(pdf)

Because China is a member of the World Trade Organization (WTO), imports from China are eligible for the “normal” U.S. tariff rates that apply to imports from WTO members. Soon after China joined the WTO, then-Rep. Bernie Sanders (I-VT) introduced legislation to strip the application of normal U.S. tariff rates to imports from China, a position he reiterated in his 2020 presidential run.[1] Sen. Josh Hawley (R-MO) recently introduced similar legislation.[2]

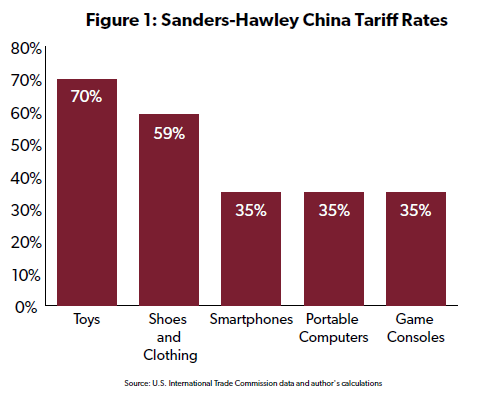

A “Sanders-Hawley Tariff” on Americans who import goods from China would be the biggest U.S. tariff increase since the Smoot-Hawley Tariff Act of 1930. Based on 2022 import levels, Sanders-Hawley tariffs would increase the average tax on imports from China from 11.1 percent to 40.9 percent.[3] High taxes would be levied on products like shoes and clothing (59 percent Sanders-Hawley tariff rate), toys (70 percent tariff rate), and computers and cellphones (35 percent tariff rate). The resulting price increases would come at a time when inflation and everyday bills remain big concerns for American families.[4]

Tariff Hikes Would Harm Working Families

China produces nearly 80 percent of the toys sold in the United States. Adding a 70 percent tariff to toy imports is not a policy that would benefit America’s working families. Increased import taxes could add $86 to the price of smartphones from China, $111 to laptop computers, and $39 to video game consoles.

Proponents of massive tariff increases want Americans to believe they would create jobs in the United States. That’s wishful thinking

Tariffs would encourage some companies to divert production from China, but any production moving from China to the United States would largely be automated. For example, the CEO of Stanley Black and Decker recently suggested that while a power tool assembly in China might take 50 to 75 people on the assembly line, production in the United States might take just two or three people on the assembly line.[5]

More generally, tariff increases don’t create jobs. Consider the potential impact of the Sanders-Hawley tariff on clothing prices. Increasing the average tariff on shoes and clothing from 19 percent to 59 percent would encourage many families to defer purchases of new clothing. Those families who pay higher clothing prices would have less money to spend elsewhere, reducing jobs in other sectors of the economy. Added to this damage would be the additional jobs destroyed by lost exports to our third-largest export market due to inevitable retaliation by China.

Aiming for China, But Hitting Workers in Japan, Taiwan – and the United States

It might appear to be self-evident that tariff increases would stick it to Chinese exporters. The truth is more complicated, since many U.S. imports from China consist largely of components from other countries that have been sent to China for final assembly.

For example, researchers estimate that just 3.6 percent of the cost of an iPhone imported from China goes to China. Suppliers in the United States and Japan each account for 28.6 percent of the cost, while suppliers in Taiwan account for 20.2 percent of the cost.[6]

This means a big tariff increase on iPhones imported from China would largely hit suppliers in the United States, Japan, and even Taiwan.

Tariffs on phones assembled in China would also give Korea’s Samsung a competitive edge over U.S.-based Apple[7]. Since Samsung assembles most of its phones in Korea and Vietnam. Samsung could continue to export those phones to the United States tariff-free.

Similarly, more than 70 percent of the value of “imported” clothing originates in the United States. The final sewing may take place abroad, but that represents just a fraction of the value of new apparel.[8] And according to the Toy Association, while most toy assembly takes place in China, 80 percent of the dollars Americans spent on toys remains in the United States.[9]

The Sanders-Hawley tariff would even tax capital goods used to create jobs in the United States. Nearly half of U.S. imports from China are capital goods – machines and tools used in the production of other goods.[10] Tariff increases would make it harder for American businesses to afford capital goods to make more things in the USA.

