(pdf)

The phrase “trade not aid” commonly refers to giving people in other countries access to the U.S. market as an alternative to sending billions of dollars in foreign aid. However, the phrase could also be applied to U.S. agricultural producers. As Congress approaches a possible vote on the farm bill, most of the focus will be on federal aid, even though trade is much more important to America’s agricultural sector.

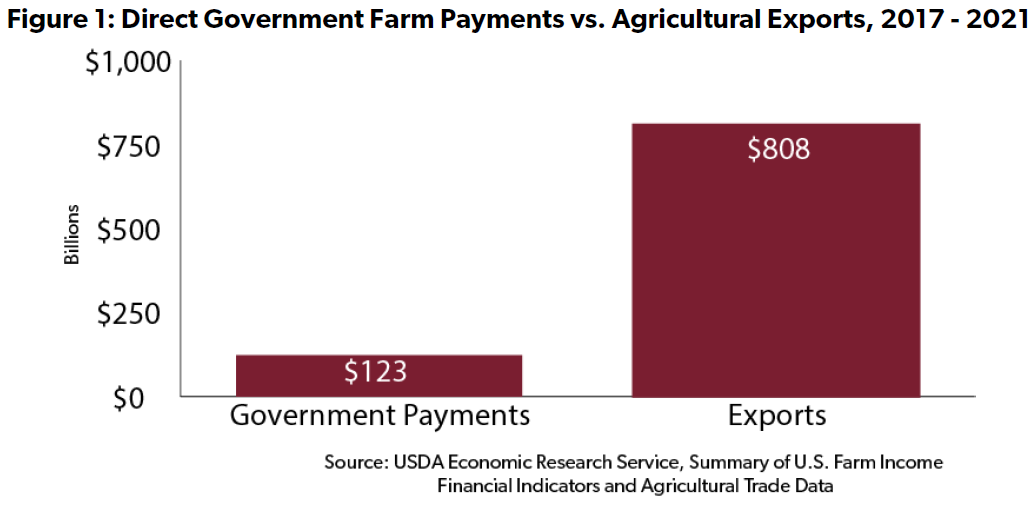

From 2018 to 2022, farmers received 6.5 times more income from exports than from direct government payments, even after accounting for unprecedented government aid they received to compensate farmers for President Trump’s trade war and for the COVID pandemic.

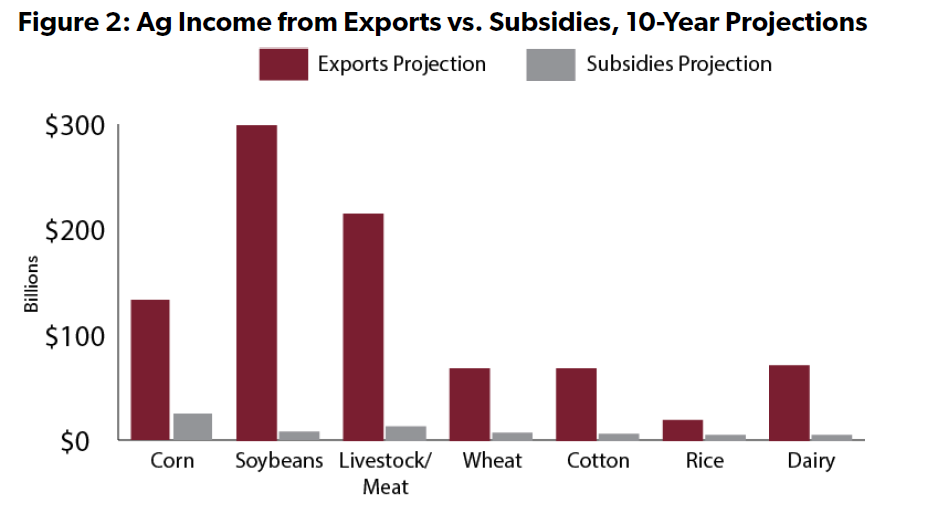

Most agricultural producers don't receive significant direct government payments via the farm bill, but even for those that receive large subsidies, federal support is insignificant compared to how much they earn from exports.

