(pdf)

Recent reporting on President Biden’s infrastructure plans, and Dr. Janet Yellen’s confirmation hearing to be Biden’s Treasury Secretary, have raised a number of questions about how the new President and a Democratic Congress will handle tax policy in 2021 and beyond.

NTU always tries to emphasize what we’re for rather than what we’re against, and some of our recommendations for pro-growth tax policy in 2021 are here and here and here. Unfortunately, some recent proposals from President Biden and leading Democrats in Congress would harm individual taxpayers and economic growth as the U.S. seeks to recover from the worst downturn in generations. A different category of proposals are not as harmful, but are still improperly targeted if policymakers’ goal is to deliver relief to families struggling the most during the pandemic.

Below are some of the tax policies Democrats should avoid in the months ahead:

- Raising the corporate income tax rate from 21 percent to 28 percent;

- Doubling the global intangible low-taxed income (GILTI) tax rate from 10.5 percent to 21 percent;

- Enacting a financial transactions tax (FTT);

- Raising the capital gains tax rate and/or raising the Net Investment Income Tax (NIIT).

- Enacting a mark-to-market system for taxing financial assets;

- Eliminating the $10,000 limitation on the state and local tax (SALT) deduction;

- Expanding the Child Tax Credit (CTC) in a manner that benefits many high-income households; and

- Significantly expanding the Child and Dependent Care Tax Credit (CDCTC) in a manner that primarily benefits high-income households;

These policies could come up in the debate over President Biden’s $1.9 trillion COVID relief plan, or they could be raised as provisions to pay for a larger infrastructure package the President reportedly wants to pursue later in the year. Given either or both of these legislative efforts may be pursued through the budget reconciliation process, it’s possible that these bills may pass on party-line votes. With plenty of Democrats worried about avoiding new tax burdens on families and businesses, though -- and plenty focused on ensuring COVID relief is directed to those who actually need it -- we are hopeful that lawmakers in both parties will agree the following tax policies would be unwise and counterproductive to the recovery.

Infrastructure Pay-Fors: Avoid Anti-Growth Changes That Would Hamper the Recovery

The most significant and disruptive changes to the tax code could come when President Biden and Democrats in Congress attempt to pass an infrastructure package later in the year. Some reports indicate that Biden will follow up on his $1.9-trillion COVID relief plan later this year with a climate and infrastructure package that could cost more than $2 trillion. As the President and his allies in Congress pursue tax hikes or spending cuts to pay for this $2 trillion infrastructure package, there are a few tax changes that either Biden or Congressional Democrats have proposed that would be particularly damaging to the U.S. economy. Policymakers should avoid them at all costs.

Increasing the corporate tax rate to 28 percent: President Biden has called for increasing the corporate tax rate to 28 percent, a 33-percent increase from the current rate of 21 percent. Before the TCJA, the U.S. 35-percent federal corporate tax rate was the second-highest among 37 Organization for Economic Cooperation and Development (OECD) nations, making the U.S. less competitive in attracting and retaining multinational companies (and the jobs that come with them). Now, the U.S. is tied for just the 20th-highest federal corporate tax rate among 37 OECD nations. A 28-percent rate would put the U.S. back in the top five in the OECD, making it harder for American businesses and workers to compete in the post-COVID economic recovery. As Sen. Chuck Grassley (R-IA) pointed out in his written questions to Secretary Yellen, governmental and nongovernmental experts estimate that anywhere from 20 to 25 percent of the corporate tax is “borne by workers,” meaning that any hike in the corporate tax rate will function in part as a tax hike on workers. And regardless of the share in tax hikes borne by businesses vs. workers, an increase of this magnitude will harm the U.S. economy at an extraordinarily fragile time.

Doubling the U.S. global intangible low-taxed income (GILTI) tax rate from 10.5 percent to 21 percent: GILTI was a complex part of TCJA that helped move the U.S. from a worldwide to a “quasi-territorial tax system,” increasing the competitiveness of the U.S. tax code for businesses with foreign subsidiaries. As former NTU Foundation Vice President Nicole Kaeding put it in 2019, “[t]he GILTI provision functions as a minimum tax to ensure that companies are not moving their intellectual property to low-tax countries to escape taxation.” The Congressional Research Service notes, “GILTI applies at [foreign tax] rates lower than 13.125%,” and the GILTI tax rate is 10.5 percent of the income of foreign subsidiaries “in excess of a deduction for 10% of tangible assets minus interest costs” (the 10.5-percent rate is calculated by applying a 50-percent deduction to the 21-percent U.S. corporate tax rate). President Biden has proposed doubling the GILTI rate from 10.5 percent to 21 percent. We agree with Sen. Grassley’s assessment in written questions to Secretary Yellen, when he wrote that “[a]n increase in the GILTI rate to 21 percent would make U.S. companies far less competitive with their foreign counterparts because most foreign countries do not subject a company’s foreign earnings to the same level of tax as domestic earnings.” Unfortunately, Secretary Yellen indicated support for this tax hike in her written answers to Senators’ questions. We hope the Biden administration changes course.

