(pdf)

The free-market principles that have made the United States into the world's economic powerhouse are under attack from both the left and the right. American Compass, an organization that purports to be conservative but is dedicated to eschewing free markets in favor of a "robust national economic policy," recently released Rebuilding American Capitalism: A Handbook for Conservative Policymakers, a blueprint that would be more likely to wreck American capitalism than rebuild it.[1]

In particular, the group’s proposed suggestions regarding trade policy are anything but conservative. American Compass calls on policymakers to replace free market trade policies with failed left-wing trade policies that have long been advocated by people like Rep. Richard Gephardt (D-MO), Sen. Bernie Sanders (I-VT), and Venezuela’s Hugo Chavez.

However, the handbook’s trade policy recommendations can nevertheless be useful to conservative policymakers by serving as a guide for what not to do. For example:

- Instead of increasing protectionist tariffs and taxes on imports from our allies, reduce or eliminate them. Tariff cuts would strengthen our economy, encourage trade with countries other than China, and strengthen our ties with allied countries. Furthermore, at a time when many working-class Americans and small businesses are struggling to deal with inflation, tariff reductions would lower the cost of the goods they depend upon. Policymakers should focus on the common good – what’s best for the nation as a whole. Protectionist tariffs do the opposite.

- Instead of abandoning the World Trade Organization (WTO) in order to punish China, strengthen it. The WTO has been our most successful forum to challenge unfair Chinese policies. If the United States wants to contain China, we should demonstrate global leadership and harness the collective strength of our trade partners to put pressure on China.

- Instead of copying policies used by China and other centrally controlled countries, build on our strengths. The government should implement tax, trade, and regulatory policies that empower Americans. It is a mistake to suggest that empowering individuals undermines the common good, and it is a further mistake to suggest that vastly expanding government control of Americans’ economic decisions is necessary to rebuild capitalism. Free market capitalism created the most prosperous nation in the history of the world and lifted hundreds of millions out of poverty. We shouldn’t abandon it.

Policymakers should be cautious about several of the assertions contained in the document, including these:

“Rebuilding American Capitalism”:

“Misunderstanding their own theory, economists presumed that abstract concepts like ‘the invisible hand’ and ‘comparative advantage’ would ensure that free trade enhanced the prospects and prosperity of all who participated.”

Reality check:

This never happened, as anyone who has bothered to open an economics textbook knows. Economists explain the impact of trade like this: “While free trade increases the total quantity of goods and services available to each country, there are both winners and losers in the short run.”[2] The 95 percent of economists who agree that tariffs and import quotas reduce general welfare (aka the common good) are not the ones guilty of misunderstanding economics.[3] Policymakers should not ignore abstract concepts like “comparative advantage” any more than they should ignore abstract concepts like “gravity.”

“Rebuilding American Capitalism”:

American economists insisted “that low prices for consumers were all that mattered, while manufacturing – with its innovation, supply chains, and jobs – headed abroad.”

Reality check:

This never happened. But in 2018, more than 1,100 economists, including 15 Nobel laureates, did warn: “We are convinced that increased protective duties would … injure the great majority of our citizens.”[4]

