When President Biden signed the so-called Inflation Reduction Act (IRA) into law last year, he bragged about subsidizing electric vehicle (EV) purchases by providing tax credits worth up to $7,500 per vehicle. So far, the subsidies have proven to be a costly fiasco.

The Congressional Budget Office (CBO) and Joint Committee on Taxation estimated that these EV subsidies would cost $7.5 billion over 10 years, in addition to another $6.7 billion for qualified used vehicles, commercial vehicles, and EV charging equipment. As NTU pointed out at the time, a $7,500/vehicle subsidy is equal to about 100,000 EV purchases a year. That’s not much compared to annual average light vehicle sales of 15.6 million per year since 2000. CBO estimated that total clean energy subsidies would cost $391 billion, two-thirds of which would be provided through tax credits.

More recently, Goldman Sachs reportedly estimated that the actual cost of EV subsidies for light vehicle purchases would be $300 billion, contributing to a total green energy subsidy cost of $1.2 trillion. Credit Suisse has estimated the total federal cost of climate spending to be $800 billion.

The best solution to these exploding costs is to trim the green energy credits, as proposed in the Limit, Save, Grow Act of 2023.

NTU has long cautioned against inappropriate use of market-distorting tax credits in general, and specifically criticized the EV subsidies included in the IRA. In some cases, such subsidies are simply spending programs placed in the tax code, as former Sen. Tom Coburn (R-OK) described them. According to economist Vance Ginn, Ph.D., in recent testimony before the Ways and Means Committee: “these costly tax credits should be scrutinized and possibly eliminated because of their excessive costs and distortions to the marketplace.”

EV Subsidies are Still Regressive

One of the criticisms of EV subsidies has been that they primarily benefit high-income car buyers. The IRA tried to address this by capping eligibility for subsidies to Americans earning $225,000 or less for heads of households, for $300,000 or less for joint filers, and $150,000 or less for all other filers. In addition, the Manufacturer Suggested Retail Price may not exceed $80,000 for pickups and sport utility vehicles or $55,000 for other vehicles.

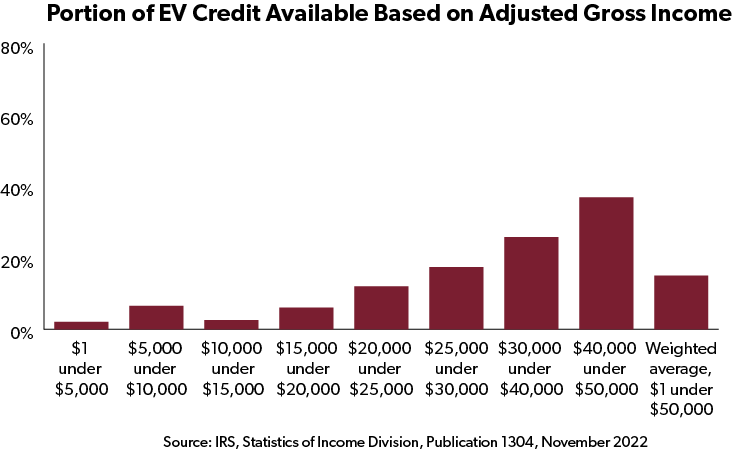

But the potential $7,500 tax credit does little to benefit many Americans. As of tax year 2020, more than half of tax returns reported Adjusted Gross Income under $50,000, with an average tax of $1,146. On average, these filers would only be eligible for about 15.3 percent of the potential $7,500 tax credit.

Figure 1: Eligibility for EV Tax Credits

EV Subsidies Help China by Alienating U.S. Friends and Allies

Reducing reducing carbon emissions is supposed to be the primary goal of EV tax credits. The Biden administration and Congress subverted this goal by including costly “Buy American” provisions in the IRA. According to President Joe Biden:

“American auto companies, along with American labor, are committing their treasure and their talent — billions of dollars in investment — to make electric vehicles and battery and electric charging stations all across America, made in America. All of it made in America.”

That perspective is based on an outdated 1950s mentality that no longer applies in today’s interconnected world. Vehicles built in Germany, Japan, or Korea are not currently eligible for EV subsidies. All of those countries strongly criticized the IRA. The European Commission wrote: “The Act risks causing not only economic damage to both the US and its closest trading partners, resulting in inefficiencies and market distortions, but could also trigger a harmful global subsidy race to the bottom on key technologies and inputs for the green transition.”

The Limit, Save, Grow Act of 2023 Act addresses these issues capping the number of vehicles eligible for subsidies and removing the protectionist requirement that EVs be assembled in North America to qualify for the subsidy.

CBO on Limit, Save, Grow Act

CBO estimates the energy provisions of the Limit, Save, Grow Act would reduce the federal budget deficit by a cumulative $570 billion during the 2023-2033 period. CBO refers to $553 billion in revenue increases, but it is important to understand that these are not traditional tax increases, but rather a reduction in targeted tax subsidies.

It would be a costly mistake for Republicans to allow the Biden administration’s subsidies to remain on the books indefinitely simply because the support is provided through the tax code instead of through direct spending.

Green subsidies are growing far beyond what was promised in the Inflation Reduction Act. The Limit, Save, Grow Act would give them a much-deserved pruning.