(pdf)

What Are the Major Credits and Deductions for Energy?

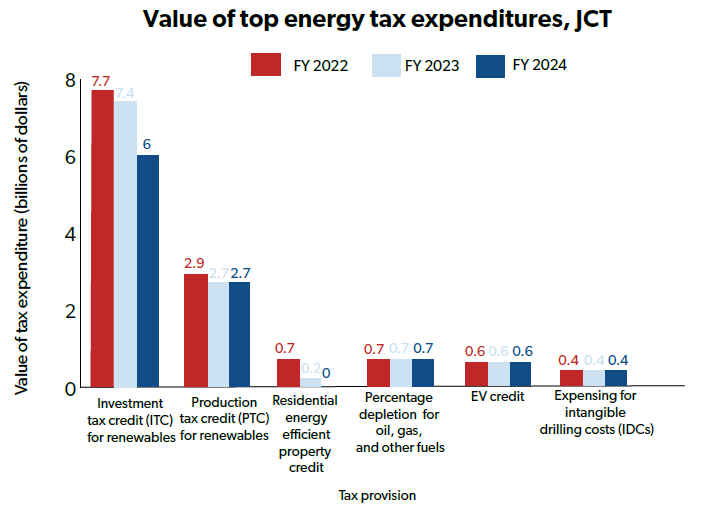

- There are numerous credits and deductions under current law for both businesses and individuals/families that subsidize the investment in or production of various types of energy, or that account for the costs of doing business that are unique to energy businesses; some of the top credits and deductions (or tax expenditures) identified by the Joint Committee on Taxation (JCT) for FY 2022 are:

- Of JCT’s total estimate of $74.9 billion in energy-related tax expenditures for FYs 2020 through 2024, 82% ($61.6 billion) went to renewable energy, energy efficiency, or energy conservation efforts; only 18% ($13.3 billion) went to either oil and gas or to expenditures that were effectively source-neutral

- The top five expenditures, by total estimated value over the next three fiscal years (FYs 2022-2024), are:

- The investment tax credit (ITC), which provides a credit for construction of various renewable energy facilities such as wind property, solar property, fuel cell property, biomass property, and more1; total value FYs 2022-24: $21.1 billion

- The production tax credit (PTC), which provides a credit per kilowatt-hour of energy produced from various renewable sources, including wind, biomass, geothermal, and hydropower2; total value FYs 2022-24: $8.3 billion

- The section 25D credit for residential energy efficient property allows households to take a credit for the “costs of purchasing and installing qualifying energy property” like solar property, small wind property, fuel cell power plants, and more; the credit rate in 2021 and 2022 is 26% of costs; total value FYs 2022-24: $0.9 billion

- Percentage depletion is generally used by oil and gas companies, and allows those companies to deduct from their tax liability a certain percentage of their gross income from oil- and gas-producing property (usually 15%); this provision often allows faster cost recovery for oil and gas companies than under the alternative, cost depletion; total value FYs 2022-24: $2.1 billion

- The electric vehicle (EV) tax credit provides consumers with a credit of up to $7,500 for the purchase of a qualifying plug-in EV, subject to limits on the amount of EV credits that can be claimed per auto manufacturer; in 2018 more than half of EV credits were claimed by taxpayers earning more than $200,000; total value FYs 2022-24: $1.8 billion

- Expensing for intangible drilling costs (IDCs) enables oil and gas companies to recover certain costs of doing business more quickly than under a depreciation schedule, such as “fuel, labor, and repairs to drilling equipment, materials, hauling, and supplies”; total value FYs 2022-24: $1.2 billion

- The investment tax credit (ITC), which provides a credit for construction of various renewable energy facilities such as wind property, solar property, fuel cell property, biomass property, and more1; total value FYs 2022-24: $21.1 billion

Are These Credits and Deductions “Loopholes”?

- The Biden administration has claimed that oil and gas tax “preferences” have “distort[ed] markets”; Sen. Bernie Sanders (I-VT) and Rep. Ilhan Omar (D-MN) have called certain provisions of the code “loopholes” and “federal subsidies”; and Chair Wyden has referred to similar provisions as “preferential incentives”

- Some of this language treats all energy tax expenditures as equal, when in reality each of these provisions should be evaluated separately

- For example, expensing for IDCs is not a loophole, given it affords energy companies the opportunity to treat intangible costs in the same way (i.e., full expensing) that the tax code allows other industries and sectors to treat intangible costs like research and development

- A “loophole” suggests that a company or taxpayer is cleverly using the law to pay less than what they should pay in taxes; NTU believes that companies should be able to fully and immediately expense (recover) their costs for acquiring and developing both tangible and intangible assets; IDCs are just one set of relevant costs that can and should be fully expensed

What Are the Major Biden, Senate, and House Proposals Addressing Energy Credits and Deductions?

