(pdf)

Wealth taxes have been a hot proposal in certain progressive circles ever since Senator Elizabeth Warren (D-MA) first introduced one on the presidential campaign trail in 2020. Now, Senator Warren is back at it with a new wealth tax bill in Congress. Unfortunately, the new Warren plan has all the same defects as the first one, and manages to arrive at an even worse time.

This time, Warren’s plan would tax wealth between $50 million and $1 billion at an annual rate of 2 percent, while wealth above $1 billion would be taxed at a 3 percent rate. The proposal also includes anti-avoidance provisions that include an enormous $100 billion cash infusion into the Internal Revenue Service (IRS), a 30 percent minimum audit rate, and a 40 percent exit tax rate on taxpayers subject to the tax leaving the country.

Unfortunately, Warren’s new plan falls prey to the same problems that have plagued past wealth tax proposals.

Administrative Difficulty

A major reason why countries generally avoid wealth taxes is the difficulty inherent in assessing the value of non-liquid assets. While assets such as publicly-traded stock shares can be easily valued at a given time, other non-liquid assets such as artwork, jewelry or stakes in privately-held companies are far more difficult to establish on an annual basis. Affected taxpayers would have a strong incentive to hide or underreport the value of their assets, and tax officials would have a strong incentive to overreport asset values.

Some contend that the IRS already administers a similar levy in the estate tax, which imposes tax on the fair market value of assets being passed from decedents to their heirs. This, however, is not the defense of a wealth tax it might seem to be since the estate tax is an administrative nightmare that is difficult and time-consuming for taxpayers and revenue officials, even after the 2017 tax reform law raised the exemption.

That difficulty would only be multiplied with Warren’s wealth tax — the IRS currently processes about 4,000 estate tax returns each year, while Warren estimates that her wealth tax would fall upon 100,000 households. Even that likely does not tell the full story, as households close to the $50 million exemption may be required to perform all of the work of valuing their assets, even if they ultimately have no wealth tax liability.

Warren’s solution to this problem is to throw money at the IRS and hope they can figure it out. Warren would spend $100 billion over ten years to “rebuild and strengthen” the IRS — more than eight times the agency’s entire FY 2021 operating budget. Of this amount, 70 percent would be devoted simply to enforcing the wealth tax. Beyond that, there’s little in the way of practical solutions to administrative difficulties Warren’s wealth tax would face. In fact, the process of determining a taxpayer’s net worth is almost entirely left up to the Secretary of the Treasury to figure out.

Warren’s decision to punt to Treasury and the IRS may also create problems of its own. Prior experience shows that when independent agencies are allowed to make their own rules, they tend to err on the side of red tape. As a result, there’s a risk that the agency may turn every wealth tax assessment into a never-ending blizzard of filings, appeals, and legal challenges that dramatically reduce any utility derived from revenue extraction.

An unfortunate example of this is the IRS’s treatment of taxpayers attempting to claim the conservation easement deduction. Of its own volition, the IRS decided to wage a war on groups of individuals who form a partnership to donate land and claim a conservation easement deduction. Through absurd enforcement actions, retroactive rule changes, and valuation denials, the IRS has sought to discourage use of this tax provision.

In the case of Warren’s legislation, the IRS would have every incentive to aggressively and painstakingly audit taxpayers subject to her wealth tax. Not only would the $100 billion budget bonanza the agency would get from Warren’s legislation send a message that stricter tax enforcement would lead to budget increases, but the legislation itself encourages audits — with a 30 percent minimum audit rate.

Guaranteeing that at least around 30,000 taxpayers liable for paying a wealth tax would face an audit — and all the valuation reviews, legal challenges, and enforcement actions it would entail — mean that this could quickly turn into an expensive taxpayer boondoggle. And given the sheer scale of non-liquid assets that would need to be valued by a taxpayer preparing their own wealth tax return, you can guess that the IRS would remain well above that 30 percent baseline audit rate.

And while Warren believes that her wealth tax would raise over $3 trillion, it is worth noting that the $3 trillion number comes from wealth tax crusaders Emmanuel Saez and Gabriel Zucman, who make some questionable assumptions. For example, they assume a 15 percent rate of tax avoidance, but that is the rate for the entire tax system — mostly made up of easier-to-administer taxes like the payroll and individual income tax.

Administration of a wealth tax would prove far more difficult, particularly without well thought-out enforcement mechanisms. As previously mentioned, the IRS would also likely have to contend with undervaluations of difficult-to-assess net worth. Conclusively proving the true worth of certain assets would be difficult and time-consuming for the IRS to do.