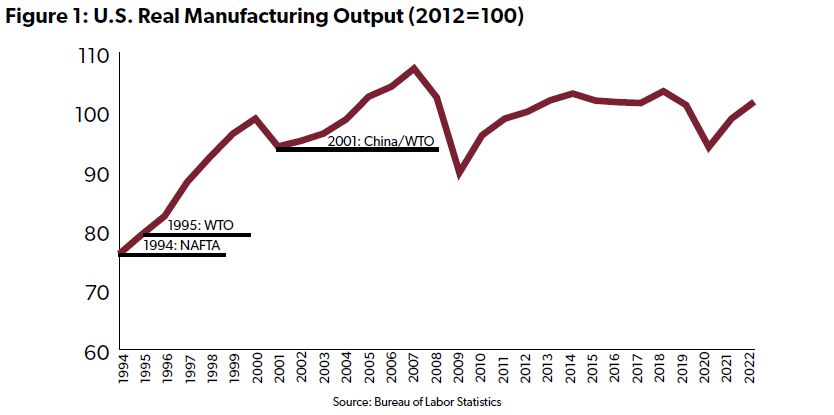

Under U.S. leadership, world trade tariffs fell from 8.6 percent in 1994 to 2.6 percent in 2017 and domestic manufacturing output soared. Real manufacturing output increased after the United States joined the North American Free Trade Agreement (NAFTA), increased more after we joined the World Trade Organization (WTO), and increased even more after China joined the WTO. After recovering from the Great Recession, manufacturing output leveled off after 2012. Perhaps coincidentally, that’s also the last year the country implemented a new, market-opening trade agreement.

With respect to manufacturing, it’s true that in the past employment in sectors like manufacturing and agriculture declined as new labor-saving technologies were introduced.[5] But since 2010, the country added more than a million new manufacturing jobs.[6] Now the problem is not a lack of domestic manufacturing jobs, it is a shortage of workers to fill those jobs.[7]

"Rebuilding American Capitalism”:

For trade to work, it must be balanced: goods and services produced by foreign workers for America exchanged for ones made by American workers for the world.

Reality check:

For trade to work, it should be free from government control. Nothing is more laughable than the idea that trade must be, or even can be, balanced.[8] This idea is pure, primitive mercantilism from the 1500s.

A nation’s trade balance is calculated by adding up millions of mutually beneficial transactions. Many of the dollars our trading partners earn from exports are in turn invested back in the United States, one of the most open and safe places in the world for investment. As a result, we typically have an investment surplus – the flip side of a trade deficit. When our trading partners buy American soybeans, the trade deficit is lowered. When they buy shares of Apple, the trade deficit increases. Either way, Americans benefit.

In 2022, the United States had a $951 billion trade deficit. That “deficit” doesn’t count any financial inflows to the United States, including $1.2 trillion in U.S. income from investments abroad, $335 in new foreign direct equity investment in the United States, or $611 billion in foreign purchases of Treasury and federal agency securities.[9]

Of those transactions, only the purchases of government securities will have to be repaid. Of course, the accumulation of trillions in federal debt has nothing to do with trade deficits and everything to do with federal overspending relative to revenues.

“Rebuilding American Capitalism”:

“Establish a uniform Global Tariff on all imports, set initially at 10 percent and adjusted automatically each year based on the trade deficit.”

Reality check

This “conservative” proposal is copied from legislation introduced by Democrats in the 1980s and 1990s. A similar bill from Rep. Richard Gephardt (D-MO) was cosponsored by 124 Members of Congress, including 123 Democrats.[10] A 1980s version of the bill was opposed by the Reagan administration and Republicans including Jack Kemp, who compared it to the infamous Smoot-Hawley Tariff Act.[11]

Assuming a 10 percent tariff reduced imports by 20 percent, then based on 2022 import levels, the tariff hike would more than double import taxes paid by Americans – a $168 billion tax increase.[12]

“Rebuilding American Capitalism”:

“Eliminate the trade deficit.”

Reality check:

The surest way to reduce the trade deficit is to wreck the economy. During the Great Recession, the trade deficit in goods and services was reduced by 45 percent in a single year.[13]

A large majority of economists agree that the trade deficit does not result from foreign trade barriers and that it does not have an adverse effect on the U.S. economy. The trade deficit is a result of broader macroeconomic factors. When our economy grows, the amount we can afford to buy increases. This applies to both U.S.-made goods and imports. As a result, a growing economy may tend to increase imports and the trade deficit. When our trading partners choose to provide U.S. companies with investment dollars instead of buying exports, that also may tend to increase the trade deficit.

Consider recent U.S. history. Since 2000, real U.S. GDP has increased more than twice as much in years where the trade deficit has increased than in years where it has gotten smaller.