Enacting a financial transactions tax (FTT): Though President Biden has not proposed an FTT, as Secretary Yellen recently noted, several Democrats in Congress have proposed one. Rep. Peter DeFazio (D-OR), the Chairman of the House Transportation and Infrastructure (T&I) Committee, just introduced a bill to “tax the sale of stocks, bonds, and derivatives at 0.1 percent,” which DeFazio (and the Congressional Budget Office) says would raise taxes between $750 billion and $775 billion over 10 years. As NTU’s Brandon Arnold recently pointed out, an FTT would hit many working families who hold investments and/or retirement savings in financial markets -- according to Gallup, more than half (55 percent) of Americans report owning either “an individual stock, a stock mutual fund, or [stock market investments] in a self-directed 401(k) or IRA.” Unfortunately, this bill is co-sponsored by key Democratic leaders in Congress, including House Majority Whip James Clyburn (D-SC), which makes it a candidate to be included as a pay-for in future Biden infrastructure legislation.

Raising taxes on capital gains or raising the Net Investment Income Tax (NIIT): As Secretary Yellen noted in her written answers to questions from Senators, “President Biden has proposed to tax the investment income of families making more than $1 million at the same rate they pay on their wages.” This proposal would increase capital gains tax rates on high-income households by two-thirds, from 23.8 percent to 39.6 percent. Additional proposals may look to increase the 3.8-percent Net Investment Income Tax (NIIT) levied on certain high-income households by the Affordable Care Act. In addition to the deleterious effects these tax hikes could have on investment by American households and businesses, these changes would only increase the harmful impacts of double taxation on corporate income (which the nonpartisan Tax Foundation explains well here). The impact of capital gains tax hikes are something of a lose-lose situation for proponents and opponents of the policy, as extensive research indicates that a five-percent increase in the capital gains tax rate would lead to taxpayer responses that significantly reduce the potential revenue gains from the tax hike.

Enacting a mark-to-market tax regime for financial assets: Former NTU Foundation VP Nicole Kaeding explains mark-to-market best, at least as it pertains to the 2019 mark-to-market proposal from incoming Senate Finance Committee Chairman Ron Wyden (D-OR): “Senator Wyden’s proposal builds upon the Haig-Simons definition of income and attempts to move the U.S. toward taxing capital appreciation on an annual basis, eliminating the current realization treatment for many investors. The proposal includes several key components. Individuals with more than $1 million in income or $10 million in qualifying assets over a three year period would be taxed annually on the change in value of their tradable asset. In addition, Senator Wyden proposes eliminating the lower capital gains tax rate, instead taxing capital gains as ordinary income using the existing progressive rate schedule.” Kaeding adds that Wyden estimates his proposal will bring in $2 trillion over a decade. Wyden recently reiterated his interest in passing mark-to-market during the 117th Congress (read more here; article paywalled). There are numerous administrative challenges with a mark-to-market scheme -- as Kaeding points out, challenges regarding valuations, capital losses, liquidity, and exemptions -- not to mention the potential drag mark-to-market would have on American investment and innovation.

COVID Relief: Focus on Tax Policy That’s Properly Targeted to Those Who Need It

Before a major infrastructure bill (with major tax increase proposals) may come a Biden-supported COVID relief package. Since June of last year, NTU has made a distinction between COVID relief and recovery efforts. That distinction says:

Relief efforts should be temporary, and targeted at the workers, businesses, and families most impacted by the pandemic and economic downturn; and

Recovery efforts should make broad changes to the tax code that do not seek to benefit one industry or interest over others and have a material effect that spurs economic activity.

We’re glad to see President Biden make a similar distinction between “rescue, from the depths of this crisis, and recovery, by investing in America” (emphasis theirs). Unfortunately, not every tax policy in Biden’s rescue/relief plan is adequately targeted to those truly in need.