For example, the Congressional Budget Office projects that corn producers will be the biggest recipient of farm subsidies over the next 10 years, receiving $24.8 billion under the current budget baseline.[1] According to the U.S. Department of Agriculture (USDA), corn producers earned an average of $13.3 billion a year from exports over the last five years.[2] If exports are maintained at that level, then corn producers stand to earn five times as much from exports as from federal subsidies over the next decade. The importance of exports over subsidies applies to every major recipient of direct farm subsidies.

These 10-year export and subsidy numbers in Figure 2 are only estimates. Several factors could affect them for better or worse.

The most concerning potential development is a trade war that would reduce exports and boost farm subsidies. For example, Trump administration tariffs provoked foreign retaliation that cost U.S. agricultural producers $27 billion from 2018 to 2019.[3] The administration responded with $23.1 billion in agricultural subsidies[4] for those “unjustified” foreign retaliatory tariffs.[5]

On the upside, new market access agreements and tariff cuts would be likely to increase agricultural income far above these conservative export projections. From 2018 to 2022, the value of U.S. agricultural exports increased by 35 percent.[6] The goal should be not just to maintain current exports, but to generate continued export growth.

It is especially vital for Congress to act on trade given the Biden administration’s lack of interest in opening new markets for American agricultural products.

The Biden administration’s trade policy has largely consisted of maintaining most of the tariffs it inherited from the Trump administration while failing to even try to open new markets for U.S. exporters. U.S. Trade Representative Katherine Tai and National Security Advisor Jake Sullivan each call the Biden administration’s refusal to seek tariff liberalization a feature, not a bug, of its trade policy.[7]

Many agricultural groups have weighed in on the need for trade policy changes. In a 2022 letter to President Biden, a broad-based cross-section of agricultural trade associations wrote: “It is long past time to suspend, reduce, or eliminate the tariffs which currently hinder our food and agriculture exports. We are encouraged by President Biden’s recent comments that he will consider 301 tariff reduction in the context of his efforts to curb inflation. We urge you to work to suspend, reduce, or eliminate all remaining Section 232 and Section 301 tariffs in return for commitments from other countries to suspend commensurate retaliatory tariffs that have adversely affected our industry and America’s farm families.”[8] So far, the Biden administration has disregarded their request.

What Congress Should Do

The Constitution gives Congress authority over duties and foreign commerce. The following reforms would be much more beneficial to agricultural producers than tinkering with subsidies in the farm bill.

- Fix trade remedy laws to account for the interests of the agriculture sector. Antidumping and countervailing duty laws should require government agencies to account for the impact of imports and possible tariffs on all Americans. For example, if a domestic fertilizer cartel were to seek new duties on fertilizer imports, the government should be required to consider the impact of these proposed tariffs on farmers.

- Reauthorize the Generalized System of Preferences (GSP) and the African Growth and Opportunity Act (AGOA). GSP and AGOA are “trade preference” programs that reduce tariffs on certain goods from designated developing countries, thereby encouraging mutually beneficial trade. Cutting U.S. tariffs gives foreign producers more earnings to spend on U.S. agricultural exports and encourages economic growth here and abroad. Ideally the programs should be expanded and improved. At a minimum they should be reauthorized.

- Reclaim Congress’s constitutional authority over trade. Congress should limit the ability of future administrations to impose tariffs without congressional approval. Sen. Mike Lee (R-UT) has introduced the most comprehensive legislation addressing this concern, the Global Trade Accountability Act (S.1060). This bill would require presidents to submit future tariff requests, along with a cost-benefit analysis, to Congress for approval.[9] Reps. Mike Gallagher (R-WI) and Don Beyer (D-VA) have introduced the Congressional Trade Authority Act.[10] Their legislation would allow Congress to review alleged “national security” tariffs imposed by the executive branch under Section 232 of the Trade Expansion Act of 1962. As Rep. Gallagher explained: “Congress’s penchant for ceding its constitutional authorities to the Executive Branch has left the institution weak and the country increasingly governed by executive fiat.”[11] Either of these bills would reduce the possibility of future trade wars where America’s farmers and ranchers would inevitably get caught in the crossfire.