Former Obama administration economic advisor Lawrence Summers and professor Natasha Sarin, considering these factors, estimated that a similar wealth tax proposal by Warren would yield closer to $250 billion over a ten year period. Though they do acknowledge that this may be an underestimate, it does cast doubt on the revenue bonanza Warren anticipates. Should this IRS budget explosion prove to represent closer to a fifth or even a tenth of the revenue to be raised from a wealth tax, it would highlight the inefficiency of the tax.

Taxing Investment

Warren’s plan, like most other wealth taxes, would establish perverse incentives when it comes to investment decisions. Because investments are a subset of wealth, a wealth tax would have huge impacts on investments, and Warren’s plan would place heavy burdens on “normal” returns while lightly taxing “supernormal” returns.

For example, because Warren’s plan would tax affected investors’ wealth at a rate of 2 or 3 percent, any investment returns up to that threshold would effectively be taxed away. Wealthy investors are therefore discouraged from investing, particularly in low-yield investments.

Ideally, taxes on investments should aim to exclude “normal” returns, or what an investor expects to receive from their investment, and target “supernormal” returns, or unexpected windfall returns. For example, most people who buy stock are expecting an annual return around 5 percent, though this of course fluctuates depending on the state of the market. They may hope for more, and would be thrilled to see it, but it is the expected moderate return that leads most investors to invest.

Generally speaking, therefore, it causes less economic distortion to tax windfall returns than normal returns. Yet under Warren’s plan, modest investment returns could be wiped out entirely by the wealth tax while high-return windfalls would face much lower “effective” rates. This could have the effect of significantly reshaping economic decisions, encouraging more risky investments and diluting important signals investors need in order to balance risk and reward.

As previously mentioned, nearly all wealth tax proposals suffer from this defect (a reason why taxing income generally makes for better tax policy), but Warren makes no effort to ameliorate this failing. This suggests that her plan is as much about signaling as it is about making actual tax policy.

Impact on Private Foundations

Emmanuel Saez and Gabriel Zucman, the economists behind Warren’s wealth tax proposal, have suggested in the past that a wealth tax must not only fall upon a taxpayer’s personal assets, but the assets of private foundations associated with these taxpayers as well. In other words, Bill and Melinda Gates would pay tax not just on their own private wealth but also on the assets of the Gates Foundation, which engages in billions of dollars’ worth of charitable activity each year. While this is purportedly aimed at reducing tax avoidance, it would have profound consequences for civil society and charitable pursuits.

First and foremost, a rule such as this would create enormous administrative difficulties all on its own. Legislators or (more likely) regulators would have to determine how private foundations’ assets would be attributed to private individuals. That would leave two main options, neither of which are appealing.

Attribute foundation assets to “heads'' of the organization.

Under this option, individuals determined to be responsible for charitable foundations, be it founders or trustees, would see the foundation’s assets attributed to them for tax purposes. This creates plenty of issues of its own: it could disrupt foundation management by introducing tax minimization as a primary goal rather than effective administration of funds and activities. Foundations may find it in their interest to add new trustees or to “divorce” themselves of their founders in order to reduce the impact of a wealth tax on their operations. In the case of family foundations whose founders are long deceased, such as the Russell Sage Foundation, the foundation’s assets may have to be split among many inheritors.

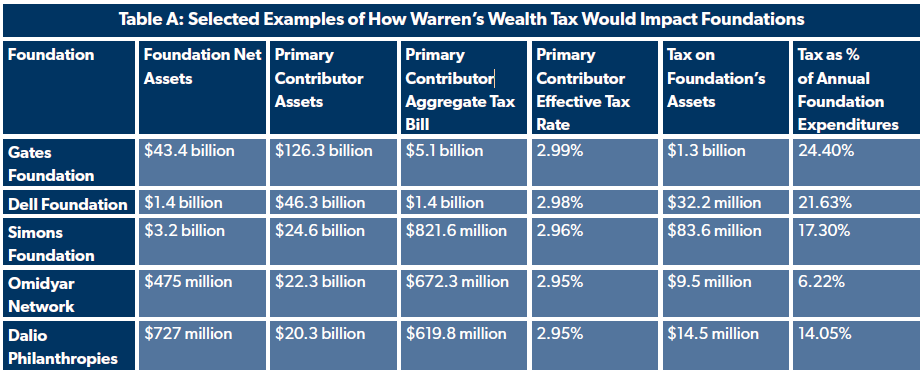

Because foundation assets may trigger new tax liabilities, charities could see their operation effectively subject to significant tax burdens. A small sample of prominent charitable foundations shows that foundation assets would effectively face a wealth tax that ranges between 6 and 24 percent of their annual expenditures, potentially limiting private altruism.