Policymakers should aim to increase economic growth and opportunity, not to reduce the trade deficit.

“Rebuilding American Capitalism”:

“In the past 50 years … wages went nowhere—up only 1 percent.” And: “Whereas 40 weeks of the typical male worker’s income in 1985 could provide the middle-class essentials for a family of four, by 2022 he needed 62 weeks of income—a problem, there being only 52 weeks in a year.”

Reality check:

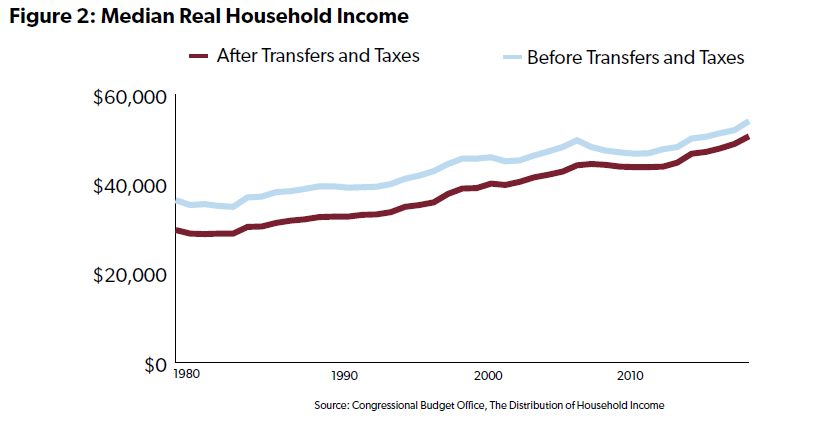

Turning back the clock from 2019 to 1993, before NAFTA, the WTO, and the emergence of China as an economic power, would require a $17,500 reduction in median real household income. After accounting for taxes and government transfer payments, the Congressional Budget Office calculates that from 1979 to 2019, real household income increased by 71 percent. While the number of workers per household is up slightly since 1979, the bulk of the increase resulted from increased income per worker.

Other analysts have more directly questioned the American Compass assertion. Economist Don Boudreaux calculates that the real hourly wage of production and nonsupervisory workers has increased by about 92 percent since 1995. Scott Winship and Jeremy Horpedahl calculate that the alleged 62 weeks of income needed to support a family is off by around four months.

"Rebuilding American Capitalism”:

“No force has done more to undermine American capitalism than globalization.”

Reality check:

If globalization is defined as reductions in government barriers to mutually beneficial exchange, then its expansion is among American capitalism’s greatest triumphs.[14] Since the end of World War II, the United States has led global efforts to reduce trade barriers in order to reduce economic conflict and prevent another Great Depression. According to the conservative Heritage Foundation’s 2023 Index of Economic Freedom, which compares the economic policies of 184 countries: “The degree to which government hinders the free flow of foreign commerce has a direct bearing on the ability of individuals to pursue their economic goals and maximize their productivity and well-being.”[15]

“Rebuilding American Capitalism”:

“[O]ffshoring of industrial capacity in pursuit of lower costs diminished America’s ability to compete or innovate.”

Reality check:

