(pdf)

Who Pays the Corporate Tax?

Approximately 1.5 million active C corporations pay the corporate income tax, according to the most up-to-date IRS Statistics of Income (SOI) for tax year 2018

What Is the Tax Rate?

What Is the Tax Rate?

21% of taxable income, according to 26 USC 11

Before the passage of the Tax Cuts and Jobs Act (TCJA) in 2017, the corporate tax rate was graduated, starting at 15% of taxable income up to $50,000 and accelerating to a maximum rate of 35% of taxable income beyond $10 million; TCJA changed this to a flat, 21% rate on all taxable income

On What Income Is the Tax Assessed?

The tax is assessed on net income from U.S. sources and certain foreign sources after subtracting ordinary deductions, statutory special deductions, foreign income deductions, and credits

The most common ordinary deductions are for the cost of goods sold by the business (COGS), salaries and wages of employees, depreciation of tangible assets, and interest expenses

The most common special deduction is for businesses with net operating losses (NOLs)

The most common foreign income deductions are for global intangible low-tax income (GILTI) and for income derived from exports (the foreign derived-intangible income, or FDII, deduction)

The most common tax credits are for foreign tax credits and general business credits (such as for building low-income housing, building energy-efficient homes, or conducting research)

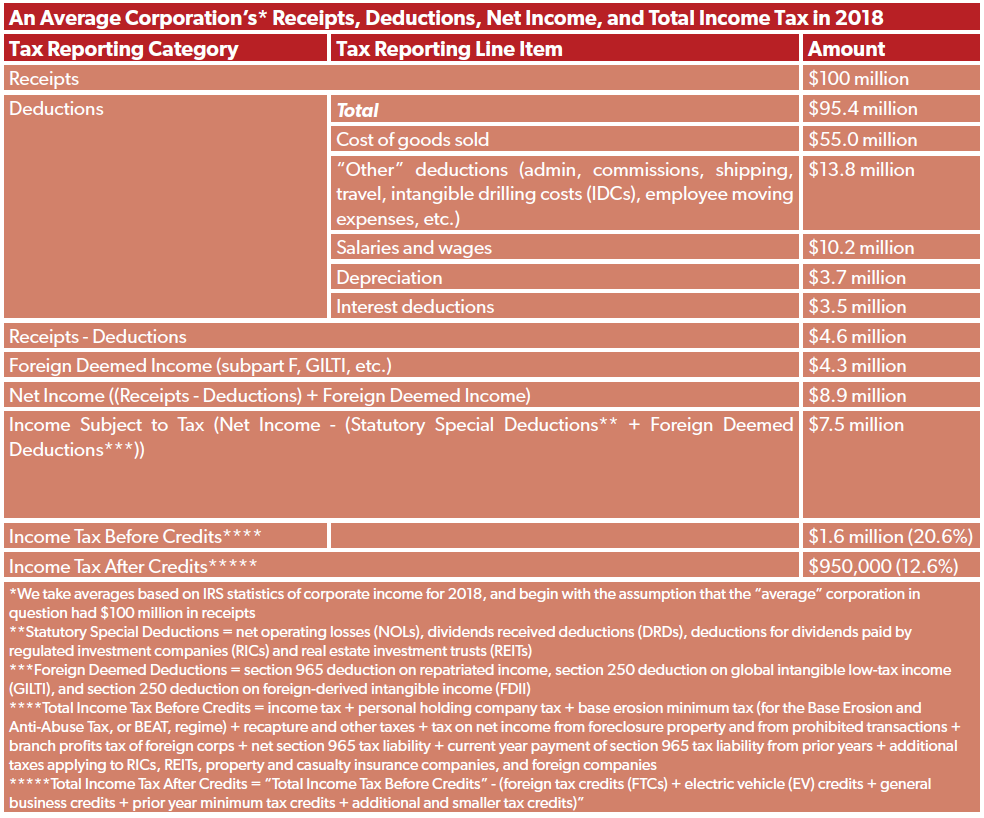

The below chart uses IRS SOI data from tax year 2018 to demonstrate what the average C corp would have in deductions, net income, and income tax liability (before and after credits) if they had $100 million in receipts; the chart is only meant to be illustrative of statistical averages and does not reflect a typical C corporation’s tax return

- Some policymakers and media figures express shock when a successful U.S. corporation reports high sales but then pays a relatively small proportion of those sales numbers in corporate income taxes

This is not an indication of tax evasion, though; it’s merely a function of numerous deductions and credits that policymakers have determined are necessary or effective, and/or sound tax policy, and have often supported on a bipartisan basis

How Much Does the Government Collect in Corporate Taxes?

