(pdf)

Introduction

The Earned Income Tax Credit (EITC) is a refundable tax credit available to workers with relatively low incomes. It is the largest needs-tested antipoverty program that provinces cash to families. The EITC is designed to increase workforce participation and was originally enacted in 1974 in the face of a recession. The EITC was expanded under the American Rescue Plan Act (ARPA). Democrats are considering extending the expanded EITC as part of the multi-trillion dollar spending plan.

Who Gets the EITC?

In 2018, 26.5 million taxpayers, or about 17 percent of all taxpayers, received $64.9 billion from the EITC. In this same year 97 percent of the credit was received by families with children. Of the $64.9 billion, $64.3 billion was received as the refundable portion of the credit.

The Tax Policy Center found that the bottom 60 percent of taxpayers receive almost all of the EITC. A Congressional Research Service (CRS) report shows that 45 percent of all tax returns with the EITC had adjusted gross income (AGI) below $15,000. For context, the federal poverty line in 2021 for a two-person household is $17,420.

There are eight requirements that a taxpayer must meet to be eligible for the EITC. The taxpayer must: 1. Have a federal income tax return, 2. Have earned income, 3. Meet residency requirements, 4. Determine if they have qualifying children, based on relationship, residency, and age requirement, 5. Be between the ages of 25 and 64 only if there are no qualifying children, 6. Have investment income below a certain amount, 7. Not be disallowed the credit due to prior fraud or disregard of the rules when previously claiming the EITC, and 8. Provide the social security number for themselves, their spouse (if married), and any children the credit is claimed for.

According to the Internal Revenue Service (IRS), in 2016 78 percent of eligible EITC recipients received the credit. Participation rates were higher among taxpayers with qualifying children than those without.

A Congressional Research Service (CRS) report found that the EITC encouraged single mothers to enter the workforce, but the credit had little to no effect on the number of hours they work.