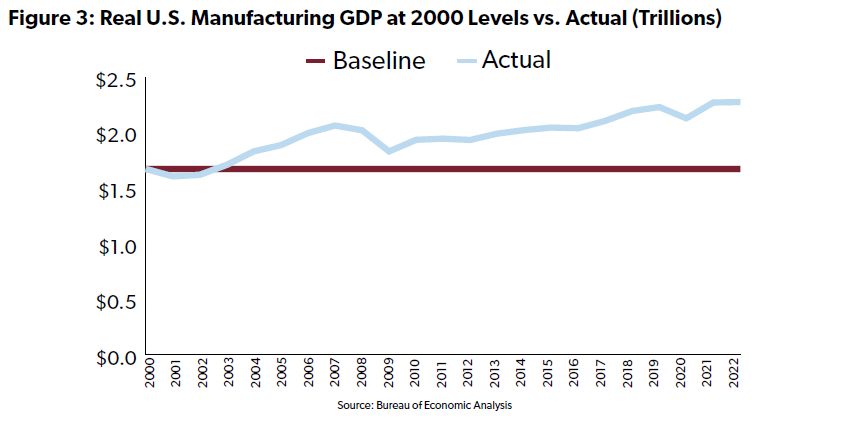

Since 2000, cumulative foreign direct investment (FDI) in U.S. manufacturing exceeded U.S. investment in foreign manufacturing by more than $1.1 trillion. During that time, we produced $6.9 trillion more, after accounting for inflation, than if manufacturing had stayed stuck at 2000 levels.[16]

"Rebuilding American Capitalism”:

Free trade has meant in practice the hollowing out of American industry.

Reality check:

According to the Department of Commerce in 2015, “The value of the gross output produced by U.S. manufacturers was $5.7 trillion, with 82 percent of that value ($4.7 trillion) consisting of domestic content.”[17] A more recent Federal Reserve Bank of San Francisco study reached a similar conclusion, estimating that 89 percent of the value of personal consumption expenditures was accounted for by domestic production.[18]

According to World Bank data on imports as a percentage of GDP, as of 2020 only three countries were less reliant on imports than the United States.[19]

“Rebuilding American Capitalism”:

“Free trade has meant in practice the loss of millions of jobs.”

Reality check:

Since 1994, the economy has added 38.2 million net new jobs.[20]

Some people lost their jobs as a result of free trade, but other jobs were created – an abstract concept known as “creative destruction.” For example, more than 700,000 U.S. clothing manufacturing jobs have been eliminated since 1994.[21] But more than a million jobs for registered nurses have been created.[22] Were Americans better off with more people running sewing machines and fewer healthcare workers?

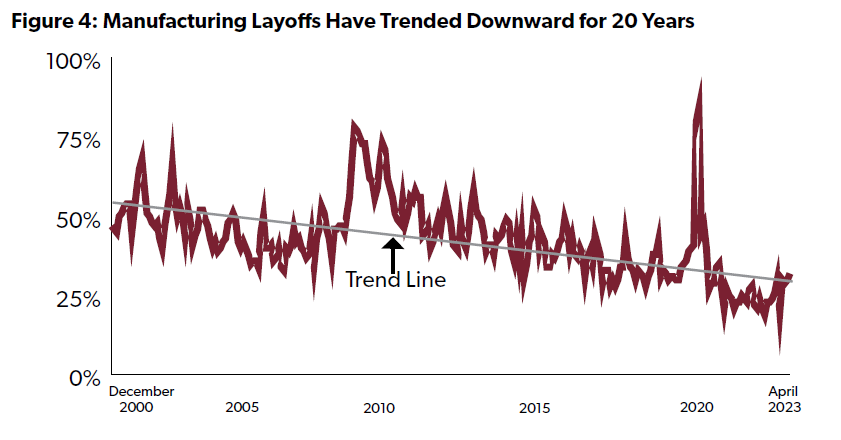

In the manufacturing sector, most job losses are voluntary, not a result of layoffs or firings. The percentage of manufacturing job losses due to layoffs has trended downward since the Bureau of Labor Statistics first started reporting on job turnover data in 2000.[23] As noted at the outset, actual manufacturing employment has increased since 2010.[24]

"Rebuilding American Capitalism”:

“Free trade has meant the accumulation of trillions in debt.”

Reality check:

Free trade has reduced the amount of debt Americans have accumulated.

It’s easy to see how people who haven’t studied trade can fail to understand this. The phrase “trade deficit” falsely implies a debt. Here is how things work in practice:

If your neighbor pays $20 for a made-in-China shirt from Target, it doesn’t mean they still owe Target (or China) $20.

It doesn’t mean you owe China $20.

And it doesn’t mean “Americans” owe China $20.