As tariff increases raised costs for U.S. businesses, their competitors would benefit from the ability to buy low-priced products from China. Retaliatory tariffs would harm exporters, giving their competitors preferential access to China’s market. Protectionism would inevitably spill over into trade with other countries.

China Presents Many Challenges, but Tariffs Are Not the Answer

In 2016 GOP presidential debates, Sen. Ted Cruz (R-TX) observed: “It’s not China that pays the [import] tax. It’s you, the working men and women. So ask yourself at home: How is this helping you? If your wages have been stagnant for 20 years; if you can’t pay the bills, how does it help you to have a president come and say,’I’m going to jack - I’m going to put a 45 percent tax on diapers when you buy diapers, on automobiles when you buy automobiles, on clothing when you buy clothing.’ That hurts you. It’s why we’ve got to get beyond [the] rhetoric of ‘China bad,’ and actually get to how do you solve the problem. Because this solution would hurt jobs and hurt hard-working taxpayers in America.”[11]

At the time, Sen. Marco Rubio (R-FL) explained: “We are all frustrated with what China's doing. I think we need to be very careful with tariffs and here's why: China doesn't pay the tariff. The buyer pays the tariff. If you send the tie or a shirt made in China into the United States and American goes to buy it at the store and there's a tariff on it it gets passed on in the price to the consumer so I think the better approach, the best thing we can do to protect ourselves against China economically is to make our economy stronger.”[12]

Senators Cruz and Rubio were prescient to warn about the risks of tariffs. Over the past five years, the federal government has given Americans a case study on the use of tariffs to change China’s behavior. During that time, Americans have paid nearly $177 billion in Section 301 tariffs on imports from China, the equivalent of greater than $1,400 per household in hidden taxes. These tariffs were supposed to convince China to modify its policies related to technology transfer, intellectual property, and innovation.[13]

Instead, Chinese Communist Party intervention in the economy broadened, China imposed retaliatory tariffs on U.S. exports, and nearly the entire cost of tariffs was paid for by Americans.[14]

While the Sanders-Hawley tariff would be the most aggressive tariff hike, it’s not the only such proposal. The China Trade Relations Act, cosponsored by Senators Tom Cotton (R-AR), Rick Scott (R-FL), Ted Budd (R-NC) and J.D. Vance (R-OH) and Representatives Chris Smith (R-NJ) and Tom Tiffany (R-WI), would empower President Biden and future presidents to determine every year whether China should continue to receive normal trade status, subject to congressional review.[15] These policies would also disrupt U.S.-China trade by making it difficult for businesses to engage in long-term planning.

Tariffs on China Come with a Big Price Tag

Some critics of trade with China have suggested that China’s economic growth came at the expense of the United States. This would imply that disrupting trade with China is either a no-cost policy, or one that would generate net benefits for the United States. That’s incorrect. Whatever policies the Biden administration and Congress choose to pursue with respect to China, they should understand that broad-based tariff hikes would increase prices for American families, undermine the creation of good new jobs, and weaken the U.S. economy. That was the case with the Smoot-Hawley tariff in 1930, and remains true today.

[1] H.R.728 - To withdraw normal trade relations treatment from the products of the People's Republic of China. 109th Congress (2005-2006). Introduced by Rep. Bernie Sanders (I-VT). Retrieved from: https://www.congress.gov/bill/109th-congress/house-bill/728.

[2] Sen. Josh Hawley. “Hawley Announces First Bill in Worker's Agenda to Rebuild America: Ending Normal Trade Relations with China Act.” March 20, 2023. Retrieved from: https://www.hawley.senate.gov/hawley-announces-first-bill-workers-agenda-rebuild-america-ending-normal-trade-relations-china-act.

[3] Author’s estimate based on statutory “Column 2” tariff rates that apply to countries not covered by Normal Trade Relations and 2021 import volume. See U.S. Customs and Border Protection, https://help.cbp.gov/s/article/Article-310?language=en_US#:~:text=Countries%20not%20covered%20by%20NTR,North%20Korea%2C%20Russia%20and%20Belarus..

[4] “Half Say Middle Class Not Benefiting at All from Biden Policies.” Monmouth Poll Reports. April 11, 2023. Retrieved from: https://www.monmouth.edu/polling-institute/reports/monmouthpoll_us_041123/#Question5.