Biden Proposals

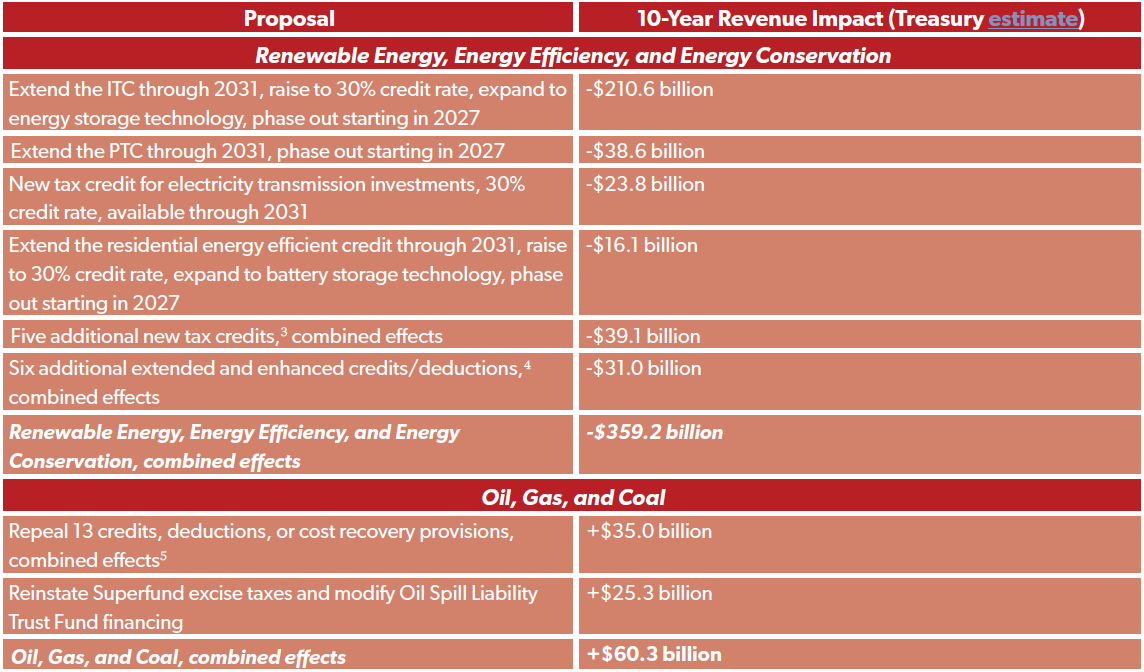

- Here are President Biden’s major energy tax proposals, which on net would reduce tax revenues by about $300 billion over a decade:

Senate Proposals (Finance Chair Ron Wyden; Sen. Sanders)

