A top Treasury Department official defended the Biden administration’s proposed changes to international tax law last week by claiming that they would affect only 0.02 percent of all U.S. companies. This talking point lacks significant context, and neither the administration nor its allies in Congress should use this statistic when defending their proposals to taxpayers and other policymakers.

The data point came from Assistant Secretary for Tax Policy Lily Batchelder at an event hosted by the Brookings Institution, according to Politico (full article paywalled):

“Assistant Secretary for Tax Policy Lily Batchelder reminded that the plan for a 15 percent global minimum tax on large businesses would only potentially apply to an ‘incredibly small’ number of the nation’s biggest corporations — on the order, she added, of 0.02 percent of all U.S. companies.

‘This is emphatically not something that small or even reasonably large corporations will be affected by,’ Batchelder said in a forum sponsored by the Brookings Institution.”

Batchelder is technically correct: Pillar Two’s rules only apply to multinational companies with €750 million or more in annual revenue – a little over $800 million as of this writing. That means only a small proportion of all U.S. companies are affected by the Biden administration’s proposed changes to come in compliance with the second pillar of the two-part international tax agreement the U.S. signed in October.

However, the 0.02 percent of companies who are affected by the rules make up a significant portion of annual revenue reported by U.S.-based companies and total assets owned by U.S. businesses. They also employ millions of Americans, meaning Treasury’s tax rules will affect not only these companies but potentially millions of workers.

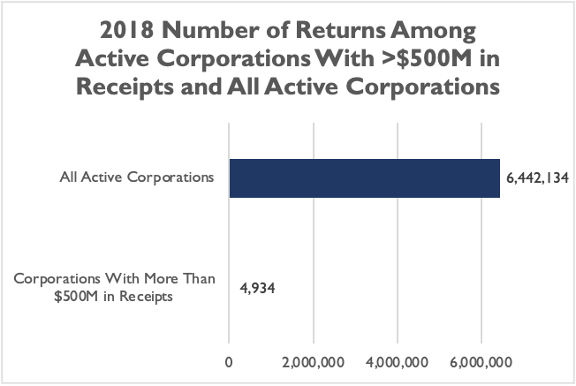

According to Internal Revenue Service (IRS) data, there were just under 5,000 companies with at least $500 million in business receipts in 2018.[1] This is less than 0.1 percent of the 6,442,134 active corporations who filed a return in 2018.

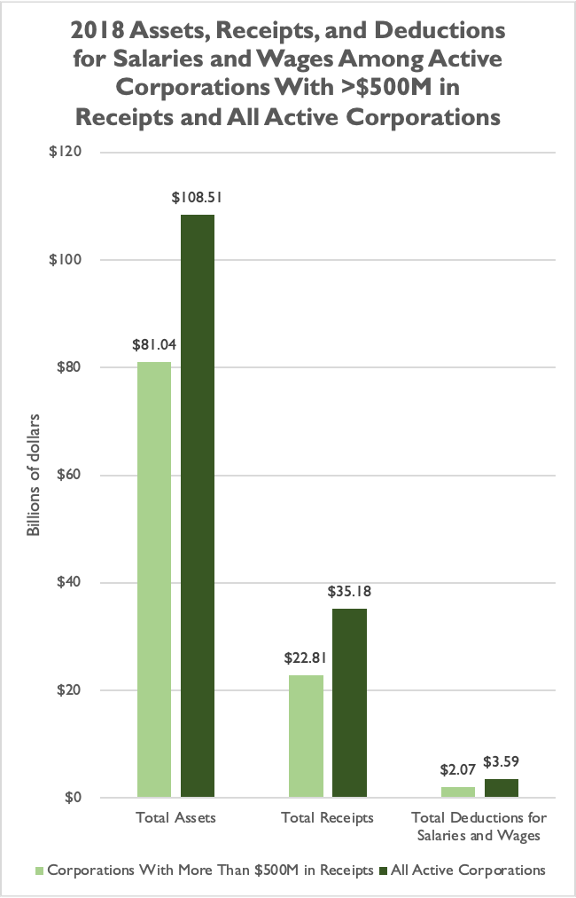

However, those nearly 5,000 companies accounted for nearly 75 percent of total business assets reported to the IRS in that same year, along with nearly 65 percent of total receipts and nearly 58 percent of total deductions for salaries and wages.

According to some dated U.S. Census data, in 2015 the overwhelming majority of business establishments (5.62 million out of 6.87 million, or 82 percent) had fewer than 500 employees, but a slight majority of all U.S. workers (65.15 million out of 124.07 million, or 52.5 percent) were employed at businesses with more than 500 employees.[2] According to slightly more dated Census data tracked by The Wall Street Journal, 27.8 percent of all U.S. workers worked at companies with 10,000 or more employees in 2014. Another 11.4 percent worked at companies with between 2,500 and 9,999 employees.

More recent data tracked by Fortune indicates that dozens of the top earning U.S. companies would likely be subject to Pillar Two (where they have foreign income). For example, the top 25 U.S.-based companies by revenue in 2021 combined for $4.8 trillion in business revenue, $12.6 trillion in total assets, and more than 7.8 million employees.[3]

In short, it is disingenuous for Treasury to defend their proposals by claiming only “0.02 percent” of companies will be affected. Even if technically true, these companies bring in trillions of dollars of revenue each year, pay tens of billions of dollars in federal taxes, and employ tens of thousands (or hundreds of thousands or, in some cases, even millions) of Americans. Pillar Two changes absolutely will affect these workers. Treasury should consider those impacts carefully when designing policy proposals, and should work in collaboration with Congress on global tax challenges ahead.

[1] IRS data does not specify how many companies had at least $750 million in business receipts in 2018. Instead, their final two business receipt categories are between $500 million and $1 billion in business receipts and $1 billion or more in business receipts. See Table 3.1 here.

[2] Of course, not all businesses with more than 500 employees will have more than $800 million in annual revenue. We include this data to illustrate that businesses with more than 500 employees are much more likely to have $800 million in revenue per year than businesses with fewer than 500 employees, and that a majority of Americans work at businesses with more than 500 employees despite the vast majority of businesses having fewer than 500 employees.

[3] Not all of these employees – nor all of the revenue or assets reported by Fortune – are based in the U.S. We cite these data to demonstrate that the relatively small number of companies affected by Pillar Two report large amounts of revenue and assets, and employ among them millions of workers.