Eliminating the SALT deduction limit: One very problematic tax change, proposed by many Congressional Democrats, could sneak its way into a COVID relief bill: elimination of the TCJA’s $10,000 cap on state and local tax (SALT) deductions. Indeed, recent reporting suggests New Jersey representatives are pushing for inclusion of SALT cap repeal in the COVID relief bill.

To recap, the TCJA put a $10,000 limit on the amount of state and local taxes that individuals can deduct from their taxable income at the federal level. NTU and NTU Foundation have demonstrated before that the SALT deduction primarily benefits wealthy taxpayers in high-tax states. Leaders in these high-tax states, including New York, New Jersey, Connecticut, and California, have fiercely lobbied Congress and the courts to repeal the limit. The Joint Committee on Taxation (JCT) estimated that just repealing the limit for tax year 2020, as House Democrats proposed last year, would reduce federal revenues by $65 billion. And the Tax Policy Center estimates that more than 82 percent of the benefits of repealing the $10,000 limit would flow to households in the top five percent of income earners.

Repealing the SALT limit is highly regressive, and Democrats in Congress should avoid this multibillion-dollar change at all times -- but especially in a targeted COVID relief package. Secretary Yellen did not commit to either supporting or opposing attempts to repeal the SALT deduction in her response to written questions from Senate Finance Committee members, but we hope the Biden administration soon commits to opposing attempts to repeal the deduction limit.

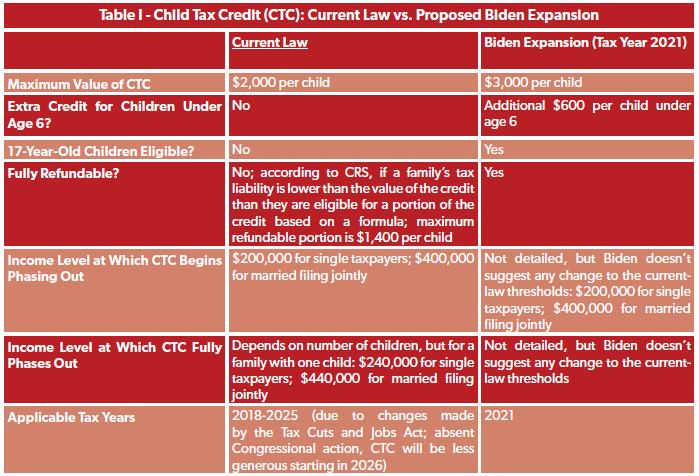

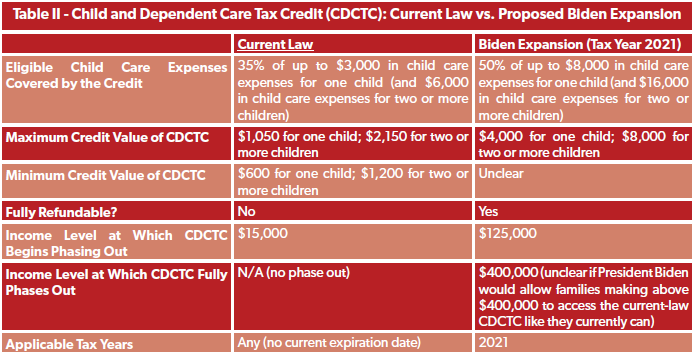

Expanding CTC and CDCTC: Two of the three main tax planks in Biden’s $1.9 trillion COVID relief plan are a one-year increase in the Child Tax Credit (CTC) and a one-year, significant increase in the Child and Dependent Care Tax Credit (CDCTC) (the third is an expansion of the Earned Income Tax Credit, or EITC).

As the tables below demonstrate, many high-income households would benefit from Biden’s proposed changes to CTC and CDCTC:

Biden proposes increasing the size of the CTC by 50 percent (and by 80 percent for children under 6) without regard to a taxpayer’s income;

He proposes more than doubling the amount of child care expenses eligible for the CDCTC without regard to a taxpayer’s income;

And Biden proposes making the CDCTC credit value and phase-down much more generous for high-income households.

The point here is not to shame high-income households, of course, but to point out that every deficit-financed dollar spent on COVID relief counts -- and that relief measures should be narrowly targeted at families who need immediate and urgent support. The CTC and CDCTC are already poor instruments for targeting COVID relief to those who need it; about 30 percent of CTC dollars in 2018 went to households making $100,000 per year or more, while nearly half of CDCTC dollars in 2018 (44 percent) went to households making $100,000 per year or more. Most of these proposed expansions from Biden would further benefit high-income households.

