Key Facts

During election season, some politicians promise to create or expand government services while assuring voters that “taxing the rich” will cover the costs.

This wishful thinking falls short of fiscal reality: higher taxes on the top 1% of earners would cover only a fraction of our government’s bloated spending on an annual basis.

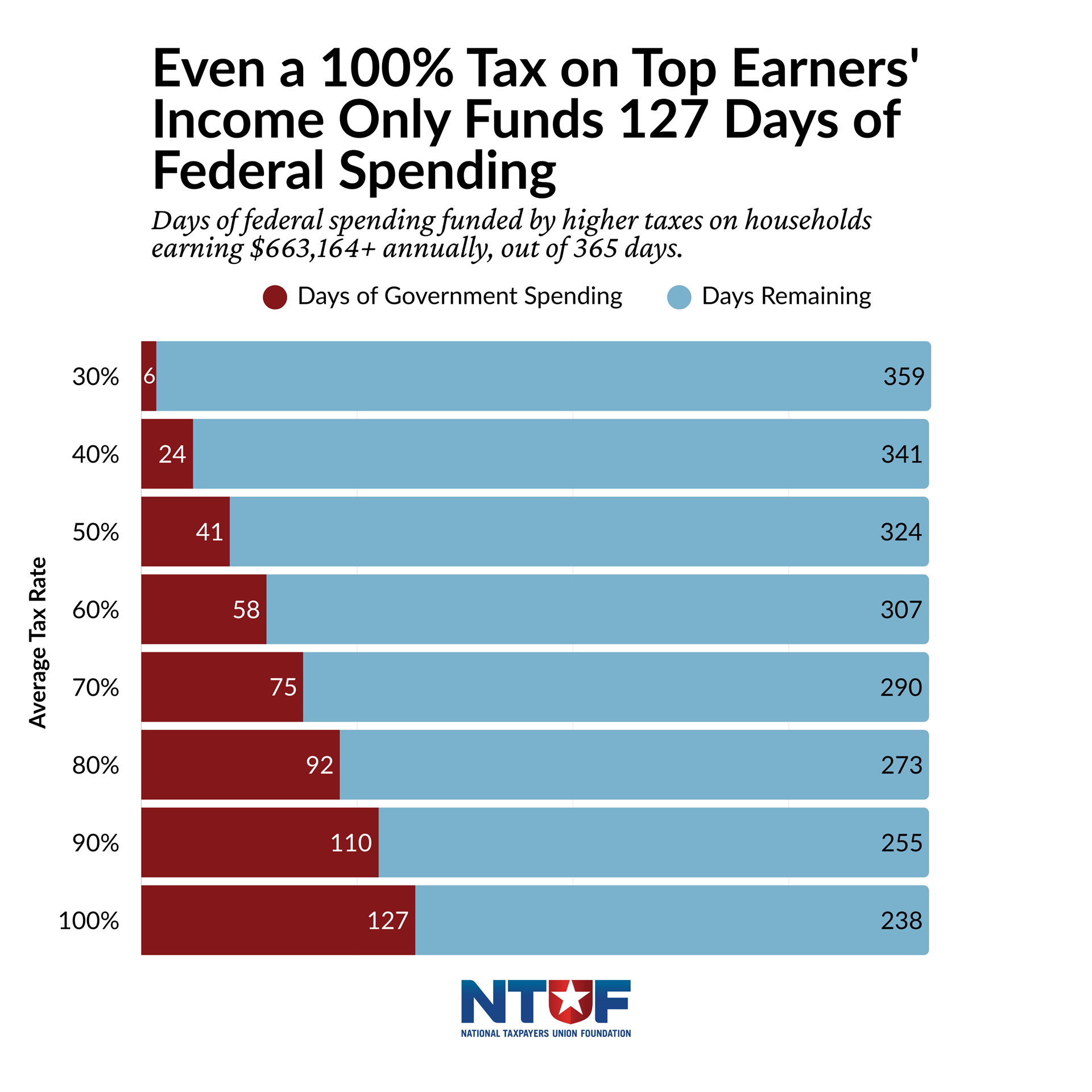

Even if the government werewas able to tax the income of the wealthiest Americans at a 100% rate, that would only fund the government for 127 days.

