(pdf)

Since March 2020, Congress has passed several pieces of legislation enabling the federal government to spend over $3 trillion to mitigate the economic and public health impacts of the COVID-19 (coronavirus) pandemic. The most recent of these bills, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, includes over $2 trillion of financial assistance that the Congressional Budget Office estimates will increase federal deficits by about $1.7 trillion.

The federal debt has been growing uncontrollably for years, and there is an acute need to provide resiliency in the nation’s finances so as to better accommodate emergencies. Furthermore, boosting expenditures by $3 trillion (without corresponding spending reductions) in a single year is, even under abnormal circumstances such as these, an occasion for serious pause. While we remain deeply concerned about America’s rising debt, its soaring deficits, and the long-term fiscal health of our nation’s largest federal programs like Social Security and Medicare, we recognize that the historic disruptions caused by COVID-19 entailed a major federal response.

Although Congress must think seriously about how to achieve long-term solvency in federal finance, right-sizing the federal budget will be difficult without a robust effort to combat the effect of the government-mandated shutdowns to contain COVID-19. The enduring strength of the American workforce has been on full display as states slowly start to reopen; it is Congress’s responsibility to ensure the recovery continues in a way that erases the sharp recession brought on by the pandemic. Doing so will benefit individuals, businesses, and government treasuries alike.

The Health and Economic Recovery Omnibus Emergency Stimulus (HEROES) Act from House Democrats, passed in May, is an example of what not to do. This one bill alone would add over $3 trillion to the national debt, and as NTU pointed out, was laden with hundreds of billions of dollars of provisions unrelated to the COVID-19 pandemic or resulting recession.

Instead, lawmakers should adhere to a few principles in crafting COVID-19 relief and/or recovery legislation:

- Relief efforts should be temporary, and targeted at the workers, businesses, and families most impacted by the pandemic and economic downturn;

- Recovery efforts, on the other hand, should make broad changes to the tax code that do not seek to benefit one industry or interest over others and have a material effect that spurs economic activity;

- All efforts in a fourth COVID-19 bill should come with prudent guardrails, to prevent taxpayer dollars from flowing to unrelated or unproductive causes or to projects that have nothing to do with the pandemic and recession.

Below we will outline in more detail some proposals and legislation that NTU believes would follow the principles outlined above and best achieve the following three goals:

- Supporting workers in the transition from unemployment back to work;

- Supporting businesses with health, safety, and economic recovery; and

- Supporting states and municipalities in a fiscally responsible manner.

We hope lawmakers consider this report a promising blueprint for Phase 4 legislation, and we stand ready to work with both chambers to ensure these priorities reach the president’s desk.

Supporting Workers

Unemployed Workers

One of the major debates taking place in Congress as of this writing is whether or not to extend the $600-per-week federal boost to unemployment insurance (UI) that’s in effect nationwide through July 31. House Democrats proposed extending the benefits through January 2021 in the HEROES Act, a provision that the Congressional Budget Office (CBO) estimated would cost hundreds of billions of dollars over just six months.

Congressional Republicans have been right to point out that a long-term $600-per-week boost is ill-advised because it would hamper the economic recovery at a time when signs are appearing that many Americans may soon be able to return to work. While Representatives and Senators in both parties have signaled the potential for a short-term extension of enhanced UI, lawmakers should instead heed the warning of a bipartisan group of economic experts telling Congress not to extend UI at the $600-per-week level. Jason Furman, President Obama’s chairman of the Council of Economic Advisers (CEA); Timothy Geithner, President Obama’s Treasury secretary; Glenn Hubbard, President Bush’s chairman of the CEA; and Melissa S. Kearney, director of the Economic Strategy Group, recently wrote in the Washington Post: .

“With the highest unemployment rate since the Great Depression, maintaining unemployment insurance support is essential both to protect families and support demand. This makes economic sense: Evidence shows that every $1 paid in unemployment insurance adds $1.50 to the economy. But extending the $600 weekly unemployment insurance benefit enacted at the start of the shutdown does not make sense now, when better protections against covid-19 are being put in place and the unemployment rate is coming down. We thus propose phasing down this federal benefit by tying it to the specific economic circumstances of individual states.”