On the other hand, attributing assets of these foundations to just a few individuals would create a strong incentive for private foundations to refuse donations from outside sources, lest their wealth tax bills increase as a result. The Gates Foundation, for example, has famously received billions of dollars in contributions from finance guru Warren Buffett, who has chosen to “piggyback” on the Gates’ charitable activities with his own resources. A wealth tax that attributes the Gates Foundation’s assets to its trustees may in fact have the effect of discouraging such an arrangement, reducing the charity’s ability to execute its health care and poverty alleviation programs.

Consider assets donated to private foundations as part of the donor’s net worth.

This option would include any assets donated to a private charitable foundation as still counting towards a taxpayer’s net worth for wealth tax purposes. In essence, it would eliminate the charitable deduction for individuals subject to the wealth tax. While the previous method would provide an incentive for foundations to refuse donations, this approach would reduce the incentive for private individuals to donate to foundations.

Though Saez and Zucman suggest that assets donated to foundations could potentially receive “preferential” treatment in terms of calculating wealth tax liability, any inclusion of donated assets in net worth calculations would increase the financial cost of donating to charitable activities.

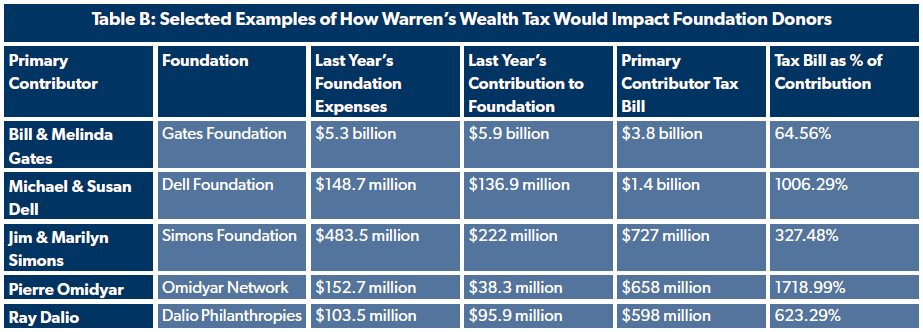

Furthermore, the donors that foundations rely on would find that they have less available wealth to give to private foundations. A look at the above sample of organizations shows that most primary contributors to foundations would face wealth tax bills well in excess of their normal contributions, potentially crowding out charitable activity.

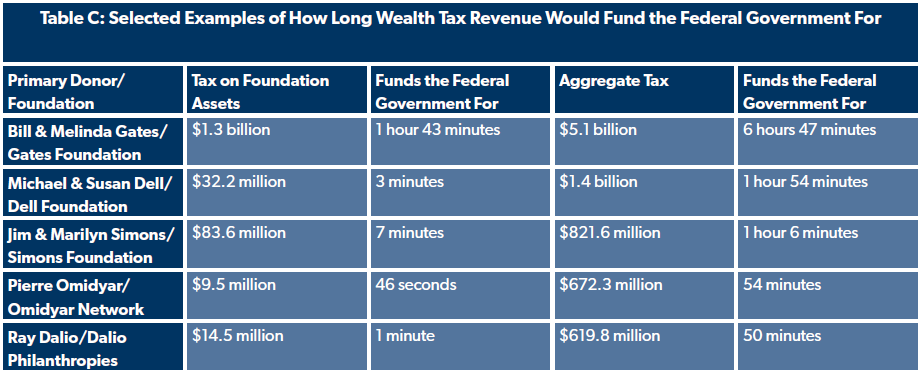

Wealth tax advocates may counter by stating that this means that a wealth tax would be able to collect significantly more wealth from billionaires than they are donating voluntarily. But while even relatively small donations to charitable organizations accomplish a great deal across the world, that same money being turned into tax revenue would barely put a dent in the federal government’s insatiable spending habits.

At the end of the day, the meager revenues to be gained relative to the federal government’s profligate spending habits would do little to offset the substantial loss of charitable activity that it would cause.

Warren’s proposal chooses not to tackle this key administrative question, largely deferring to the Treasury Department regarding net worth valuation. Yet should a wealth tax ever become law, the question of how to handle private foundations’ assets remains a thorny one that someone would have to figure out.