Introduction

During election season, some politicians promise to create or expand government services while assuring voters that “taxing the rich” will cover the costs. These proposals are often framed around claims that wealthy taxpayers are not paying their “fair share,” and that higher rates or new wealth taxes could generate substantial new federal revenue.

However, with the federal government currently spending $19.2 billion per day, even if the government was hypothetically able to tax the income of the wealthiest Americans at a 100% rate without imposing severe economic damage, that would only fund the government for 127 days. Completely confiscating the fortunes of the five richest billionaires would fund the government for little more than two months.

Unsurprisingly, the idea works better as a campaign speech than a revenue generator. This wishful thinking about how much additional revenue could be raised in the name of making the wealthy pay their “fair share” falls short of fiscal reality: federal spending already far exceeds revenues, the tax code is highly progressive, and new research shows that higher taxes would not generate as much as advocates claim and will harm economic growth.

Hiking taxes on the rich cannot compensate for bloated government spending.

In Fiscal Year 2025, the federal government spent $7.01 trillion and collected $5.235 trillion in tax revenue, resulting in a budget deficit of $1.775 trillion. Unsustainable deficits are an increasingly common feature of our federal budget, with the annual deficit surpassing $2 trillion in 2021 following the passage of costly partisan subsidies cloaked as pandemic relief.

On average, this means that the federal government spent about $19.2 billion per day. At this level of spending, raising the average federal tax rate on the top 1% from its current level of 26.09% to 30% would fund the government for only 6 additional days. Even setting aside all the other practical and economic consequences of doing so, seizing the entire income of the top 1% by taxing them at an average federal rate of 100% would not even fund the government for half a year—only raising enough revenue to fund 127 days of government spending.