A better path forward would be either declining to extend the federal UI boost, or phasing it down as recommended above, and pairing either choice with a temporary bonus that induces employees to return to work. On the back-to-work front, lawmakers should include one of two recent proposals for a one-time “hiring bonus,” as an alternative to extending the $600-per-week federal UI boost. One proposal is from House Ways and Means Committee Ranking Member Kevin Brady (R-TX) and the other is from Sen. Rob Portman (R-OH):

- The Brady proposal, the Reopening America by Supporting Workers and Businesses Act of 2020, would allow UI beneficiaries returning to work “to keep up to two weeks of the supplemental federal unemployment benefits after accepting a job, comparable to a $1,200 hiring bonus.” Bonus eligibility would run out on the same day the federal UI boost runs out (currently, July 31).

- The Portman proposal would provide a $450-per-week bonus to UI beneficiaries who return to work, through July 31.

Depending on the timing of the next COVID-19 bill and how the Brady and Portman proposals change between now and then, it is possible the Brady proposal will represent a more fiscally responsible choice for lawmakers than the Portman proposal. Either proposal, though, would be an improvement over a lengthy extension of $600-per-week federal UI, for two primary reasons: 1) back-to-work bonuses would incentivize work when the American economy needs to begin reopening, and 2) whether it’s two weeks of a $600-per-week bonus or a time-limited bonus of $450-per-week, either back-to-work proposal would be less expensive to taxpayers than a lengthy extension of the $600-per-week UI boost.

Essential Workers

Lawmakers have also turned their attention in recent weeks to providing some level of support to the grocery store employees, health care providers, and other essential workers who have enabled tens of millions of Americans to work safely and efficiently from their homes. Sen. Mitt Romney (R-UT) introduced a “Patriot Pay” proposal to provide a “temporary bonus of up to $12 per hour in May, June, and July” for essential workers. This is a type of limited ‘hazard pay’ for Americans who are putting their health and safety at risk for jobs that often pay lower wages than the national average. NTU wrote of Patriot Pay:

“Patriot Pay is a more fiscally responsible approach than an open-ended extension of the federal UI boost, and the payroll tax credit for bonuses would be limited to employees making less than $90,000 per year (inclusive of the bonus) and no more than $1,920 in bonuses per month (or an annualized bonus of $23,040 per year). … [T]his proposal could serve as an alternative to the extension of the $600 per week UI increase beyond July, helping workers with the hazard pay they deserve as the crisis continues and helping employers who have limited means to provide their workers with a significant pay raise right now.”

A separate, bipartisan proposal in the House, the Rewarding American Workers Act, would provide a bonus to workers making up to $99,000 per year through a one-time advanceable and refundable tax credit to businesses. The bonus would be:

- Equal to 30 percent of wages earned during the crisis for individuals making up to $30,000 per year;

- Phased down for individuals making between $30,000 to $55,000 per year, until it’s worth a low of five percent of wages earned during the crisis;

- For individuals making between $55,000 and $99,000 per year, a flat $600 credit.

It’s unclear at this time whether the refundable portion of the Romney or bipartisan House proposal would cost less to taxpayers, but lawmakers should carefully consider both options. Either would incentivize work over UI, and would be particularly helpful to include in a COVID-19 bill if lawmakers choose to extend the generous $600-per-week federal UI boost.

Support Outside of Work

While Congress is spending much of its time thinking of the tens of millions of Americans out of work and the tens of millions more doing essential work — and rightly so — it should also make smaller changes that support all workers, regardless of their current employment status.

Here’s a summary of some of the reforms NTU is looking for in a fourth COVID-19 package:

- Give workers and their families FSA flexibility for 2020. New, bipartisan legislation from Reps. Brad Wenstrup (R-OH), Cindy Axne (D-IA), and Mike Kelly (R-PA) would allow tens of millions of Americans with access to health care and dependent care flexible spending accounts (FSAs) to roll over their unspent FSA dollars from 2020 to 2021. The bill would also increase outdated contribution caps for both dependent care FSAs and Health Savings Accounts (HSAs). Unanticipated changes to health and dependent care needs due to COVID-19 could put millions of Americans on the hook for unspent balances in their FSAs, but the Wenstrup-Axne-Kelly legislation would offer much-needed relief. Reps. Derek Kilmer (D-WA) and Cathy McMorris-Rodgers (R-WA) have similar legislation covering health FSAs.

