During negotiations over the One Big Beautiful Bill Act, the Senate Parliamentarian struck multiple provisions for falling outside the bounds of budget rules. Among those removed were key elements of the Regulations from the Executive in Need of Scrutiny Act (REINS Act), a proposal aimed at curbing executive overreach in the regulatory process.

The REINS Act would mandate congressional approval of any new federal regulation projected to have an economic impact of $100 million or more. Under current law, federal agencies can implement far-reaching rules that affect individuals, businesses, and entire markets without direct legislative endorsement. While proposed rules typically undergo a public comment period, they are not subject to a vote in either House or Senate. The only existing legislative check—the Congressional Review Act—allows Congress to overturn finalized rules, but only after they’ve taken effect, and even then, reversal requires presidential approval or a difficult veto override.

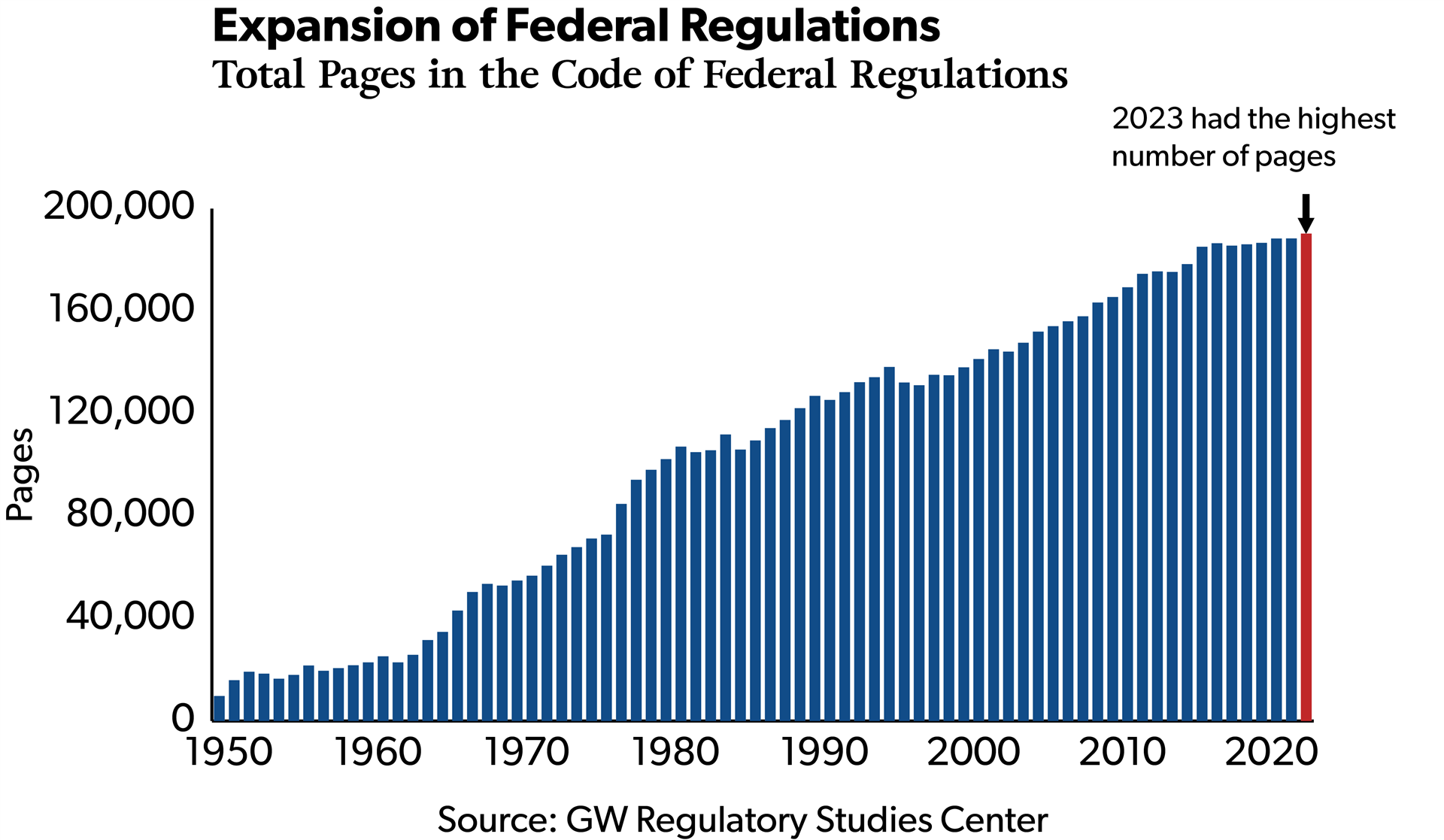

At its core, the REINS Act seeks to restore constitutional checks and balances by curbing the broad delegation of lawmaking authority to executive agencies. Today, unelected regulators often impose economically significant rules with limited public accountability. A manifestation of this trend is the steady expansion of the federal regulatory code. According to the George Washington University Regulatory Studies Center, the Code of Federal Regulations (CFR) reached a record length of more than 190,000 pages in 2023—nearly ten times its size in 1950.

While not every page corresponds to a major rule, the sheer expansion of the Code of Federal Regulations signals a broader shift in policymaking power away from Congress and toward the administrative state. This growing regulatory burden functions like an effective tax on businesses and individuals—imposed without the transparency, debate, or accountability that typically accompanies fiscal policy. Complex and costly compliance requirements distort incentives, raise barriers to entry, and disproportionately harm small businesses with limited legal and financial capacity. The cumulative effect is slower job creation, reduced innovation, and higher prices for consumers.

A growing body of research highlights the magnitude of the challenge. A 2023 study by the National Association of Manufacturers estimated that federal regulations imposed a total burden of $3.079 trillion in 2022—roughly 12% of U.S. GDP—with small manufacturers facing average compliance costs exceeding $50,000 per employee annually. The Competitive Enterprise Institute put the cost at $2.155 trillion. Despite methodological differences, the evidence paints a consistent picture: unchecked regulatory growth places a heavy drag on economic productivity and erodes U.S. competitiveness.

