Businesses and consumers could potentially receive clarity this week from the Supreme Court regarding President Trump’s broad tariff authority. While most expect the tariffs imposed under the International Emergency Economic Powers Act to be ruled unconstitutional, it’s worth noting that such a ruling would not impact the slew of tariff investigations under Section 232 of the Trade Expansion Act of 1962. In particular, it would not impede an ongoing misguided investigation that could result in the imposition of costly new tariffs on imported medical devices and equipment.

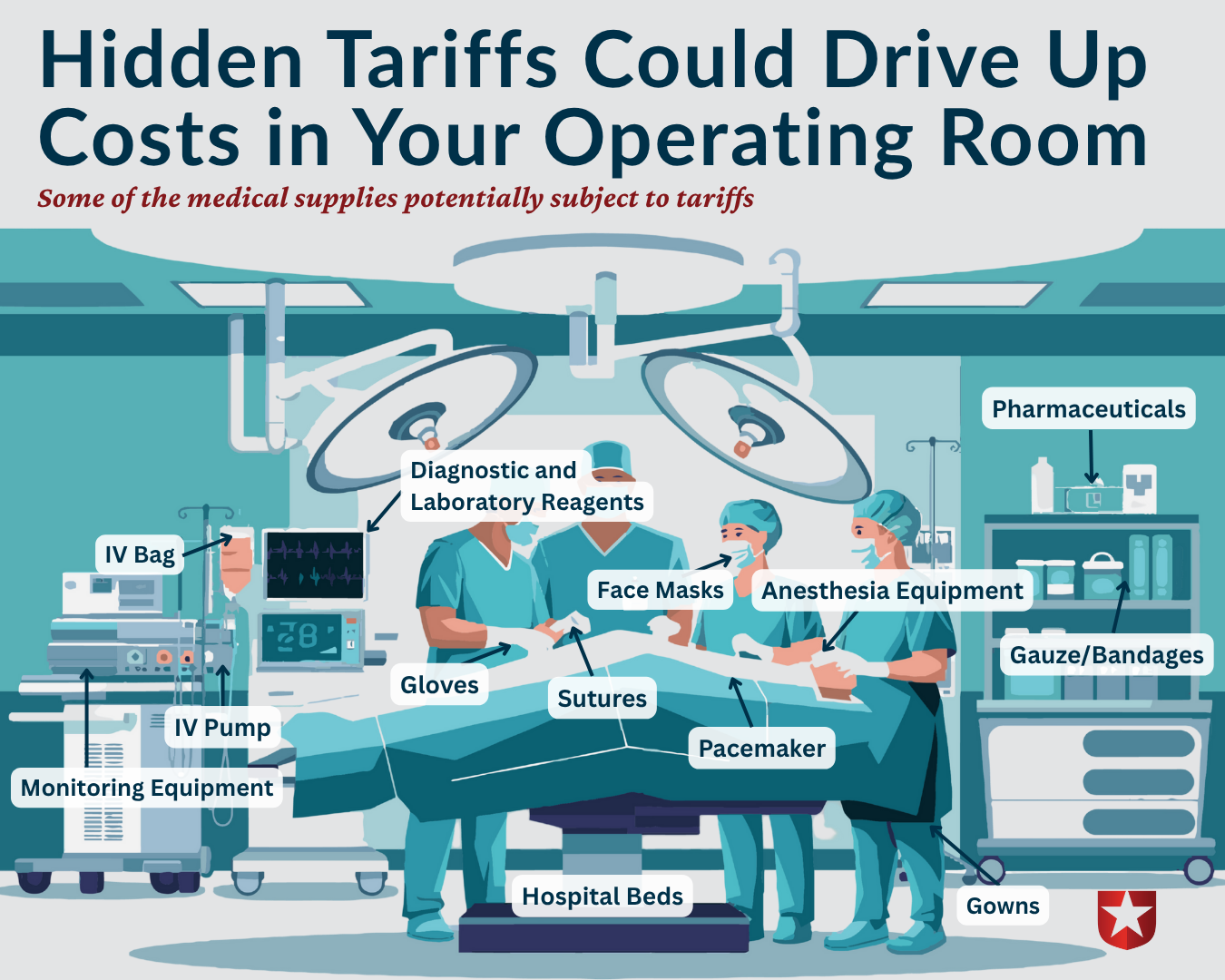

Despite claims to the contrary, tariffs are taxes on imported goods, and the Department of Commerce is considering imposing taxes on many products vital to America’s health care system. This includes personal protective equipment like masks and gloves and complex devices such as diagnostic machines, heart pacemakers, and surgical instruments.

See here for just some of the products in a hospital room that would be impacted by these tariffs.

Tariffs can cause procurement delays, shortages, and logistical challenges, which slow down the delivery of care and increase the likelihood of backorders for equipment that clinicians use daily. The U.S. medical device market relies heavily on imports; approximately 69% to 75% of medical equipment used in the U.S. is manufactured abroad. Upending long-established supply chains will create headaches for manufacturers, importers, and businesses that depend on the hundreds of products that could be subjected to tariffs.

Tariffs will also raise the cost of medical devices and equipment. When tariffs are applied, companies that import these goods face higher input costs and typically pass those costs on to hospitals, then to insurance companies, and then, ultimately, to consumers through higher premiums and rates. When prices rise, some patients may delay necessary care, skip treatments, or be unable to afford critical monitoring devices, leading to poorer health outcomes over time.

A survey of health care industry experts found broad agreement that new tariffs would disrupt supply chains and increase hospital and health system costs, resulting in reductions in equipment purchases and upgrades. The consulting firm PwC projects that tariffs affecting the pharmaceutical, life science, and medical device industries could cost as much as $63 billion a year. That’s a significant amount of money that will be transferred out of the private sector and into government coffers.

Tariff costs would also hit U.S. taxpayers by driving up costs to the federal government, which spent more than $1.7 trillion on health care in fiscal year 2025.

Of course, we should produce more products in the United States when it makes economic sense for businesses to do so. But, rather than impose taxes to achieve such an outcome, a better alternative would be to deliver tax relief for construction, expand energy dominance to power energy-intensive factories, and enact permitting reform to build the supporting infrastructure at a faster pace.

As the Department of Commerce finalizes its investigation, we hope the Administration will agree that tariffs on medical equipment represent a step in the wrong direction. By driving up prices for essential devices, squeezing hospital budgets, and complicating the supply chains on which our system depends, these trade barriers risk making care less affordable and less accessible. Public health policy should lower costs and expand the availability of lifesaving technology, not place new burdens on patients and providers.

Medical goods should not be subjected to new tariffs, so that America’s health care system can focus on healing rather than absorbing unnecessary economic shocks.