- Extend a variety of individual tax provisions benefiting workers and families. Every year, Congress extends a number of individual and business tax provisions that are set to expire, often for short periods like one or two years. These provisions are referred to as “tax extenders.” A number of individual tax provisions scheduled to expire at the end of calendar year 2020 help workers and families, and to let these provisions expire could cause additional economic harm to Americans as they seek to recover from the recession. Congress should consider extending the deduction for medical expenses above 7.5 percent of a taxpayer’s gross income, the deduction for qualified tuition expenses, and the exclusion from gross income for benefits given to volunteer firefighters and emergency responders. Taken together, extending these tax provisions for one year would only amount to around $4.3 billion in foregone revenues, or 1.4 percent of what Congress has appropriated to fight COVID-19 so far. To be clear, “extenders” are far from ideal policies. Normally Congress should either allow truly temporary provisions that have outlived their usefulness to expire, or it should make permanent those provisions that are desirable over the long term instead of using them as political bargaining chips. Still, current circumstances dictate an expedient middle road.

The impacts of these efforts are smaller than either a back-to-work bonus or a “hazard pay” proposal, but could nonetheless provide some flexibility and relief for millions of Americans. There should be bipartisan support for this low-hanging fruit.

Another debate between lawmakers and members of the Trump administration is whether to issue another round of relief checks, after tens of millions of Americans received $1,200 checks through the CARES Act. If the aim of another round of checks is, indeed, to prompt economic activity, then lawmakers should think carefully about both the eligibility for and the size of another round of checks. Early data indicate that while around 40 percent of people making less than $1,000 per month spent their checks in the first 10 days, only 20 percent of people making more than $5,000 per month did. Northwestern University’s Scott R. Baker notes that, in this study, “usage of stimulus funds nationwide may more closely resemble this higher-income portion of the sample.” If more people are saving their checks instead of spending them, then another round of checks may not have the effect on the economy desired by lawmakers.

Supporting Businesses

Pro-Growth Tax Reform

For years, NTU has recommended a number of pro-growth changes to the federal tax code. We believe these recommendations are even more important today, given the need for a robust economic recovery in the U.S.

- Enact broad-based changes to the tax code that make it less expensive for pharmaceutical innovators to onshore their production to the U.S. The Trump administration is reportedly considering a few significant tax changes in a future economic recovery bill, including 1) extending beyond 2022 the full and immediate expensing provision for short-term assets passed in the Tax Cuts and Jobs Act (TCJA), and 2) expanding full and immediate expensing to structures — both NTU priorities. The movement to extend full and immediate expensing for short-term assets recently received a boost from Rep. Jodey Arrington (R-TX) and his colleagues, who introduced the Accelerate Long-Term Investment Growth Now (ALIGN) Act (H.R. 6802). This bill would make the full and immediate expensing provisions of the Tax Cuts and Jobs Act (TCJA) permanent, allowing businesses to make critical investments as American economy recovers and rebuilds from the effects of COVID-19. Earlier in the year, Sen. Pat Toomey (R-PA) released the same bill in the Senate. As for expanding full and immediate expensing to structures, Rep. Chip Roy (R-TX) recently introduced legislation that would treat “non-residential real property purchases” by medical supply and pharmaceutical companies as 20-year property, instead of 39-year property, which would effectively allow these companies to fully and immediately expense those investments.

- Correct the TCJA’s mistreatment of research and development (R&D) costs. NTU Foundation’s Nicole Kaeding details this issue here, and highlights this inevitable scenario: the TCJA included a provision that changed the treatment of U.S. businesses’ R&D costs from full and immediate expensing, the correct treatment, to five-year amortization starting in 2022. This pending change to the tax code will make it less profitable for businesses to invest in R&D here in the U.S. and would, as Kaeding puts it, “[mean] less innovation and new technologies for the U.S. economy, leading to lower levels of productivity, lower wages, and a smaller economy.” Congress should consider correcting this change, and the Trump administration is reportedly also considering asking for such a change in a forthcoming recovery package.

PPP & ERTC

Similar to the UI debate mentioned above, another important discussion shaping up in Congress is whether and how to extend two popular CARES Act programs: 1) the Paycheck Protection Program (PPP) providing loans to small businesses that are forgivable if used on payroll, employee benefits, and rent or utilities, and 2) the employee retention tax credit (ERTC) that gives certain employers a payroll tax credit if they keep workers on payroll.