According to the Congressional Budget Office’s (CBO) July 2021 baseline, the U.S. will collect approximately $238 billion in corporate tax revenues in fiscal year 2021, which runs from October 2020 through September 2021

This is 6.2% of all federal revenues collected (the majority are from individual income and payroll taxes) and 1.1% of U.S. gross domestic product (GDP)

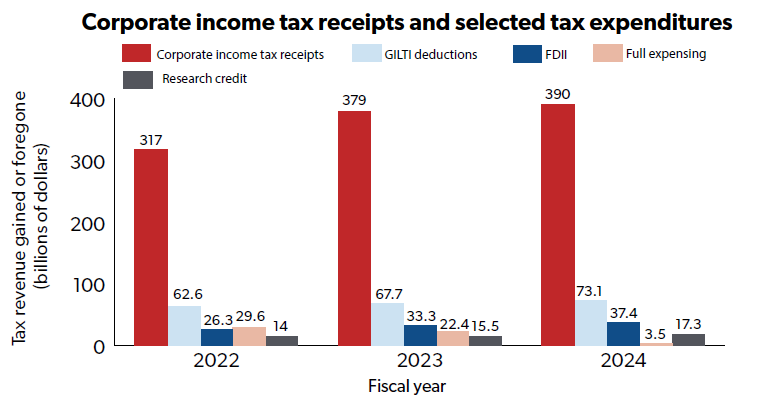

CBO projects corporate income tax revenues will jump to $317 billion in the next fiscal year, FY 2022, and will total $3.9 trillion over the next 10 years (an average of around $390 billion per year)

The four largest tax expenditures (deductions or credits) for corporations, which collectively make up about two-thirds of the value of all corporate tax expenditures, were

1) the 50% deduction for GILTI (meaning such foreign-source intangible income is taxed at an effective 10.5% rate)

2) the 37.5% deduction for FDII (which taxes export income at an effective 13.125% rate)

3) the temporary ability for corporations to fully write off investments in machinery, equipment, and other short-lived assets in the year of purchase (“full expensing”), and

4) the incremental research tax credit

The below chart compares the Joint Committee on Taxation’s (JCT) estimates of the value of top business tax expenditures over the next three fiscal years with the total amount of projected corporate tax receipts in the next three fiscal years

Please note that an estimate of the value of a tax expenditure is not equal to the revenue policymakers could gain by repealing or removing the expenditure, since repeal or removal would have to account for taxpayers’ responses to a policy

What Are the Biden Administration Proposals Affecting Corporate Tax Revenues?

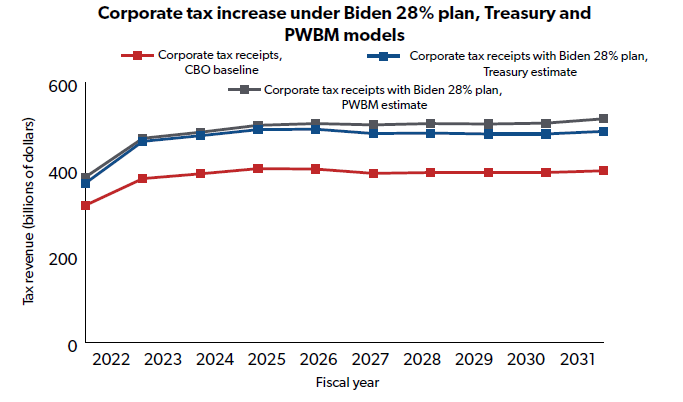

President Biden has five major proposals that would affect corporate tax revenues; the headline proposal, and the one with the largest revenue impact, is to raise the corporate tax rate by a third, from 21% to 28%

The impact of this first Biden proposal on corporate tax revenues is illustrated in the chart below, with slightly different estimates from the Treasury Department and the University of Pennsylvania Penn-Wharton Budget Model (PWBM)

