Everyone knows the Inflation Reduction Act (IRA) won’t help reduce inflation. What some people might not know is that the bill is laden with special interest provisions that will harm workers and taxpayers. For example, it includes provisions that exclude 87 percent of the U.S. construction workforce by requiring private developers of clean energy projects to either hire union-signatory contractors and unionized construction workers or lose access to tax incentives that would help propel the advancement of these projects by reducing the financial risk involved.

The IRA reduces current clean energy tax credits from 30 percent to 6 percent, but includes a bonus tax credit of up to 500 percent, available only to developers who utilize union workers, or government-registered apprentices at union rates.

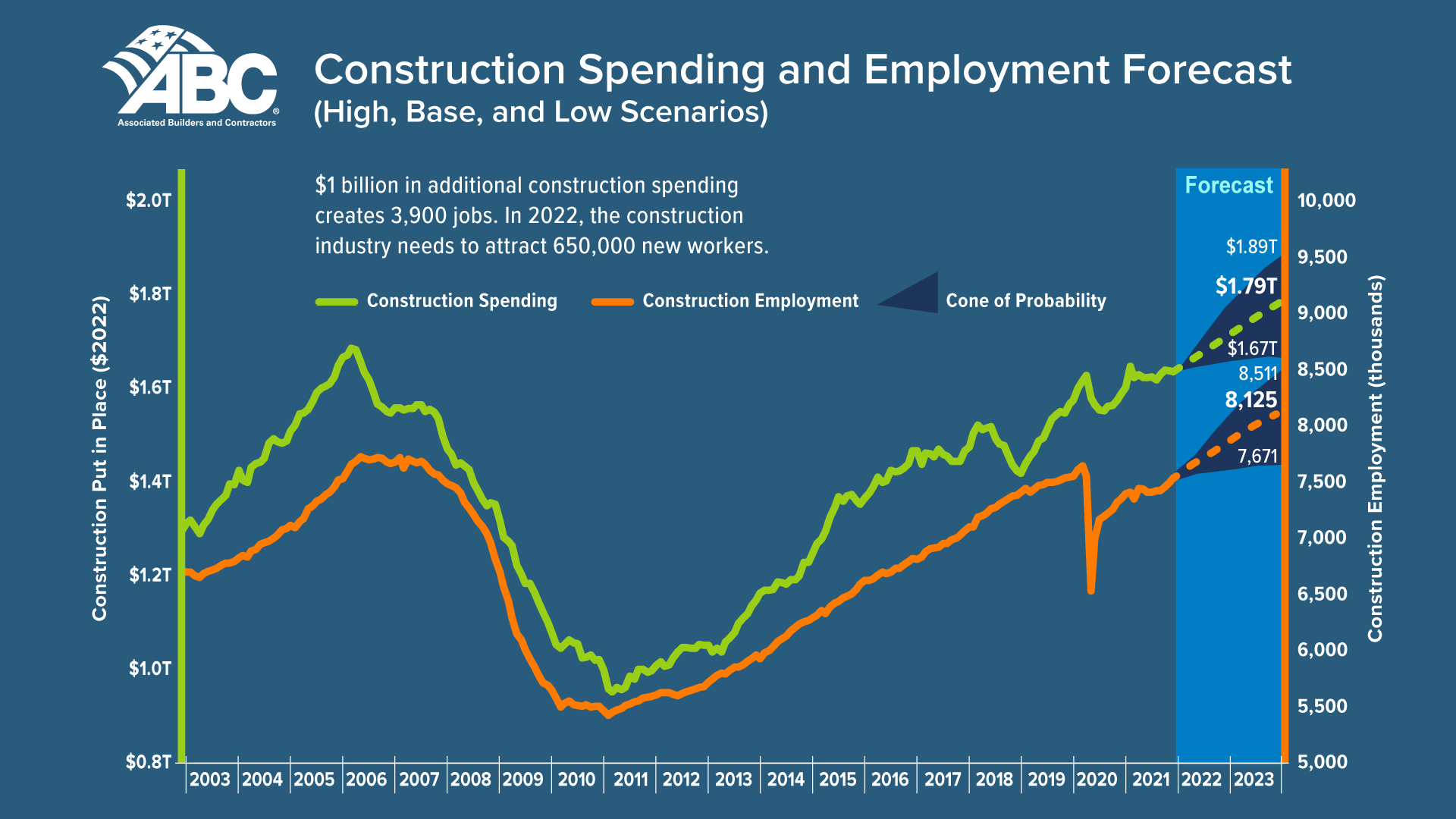

The Bureau of Labor Statistics tracks union membership by industry and according to their most recent report, only 12.7 percent of the construction industry is currently a part of a union, while the vast majority 87.3 percent are non-union workers. This is a major issue considering that the construction industry is already experiencing a shortage of workers, and with the passage of the IRA and the Infrastructure Investment and Jobs Act demand for workers will be at an all time high in the coming decade as these multi-billion dollar bills get implemented. According to the Association of Builders and Contractors, the construction industry is currently facing a shortfall of 650,000 workers on top of their normal pace of hiring to meet demand for 2023.

(Figure 1, Construction Spending & Employment, Association of Builders and Contractors)

The IRA’s union-only provisions could stall out these green projects and represent just the latest example of unintended consequences from bad energy policy by the current administration. These policies will needlessly increase costs, reduce competition, and completely undermine the intention of the IRA while leaving 87 percent of the construction industry out in the cold.

The IRA includes many provisions that NTU is opposed to, this being only the latest concern to come out of the massive spending spree. The administration and Congress have completely undermined the construction industry with the clean energy tax credits and missed an opportunity to increase private involvement in clean energy projects. If the IRA’s true intention was to transition to clean energy as quickly as possible while empowering the US workforce then voters should demand the repeal of this policy that is sure to slow down clean energy deployment and stagnate job creation.