- PPP is an incredibly popular program first established by the CARES Act in March. PPP loans are generally open to businesses and 501(c)(3) nonprofits with fewer than 500 employees, including sole proprietors and independent contractors. The loan limit is $10 million per applicant. According to the Congressional Research Service (CRS), “PPP loans used for payroll expenses and for specified nonpayroll operating costs paid or incurred during an eight-week ‘covered period’ can be forgiven if the borrower meets certain payroll and employment retention criteria.” A recent law passed by Congress extended the covered period to the earlier of 24 weeks or December 31, 2020, and allowed up to 40 percent of PPP funds to be used for non-payroll costs like rent (under previous regulations, the limit was 25 percent). The CARES Act included $350 billion in funding for PPP, which quickly ran out. Congress added another $310 billion to the program in April, and as of mid-June around $130 billion was still available.

- ERTC is, according to CRS, “a refundable tax credit that reduces an employer’s payroll taxes. The credit can be claimed for wages paid after March 12, 2020, and before January 1, 2021.” Current law limits the tax credit to 50 percent of $10,000 in wages paid per employee, or a total credit of $5,000, and limits eligibility to employers who “are required to fully or partially suspend operations due to a COVID-19-related order (including nonprofit employers)” or experience a drop in gross receipts of 50 percent or more (compared to the same quarter last year). Currently, employers cannot take advantage of both the PPP and ERTC programs. The Congressional Budget Office (CBO) estimated that the current-law ERTC will have a $55 billion impact.

While NTU believes it would be premature to discuss additional funds for PPP at this time, with $130 billion in funding remaining, we do believe lawmakers should take a careful look at several reform options that would make PPP a more flexible program for small employers around the country. These options include:

- Legislation from Sen. John Cornyn (R-TX) and Rep. George Holding (R-NC) that would enable PPP recipients to deduct PPP-related business expenses from their gross income. Current IRS guidance disallows deductions, apparently out of concern over small business owners “double dipping” with PPP loans and a tax deduction. Several lawmakers have made clear, though, that their intent with PPP was to afford small employers maximum flexibility in a time of crisis. Cornyn’s legislation is sponsored by nearly a quarter of the Senate (including seven Democrats), and Holding’s legislation has 18 cosponsors in the House.

- Allowing private equity-backed companies and franchisees to access PPP. The Small Business Administration (SBA) has encouraged franchisees with public parent companies to return or not apply for PPP loans, and has suggested that private equity-backed firms may not qualify for PPP under the requirement that they certify “current economic uncertainty makes this loan request necessary.” Unfortunately, small employers at the franchise level or those who happen to receive funds from private equity (PE) may be hurting just as much as other small businesses, and SBA should not assume these firms automatically have more or easier access to capital than non-franchise firms or firms that have not received PE backing. Congress could help here by stepping in and clarifying that as long as a business meets the existing requirements for PPP eligibility, they would not be automatically barred from accessing PPP simply for being a franchise or having received PE backing at some point.

Recent controversy over members of Congress benefiting from PPP loans also illustrates the need for more robust and clear reporting requirements for PPP recipients. While lawmakers should avoid proposals that seek to overburden small businesses with excessive reporting, or make an example out of alleged ‘bad apples,’ we believe that a $660 billion federal program should have some minimum reporting requirements that let taxpayers know who is benefiting from the program. Similar reporting requirements for the $500 billion Treasury Department fund benefiting larger businesses could also be helpful for oversight purposes, but the temptation should be avoided to use such information as a political weapon against firms that are simply availing themselves of various tax relief laws in good faith. Media reports essentially “shaming” employers keeping thousands of workers on the job are unhelpful to a strong economic recovery.

NTU believes that a more promising path forward for lawmakers — and a possible alternative to expanded UI and/or expanded PPP — is expansion of the ERTC. Several of the following good ideas have bipartisan support:

- Increase the percentage of wages that the payroll tax credit covers. Current law limits the tax credit to 50 percent of $10,000 in wages paid per employee, or a total credit of $5,000. The Jumpstarting Our Businesses’ Success Credit (JOBS Credit) Act, from Reps. Stephanie Murphy (D-FL), John Katko (R-NY), Suzan DelBene (D-WA), Brian Fitzpatrick (R-PA), and Chris Pappas (D-NH), would increase the credit to 80 percent of up to $15,000 in wages paid per calendar quarter (up to $45,000 total). Therefore, the maximum value of the credit would increase from $5,000 to $36,000. The Joint Committee on Taxation (JCT) has estimated a similar provision from the HEROES Act would amount to $164 billion — a significant amount — but this is a fraction of the $437 billion cost of extending UI through January 2021, as the HEROES Act would do.