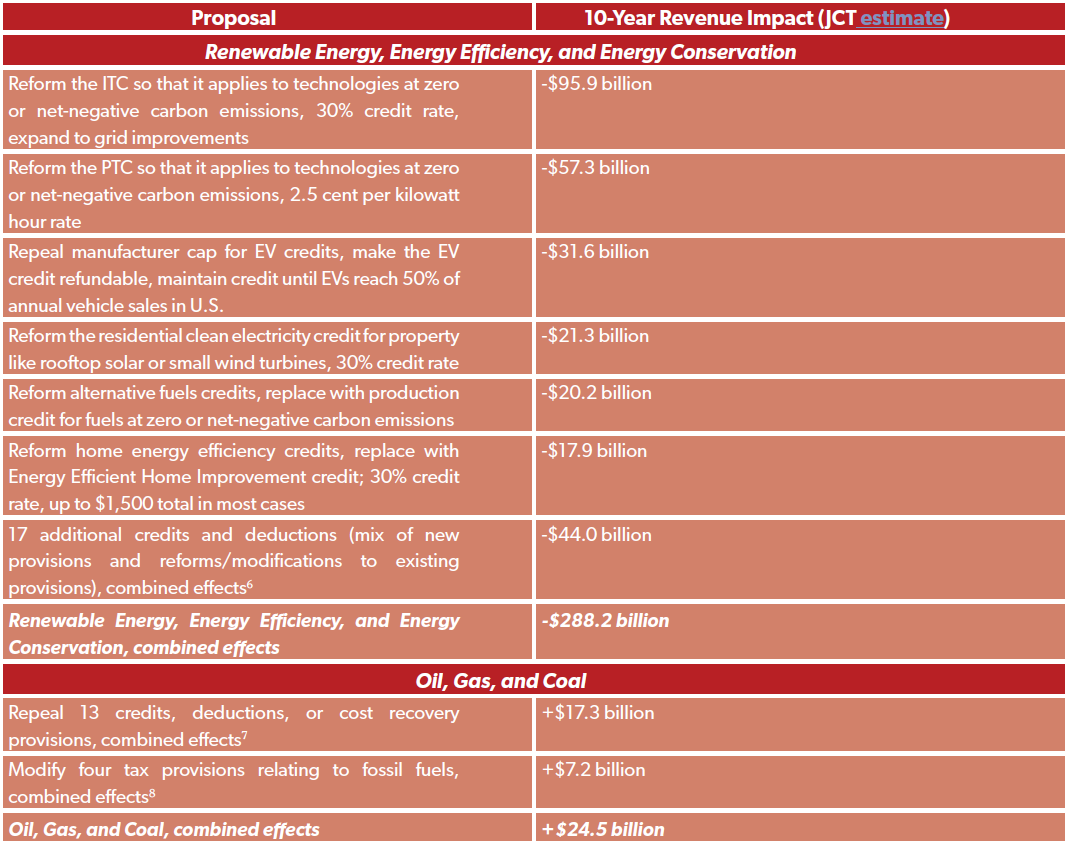

- Perhaps the most influential energy taxes proposal in the Senate at this time is the Clean Energy for America Act from Finance Chair Ron Wyden (D-OR), which on net would reduce taxes by about $260 billion over a decade:

- The “End Polluter Welfare Act” from Sen. Sanders (I-VT) and Rep. Omar (D-MN) would repeal many of the same tax provisions as the Biden administration or Chair Wyden, but goes further in seeking to punish fossil fuel companies by preventing them from accessing parts of the tax code available to other industries and sectors, including:

- Prohibiting full and immediate expensing for any equipment “primarily used for fossil fuel activities”

- Prohibiting fossil fuel activities from accessing the qualified business income (QBI) deduction for pass-through businesses

- Prohibiting fossil fuel companies from accessing the research and development (R&D) tax credit

- Prohibiting fossil fuel companies from using the Foreign-Derived Intangible Income (FDII) deduction for U.S. businesses that export goods abroad

- Terminating the section 45Q tax credit for carbon oxide sequestration

- Terminating the section 48A and 48B tax credits for advanced coal and gasification projects; and

- Prohibiting the Departments of Transportation, Agriculture, and Energy from making certain grants, loans, and loan guarantees to fossil fuel projects

- Prohibiting full and immediate expensing for any equipment “primarily used for fossil fuel activities”

House Natural Resources Committee’s Reconciliation Proposal

- Though the House Ways and Means Committee has primary jurisdiction over the tax rates, credits, and deductions of American energy companies, they aren’t the sole committee that can affect government-imposed financial burdens on American energy producers

- The House Natural Resources Committee, for example, has the ability to set oil and gas royalty fees, rents, and other types of charges

- U.S. federal oil and gas royalties are payments made by companies to the federal government for the oil and gas extracted on public lands and waters

- Essentially, if a company wants to extract oil or gas on federal land, they have to compensate taxpayers.

- U.S. federal oil and gas royalties are payments made by companies to the federal government for the oil and gas extracted on public lands and waters

- Under the Mineral Leasing Act of 1920, the federal government cannot charge a royalty below 12.5% on the extraction of these resources

- There has been much discussion, mainly by those on the far-left, arguing these rates should be increased since royalties have been at the same rate for over a century

- As with any government tax or fee, it is not a sound argument that they should be increased simply because they haven’t risen over a certain period of time

- There has been much discussion, mainly by those on the far-left, arguing these rates should be increased since royalties have been at the same rate for over a century

- It should also be noted that only a small percentage of oil and gas extraction actually takes place on federal lands

- According to the Congressional Research Service, only 9% of oil production took place on federal lands, compared to 76% on non federal lands in 2019

