(pdf)

What’s the Deal With Medicare Price Negotiation and a Prescription Drug Tax?

- This issue brief concerns:

- Requiring Medicare to negotiate prescription drug prices

- Penalizing manufacturers who refuse to submit to negotiations (or refuse to agree to a price) with a steep excise tax

But Wait, Isn’t Having Medicare Negotiate Prescription Drug Prices Popular?

- Yes, it is; according to Kaiser Family Foundation (KFF) polling from May 2021, 77% of Republicans, 89% of independents, and 96% of Democrats support “allowing the federal government to negotiate for lower prices on medications”

- Here are three things those simple poll questions (sometimes) miss:

- The public is less certain about Medicare negotiations when they hear about the trade-offs; according to KFF (emphasis ours), “majorities oppose this policy proposal when the public hears argument made by pharmaceutical companies that it could lead to less research and development for new drugs, or that access to newer prescriptions could be limited.”

- The more than 300 organizations sponsoring Medicare Part D plans already negotiate the price of drugs, earning “postsale rebates and discounts” from manufacturers based on their enrollee populations and on negotiating tools like formulary placement; proposals to “allow” Medicare to negotiate the price of drugs are really proposals to replace private-sector negotiations with top-down, federal government negotiations.

- The Congressional Budget Office (CBO) reported in 2007 (and reconfirmed in 2019) that Medicare price negotiations would not be effective without a proverbial ‘stick’ for HHS, either a national formulary or mandatory price concessions/reductions; the formulary concept is unpopular, hence H.R. 3’s excise tax proposal.

Who Would Pay Prescription Drug Taxes?

- In H.R. 3, “the manufacturer, producer, or importer” of any drug selected by HHS for Medicare price negotiations

- Under H.R. 3, HHS must negotiate the price of 25 drugs in 2024 and 50 drugs in 2025 and every year after (along with new drugs and insulin), subjecting potentially dozens of manufacturers -- large and small -- to negotiations

- Of note for new drugs...according to Iqvia nearly two-thirds of drugs approved in 2018 were from “emerging” pharmaceutical manufacturers with either a) less than $200 million per year in R&D or b) less than $500 million per year in revenue

What Would the Tax Rate Be?

- In the first three months of failure to reach a negotiated price, the tax rate would be 65% of gross sales; in the next three months the tax rate would be 75% of gross sales; in the third three months the tax rate would be 85% of gross sales; and after nine months the tax would be 95% of gross sales

- However, the tax rate could be up to 1,900% of gross sales … and we didn’t mistakenly add an extra zero

- JCT and Tax Foundation’s Erica York each succinctly explain the difference between “tax-inclusive” and “tax-exclusive” rates, and York demonstrates that a tax-exclusive rate on prescription drugs under the 95% gross sales tax period could equal an effective tax rate of 1,900%

How Much Would the Government Collect in Prescription Drug Taxes?

- $0

- That’s not a typo; according to the Joint Committee on Taxation (JCT) “the revenue provisions of H.R. 3 will have no effect on Federal fiscal year budget receipts during the period of fiscal year 2020 through fiscal year 2029”

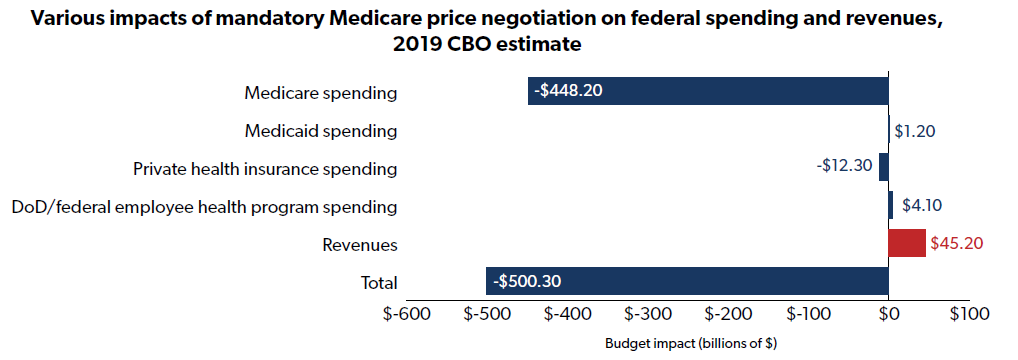

- Instead, the excise tax is so severe that manufacturers would either submit to ‘negotiations’ or exit the U.S. market altogether; the ‘negotiations,’ where the government would have all the leverage and an extraordinarily punitive excise tax hanging over their negotiating party’s head, would have a total budget impact of $500.3 billion over a decade

- Here’s how that $500 billion impact breaks down:

- CBO also projects a $45 billion per year unfunded mandates cost in each of the first five years of H.R. 3 ($225 billion total)

- According to CBO, there are two primary unfunded mandate costs:

- 1) “the cost to the manufacturers whose drugs would be selected for negotiation,” and

- 2) “the cost to other manufacturers who would face competition from lower-priced alternatives”

- According to CBO, there are two primary unfunded mandate costs:

What Impact Would Prescription Drug Taxes Have on R&D?