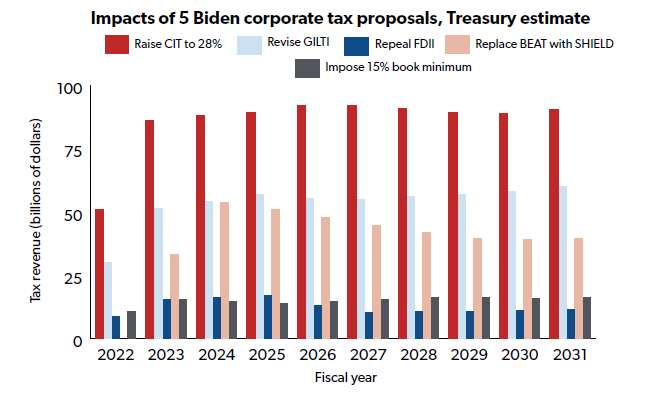

Four other proposals from President Biden would also significantly affect corporate tax revenues:

Revising the international tax regime that taxes the foreign profits U.S. businesses earn on certain highly-mobile, highly-profitable intangible assets (GILTI)

Repealing the deduction U.S. businesses can take on their income derived from exports, the foreign-derived intangible income (FDII) deduction

Replacing the Base Erosion and Anti-Abuse Tax (BEAT), which seeks to tax businesses that send profits away from the U.S. to lower-tax jurisdictions, with a new Stopping Harmful Inversions and Ending Low-tax Developments (SHIELD) regime that is more punitive against U.S. companies, and

Imposing a 15% minimum tax on corporations’ book profits, which often differ from the “Income Subject to Tax” we discussed above

The below table shows the tax revenue the Biden administration projects to raise under these five proposals:

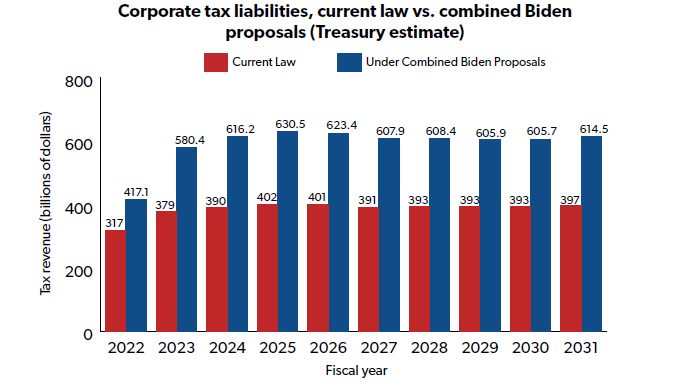

And the below table demonstrates the combined impact of these five Biden proposals on corporate tax revenue versus the CBO baseline

Who Bears the Corporate Tax?

While C corporations directly pay the income tax, there is rigorous academic debate over which individuals are ultimately responsible for bearing the effects of the tax

Tax Foundation’s Stephen Entin cites economists’ studies that estimate employees of corporations may bear up to “70 percent or higher” of the corporate income tax, with shareholders of corporations bearing the rest

CBO allocates 25% of the corporate income tax to workers, and 75% to shareholders (explanation from JCT here)

JCT further explains that in the short run corporate tax increases are borne by shareholders, but in the long run a growing share of the tax hike is borne by workers

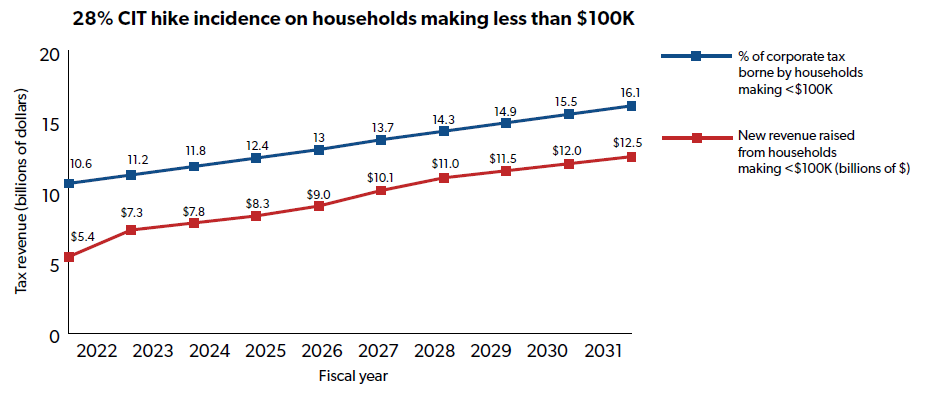

Using JCT analysis, NTU estimated in August 2021 that a seven-point increase in the corporate tax rate, from 21% to 28%, would raise taxes on households making less than $100,000 by nearly $100 billion over a decade

Where Can I Find Additional Resources?