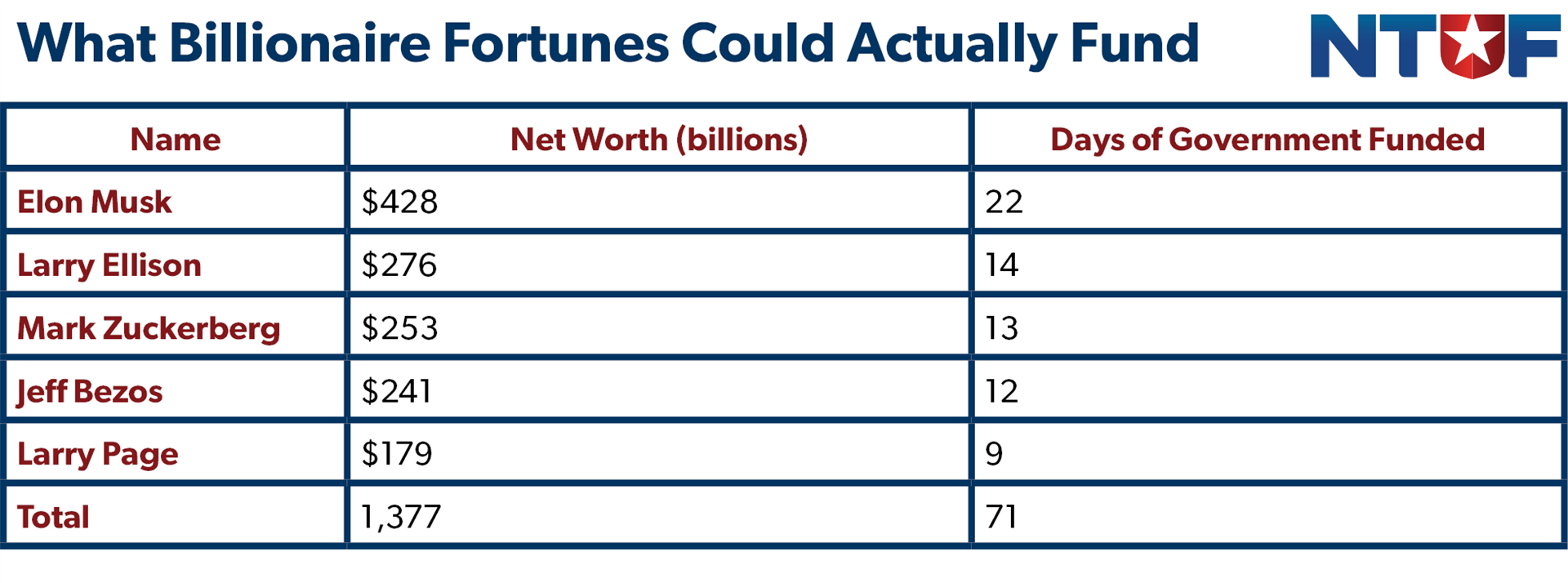

Proposals to tax unrealized gains by targeting a taxpayer’s net worth would not solve our fiscal crisis either. The table below shows the net worth of the wealthiest Americans and the amount of federal spending their fortunes would cover, under a hypothetical situation that the government could seize or tax these assets entirely without triggering severe economic disruption. If Elon Musk handed his entire net worth over to the government, it would only fund government spending for three weeks and one day. Based on Forbes data, the combined wealth of the top five richest people in the U.S. would only fund the government for ten weeks.

Source: Forbes 400 https://www.forbes.com/forbes-400/

As federal spending grows exponentially, including spending per capita, nearly half of all inflation-adjusted federal spending has occurred since the year 2000 alone. In that same period, we have added more than $30 trillion to the national debt. U.S. debt officially surpassed gross domestic product (GDP) in 2012 and reached as high as 132% of GDP during the pandemic. High debt is not merely a balance sheet matter: it significantly increases the risk of economic decline through high interest rates, above-baseline inflation, and full-blown fiscal crisis.

The Congressional Budget Office (CBO) confirms these potential consequences in its latest long-term budget outlook. CBO expects increased federal borrowing to contribute to slower capital formation, leading to decreased labor force productivity. CBO expects real GDP growth to average 1.6% over the next 30 years while total outlays and primary deficits continue to climb.

Higher taxes can no longer provide a way out of the precarious fiscal situation we currently face. Instead, policymakers would be better served by legislating spending guardrails like a Balanced Budget Amendment to the U.S. Constitution or by following existing guardrails such as statutory PAYGO spending cuts.

Taxing the rich is ineffective at best and economically damaging at worst.

According to the latest Internal Revenue Service (IRS) data (for tax year 2022), the richest 1% consists of those taxpayers with an annual adjusted gross income of $663,164 or more. While these taxpayers face a top tax rate of 37%, they have an average federal tax rate of 26.09%.

Despite the progressivity of the tax code, proponents of higher taxes argue that additional revenues can be extracted from high earners through a variety of proposals. Raising the top rate is just one way politicians occasionally propose to tax the rich, and is perhaps the most straightforward. Other ideas include increasing taxes on investment income and implementing a wealth tax. However, a growing body of research suggests that these proposals would raise far less revenue than their advocates claim.

A new study by economists Rachel Moore, Brandon Pecoraro, and David Splinter at the Joint Committee on Taxation titled “Laffer Curves Are Flat” shows that not only is there little revenue to be gained from increasing taxes on the highest earners, but that higher taxes bring the risk of economic decline. According to the economists, raising the top federal income tax rate two percentage points to 39% would only yield an additional 0.2% of revenue. Taking federal, state, and local taxes together, tax rates are already near their revenue-maximizing potential.

Proposals to indirectly tax the rich through their investments, businesses, and net wealth face other challenges. Raising taxes on capital gains, investment income, or business activity hinders economic growth and ultimately results in fewer jobs, less wage growth, and higher costs for families at lower income levels. Taxing unrealized gains in the form of a wealth tax would not only be unconstitutional, but has also proven to be an ineffective way to generate revenue—a fact that has led most European countries which once had such taxes to abandon them.

Conclusion

Promising to tax the rich to solve budget problems is politically appealing because it is an easy answer, but it is not fiscally viable. The evidence shows that extortionate levels of taxation cannot offset bloated, unchecked federal spending. Furthermore, many proposals to impose additional taxes on the highest earners would be ineffective or even unconstitutional while undermining economic growth. Addressing the nation’s fiscal challenges will require serious attention to reining in spending rather than reliance on politically convenient revenue promises.