- For natural gas, about 88% of all production takes place on private land

- According to the Congressional Research Service, only 9% of oil production took place on federal lands, compared to 76% on non federal lands in 2019

- Regardless of which land category the oil or gas is extracted from, the U.S. has greatly increased energy production, fostering what some have dubbed the “American energy renaissance”

- Crude oil production has risen from about 2 billion barrels in 2010 to about 4.5 billion barrels in 2019, and natural gas from 26,000 billion cubic feet (bcf) to over 40,000 bcf

- Crude oil production has risen from about 2 billion barrels in 2010 to about 4.5 billion barrels in 2019, and natural gas from 26,000 billion cubic feet (bcf) to over 40,000 bcf

- The American energy renaissance is also a boon for federal coffers

- While the government can collect multiple types of income from resource extraction, royalties constitute the overwhelming share of federal government revenue collected from oil and natural gas leases

- In FY2019, the federal government collected $2.93 billion in royalties from oil and natural gas resources extracted from federal land

- This collection is only slightly higher than what was collected in 2010, but double what it was in 2016, largely due to the low price of crude oil

- While the government can collect multiple types of income from resource extraction, royalties constitute the overwhelming share of federal government revenue collected from oil and natural gas leases

- Despite the billions of dollars collected by the federal government, the Democratic majority on the Natural Resources Committee wants to substantially increase a slew of fees and royalties on companies that do business on federal lands

- Their $31 billion reconciliation bill not only creates new duplicative or wasteful federal programs, but also contains crippling fees that will make it expensive to extract resources

- At this time, the Congressional Budget Office has not scored just how much the many misguided provisions of the bill would bring in annually. Their bill, which was reported favorably on a straight party-line vote, includes:

- Increasing royalty rates on both onshore and offshore drilling from 12.5% to 20%

- Quintupling the minimum bid price on oil and gas leases from $2 per acre, to $10 per acre, and indexing it to inflation

- Imposing a new federal “expression of interest” fee of $15 per acre on applications. This fee would be adjusted every four years.

- Imposing a new annually occurring $4 per acre fee for producing onshore/offshore oil and gas leases

- Adding annual inspection fees for each oil and gas lease on Federal onshore and offshore lands

- Adding new “severance fees” from leases on Federal lands at not less than $0.50 per barrel of oil equivalent on oil/natural gas produced from Federal lands and not less than $2 per metric ton of coal produced from Federal lands

- Adding new annual and escalating idled well fees, up to $7,500 for wells that have been idled for at least 15 years

- Adding a new annual offshore pipeline owner fee, up to $10,000 per mile for pipelines in water with a depth of 500 feet or greater

- Increasing royalty rates on both onshore and offshore drilling from 12.5% to 20%

- The House Natural Resources Committee is unleashing an unprecedented assault on American energy

- The Committee either wants to use these producers as a piggy bank to pay for big government programs, or wants to make producing on federal lands so economically unviable that companies will choose to simply not produce nonrenewable energy

- This is the wrong solution if the United States wants to be energy independent through an “all of the above” energy strategy

- The Committee either wants to use these producers as a piggy bank to pay for big government programs, or wants to make producing on federal lands so economically unviable that companies will choose to simply not produce nonrenewable energy

- Either way, higher taxes and fees will stifle energy production, raise consumer energy prices, and hurt American jobs

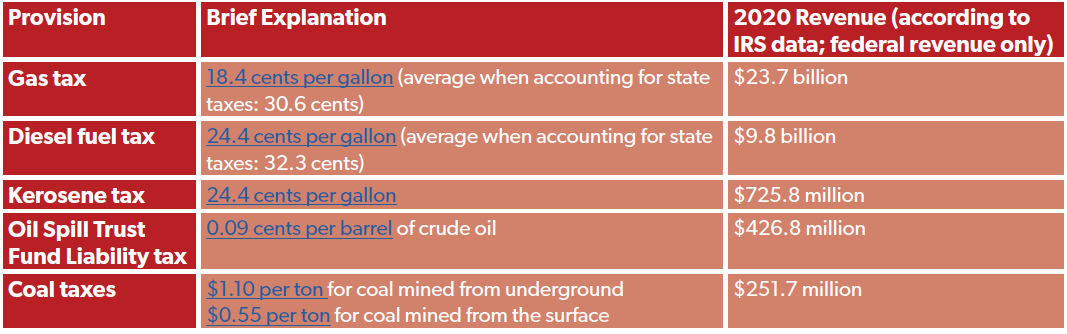

What Are the Major Excise Taxes on Energy?

