Key Facts

- Extending the COVID-era premium tax credit enhancements would represent a costly continuation of misguided pandemic policy.

- Improper payments and skyrocketing enrollment for potentially ineligible taxpayers perpetuate misuse of the enhanced premium tax credit.

- At a time when our nation’s fiscal outlook should be front and center, extending these credits is not worth the ten-year cost to the federal government of over $410 billion.

Introduction

With a government shutdown looming, lawmakers are under mounting pressure to strike a deal—and one of the biggest sticking points is whether to extend costly COVID-era health care subsidies. These enhanced Premium Tax Credits (PTCs) were sold as temporary emergency relief during the pandemic but are now at risk of becoming a permanent fixture of the tax code and a major driver of federal spending.

Extending these subsidies would not only represent a costly continuation of misguided policy adding $410 billion over ten years to the deficit but would also fail to address the root cause of soaring health insurance premiums. With the federal debt topping $37 trillion, our nation’s fiscal picture must be front and center.

Origin and Expansion of the Premium Tax Credit

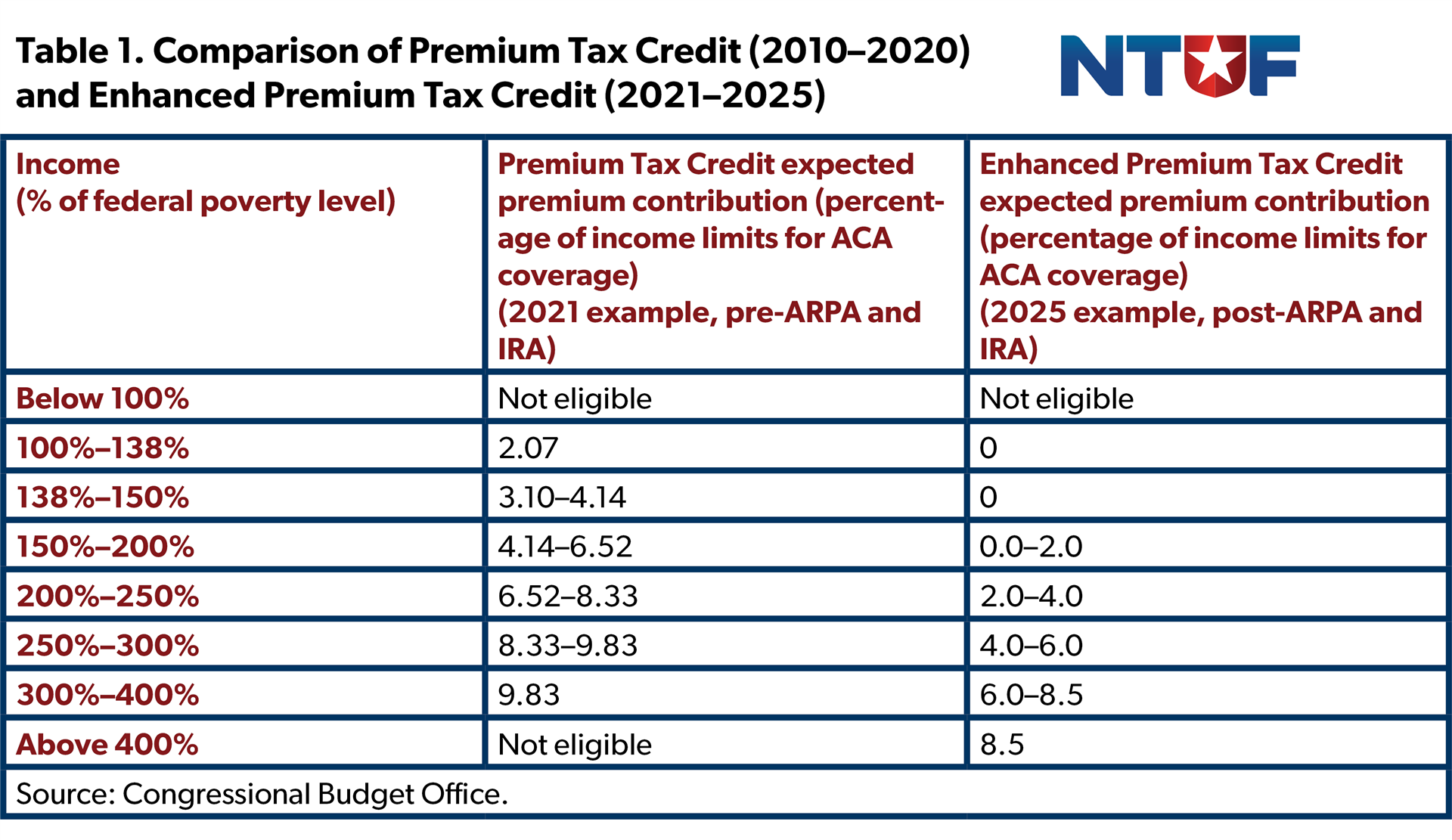

The PTC was originally created in the Affordable Care Act of 2010, commonly known as “Obamacare” to subsidize health insurance purchased through the new exchanges established in that law. Households with income up to 400% of federal poverty level could receive a PTC to ensure that health insurance premiums did not exceed a certain percentage of their household income, ranging from 2% to just under 10%. The credit was made refundable, meaning that it could be claimed even if a filer owed no income tax. It was also available as an advance payment made directly to insurers based on a filer’s projected income—a feature that introduced compliance risks and reconciliation issues when actual income differed from estimates.

During the COVID-19 pandemic, Democrats cited the public health emergency as a justification to expand the PTC beyond its original scope, amounting to the most substantial change to Obamacare since its creation in 2010. This came after the passage of four bipartisan relief packages amounting to $3.5 trillion to address a broad range of challenges faced by Americans through the public health crisis.

The American Rescue Plan Act (ARPA) of 2021, enacted even as the economy was already recovering from the pandemic shutdown, made sweeping changes to the PTC. These changes drove an enrollment surge in the individual health care marketplace, opened the door for fraud and abuse by enrollees and insurers, and resulted in significant cost increases to the federal government on top of existing health care expenditures.

The COVID-19 PTC enhancements include:

- Removal of the income cap of 400% of the federal poverty level for PTC eligibility

- Capped household contribution for premiums at 8.5% of household income, down from the pre-COVID cap of just under 10%

- Fully subsidized health care premiums for individuals earning between 100% and 150% of the federal poverty level by requiring zero out-of-pocket cost for those households and reducing the amount of out-of-pocket costs for all other households

ARPA’s enhanced PTC was meant to be temporary through the end of Fiscal Year 2022, however the Inflation Reduction Act (IRA) of 2022 extended the expanded subsidy through the end of 2025.

Source: Congressional Budget Office.

The Impacts of the Enhanced PTC

Expanded Enrollment

The effects of this vastly enhanced PTC subsidy played out exactly as expected. Enrollment in the Obamacare marketplace has surged, rising by an enormous 79% from 2021 to 2024, reaching an all-time high in 2025. Paragon Institute has found that eliminating the requirement for households earning between 100% and 150% of the federal poverty level to pay for health care premiums has led this income group to account for nearly half of all enrollees. Previously, these enrollees were required to pay only up to 4% of their household income on health care premiums. ARPA’s changes require zero out-of-pocket costs for these enrollees. Prior to PTC expansion, these households would have paid only around $25 or less per month for coverage.

The increase in enrollees does not simply account for individuals who were unable to afford health insurance without subsidies. In fact, Paragon Institute finds that an estimated 8 million enrollees annually do not have any medical claims—no doctor visits, prescriptions filled, or health services received. Paragon’s research indicates that this could be because these individuals had duplicate coverage or were unaware of their enrollment in a marketplace plan. The amount of individuals with no annual claims rose by 16% from 2021 to 2024 after the COVID subsidies came into effect.

Although the COVID credits increased enrollment by more than 12 million, the Congressional Budget Office (CBO) estimates that 3.8 million enrollees could lose insurance coverage over the next decade if the subsidies end. However, it is worth noting that CBO has often overestimated the extent of coverage losses resulting from past policy proposals. In the new report estimating insurance coverage rates if the enhanced PTC is extended, CBO itself provides the caveat that its:

… estimates of the budgetary and coverage effects of enacting the health coverage policies are subject to significant uncertainty for many reasons. For example, the premiums that insurers charge may be higher or lower than CBO estimates. The way that people make decisions about enrollment in health insurance, along with the roles of insurance brokers and other intermediaries, may differ from the past.