[5] Allan, Donald Jr., cited in Keilman, John. “America Is Back in the Factory Business.” The Wall Street Journal, April 8, 2023. Retrieved from: https://www.wsj.com/articles/american-manufacturing-factory-jobs-comeback-3ce0c52c.

[6] Dedrick,Jason, Linden, Greg, and Kraemer, Kenneth L. “The guts of an Apple iPhone show exactly what Trump gets wrong about trade.” TheStreet, June 25, 2019. Retrieved from: https://www.thestreet.com/phildavis/news/the-guts-of-an-apple-iphone-show-exactly-what-trump-gets-wrong-about-trade.

[7] Kharpal, Arjun. “Apple begins making the iPhone 14 in India, marking a big shift in its manufacturing strategy.” CNBC, September 26, 2022. Retrieved from: https://www.cnbc.com/2022/09/26/apple-starts-manufacturing-the-iphone-14-in-india.html.

[8] Moongate Associates. “2017 Apparel Value Chain Study.” Produced for U.S. Global Value Chain Coalition. Retrieved from: https://img1.wsimg.com/blobby/go/f23cae5a-2434-44f6-91d1-3695bf2115a3/downloads/1catkgucb_898671.pdf.

[9] Pasierb, Steve. Comments in response to “Request for Public Comment Concerning Proposed Modification of Action Pursuant to Section 301: China's Acts, Policies, and Practices Related to Technology Transfer, Intellectual Property, and Innovation. Docket Number: USTR-2018-0026.” September 6, 2018. Retrieved from: https://www.toyassociation.org/PressRoom2/News/2018-news/september-2018-toy-association-comments-to-ustr-on-tariffs-list.aspx.

[10] World Integrated Trade Solution data. Retrieved from: https://wits.worldbank.org/CountryProfile/en/Country/USA/Year/2020/TradeFlow/Import/Partner/CHN/Product/stages-of-processing/Show/Product%20Group;MPRT-TRD-VL;MPRT-PRDCT-SHR;AHS-WGHTD-AVRG;MFN-WGHTD-AVRG;/Sort/MPRT-TRD-VL (Accessed May 9, 2023.)

[11] Sen. Ted Cruz (R-TX). “Transcript of Republican debate in Miami, full text.” March 15, 2016. Retrieved from: https://www.cnn.com/2016/03/10/politics/republican-debate-transcript-full-text/index.html.

[12] Sen. Marco Rubio (R-FL). “Debate: 6th Republican Presidential Candidate Debate - January 14, 2016.” Retrieved from: https://www.youtube.com/watch?v=asr0i_B4Ny0 (Accessed May 9, 2023).

[13] “Findings of the Investigation Into China’s Acts, Policies, and Practices Related to Technology Transfer, Intellectual Property, and Innovation Under Section 301 of the Trade Act of 1974,” Office of the U.S. Trade Representative, March 22, 2018. Retrieved from: https://ustr.gov/sites/default/files/Section%20301%20FINAL.PDF.

[14] “2020 Report to Congress.” U.S.-China Economic and Security Review Commission, November 2021. Retrieved from: https://www.uscc.gov/sites/default/files/2021-11/2021_Annual_Report_to_Congress.pdf (Accessed May 9, 2023); Bown, Chad P.; Jung, Euijin, and Lu, Zhiyao (Lucy). “China's Retaliation to Trump's Tariff.” Peterson Institute for International Economics,June 22, 2018. Retrieved from: https://www.piie.com/blogs/trade-and-investment-policy-watch/chinas-retaliation-trumps-tariffs; and “Economic Impact of Section 232 and 301 Tariffs on U.S. Industries.” U.S. International Trade Commission, March 2023. (Investigation No. 332-591, USITC Publication 5405)” Retrieved from: https://www.usitc.gov/sites/default/files/publications/332/pub5405.pdf.

[15] Sen. Rick Scott (R-FL). “Sens. Rick Scott, Tom Cotton & Colleagues Introduce Bill to End China’s Permanent Normal Trade Status.” January 27, 2023. Retrieved from: https://www.rickscott.senate.gov/2023/1/sens-rick-scott-tom-cotton-colleagues-introduce-bill-to-end-china-s-permanent-normal-trade-status.