Impact on Market Competitiveness

NTUF has documented how past wealth tax proposals could carry unintended consequences, one major one being the impact on entrepreneurship. Entrepreneurship is crucial to driving innovation, which in turn leads to job creation and rising wages. Unfortunately, even prior to the pandemic, the number of Americans employed by new businesses had been falling for some time. At a time when new entrepreneurship should be fostered, a wealth tax risks hamstringing it.

That’s because a lot of successful entrepreneurs and innovators find themselves asset-rich but cash-poor early on. Many successful start-ups go quite some time before becoming public companies, allowing plenty of time for their founders to clear the $50 million net worth threshold. Though these successful entrepreneurs by no means are living hand-to-mouth during this time, it does mean that they often do not have the spare liquidity to pay off substantial tax bills.

For example, the sole founder of a privately-held start-up valued at $100 million would owe a $1 million tax bill each year under Warren’s plan. This could necessitate selling controlling shares in the business in order to satisfy a tax bill, slowly diluting their ownership. This would be exacerbated significantly if Senator Warren also got her way with proposed increases to capital gains taxes and higher investment income taxation.

With all these factors, this hypothetical founder could have to sell $3.5 million worth of their business just to pay their $1 million tax bill. Even without these other changes, existing taxes on capital gains and net investments would raise the founder’s tax bill well over $1 million should they fund it by selling shares in their business. Over time, that founder could see their stake in the company steadily chipped away as they continue to sell off pieces to pay their annual wealth tax bill. The result could be one more factor pressuring entrepreneurs to cash out and accept takeovers of their innovative businesses by established competitors.

When Netflix founders approached Blockbuster at the turn of the century, offering to sell their company for $75 million in today’s dollars, they were laughed out of the room. That, it turns out, was fortunate for consumers. Blockbuster had about 10,000 brick-and-mortar locations at the time, and likely would have been slower to fully embrace the digital streaming service that constitutes Netflix’s core business. Americans likely would have been nudged towards renting DVDs in person by price differences for much longer than they were as Blockbuster sought to salvage its investments in brick-and-mortar locations.

That’s just one example of how artificially pushing innovative start-ups towards being scooped up by established competitors is bad for the economy. The American Action Forum, headed by former Congressional Budget Office director Douglas Holtz-Eakin, estimated that a prior version of Warren’s wealth tax would cost workers $1.2 trillion in lost earnings over a decade as a result of the effects it would have on innovation and investment.

At a time when the American tax system should be doing all it can to foster entrepreneurship and innovation, Warren’s wealth tax would represent a step back.

Legal Problems

Even aside from all of these policy issues, any enacted wealth tax legislation would likely face legal hurdles, and Warren’s proposal is no different.

The first major legal barrier, not unique to Warren’s specific proposal but pertinent nonetheless, is the Constitutional requirement that “direct taxes” be apportioned equally among the states based on population. Back in 1895, the Supreme Court ruled in Pollock v. Farmers Loan and Trust Company that income taxes violated this Constitutional requirement that direct taxes be equally apportioned. Now, taxpayers are on the hook for income taxes today because the Sixteenth Amendment overrode this decision via the appropriate constitutional process, but it did so specifically for income taxes.

Wealth taxes would still be subject to this constitutional requirement. Since a wealth tax would affect states with disproportionately high numbers of wealthy residents more, Warren’s proposal as it stands would violate the Constitution should it be considered a direct tax by the courts.

That means that any potential wealth tax would have to either prove it was not a direct tax (somewhat of an open question) or necessitate passing a constitutional amendment authorizing it, as happened with the Sixteenth Amendment.

Warren’s framework does raise another unique problem, however. The right to exit a country has been recognized as a fundamental human right since the time of the Magna Carta, and was confirmed by the U.N. Universal Declaration of Human Rights in 1948. In the United States, the Supreme Court ruled in Kent v. Dulles (1958) that the Fifth Amendment protects the right to exit.

Warren’s imposition of a substantial 40 percent exit tax on any American affected by her wealth tax who attempts to move to another country could be seen as a violation of the right to exit. Such a punitive confiscation of an American’s wealth for emigrating to another country could be seen as an unreasonable burden on this fundamental right.

Conclusion

Senator Warren's newest effort at confiscating wealth does a poor job of addressing the major structural issues that plague such taxes. Her plan would likely collect far less revenue than advertised while introducing significant legal and administrative complications to a tax code that is already difficult to manage.