Legislation called the CHIPS-Plus Act is barrelling through Congress. Although the legislation is supposed to boost U.S. competitiveness and counter China, there are several ways the CHIPS-Plus Act, if enacted, would have the opposite effect. For example:

Increasing the federal budget deficit: In a matter of days, the possible cost of the bill exploded from $52 billion to $279 billion. According to the Congressional Budget Office (CBO), the base 10-year deficit impact would be $79.344 billion, though, as described below, that number will be much higher if Congress decides to appropriate the funding that is authorized in the bill.

On the spending side, it would increase outlays for the following:

- $50.4 billion for the Creating Helpful Incentives to Produce Semiconductors (CHIPS) for America Fund,

- $1.4 billion for Wireless Supply Chain Innovation,

- $3.1 billion for research and innovation programs, and

- $19 million to boost security for the Supreme Court.

Pay-as-you-go budget enforcement is waived for the spending and there are no offsets included in the bill.

In addition, CBO notes that the bill would authorize the appropriation of potentially $200 billion over the 2022-2031 period, primarily for research activities. That’s $200 billion that is not being appropriated right away in the CHIPS-Plus Act, but may be appropriated in some future bill passed by Congress.

The way many of these spending authorizations are written could cause budgetary confusion. Many are indirect authorizations that refer to other legislation that will need to be drafted in the future. For example, the bill authorizes funding for several specified projects under the direction of the Department of Energy's Office of Science. To fund these efforts, the text of the bill provides that "out of funds authorized to be appropriated to the Office of Science in a fiscal year, there are authorized to be appropriated to the Secretary to carry out the activities described ..." a total of $34 billion.

The Office of Science was last authorized through 2013. Appropriators have provided $52 billion to the Office since then despite the lapsed authorization. The new text is largely based on a separate bill called the Department of Energy Science for the Future Act of 2022. Its author, Senator Joe Manchin (D-WV) noted that it would provide "the first-ever comprehensive authorization for the DOE’s Office of Science." But the funding provided in the language is hardly comprehensive. The level of spending resulting from these authorizations in the Senate's new bill will depend on top line levels established in future authorization bills and ultimately by appropriators.

Undermining tax reform: The CHIPS-Plus Act would reverse progress made in the Tax Cuts and Jobs Act (TCJA) to broaden the tax base and limit provisions designed to benefit specific industries. A $24 billion investment tax credit would be narrowly targeted at semiconductor manufacturing, even though more comprehensive reforms – like returning the tax treatment of research and development (R&D) costs to full and immediate expensing – would offer similar levels of tax relief to a much broader array of U.S. businesses and industries.

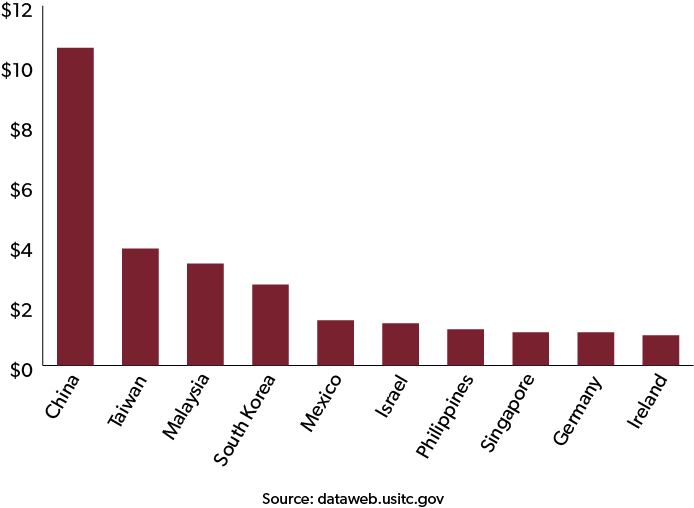

Subsidizing China chip users: The CHIPS-Plus Act could also subsidize semiconductor chips purchased by Chinese manufacturers. China is the largest export market for U.S.-made semiconductor chips, and semiconductor subsidies would free up funds for production of so-called legacy semiconductor chips in China. Many U.S.-based chip companies earn more on their China sales than on U.S. sales. There’s nothing wrong with that, subject to legitimate national defense concerns. It just shouldn’t come at taxpayer expense.

Figure 1: Top 2021 U.S. Export Markets for Semiconductors & Related Devices, NAICS 334413 (Billions of Dollars)

Encouraging conflict instead of cooperation with our allies: The CHIPS-Plus Act has been pitched as a response to China, but instead it helps China by encouraging economic conflict between the United States and our allies. On July 19, the CEOs of Intel and Ford wrote: “South Korea and Taiwan, notably, have spent years actively investing in their own chip manufacturing, creating an uneven playing field for U.S. chip makers that harms our economy and global competitiveness.” Intel’s CEO has said that without subsidies, the company would invest “a lot more” in Europe. He added: “We are not competing with TSMC or Samsung. We are competing with Taiwan and Japan and Korea.” Instead of escalating a global subsidy war that creates conflict between the United States and our allies, the United States should promote cooperation with Taiwan, Japan, Korea, Europe and other allies to respond to China’s non-market activities.

Undermining U.S. leverage in trade negotiations: The CHIPS-Plus Act weakens U.S. credibility in negotiations with China. U.S. Trade Representative Katherine Tai has specifically called out “unfair state-led industrial planning and targeting of certain sectors” by China. To maintain credibility on this point, the U.S. government should not engage in industrial planning and targeting of its own.

Encouraging industries to engage in lobbying instead of productive activities: The CHIPS Act would encourage other industries to ramp up their lobbying efforts in order to extract benefits from Congress. As Sen. Bernie Sanders (I-VT) warned: “You pass this bill and tomorrow we’ll hear, no doubt, from the cellphone industry, from the computer laptop industry, about how they need their welfare checks as well.”

For these reasons, Congress should reject the flawed CHIPS-Plus Act and instead pursue broad-based economic reforms designed to benefit all U.S. taxpayers.