- According to IRS excise tax statistics for 2020, energy-related excise taxes totaled about $35.4 billion, about 37 percent of all excise tax collections in 2020

- The largest by far was the gas tax, bringing in $23.7 billion

- The diesel fuel tax brought in $9.8 billion

- The excise tax on kerosene brought in $725.8 million

- The Oil Spill Liability Trust Fund taxes on petroleum brought in $426.8 million

- Coal excise taxes brought in at least $251.7 million

- An additional 14 smaller excise taxes (on natural gas, aviation fuel, and more) brought in a combined $468.1 million

- The largest by far was the gas tax, bringing in $23.7 billion

- The following table briefly describes the major excise taxes mentioned above:

What Would Make for Ideal Energy Tax Policy?

- Full and immediate cost recovery for the energy sector that is identical to provisions afforded companies in other industries and sectors (i.e., full expensing for intangible drilling costs, and allowing all energy companies -- fossil fuels and renewables -- to access full and immediate expensing for short-lived assets, R&D, and other business expenses)

- Fewer tax credits that artificially lower the cost of certain types of energy, either at the producer level or the consumer level

- Neutrality as to how the tax code treats different forms of energy; a byzantine set of credits, deductions, and excise taxes is an extremely inefficient and ineffective way to account for the negative externalities of carbon emissions

Where Can I Find Additional Resources?

● Significant Changes Recommended for House Natural Resources Committee Reconciliation Bill

● Tax Foundation, “A Guide to the Fossil Fuel Provisions of the Biden Budget,” September 2021

● JCT, “Description Of The Chairman’s Mark Of The ‘Clean Energy For America Act,’” May 2021

[1] There are actually 11 different credits, all with differing credit rates and some with credit rates that decline over time. Three of the 11 credits (microturbine property, fuel cell property, and residential energy efficient or other residential property) have a dollar maximum credit amount, regardless of the credit rate. Seven of 11 credits expire in 2024. One expires in 2022, one expires in 2023, and two never expire.

[2] There are seven different credits, all of which expire in 2022. Wind, geothermal, and closed-loop biomass are eligible for a credit of 2.5 cents per kilowatt-hour produced, while open-loop biomass, municipal solid waste, qualified hydropower, and marine/hydrokinetic production are eligible for a credit of 1.3 cents per kilowatt-hour produced.

[3] Those five new credits are for: 1) electricity generation from nuclear power plants, 2) advanced energy manufacturing, 3) heavy- and medium-duty zero emissions vehicles, 4) sustainable aviation fuel, and 5) low-carbon hydrogen. Combining effects in the table above since these five credits are each worth less than $10 billion over a decade.

[4] Those six expanded or extended credits/deductions (all credits unless specified) are for: 1) nonbusiness energy property, 2) construction of new energy efficient homes, 3) energy efficient commercial buildings (deduction), 4) mechanical insulation labor costs, 5) carbon oxide sequestration, and 6) EV charging stations. Combining effects in the table above since these five credits are each worth less than $10 billion over a decade.

[5] Repeal of expensing for IDCs (+$10.5 billion), percentage depletion (+$9.2 billion), and the enhanced oil recovery credit (+$7.8 billion) are by far the three largest tax hikes of the 13 repealed provisions, and together account for 78% ($27.5 billion) of the $35 billion estimate above.

[6] The additional expenditures and/or expenditure reforms in Wyden’s legislation are too numerous to list here, but the most valuable five are: 1) modifications to the energy investment credit (-$12.5 billion), 2) extension and modification of the advanced energy property credit (-$6.7 billion), 3) a credit for clean hydrogen production (-$6.1 billion), 4) modifications to the renewable electricity production credit (-$5.6 billion), and 5) a credit for commercial EVs (-$5.2 billion).

[7] Repeal of percentage depletion (+$5.2 billion), expensing for IDCs (+$3.4 billion), the enhanced oil recovery credit (+$3.1 billion), and amortization of geophysical and geothermal (G&G) costs (+$3.1 billion) are by far the four largest tax hikes of the 13 repealed provisions, and together account for 86% ($14.8 billion) of the $17.3 billion estimate above.

[8] Changes to the treatment of so-called “dual capacity” U.S. taxpayers who have operations in foreign countries (+$5.6 billion) is by far the largest tax hike of these four, making up 78% ($5.6 billion) of the $7.2 billion estimate above.