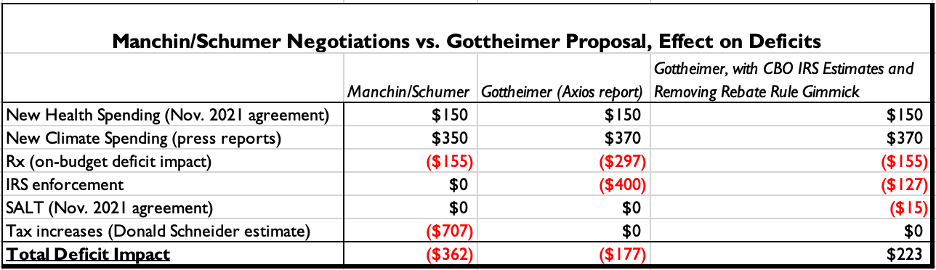

As Senate Majority Leader Chuck Schumer (D-NY) and Sen. Joe Manchin (D-WV) negotiate the confines of a reconciliation proposal focused on climate spending, health spending, tax increases, and deficit reduction, a small group of centrist House Democrats are preparing a new proposal that they claim would reduce deficits without raising taxes. Unfortunately, their plan relies on overly optimistic assumptions about revenue the IRS could collect from increased tax enforcement and utilizes a shameless budget gimmick regarding a Trump-era prescription drug spending regulation. Using more realistic assumptions, the centrist House Democrats’ proposal would instead increase deficits by $200 billion over a decade.

Axios was first to report on the centrist Democratic proposal, led by Rep. Josh Gottheimer (D-NJ). The New Jersey congressman’s discussions currently include at least half a dozen other center-left House Democrats. Axios reported the Gottheimer-led measure would include $520 billion in new health and climate spending, “offset” by:

- $400 billion from increasing Internal Revenue Service (IRS) tax enforcement efforts;

- $297 billion from Medicare prescription drug price controls; and

- A “deficit-neutral” version of lifting the $10,000 cap on the state and local tax (SALT) deduction, first enacted in the 2017 Tax Cuts and Jobs Act (TCJA).

Gottheimer estimates $177 billion for deficit reduction over 10 years, much less than the $500 billion that Sen. Manchin has been seeking.

For much of that $177 billion, Gottheimer relies on the $400 billion in added revenue following an increase to the IRS’s enforcement budget (likely by $80 billion, as proposed by the Biden administration and by House Democrats in the Build Back Better Act). But the Congressional Budget Office (CBO) has already scored the revenue effects of this enforcement budget increase, and found it would generate less than a third of that amount; $127 billion over 10 years ($207 billion minus $80 billion in added enforcement spending).

Additionally, the Axios-reported deficit impact of prescription drug legislation also appears to be optimistic relative to CBO estimates. Gottheimer is “counting on another $297 billion [in deficit reduction] from prescription drug reform,” but an existing and recent CBO estimate indicates the provisions agreed to in the Senate would decrease on-budget deficits by only $277 billion over a decade. What’s more, $122 billion of projected deficit reduction from the current prescription drug language relies on a shameless budget gimmick regarding a Trump-era prescription drug regulation, the “rebate rule.” While lawmakers claim – and CBO scoring conventions dictate – that repealing the rule will reduce government spending, NTU Foundation has regularly pointed out that the rule was never likely to be enacted and its repeal should not count as savings for taxpayers. It’s also possible Gottheimer is envisioning different prescription drug language than what’s currently in the Senate, which would net the federal government $297 billion in deficit reduction, but if he is envisioning changes to the current Senate language, he has not shared that with the public.

Between these two provisions – which do most of the deficit reduction work in Gottheimer’s plan – non-partisan, official scorekeeping would indicate that Gottheimer is $415 billion off target. Adding in a charitable view of Gottheimer’s SALT plan, if it mirrored the one passed by the House Build Back Better Act in November, would also reduce deficits, by $15 billion over 10 years (more on that below). That still means Gottheimer is $400 billion off target.

This could turn Gottheimer’s $177 billion deficit reduction plan into one that actually increases deficits by $200 billion, as detailed below:

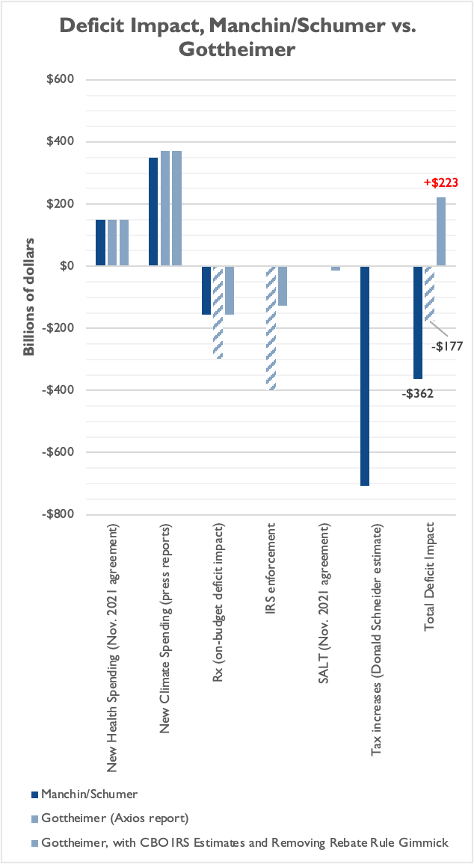

Sources: Health and climate spending estimates based on public reporting and on CBO estimates from the House-passed Build Back Better Act (BBB). Estimates for deficit reduction from prescription drug and IRS provisions based on the Axios report and on CBO estimates. SALT estimate based on the Joint Committee on Taxation’s estimate from the House-passed BBB. Tax increase estimates based on those from former House Ways and Means Republican Chief Economist Donald Schneider, on June 30, 2022.

Note: Patterned bars represent optimistic assumptions in the Axios-reported Gottheimer reconciliation proposal.

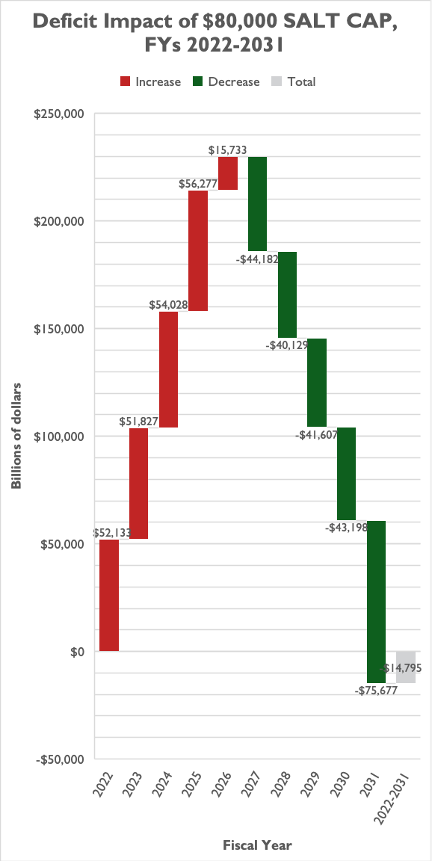

Worse yet is that the Gottheimer proposal’s SALT fix relies on a popular budget gimmick with both parties in Congress – increasing deficits now with the promise of reducing them later. The SALT provision from the Build Back Better Act would decrease deficits, on net, by $14.8 billion over 10 years, by increasing the SALT cap from $10,000 to $80,000 but extending that $80,000 cap beyond 2025, when the current-law $10,000 cap is supposed to expire, until 2030, and then decreasing it back to $10,000 in 2031. The proposal increases deficits by $230 billion from FYs 2022 through 2026, before decreasing deficits by $245 billion from FYs 2027 through 2031.

Eliminate the $10,000 cap in 2031 – a measure of budget discipline Congress seems unlikely to follow up on – and assume Congress instead continues an $80,000 cap, and this proposal very likely increases deficits on net, probably by around $10 billion to $20 billion. Eliminate the $80,000 cap from 2026 through 2030, and the proposal would increase deficits by hundreds of billions of dollars.

The SALT proposal will represent a windfall primarily for taxpayers making $200,000 or more, especially those making between $200,000 and $1.5 million.

IRS data from 2019 indicates that the households most hurt by the $10,000 SALT cap are the 4.5 million or so reporting $200,000 in income or more per year. With an $80,000 cap, taxpayers making between $200,000 and $1.5 million could see the highest proportional benefits (relative to their income) while most taxpayers making more than $1.5 million (including those making well into the millions) would still see some kind of benefit by deducting $70,000 more from their taxable income.

Comparing 2019 SALT deductions to 2017 SALT deductions (before the $10,000 cap was in place) tells a similar story about who benefits from lifting the cap, as do studies from the nonpartisan Joint Committee on Taxation, the Committee for a Responsible Federal Budget, and the Tax Policy Center.

While Rep. Gottheimer and his colleagues should be applauded for seeking to avoid some of the destructive tax increases proposed under reconciliation, his proposal misses the mark on deficit reduction (and may actually increase deficits), relies on overly optimistic projections about the revenue return from IRS enforcement funding, includes harmful prescription drug price controls, and revives a SALT cap gimmick that would primarily benefit the wealthy. This proposal would not ultimately be helpful to most taxpayers or America’s long-term fiscal outlook.