If they use a credit card to buy the shirt, less debt is incurred by purchasing the imported shirt than if they had bought a more-expensive U.S.-made shirt.

The trade deficit is not a debt Americans owe. It’s just an accounting of how much we imported compared to how much we exported.

“Rebuilding American Capitalism”:

At the outset of globalization, the United States ran a $60 billion trade surplus in advanced technology surplus. Thirty years later it ran a deficit approaching $200 billion.

Reality check:

According to the Census Bureau, U.S. exports of advanced technology products have more than tripled since 1992.[25]

According to the Bureau of Economic Analysis, real U.S. manufacturing value added relating to the digital economy increased from $102 billion in 2005, the first year for which statistics are provided, to $289 billion in 2021.[26]

U.S. advanced technology industries are stronger than ever, thanks in large part to globalization. It seems far-fetched to suggest America’s high-tech industries are weaker now than they were in 1992, before Facebook, Google or the iPhone existed.

The irrelevance of the trade deficit in advanced technology goods can be partially illustrated by the iPhone. American brainpower came up with the phone’s design, technology, marketing, and financing, while workers in China glued parts from the United States and other countries together and shipped the phones to us, adding to the trade deficit.[27] It’s a sign of American success, not weakness.

“Rebuilding American Capitalism”:

“Congress should establish a 50 percent local content requirement for goods designated as critical for national security or the U.S. industrial base.”

Reality check:

Far from a conservative policy, this is based on policies like the 35 percent domestic content requirement for automobiles under Venezuela’s United Socialist Party.[28] The only differences are that the American Compass proposal is even more restrictive and comprehensive.

The most recent USTR Report on unfair foreign trade barriers mentions foreign local content policies more than 80 times.[29] Instead of increasing our requirements, we should be working to reduce foreign barriers to U.S. exports.

Domestic content requirements are a dead-end policy.[30] They should also be strongly opposed by China hawks, since such requirements would antagonize our allies and increase the cost of making things in the United States. Nearly 90 percent of U.S. trade is with countries other than China.[31]

Rebuilding American Capitalism/Pettis:

“Rebuilding American Capitalism” includes a memo from Michael Pettis, who is a senior fellow at the Carnegie Endowment and a finance professor at Peking University. Prof. Pettis writes that “as long as the United States continues to allow unfettered foreign acquisition of its assets, it will continue to run large trade deficits.” He calls on policymakers to restrict “harmful” capital inflows.

Reality check:

Capital inflows are not harmful. While many countries have imposed capital controls, their purpose has nearly always been to prevent capital from leaving the country, not to keep it out. Restricting incoming investment is a novel idea that we should not try. Rebuilding American Capitalism says “[A]ny increase in domestic investment would be a welcome change.” Increased investment should be welcomed, regardless of whether it is made by Americans or our friends and allies. As with other international transactions restrictions should be limited to legitimate national security concerns, such as those covered by the Committee on Foreign Investment in the United States.[32]

“Rebuilding American Capitalism”:

“Rescind China’s permanent normal trade relations (PNTR) status, rejecting WTO authority over U.S. trade policy and handing the matter back to Congress….China obstructs access to its market, ignores intellectual property rules, and coerces foreign firms, but the WTO has been unable to remedy the situation.”

Reality check:

Legislation to withdraw PNTR for China was introduced by Sen. Bernie Sanders (I-VT) in 2005. Doing so today would result in the biggest U.S. tariff increase since the Smoot-Hawley Tariff Act of 1930.[33]

After China joined the WTO, its average tariff on U.S.-made products fell from 17.1 percent in 2000 to 4.8 percent in 2020.[34] The WTO has been very successful in areas where its rules apply and the United States has sought to enforce them. A 2019 Peterson Institute for International Economics study found that the United States had a 20-0 record versus China at the WTO when challenging Chinese practices, with three cases pending.[35]