- First, policymakers should understand how R&D intensive the pharmaceutical industry is relative to other industries:

- According to the OECD, in 2016 pharmaceutical R&D intensity[1] was 11.6%, on average, across OECD countries, and was more than 35% in the U.S.; R&D intensity was just 4.7% for manufacturing across the OECD, 0.8% for services, and 0.2% for construction

- According to the National Science Foundation (NSF), pharmaceuticals and medicines R&D intensity[2] in 2017 in the U.S. was 14.2%, whereas all industries averaged just 4.1%

- Second, policymakers must understand that the private sector contributes far more to pharmaceutical R&D than the government

- According to the OECD, in 2016 the U.S. gap was $28.7 billion ($64.6 billion in R&D expenditures from companies and $35.9 billion from the government)

- Contrast this with the proposed spending on NIH and FDA research in H.R. 3 -- $8.947 billion over a decade, or an average of just under $900 million per year

- Third, policymakers must understand that manufacturers could actually lose money on some drugs under H.R. 3 given that excise taxes will not be deductible from a manufacturer’s corporate income tax bill

- Consider a manufacturer that has $10 million in income subject to tax before accounting for the excise tax, and another $5 million in H.R. 3 excise taxes paid

- Instead of owing $2.1 million in income tax ($10 million * 21%), the company would effectively have to pay taxes on the excise taxes they paid under H.R. 3, leaving total taxes at $3.15 million ($15 million * 21%) or an effective tax rate of 31% ($3.15 million in taxes paid / $10 million in income subject to tax)

- CBO points out that “the combination of income taxes and excise taxes on the sales could cause the drug manufacturer to lose money if the drug was sold in the United States”

- With all of the above caveats in mind, the impact of H.R. 3 on pharmaceutical R&D is certainly negative, but the degree to which H.R. 3 negatively impacts R&D is highly uncertain with a number of studies showing wildly different results

- A new CBO paper cites a number of possibilities:

- CBO estimates an 8% annual average reduction in new drugs by the third decade after H.R. 3’s passage

- CBO cites a 2015 study that estimates a 5% reduction in new drugs

- CBO also cites a 2004 study that estimates an 80% reduction in new drugs

- Clearly, CBO settled on a number closer to the lower end of possibilities, but any reduction in new drug development could have significant consequences for Americans and for U.S. health care spending

- A 2002 NBER study found “reducing the mean age of drugs used to treat a given condition from 15 years to 5.5 years will increase prescription drug spending per medical condition by $18 for the entire population, but will lower other medical spending by $129”

- And a 2012 CBO paper found “that a 1 percent increase in the number of prescriptions filled by beneficiaries would cause Medicare’s spending on medical services to fall by roughly one-fifth of 1 percent”

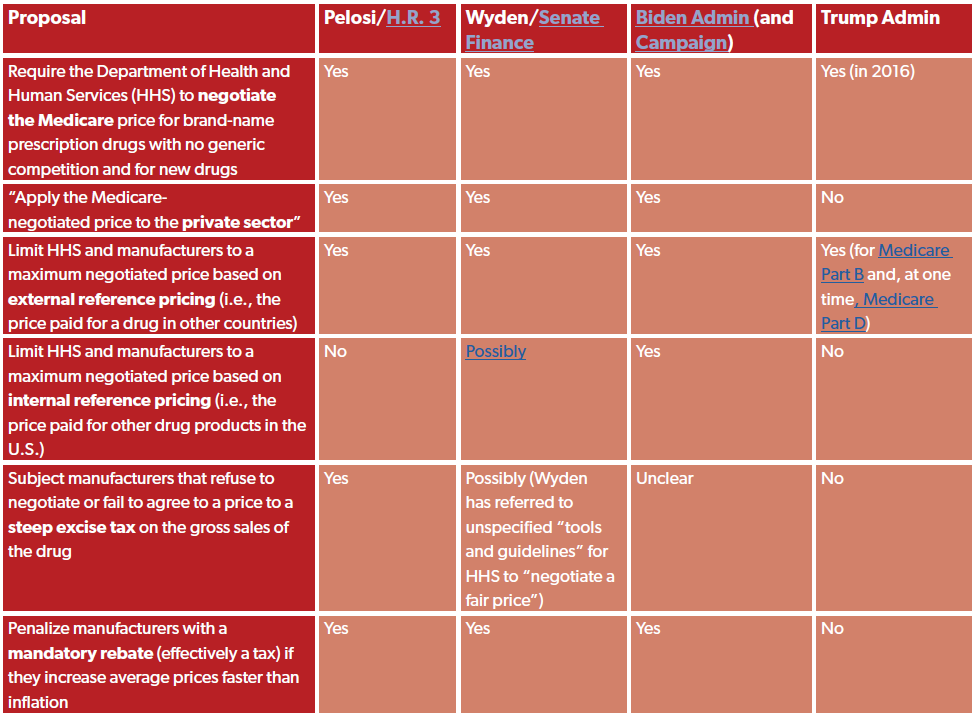

What Are the Various Proposals Affecting Prescription Drugs?

- Over the years, lawmakers and executive branch officials from the Biden and Trump administrations have offered several policy proposals that would significantly impact the prices of prescription drugs and have a significant impact on the development of new drugs

Where Can I Find Additional Resources?

- JCT, “Description Of The Revenue Provisions Of H.R.3, The Lower Drug Costs Now Act Of 2019,” October 2019

- CBO, “Budgetary Effects of H.R. 3,” December 2019

- NTU, “A Taxpayer- and Market-Oriented Path Forward for Federal Prescription Drug Policy,” February 2021

- NTU, “Report Confirms Likely Negative Impact of Prescription Drug Excise Taxes on R&D,” September 2021

- Tax Foundation, “Paying for Reconciliation Bill with “Health Care Savings” Threatens Medical Innovation,” August 2021

[1] Measured as business enterprise R&D expenditure / gross value added.

[2] Measured as domestic R&D paid for by respondent company (and others outside of the company and performed by the company) / domestic net sales of companies that performed/funded R&D. The different ways OECD and NSF measure R&D intensity explains part of the disparity between the two intensity figures.