth in initial benefits to prices (CPI) rather than wages ($109 billion in 10-year savings); 2) reduce Social Security benefits for higher-income earners while raising it for lower-income earners ($35.7 billion); 3) slowly raise the retirement from age 67 to age 70 for workers born in 1978 or later ($72.2 billion); 4) require Social Security disability insurance (SSDI) applicants to have worked four of the past six years, rather than five of the past 10 ($46.6 billion); and 5) eliminate eligibility for SSDI at age 62 or later ($20.8 billion).

Just seven Medicare and Medicaid options in CBO’s 2020 report would reduce the deficit by $1.63 trillion over 10 years. These options are: 1) eliminate the safe-harbor threshold for states’ Medicaid provider taxes ($429 billion in 10-year savings), 2) use a 50 percent FMAP for all Medicaid administrative expenses ($57 billion); 3) remove the 50-percent FMAP floor in Medicaid ($529 billion); 4) reduce the more generous FMAP rate for Medicaid expansion so it matches traditional Medicaid ($500 billion); 5) establish uniform cost-sharing in Medicare Parts A and B ($33.4 billion); 6) freeze income thresholds for income-related premiums in Medicare Parts B and D ($39 billion); and 7) reduce Medicare’s coverage of providers’ allowable bad debt from 65 percent to 25 percent ($42.6 billion). Two options (“Modify Payments to Medicare Advantage Plans for Health Risk” and “Reduce Quality Bonus Payments to Medicare Advantage Plans”) are not included here because they were included in the NTUF/PIRG Common Ground report mentioned above.

While they are certainly not without sacrifice, all 13 options would also put these programs on a more sustainable path to trust fund solvency, well beyond CBO’s 10-year budget window.

Budget Process Reform

In order for Congress to stay disciplined, reduce spending, adhere to discretionary caps, and avoid budget cheating when the political going gets tough, the institution will need to pass some kind of budget process reform legislation.

Former Senate Budget Committee Chairman Mike Enzi (R-WY) and Sen. Sheldon Whitehouse (D-RI) already have a strong blueprint, the Bipartisan Congressional Budget Reform Act (BCBRA) of 2019. NTU endorsed this legislation, but it is worth reviewing some of the strong portions of this legislation that would improve Congress’s broken budget process:

A move toward biennial budgeting: BCBRA would instruct Congress to pass a two-year budget resolution in the first year of a new session, which could incentivize Members to think more about the impact their decisions have on annual deficits and the climbing national debt. The appropriations process would still be annual, but the topline figures set by the budget resolution would be biennial, which could allow for actual enforcement of a biennial budget resolution’s targets and limits in the second year.

Debt-to-GDP targets: Budget resolutions would now have to include “a projected debt-to-GDP target for each year covered by the budget resolution” -- an absolute necessity with debt now exceeding the nation’s annual economic output. During the second year of each resolution, the Congressional Budget Office would have to report on whether or not the federal government is meeting its debt-to-GDP targets. If the government is falling short, S. 2765 would trigger a reconciliation process that forces Congress to address those failures.

Special reconciliation process for deficit reduction: Under this special reconciliation process, the Senate Budget Committee would have to report a special resolution to the Senate that contains “(1) the total level of deficit reduction and the period during which is to be achieved and (2) reconciliation instructions to one or more Senate committees specifying the total amount of deficit reduction to be achieved through changes in laws within the jurisdiction of each such committee.”

Expedited consideration for bipartisan budget resolutions: BCBRA sets up a fast-track process for biennial budget resolutions, as long as they have three-fifths support in the Senate and at least 15 minority party members in support.

Authorizing committee oversight: The bill would get authorizing committees off the sidelines by requiring them to “review programs and tax expenditures of which the committee has jurisdiction to identify waste, fraud, abuse, or duplication, and increase the use of performance data to inform committee work,” and to include “plans for improved governmental performance” in that committee’s views and estimates report they must submit to the Budget Committee.

Congress should also consider some of the following additional budget process reforms:

No budget, no recess in August and September: Under the Congressional Budget Act, it is not in order for the House of Representatives to adjourn for more than three calendar days in July if they have not approved all annual appropriations bills for the coming fiscal year. Congress could consider adding August and September to that requirement, effectively canceling August recess if the House has not passed its appropriations bills.

Compel a plan for reauthorization in an authorizing committee’s views and estimates: Under the Congressional Budget Act, authorizing committees have to tell the Budget Committees in their views and estimates report if they plan to reauthorize any Federal program. Congress could strengthen this requirement, and compel reauthorization or retirement of hundreds of expired programs by requiring committees to submit a plan for reauthorizing expired programs at the authorizing committee level within a certain timeframe (say, one year or two years).

Restore the long-term deficit point of order in the House: The Senate currently has a rule that “prohibits the consideration of legislation that would cause a net increase in deficits of more than $5 billion in any of the four consecutive 10-year periods beginning after the upcoming 10 years.” The House used to have this rule, but it went away in the (current) 116th Congress (2019-2020). The House should restore this rule in the 117th Congress (2021-2022).

Although constitutional tax and expenditure limitations remain critical parts of an ideal solution, the above reforms would help Congress better exercise its power of the purse authorities, budget ahead of time instead of in crisis mode, and stick to difficult spending decisions even when political pressure threatens to pull lawmakers in less responsible directions.

Conclusion

The above roadmap is bold and politically challenging, and would accomplish several significant aims:

Achieve more than $3.6 trillion in deficit reduction over 10 years;

Establish sustainable discretionary spending caps, while reducing some of the incentives from the 2011 BCA that convinced lawmakers to regularly raise spending limits;

Put some of America’s largest and most fragile mandatory spending programs (especially Medicare and Social Security) on a path to fiscal solvency; and

Reform a fundamentally broken Congressional budget process, allowing lawmakers and Congressional committees to plan and budget years ahead of time.

The ingredients for better budgeting and fiscal responsibility are in front of lawmakers; what needs to be added is the political will to make tough budgetary and spending decisions. Congress spent trillions of dollars in 2020 to fight the impacts of COVID-19 -- and many would acknowledge that some extraordinary amount of federal spending was necessary, especially to combat government-mandated economic shutdowns.

However, the current state of America’s debt and deficits illustrates that Congress’s addiction to spending and debt in prosperous times has made the country less safe, secure, and stable for two world-changing shifts in the last 15 years: the Great Recession and the pandemic. The nation is in a crisis right now, but Congress has been budgeting and spending in a ‘crisis-like’ mode for decades. The process must change, and another 10 years of spending caps are not enough if Congress merely cheats the caps regularly like they did from 2012 through 2019.

The Budget Control Act of 2011 was a modest effort at fiscal restraint, and even then its effectiveness was undermined by a bipartisan lack of fiscal discipline in Congress. The roadmap outlined by NTU would not solve all of America’s budget, spending, deficit, and debt woes, but it would put lawmakers on a road to a more sustainable future for the next generation of taxpayers.

1 According to CBO, from FYs 2010-2019 the federal government had an average of $2.9 trillion per year in revenues. In that same time span, deficits averaged $829.1 billion per year.

2 OCO allocations averaged $80 billion each in FYs 2020 and 2021 ($79 billion in FY 2020, $81 billion in FY 2021).