Soaring Federal Cost

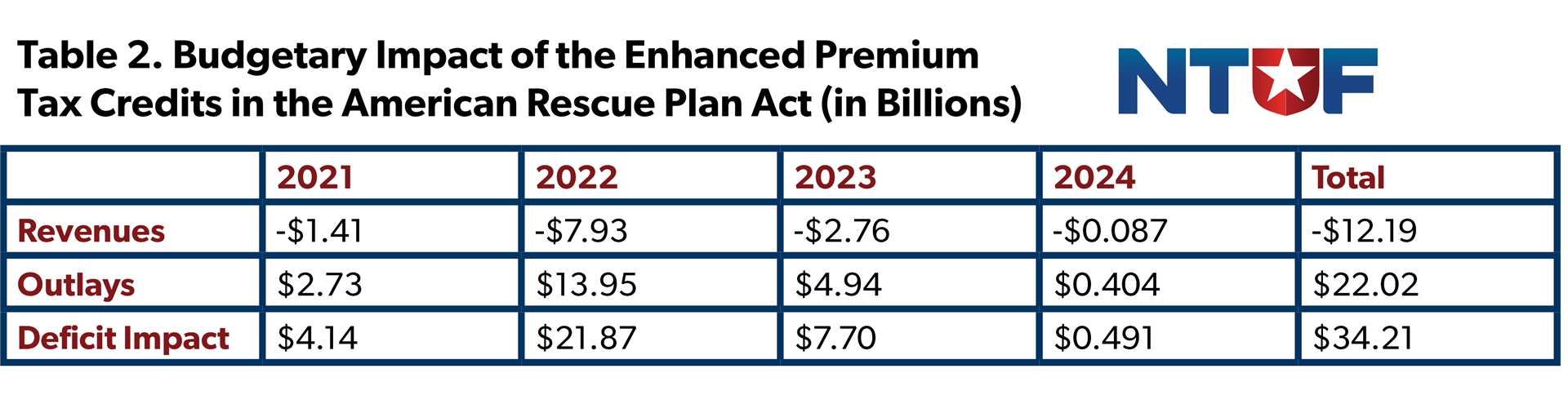

One reason that the enhanced PTC was enacted on a temporary basis was the immense cost. The budgetary impact is twofold: as a tax credit it reduces revenues, while the refundable component adds to federal outlays. At the time of passage, CBO estimated that ARPA’s two-year expansion (2021–2022) would increase federal outlays by $22 billion and reduce revenues by $12 billion. Nearly all of this impact was projected to occur over the first three years, and two-thirds of the subsidy impacted the deficit as spending.