- Increase the employer threshold for ERTC. The JOBS Credit Act would also change the large employer threshold (where the payroll tax credit becomes less flexible) from 100 employees to 1,500 employees. The HEROES Act had a similar provision.

- Phase in the benefit so more employers can access ERTC. The JOBS Credit Act would phase in the credit “so that employers who have experienced more than a 20 percent decline in gross receipts can claim a portion of the credit” (the current threshold is a 50 percent decline). The HEROES Act would have phased in the ERTC starting at a 10 percent decline in gross receipts.

- Allow health coverage to be included in credit-eligible expenses. The JOBS Credit Act would clarify “that ‘qualified wages’ include qualified health benefits and that employers who continue providing such benefits to their employees qualify for the ERTC even if they do not continue paying other qualifying wages.” This provision could help ensure that fewer people lose their employer-sponsored health insurance during the pandemic and economic downturn.

- Expand ERTC eligibility to the wages of employees who are rehired after having lost their jobs during the downturn. Such a provision could help companies quickly rehire some of the employees they laid off during the pandemic, with the potential to greatly improve America’s current unemployment situation. Lawmakers would have to carefully design such a provision so that it does not create an incentive for companies to lay off employees, and could do so by limiting eligibility to employees that were laid off between certain specified dates.

- Improve the interaction between ERTC and PPP. Some lawmakers have pointed out issues with requiring companies to choose either ERTC or PPP, especially for PPP recipients who are using a significant portion of their loan to cover non-payroll expenses. While there is a compelling interest to avoid excessive “double-dipping” (i.e., a company using PPP funds to cover payroll and then receiving a tax credit for those payroll costs under ERTC), we do not believe that mere participation in PPP should automatically exclude a business from ERTC benefits. One possible approach is also in the JOBS Credit Act. The legislation would ensure that receiving a PPP loan does not automatically disqualify a business for ERTC, and that a business that does not receive PPP loan forgiveness for certain payroll costs can then use the ERTC for those payroll costs. However, the bill would still prohibit the “double-dipping” scenario described above.

Adapting to a New Way to do Business

One topic under discussion is liability protection for businesses as they seek to reopen and avoid the spread of COVID-19. Liability protections are a matter that should ideally be handled at the state level. However, as long as liability protections are sufficiently clear, NTU believes they should be included in the next COVID-19 legislation and that lawmakers in both parties should work toward an amicable solution on this issue.

Both Republican and Democratic lawmakers have proposed various measures to support businesses when they invest in personal protective equipment (PPE), health related upgrades to facilities, or in COVID-19 testing for their workforce. These proposals include tax credits for the purchase of PPE. Given federal, state, and municipal governments are placing requirements or expectations on businesses as they reopen, it makes sense that lawmakers would seek to help businesses recover some of their costs for obtaining PPE or COVID-19 tests to protect their workers. If a credit is included in a final package, though, it must be carefully crafted so that the credit does not grossly exceed the cost of obtaining PPE, facility upgrades, or tests, does not allow a double benefit with existing deductions, and provides certainty on the length of time for which it applies.

Supporting States and Municipalities

SMART Approaches, and Not-So-Smart Approaches

In recent weeks, a divide has emerged over whether or not the federal government should offer additional support to states and municipalities suffering from significant revenue drops or a high number of COVID-19 cases. Though stakeholders can reasonably disagree on this question, NTU believes that a targeted, close-ended amount of relief with significant guardrails could help state governments avoid passing permanent tax increases in response to their temporary revenue shortfalls.

One thing is clear: the approach taken by House Democrats in the HEROES Act is precisely the type of approach to avoid. The HEROES Act contained nearly $1 trillion in aid that, we noted at the time, would enable “state and local governments to plug budget holes that have plagued [them] long before the pandemic began.” It also contained numerous other state benefits that have little to do with the crisis, such as suspending the $10,000 limit on the state and local tax (SALT) deduction (which mostly benefits wealthy taxpayers) and adding $15 billion to state highway funding.