Calculating the EITC

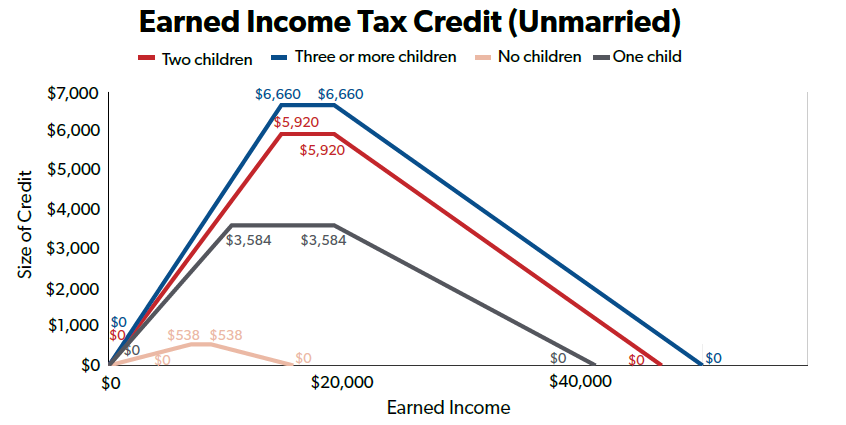

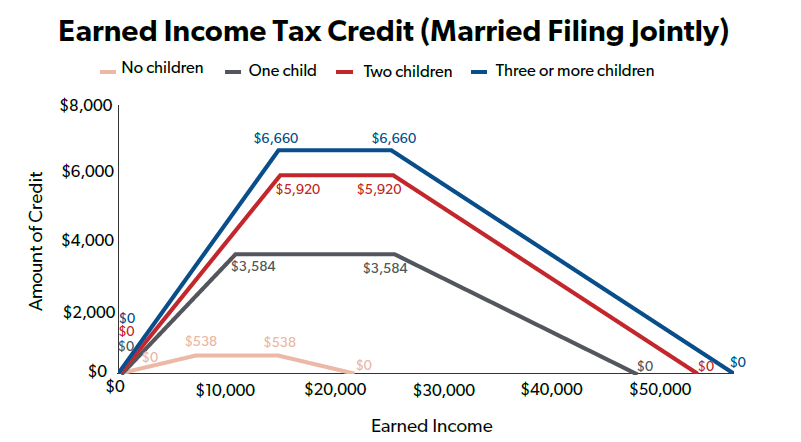

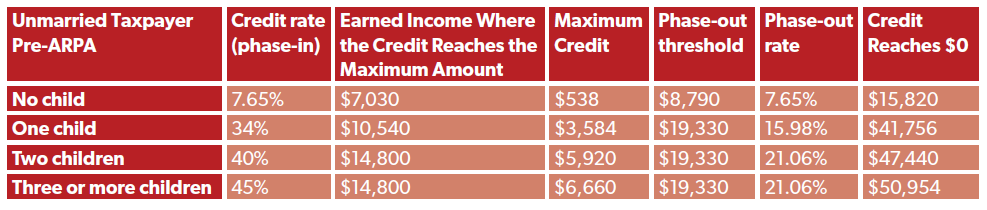

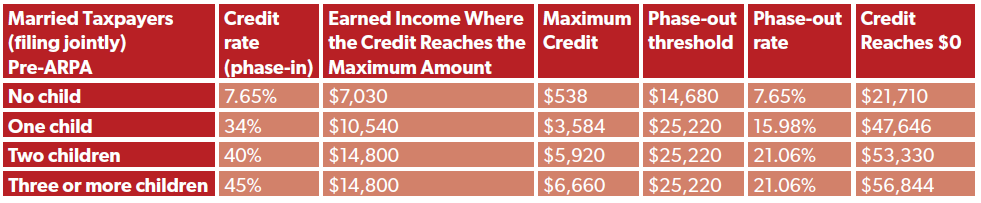

The credit is calculated based on the earned income, number of qualifying children, marital status, and adjusted gross income (AGI) of the filer. There is a “phase-in” period as income increases, followed by a plateau where the credit remains constant, followed by a “phase-out” period where each additional dollar of income decreases the size of the EITC until it reaches $0.

The EITC is provided as a lump-sum payment when a taxpayer files their tax return. The average EITC in 2018 was $2,451. However, the size of the credit depends on the number of children. For example, in 2018:

6.9 million filers with no qualifying children received an average credit of $302;

9.6 million filers with one qualifying child received an average credit of $2,396;

6.6 million filers with two qualifying children received an average credit of $3,847; and

3.3 million filers with three or more qualifying children received an average credit of $4,311.

Source: Congressional Research Service

Source: Congressional Research Service

Source: Congressional Research Service

Source: Congressional Research Service

How Did the American Rescue Plan Expand the Credit?

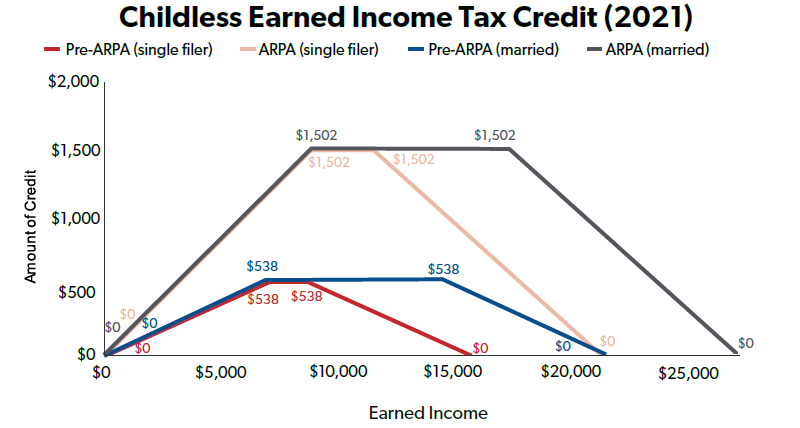

The American Rescue Plan (ARPA) expanded the benefits of the credit for “childless” workers (those without qualifying children) and reduced the minimum age of eligibility from 25 to 19 for most workers. The “childless” worker changes include:

Raising the credit rate (phase-in) from 7.65 percent to 15.3 percent;

Increasing the maximum credit amount from $543 to $1,502;

Increasing the income level the credit phases out at from $8,880 to $11,610 for a single filer ($14,820 to $17,550 for married couples filing jointly) and

Raising the phase-out rate from 7.65 percent to 15.3 percent

In 2018, out of the 26.5 million taxpayers who received the EITC, 6.9 million had no qualifying children. These “childless” workers received $2.1 billion out of $64.9 billion in benefits the same year, or about 3 percent.

A Congressional Research Service (CRS) report found that the EITC reduces the proportion of unmarried households with three children in poverty from 40.5 percent to 32.3 percent. Meanwhile, the EITC reduces the proportion of unmarried childless workers in poverty from 19.9 percent to 19.6 percent.

There is disagreement on whether expanding the credit to childless workers will encourage workforce participation, with some pointing to high labor participation rates among childless workers. A paper from the American Enterprise Institute (AEI), finds that it is unlikely that an expanded childless EITC would have positive labor supply effects, but it would provide a way to transfer income to another segment of the poor without discouraging work.

Source: Congressional Research Service

How Much Does the Credit Cost?

The one-year budgetary impact of the expanded EITC is $84 billion, according to the Joint Committee on Taxation. The pre-ARPA cost in 2018 was $65 billion, and the ARPA expansion costs an additional $16 billion.

Issues to Address with the Credit

Complexity: For taxpayers and the IRS, the EITC is an extremely complex credit, and the temporary expansion only further complicates the tax code. While the goals of reducing poverty and increasing workforce participation are laudable, the EITC presents numerous challenges from a taxpayer perspective. Navigating the eligibility requirements and determining the credit one is eligible for can be onerous and is a factor for the high level of improper payments. A 2020 guide put out by the IRS on the EITC is 41 pages of dense information. Policymakers should look for ways to reform and simply the EITC.

Improper payments: In fiscal year 2020, the Department of the Treasury United reported an improper payment estimate of approximately $16 billion (24 percent) in the ETIC. This is not an outlier. Over the past five years, the improper payment rate has averaged 24.4 percent. Several factors likely contribute to this extremely high improper payment rate, but the IRS notes that one of the most common sources of improper payments is a taxpayer incorrectly claiming a qualifying child. The Treasury report outlines five potential barriers to reducing refundable tax credit improper payments.

Marriage Penalty: A marriage penalty occurs when a married couple receives a smaller refund or benefit than the total of each person filing separately. Even prior to the ARPA expansion, there was a marriage penalty. For example, in 2018 two single parents with one child and $15,000 in income would receive $3,461 each, but if they married (combined income of $30,000 and two children) their combined EITC would be $4,526. A letter signed by 35 Republican Senators argues that the American Families Plan EITC takes the current marriage penalty and makes it worse. The increased marriage penalty under the expanded EITC occurs because of the increased size of the credit for the unmarried. Eugene Steuerle of the Urban-Brookings Tax Policy Center stated, “the bottom line is low earners who marry other low earners are largely penalized by the EITC.”

Overlapping programs: The EITC, child tax credit, temporary assistance for needy families, and numerous other programs attempt to lessen the burden on low- and moderate-income Americans. However, not all programs are created equally, and Congress should explore ways to consolidate and streamline overlapping antipoverty measures. This would allow taxpayer dollars to be used on the most effective programs and targeted to help those most in need. It would also reduce the complexity of the tax code, making it easier to navigate for taxpayers.

Conclusion

The EITC is well-intentioned but has several structural flaws that should be addressed. For taxpayers, the eligibility criteria is complex and can cause confusion. This in turn can lead to high improper payments. Excessive tax credits can complicate the tax code, and NTU supports simplifying the array of credits that are designed to lift Americans out of poverty. Lawmakers should continue to look for ways to improve the credit before permanently extending an expanded version.