The stakes are not limited to economic costs—they also extend to the federal budget. A recent report by the Congressional Budget Office (CBO) highlighted how certain regulations, particularly those affecting mandatory programs like Medicare, can increase federal spending or impact revenues without any direct vote from Congress. The costs of major regulations are automatically incorporated into the budget baseline, effectively expanding fiscal commitments beyond what lawmakers explicitly authorized.

While CBO did not estimate the full fiscal impact of the REINS Act due to uncertainty about future agency actions and congressional responses, it underscored a critical point: regulations can reshape federal outlays without legislative approval. By requiring Congress to affirmatively approve high-impact rules, the REINS Act would reestablish a vital check on regulatory-driven spending and help restore Congress’s constitutional power of the purse.

Given the ongoing regulatory burden and limited congressional oversight, the REINS Act has been introduced in every session of Congress since 2009, regularly passing the House under Republican majorities but never advancing in the Senate. In the current Congress, Representative Kat Cammack reintroduced the House version, which retains the traditional REINS framework by requiring congressional approval for any “major rule,” as defined by the Congressional Review Act to include those with an annual economic impact of $100 million or more. Senator Rand Paul offered a more expansive Senate counterpart that adds four significant provisions: allowing individuals to raise the absence of congressional approval as a legal defense, creating a private right of action to challenge unapproved rules, applying oversight to significant agency guidance, and exempting deregulatory actions from the approval process.

Agency regulations can impose significant burdens on businesses and individuals. As Congress continues to reckon with the size and scope of the administrative state, the REINS Act offers a focused and actionable step toward restoring constitutional balance. By returning final approval of high-impact rules to elected lawmakers, the legislation would not only strengthen accountability but also ensure that major regulatory decisions reflect the consent of the governed. With concern about regulatory overreach growing, the case for reform is stronger—and more urgent—than ever.