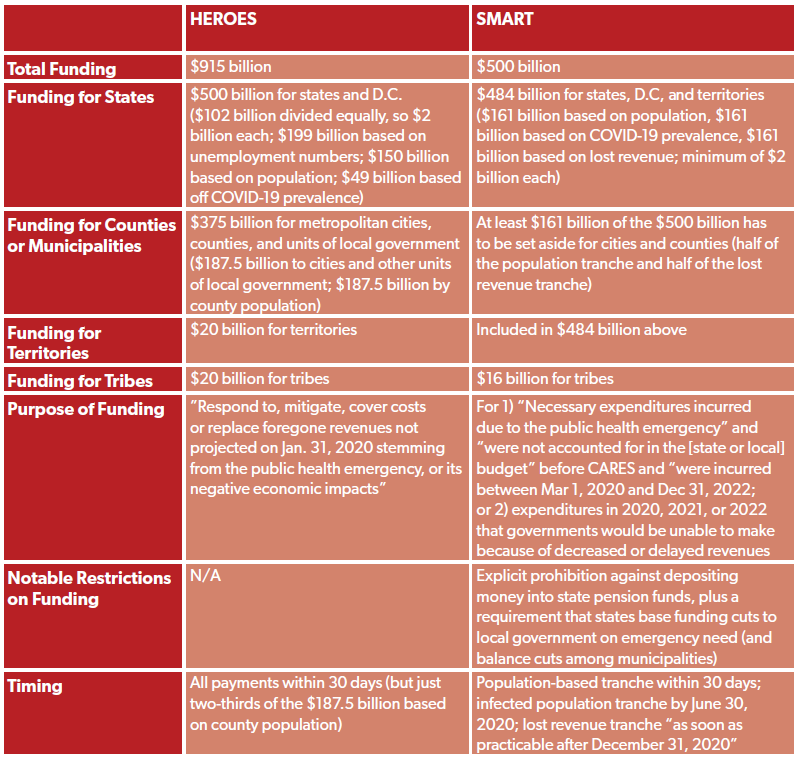

We think there is a less risky approach from Reps. Tom Reed (R-NY) and Mikie Sherrill (D-NJ), the State and Municipal Assistance for Recovery and Transition (SMART) Fund. This legislation would appropriate $500 billion instead of nearly $1 trillion, would split the funds into three tranches distributed over six months (instead of all within 30 days under HEROES), and would explicitly prohibit states and municipalities from depositing federal aid into state pension funds.

A fuller comparison of the two options is below:

Although the SMART Act is a vast improvement over the HEROES Act, $500 billion appears to be an excessive amount of state and local funding at this time. In fact, lawmakers may decide that a more appropriate amount is something closer to the anticipated $110 billion shortfall states are facing in FY 2020, with the possibility of revisiting the issue as the budget turns to FY 2021. We also encourage lawmakers to ensure that any future state and local aid come with transparency requirements that provide Congress and taxpayers information as to how this money is being spent. If federal taxpayers are to send tens or hundreds of billions of dollars to state and municipal governments, they should at minimum have some basic information detailing which agencies and services are benefiting from this aid and which are not.

Conclusion: Targeted Relief, Broad-Based Recovery

Lawmakers have some difficult questions in front of them as they consider whether to pass a fourth COVID-19 relief and/or recovery bill, and how many taxpayer dollars to devote to that effort (either in new spending or foregone revenues). We highlight the above policy recommendations not as an entire universe of questions answered regarding the next legislative effort, but as a set of best practices and principles for lawmakers looking to remain accountable to taxpayers.

We return to the three principles outlined at the beginning of this paper:

- Relief efforts (such as hiring bonuses, hazard pay, state and local aid, or a PPP/ERTC extension or expansion) should be temporary, and targeted at the workers, businesses, and families most impacted by the pandemic and economic downturn;

- Recovery efforts (such as pro-growth tax reform) should make broad changes to the tax code that do not seek to benefit one industry or interest over others;

- All efforts in a fourth COVID-19 bill should come with prudent guardrails, to prevent taxpayer dollars from flowing to unrelated or unproductive causes and projects that have nothing to do with the pandemic and recession.

These are unprecedented times, which is why some of the above policy options are unprecedented recommendations for NTU to make. Even in unprecedented times, though, lawmakers have a duty to their constituents to avoid wasting or abusing taxpayer dollars.