In contrast, unilateral U.S. actions under Section 301 of the Trade Act of 1974 were a spectacular failure. According to the 2019 Economic Report of the President, “Rather than changing its practices, China announced retaliatory tariffs on U.S. goods.”[36] These retaliatory tariffs directly hurt American manufacturers. For example, the Motor and Equipment Manufacturers Association (MEMA) commented: “A 25 percent tariff on the materials, subcomponents, and parts at issue will undoubtedly harm MEMA member companies by disrupting their U.S. manufacturing operations and increasing costs. Moreover, proposed tariffs will cause job losses due to a decrease in production if necessary parts and equipment are not available in a timely manner or the costs of production increase.”[37]

We should strengthen the WTO’s ability to discourage unfair trade practices, not abandon it.

“Rebuilding American Capitalism”/Lighthizer:

“Rebuilding American Capitalism” includes a memo from former U.S. Trade Representative (USTR) Robert Lighthizer. According to Amb. Lighthizer, “Republican presidents, particularly Ronald Reagan and Donald Trump, embraced the sensible use of tariffs and threatened to limit market access to advance America’s national interests in trade. Their focus was on supporting American workers as producers and reducing pernicious deficits.” (emphasis added)

Reality check:

This is nothing less than an effort by Amb. Lighthizer to rewrite history.

President Reagan explicitly rejected misplaced concern about trade deficits: “Trade deficits and inflows of foreign capital are not necessarily a sign of an economy's weakness. During the first 100 years of our nation's history, while we were developing from an agricultural colony to the industrial leader of the world, the United States ran a trade deficit…. Historically, fast-growing economies often run deficits in the trade of goods and services, experiencing net capital investment from abroad.”[38]

Reagan also described protectionism as “destructionism” no less than a dozen times, while calling for a Western Hemisphere free trade agreement and launching negotiations that led to the creation of the WTO.

According to biographer Craig Shirley: “Reagan was essentially a free trader, in large part because he saw trade as a means of winning the Cold War.”[39]

As a lawyer, Amb. Lighthizer became a multimillionaire working to convince government agencies to increase the cost of steel needed by American manufacturers to compete in the global economy. Asking him for advice on trade policy is like asking a shoplifter for advice on law enforcement policy. NTU Foundation has responded to Amb. Lighthizer’s misguided recommendations many times in the past, including in 11 Reasons Robert Lighthizer is (Still) Wrong about Trade and Tariffs.[40]

“Rebuilding American Capitalism”/Lighthizer:

Amb. Lighthizer calls China “an extremely dangerous adversary.”

Reality check:

Here’s what Amb. Lighthizer said about his China trade policy in 2019: “So the kinds of things that we're asking for are not anti-Chinese at all. Protection of intellectual property is not anti-Chinese. Stopping people from forcing transfer of technology is not anti-Chinese. In fact, the reformers would say it's pro-Chinese. It will help their economy, not hurt their economy.” Instead of trying to help China’s economy, we should pursue trade policies that help our economy and strengthen our ties with our allies.[41]

“Rebuilding American Capitalism”:

“Free trade with a non-market economy only undermines America’s own free market; free trade with an authoritarian nation only undermines American freedom.”

Reality check:

U.S. trade barriers undermine American freedom. For example, choosing to buy a sofa made in China is an exercise of freedom. Passing a law forbidding the purchase of foreign-made furniture would undermine freedom.

Perhaps purchases of Chinese-made sofas pose a national security threat. In that case, it would be reasonable to restrict such transactions based on national security considerations. However, as American Compass has pointed out elsewhere, “The China challenge is not only, or even primarily, one of national security.”

Americans should be cautious about blindly copying government economic controls from non-market economies. Our relatively free-market, capitalist economy has made us prosperous and strong. The proper response to non-market economies should be to double down on our strengths, including the freedom of Americans to make their own decisions subject to legitimate security concerns. The United States should provide an example to the world–a shining city upon a hill.[42]

“Rebuilding American Capitalism”:

“China’s non-market economy and authoritarian political system poses a special challenge, to which a broad decoupling is the only answer.”