Alternative Pay-Fors That Could Earn Bipartisan Support

Most major tax hikes to pay for an infrastructure bill (like the five cited earlier in this paper) would meet near-unified objections from Republicans in Congress, and will likely make some Democrats in Congress uneasy as America emerges from a major economic downturn. Given the significant investments taxpayers have made fighting the public health and economic impacts of COVID-19, NTU will likely be skeptical of any proposed infrastructure bill that would spend $2 trillion. If Democrats in Congress are insistent on passing such a bill though, particularly on a party-line vote, we would back up our opposition to the above pay-fors with alternative offsets to the bill’s cost.

Fortunately, NTU has a lengthy record of work on deficit reduction options. We recently released a paper, “The Budget Control Act of 2021: A Roadmap for Congress,” that includes $3.6 trillion in 10-year deficit reduction options. While we insist that these policy options go toward reducing the nation’s extraordinary $27.7-trillion national debt, it would ultimately be better to apply some of these options to offsetting an infrastructure bill’s cost than to pass a $2 trillion infrastructure bill with either a) no offsets or b) anti-growth offsets like the tax hikes above.

A few of the options that we believe could help pay for a Biden infrastructure bill:

All of the recommendations embedded in the 2020 Common Ground report from NTUF and the U.S. Public Interest Research Group (U.S. PIRG) Education Fund. This cross-ideological partnership identified $797 billion in spending reductions over the next decade, agreed to on a cross-ideological basis.

Elimination of the Overseas Contingency Operations (OCO) account and a corresponding adjustment to the Pentagon’s budget baseline for fiscal year (FY) 2022 and beyond. Reverting to even the FY 2021 baseline for Pentagon spending would put the Department of Defense (DoD) budget at $635.5 billion, rather than the $704 billion base-plus-OCO topline authorized by this year’s National Defense Authorization Act (NDAA). Readjusting the baseline would represent a long-overdue right-sizing of the DoD budget and could save hundreds of billions of dollars over the next decade. As Congress, the Biden administration, and military leaders look for reform opportunities to meet adjusted baseline targets, there may be some overlap with the deficit reductions recommended in the Common Ground report above. More than half ($422 billion) of the Common Ground deficit reduction options concern a bloated and oversized Pentagon bureaucracy.

Adjustments to Medicare and Medicaid that make the programs more sustainable for the decades to come: Just seven Medicare and Medicaid options in the Congressional Budget Office’s (CBO) 2020 report on deficit reduction options would reduce the deficit by a combined $1.63 trillion over 10 years. These options are: 1) eliminate the safe-harbor threshold for states’ Medicaid provider taxes ($429 billion in 10-year savings), 2) use a 50 percent FMAP for all Medicaid administrative expenses ($57 billion); 3) remove the 50-percent FMAP floor in Medicaid ($529 billion); 4) reduce the more generous FMAP rate for Medicaid expansion so it matches traditional Medicaid ($500 billion); 5) establish uniform cost-sharing in Medicare Parts A and B ($33.4 billion); 6) freeze income thresholds for income-related premiums in Medicare Parts B and D ($39 billion); and 7) reduce Medicare’s coverage of providers’ allowable bad debt from 65 percent to 25 percent ($42.6 billion). We do not believe any of these options are hyperpartisan, but even eliminating the one option likely to give Democrats the most heartache (FMAP rates for Medicaid expansion) leaves policymakers with six options reducing the deficit -- or offsetting the cost of an infrastructure bill -- by $1.13 trillion over 10 years.

Some combination of these options would pay for a $2 trillion infrastructure package without enacting anti-growth tax changes.

Conclusion

Choppy waters lie ahead for advocates of free markets and a simple, fair, pro-growth tax code. Some recent proposals from the Biden administration and from Congressional Democrats are poorly targeted to the crisis at hand, and/or would actively harm America’s economic recovery. NTU will continue to push back on them, and we will continue to work with lawmakers on more taxpayer-friendly options to offset the cost of major legislation. We appreciate that some lawmakers want to offset their significant spending proposals in the months ahead, but they must take great care to ensure their ‘pay-fors’ do not tax the very people and economic activities that will help Americans get back on their feet in a post-COVID world.