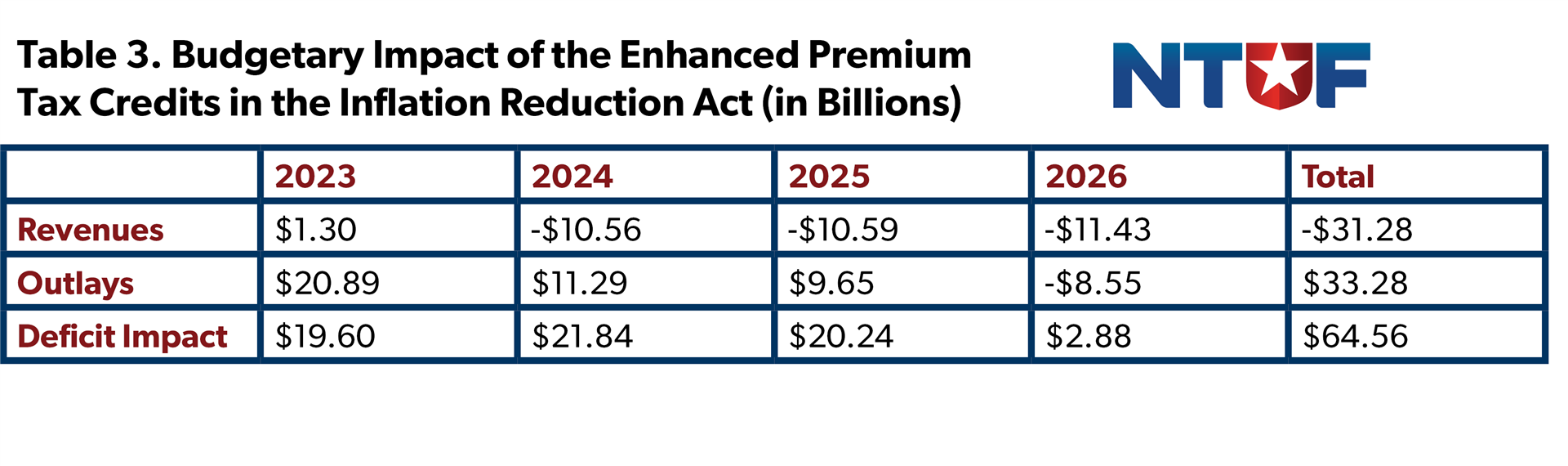

CBO also estimated that the IRA’s three-year expansion would increase outlays by over $33 billion and reduce revenue by more than $31 billion.

The combined fiscal impact of the ARPA and IRA short-term PTC expansions, nearly $100 billion, rivals the cost of entire federal programs, yet they were enacted with little debate over offsets or reforms to control underlying health care costs. CBO has reported that federal subsidies for health care insurance in 2024 reached $2 trillion in 2024 and are expected to reach $3.5 trillion by 2034. CBO attributes this significant cost in large part to increased eligibility for the PTC.

Improper Payments Increase Risks and Costs to Taxpayers

Improper payments have plagued the Premium Tax Credit since its inception, and ARPA’s expansion has only magnified the risks. The design of the PTC with advanceable, refundable payments tied to estimates of an individual’s income has consistently posed compliance risks from the beginning. Today, with more than 90% of marketplace enrollees receiving advance PTC payments, the opportunities for waste, fraud, and abuse have only grown.

Evidence points to a rising share of improper or fraudulent payments, and insurers have also been able to capture excess taxpayer dollars by ratcheting up premiums, knowing that subsidies shield many consumers from feeling the full impact of higher costs.

In 2022, the Treasury Inspector General for Tax Administration conducted a review of ARPA’s PTC changes and found that the IRS had failed to put in place “adequate processes and procedures to identify potential abuse and improper payments.”

For example, federal reporting shows that improper payments for the advance premium tax credit (APTC) totaled $256 million in 2022, $272 million in 2023, and then spiked to $563 million in 2024.

The Cost to Extend the Covid-Era Credits

In June 2024, CBO estimated that extending the enhanced PTC through 2034 would increase the deficit by $335 billion. Higher outlays of $275 billion account for 82% of the total, and revenues would be reduced by $60 billion. CBO also estimated that this would increase interest payments on the national debt by $48 billion. This would result in a net ten-year impact of $383 billion.

On September 18, 2025, CBO updated this cost estimate in response to a request from several Democratic Senators. The revised estimate sees outlays increasing by $296 billion over the decade and revenue reductions of $54 billion for a net deficit impact of $350 billion. While this estimate did not include an estimate of costs to finance the debt, CBO has previously published an interactive worksheet where users can calculate how changes in spending and revenues would impact debt-service costs. Using CBO’s latest calculator shows that extending the enhanced PTC would increase costs to finance the debt by $60 billion for a net budgetary impact of $410 billion. This amounts to nearly $10,800 a year for each recipient of the subsidy.

Conclusion

The number one priority in Washington should be reining in federal spending, not creating new pressures on the budget. Extending the COVID-era expansion of refundable health care credits would significantly add to the national debt, with most of the cost driven by the refundable outlay side of the credit. Some lawmakers have floated offsets, but those savings should be dedicated to reducing the primary deficit, not used to justify still higher spending levels.

The enhanced PTC was enacted on a temporary basis as the pandemic was winding down and the economy was re-opening after trillions were already spent in response. Extending the credits will only expose taxpayers to greater risk for fraudulent payments and add hundreds of billions to the federal debt. Congress should allow these temporary subsidies to expire as scheduled and refocus its efforts on long-term solutions that control health care costs and strengthen fiscal discipline.