Aranci v. Lower South Platte Water Conservancy District

Local Governments Can’t Ignore Taxpayer Protections

The Lower South Platte Water Conservancy District, made up of four counties in northeastern Colorado, doubled property tax collected from residents without voter approval, an obvious violation of the Colorado Taxpayer Bill of Rights (TABOR), which requires an affirmative vote of the people before a tax can increase.

Taxpayers faced significant effects including:

- Increased property tax bills. Some landowners experienced their annual property tax bill increase from $70 to $150, totalling more than $2 million in unlawful collection districtwide.

- The violation of TABOR meant other districts with the authority to impose property taxes could claim precedent to raise their rates without approval from voters.

Residents pursued non-legal methods to challenge the tax increase, attending water district board meetings and asking county commissioners to prevent certification of the property tax increase.

Taxpayer Defense Center Takes Action

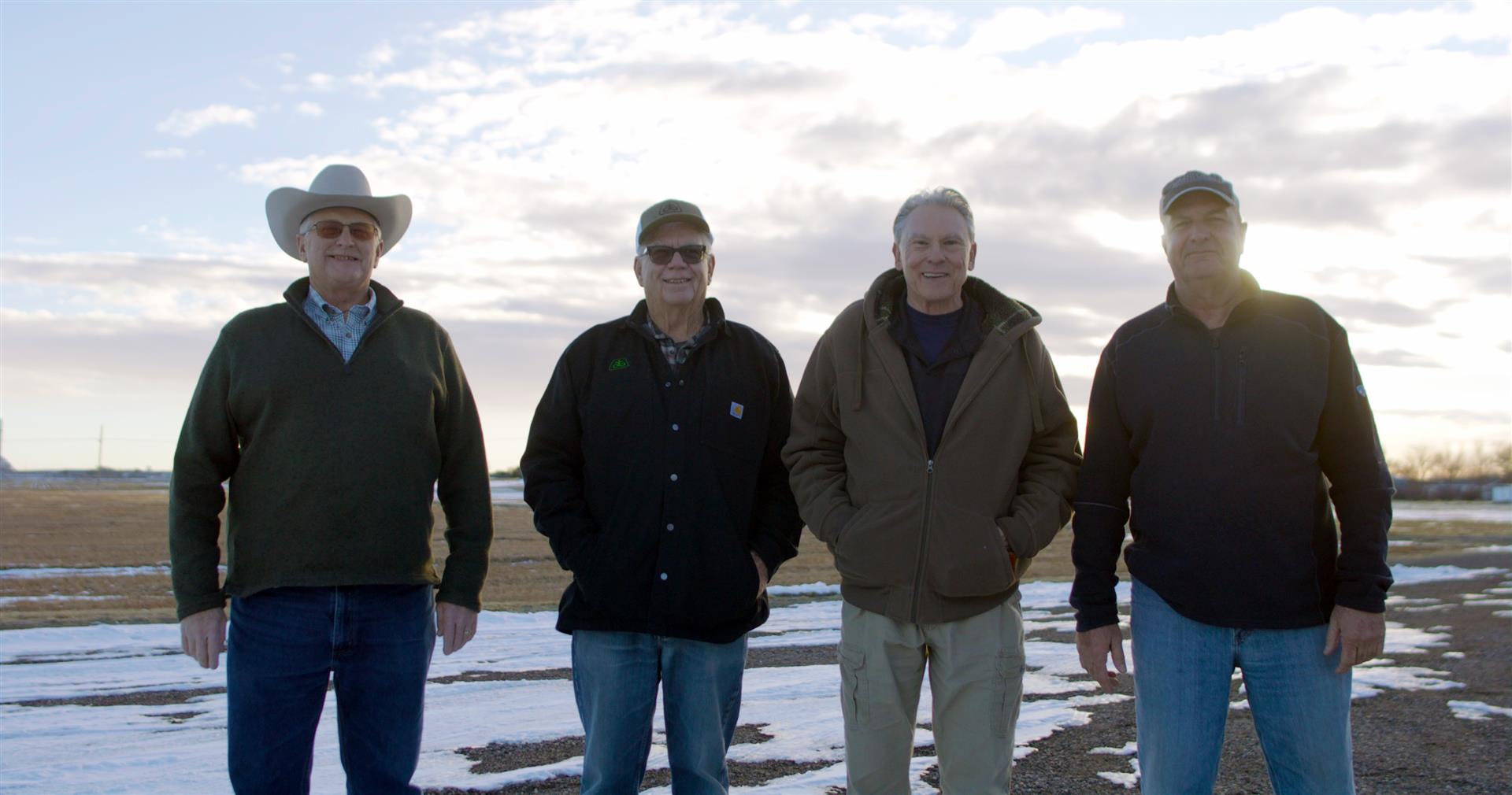

After exhausting their options outside the courtroom, Lower South Platte Water Conservancy District taxpayers Jim Aranci, Jack Darnell, William Lauck, Chuck Miller, and Curt Werner partnered with National Taxpayers Union Foundation’s Taxpayer Defense Center. The purpose was to answer the primary legal question: Can a property tax mill levy be increased without voter approval under Colorado’s Taxpayer Bill of Rights (TABOR)?

- The lower court initially ruled in favor of the Water District.

- The Colorado Court of Appeals unanimously overturned the lower court’s decision and ruled in favor of the taxpayers.

- In October 2024, the Colorado Supreme Court declined to review the case, allowing the appeals court ruling to stand in favor of taxpayers.

- The Lower South Platte Water Conservancy District was ordered to refund more than $2 million in illegally collected taxes to taxpayers.

- A District Court judge ordered the Lower South Platte Water Conservancy District to pay Taxpayer Defense Center attorneys’ fees of $145,152.50, an unusual occurrence in this type of case.

President Pete Sepp and NTUF Executive Vice President Joe Bishop-Henchman after receiving the check from the Lower South Platte Water Conservancy District paying $145,152.50 in attorneys’ fees for the work by Taxpayer Defense Center.

Victory for Taxpayers

The victory in the case established a clear legal precedent. In Colorado, property tax increases require voter approval under TABOR.

The case offers hope to taxpayers fighting against unlawful and unfair tax increases.

We will keep you posted as this case develops.

Plaintiffs Chuck Miller, William Lauck, Jack Darnell, and Jim Aranci. Not pictured, plaintiff Curt Werner.