Reality check:

Perhaps the best way to find out if a supposed China hawk is sincere in their views is to ask how they feel about reducing tariffs on our allies. NTU Foundation provided specific suggestions on how to do this in our 2021 Issue Brief, How Free Trade Can Counter China and Enhance American Competitiveness.[43] In contrast, the trade policy prescriptions proposed by American Compass would benefit the Chinese Communist Party by isolating the United States from the rest of the world.

A broad decoupling might be justified on national security grounds. But more probably, it is possible that it is in our national security interests for China to remain dependent on the United States as its largest export market.[44] Also, while reducing our national debt should be one of our highest priorities, China currently has a keen interest in the American economy, given our standing as the source of interest payments on more than $1 trillion in federal debt held by China.[45]

Recommendation:

The American Compass trade proposals provide a handbook for implementing left-wing trade policies. A better handbook was provided by our country’s founders, who cited “cutting off our trade with all parts of the world” as a reason to declare our independence and then laid the groundwork for the world’s largest free trade area via the U.S. Constitution. Free trade consists of nothing more than allowing Americans to engage in voluntary, mutually beneficial exchange. Its expansion has been an American success story. We should build on that foundation rather than take a wrecking ball to American capitalism via the imposition of costly, ill-advised new trade barriers.

[1] “Rebuilding American Capitalism: A Handbook for Conservative Policymakers.”American Compass, June 14, 2023.

[2] “Chapter 17.1, The Gains from Trade.” Principles of Economics.. Licensed under NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0).

[3] Stevenson-Geide, Doris, and La Parra-Perez, Alvaro. “Consensus among economists 2020. A sharpening of the picture.” Paper presented at the Western Economics Association International 97th Annual Conference, May 29, 2022.

[4] “More Than 1,100 Economists Join NTU to Voice Opposition to Tariffs, Protectionism.” Open letter to President Trump and Congress, May 3, 2018.

[5] Hicks, Michael J., and Devaraj, Srikant. “The Myth and the Reality of Manufacturing in America.” Conexus Indiana and Ball State University Center for Business and Economic Research, June 2015.

[6] U.S. Bureau of Labor Statistics. “All Employees, Manufacturing [MANEMP.”, Retrieved from FRED, Federal Reserve Bank of St. Louis.

[7] Wellener, Paul et al. “Creating pathways for tomorrow’s workforce today.” Deloitte Insights, May 4, 2021.

[8] Paraphrasing Adam Smith. “An Inquiry into the Nature and Causes of the Wealth of Nations.” Book IV, Chapter III: “Of the extraordinary Restraints upon the Importation of Goods of almost all Kinds, from those Countries with which the Balance is supposed to be Disadvantageous.”

[9] Bureau of Economic Analysis. “International Transactions, Services, and Investment Position (IIP) Tables.”

[10] H.R.4100 - Trade Enhancement Act of 1992. 102nd Congress (1991-1992).

[11] Kemp, Jack. “That Import Surcharge.” Washington Post, August 7, 1985.

[12] See “Economic Impact of Section 232 and 301 Tariffs on U.S. Industries” (Investigation No. 332-591, USITC Publication 5405, March 2023).

[13] Bureau of Economic Analysis. “International Transactions, Services, and Investment Position (IIP) Tables.”

[14] See President Ronald Reagan. “President Reagan's Radio Address on Canadian Elections and Free Trade on November 26, 1988.” Provided by the Ronald Reagan Presidential Library and Museum.

[15] “2023 Index of Economic Freedom.” The Heritage Foundation.

[16] Bureau of Economic Analysis. “International Transactions, Services, and Investment Position (IIP) Tables.”

[17] Nicholson, Jessica R. “2015: What is Made in America?” U.S. Department of Commerce Economics and Statistics Administration, Office of the Chief Economist, ESA Issue Brief #01-17, March 28, 2017.