Farmers will lose out if Congress decides to tweak subsidy programs while ignoring the precarious state of U.S. trade policy. It would be legislative malpractice for Congress to focus on the relatively insignificant impact of government payments to American agricultural producers while ignoring the much greater need to expand access to foreign markets and prevent future export-killing trade wars.

[1] Congressional Budget Office. USDA Farm Program Mandatory Baseline Projections, May 2023. Retrieved from: https://www.cbo.gov/system/files?file=2023-05/51317-2023-05-usda_0.pdf (Accessed October 2, 2023).

[2] Foreign Agricultural Service, U.S. Department of Agriculture. “20220 United States Agricultural Export Yearbook.” Retrieved from: https://www.fas.usda.gov/sites/default/files/2023-05/2022-Yearbook.pdf (Accessed October 2, 2023).

[3] Morgan, Stephen, et al. “The Economic Impacts of Retaliatory Tariffs on U.S. Agriculture.” Economic Research Service, U.S. Department of Agriculture, January 2022. Retrieved from: https://www.ers.usda.gov/webdocs/publications/102980/err-304.pdf?v=8211 (Accessed October 2, 2023).

[4] Economic Research Service. “Federal Government direct farm program payments, 2014-2023F.” Retrieved from: https://data.ers.usda.gov/reports.aspx?ID=17833 (Accessed October 2, 2023).

[5] Farm Service Agency, U.S. Department of Agriculture. “Market Facilitation Program.” Retrieved from: https://www.fsa.usda.gov/programs-and-services/market-facilitation-program/index (Accessed October 2, 2023).

[6] Foreign Agricultural Service, U.S. Department of Agriculture. “20220 United States Agricultural Export Yearbook.” Retrieved from: https://www.fas.usda.gov/sites/default/files/2023-05/2022-Yearbook.pdf (Accessed October 2, 2023).

[7] Lester, Simon. “Katherine Tai on Market Access, Trade and Peace, and Trade and Prosperity/Inequality.” International Economic Law and Policy Blog, October 18, 2022. Retrieved from: https://ielp.worldtradelaw.net/2022/10/katherine-tai-market-access-trade-peace-trade-prosperity.html (accessed Ocbober 2, 2023), and National Securiity Advisor Jake Sullivan. “On-the-Record Press Call on the Launch of the Indo-Pacific Economic Framework,” May 23, 2022. Retrieved from: https://www.whitehouse.gov/briefing-room/press-briefings/2022/05/23/on-the-record-press-call-on-the-launch-of-the-indo-pacific-economic-framework/ (Accessed October 2, 2023.)

[8] “Letter to request tariff relief as Biden Administration reviews tariff reduction to ease inflation,” May 26, 2022. Retrieved from: https://www.nasda.org/letter-to-request-tariff-relief-as-biden-administration-reviews-tariff-reduction-to-ease-inflation/ (Accessed October 2, 2023.)

[9] “S.1060 - Global Trade Accountability Act.” Retrieved from: https://www.congress.gov/bill/118th-congress/senate-bill/1060/text/is?overview=closed&format=xml (Accessed October 2, 2023).

[10] “Gallagher, Beyer Introduce Bill to Reassert Congress' Voice in Trade Policy.” October 10, 2023. Retrieved from: https://gallagher.house.gov/media/press-releases/gallagher-beyer-introduce-bill-reassert-congress-voice-trade-policy (Accessed October 2, 2023).

[11] “Gallagher, Beyer Introduce Bill to Reassert Congress' Voice in Trade Policy.” October 10, 2023. Retrieved from: https://gallagher.house.gov/media/press-releases/gallagher-beyer-introduce-bill-reassert-congress-voice-trade-policy (Accessed October 2, 2023).