[18] Hale, Galina et al. “How Much Do We Spend on Imports?” Federal Reserve Bank of San Francisco Economic Letter, January 7, 2019.

[19] “Imports of goods and services (% of GDP).” The World Bank. Creative Commons Attribution 4.0 (CC-BY 4.0).

[20] U.S. Bureau of Labor Statistics, All Employees, Total Nonfarm [PAYEMS]. Retrieved from FRED, Federal Reserve Bank of St. Louis

[21] U.S. Bureau of Labor Statistics. “All employees, thousands, apparel manufacturing, seasonally adjusted.”

[22] U.S. Department of Health and Human Services. “The Registered Nurse Population.” March 1996; and The American Association of Colleges of Nursing. “Nursing Fact Sheet.” September 2022.

[23] U.S. Bureau of Labor Statistics. “Job Openings and Labor Turnover Survey.”

[24] U.S. Bureau of Labor Statistics, All Employees, Manufacturing [MANEMP]. Retrieved from FRED, Federal Reserve Bank of St. Louis.

[25] U.S. Census Bureau. “Trade in Goods with Advanced Technology Products.” Retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/EXP0007, June 29, 2023.

[26] Bureau of Economic Analysis, “Digital Economy Data 2005-2021.”

[27] Dedrick, Jason. “Who Profits from Innovation in Global Value Chains? IPhones and Windmills.” U.S. International Trade Commission.

[28] Office of the United States Trade Representative.“2015 National Trade Estimate Report on Foreign Trade Barriers.”

[29] Office of the United States Trade Representative. “2023 National Trade Estimate Report on Foreign Trade Barriers.”

[30] See President Ronald Reagan. “Remarks and a Question-and-Answer Session During a United States Chamber of Commerce Teleconference.” May 10, 1983.

[31] Bureau of Economic Analysis. “International Transactions, Services, and Investment Position (IIP) Tables.”

[32] See U.S. Treasury Department, The Committee on Foreign Investment in the United States (CFIUS).

[33] Riley, Bryan. “Sanders-Hawley Tariff Would Be Biggest Tariff Hike Since Smoot-Hawley Tariff Act of 1930.” NTU, May 18, 2023.

[34] World Integrated Trade Solution, “China AHS Weighted Average from United States in percentage 2000-2020.”

[35] Schott, Jeffrey J., and Jung, Euijin. “In US-China Trade Disputes, the WTO Usually Sides with the United States.” Peterson Institute for International Economics, March 12, 2019.

[36] The White House. “2019 Economic Report of the President.”

[37] Motor and Equipment Manufacturers Association. “Comment regarding Proposed Determination of Action Pursuant to Section 301.” (Docket No. USTR-2018-0005).

[38] President Ronald Reagan, “President Reagan's Remarks at City Club of Cleveland on January 11, 1988.” Provided by the Ronald Reagan Presidential Library and Museum.

[39] Jacobson, Lewis. “Donald Trump cites Ronald Reagan as a protectionist hero. Was he?” Politifact, July 1, 2016.

[40] Riley, Bryan. “11 Reasons Robert Lighthizer is (Still) Wrong about Trade and Tariffs.” NTU Foundation, November 1, 2021.

[41] Chang, Ailsa. “U.S. Trade Representative Robert Lighthizer Discusses Ongoing Trade Talks With China.” NPR, March 25, 2019.

[42] President Ronald Reagan. “President Ronald Reagan's Farewell Address to the Nation. January 11, 1989.” Provided by the Ronald Reagan Presidential Library and Museum.

[43] Riley, Bryan, and Zachmann, Eric. “How Free Trade Can Counter China and Enhance American Competitiveness.” NTU Foundation, July 12, 2021.

[44] “China Exports by country and region 2020.” World Bank, World Integrated Trade Solution.

[45] Department of the Treasury/Federal Reserve Bank. “Major Foreign Holders of Treasury Securities.” Total includes Mainland China and Hong Kong.