(pdf)

Automatic government spending cuts (also referred to as “sequestration” or “sequester” cuts) under the Statutory Pay-As-You-Go Act (PAYGO) Act of 2010, will take effect in January 2023 unless Congress votes to prevent it. Instead of once again voting to prevent these cuts from happening, Congress should either abide by the cuts that Statutory PAYGO requires, or replace PAYGO with a more effective spending control mechanism.

Members of Congress, interest groups, and the media are turning their eyes towards a busy year-end legislative session after the 2022 midterm elections. A fiscal year (FY) 2023 spending deal and the annual defense policy bill are considered must-pass items by some in Congress, while additional legislation dealing with retirement policy, expired or expiring tax policies, 1099-K tax reform, and energy permitting reform may also be up for consideration.

One policy matter that has received relatively little attention – but could be the most impactful thing Congress does to reduce deficits before the end of the year – is Statutory PAYGO. Congress's reckless spending is expected to trigger between $114 billion and $133 billion in automatic budget reductions.

Since Statutory PAYGO was signed into law nearly 13 years ago – passed with the strong support of Democrats in Congress and then-President Obama – Congress has never actually allowed the law’s spending cuts to take effect. Instead, both parties have waived the law’s required cuts repeatedly, wiping the PAYGO “scorecard” clean and racking up debt on the American taxpayers’ credit card. This practice should stop in 2022. As others have pointed out, all Congress has to do is “do nothing” for Statutory PAYGO to take effect in January 2023.

The practical effects of Statutory PAYGO cuts could be difficult for some beneficiaries of government spending. Hospitals and doctors paid by Medicare would bear the brunt of spending reductions, one reason why interest groups representing those providers have lobbied Congress to waive Statutory PAYGO yet again.[1]

Unfortunately, the fact that Statutory PAYGO – and its legislative cousin, the spending sequester under the Budget Control Act (BCA) of 2011 – fall disproportionately hard on Medicare providers is not a bug of existing law but a feature. Congress has made two critical errors in the creation and implementation of sequestration cuts that focus cuts on Medicare:

- Congress exempted the vast majority of spending from being touched by cuts in Statutory PAYGO (including Social Security, Medicaid, income security programs, and more major categories of spending), pushing the bubble of required cuts onto Medicare and the few remaining federal programs notexempt from the law’s cuts;

- Congress has regularly kicked the can down the road on sequestration cuts under the BCA, and most recently kicked 2022 sequestration cuts under Statutory PAYGO to 2023, almost doubling the amount of cuts needed for January 2023.

The above errors should not give Congress a free pass to ignore Statutory PAYGO yet again and waive between $114 billion and $133 billion in required cuts from taking effect come January. Congress ignored its duty to taxpayers and charged $1.85 trillion to the nation’s credit card to pass the American Rescue Plan Act (ARPA). Lawmakers created this mess by driving up deficit spending and should abide by the cuts that Statutory PAYGO requires, and not punt the problem down the road.

However, even if Congress takes the responsible path and allows Statutory PAYGO to take effect, it’s clear the law is broken if lawmakers only allow it to take effect once in 13 years. Therefore, NTUF recommends that lawmakers work in a bipartisan fashion to reform Statutory PAYGO and the BCA mandatory sequester in the 118th session of Congress:

- Congress should reduce the number of exempt programs under both Statutory PAYGO and the BCA sequester, which would spread cuts out across more programs and reduce the disproportionate impact of PAYGO rules on Medicare;

- Congress could consider expanding the sequester to discretionary programs that are not currently subject to either law; such a reform would require guardrails to avoid lawmaker efforts to evade or circumvent the cuts, and would best be paired with another decade of discretionary spending caps as were in place under the BCA;

- Lawmakers must clarify how the PAYGO sequester and the mandatory sequester are to interact, given there are no “explicit directions” that govern interactions between the two laws; and

- Lawmakers should change BCA sequester rules to prohibit Congress from extending the BCA sequester beyond FY 2031; cuts that were originally scheduled for FYs 2013-2021 have been extended or modified eight times and are now in effect through FY 2031. Going forward, it would be more conducive to good policymaking to leave in place just one set of sequestration instructions.

- The best option, of course, would be for Congress to engage in an intentional, bipartisan deficit reduction effort, and such an effort – if substantial enough – could avoid the across-the-board cuts under Statutory PAYGO or even the BCA sequester.

What follows is a brief review of the Statutory PAYGO sequester and the BCA mandatory sequester under current law, the cuts scheduled to go into effect in January 2023, and a deeper dive into the reforms NTUF believes are necessary for both existing laws.

Statutory PAYGO and the BCA Sequester: Current Law and Differences Between the Two

The Statutory PAYGO Act was passed by Congress in 2010 as part of a measure to increase the nation’s debt limit. In the House, 233 Democrats voted for the measure and every Republican opposed it. In the Senate, 60 Democrats or independents voted for Statutory PAYGO while 38 of 39 Republicans voted against it (one, then-Sen. Mike Enzi (R-WY), did not vote).

In a 2009 press statement pushing for a proposal that would eventually become the Statutory PAYGO Act, the Obama administration touted Statutory PAYGO as a:

“Return to the rules of the 1990s when statutory PAYGO enforced the tough choices that moved the budget from large deficits to surpluses, and the President believes it can help to move us in that direction today.”

Speaker Pelosi even called “[p]ay-as-you-go budget accountability” a “centerpiece of Democratic budget discipline since the early 1980s.”

The basics of the law are as follows:

- Any legislation Congress passes that increases mandatory spending (i.e., spending not subject to annual discretionary appropriations from Congress) or decreases revenues on net, thereby increasing federal deficits, is added to two PAYGO “scorecards” maintained by the White House’s Office of Management and Budget (OMB), covering the subsequent five fiscal years and ten fiscal years, respectively;[2]

- At the end of each year, OMB is required to report out a final PAYGO scorecard for the year; if there are net increases to the deficit from legislation affecting mandatory spending and revenues, then the executive branch must implement across-the-board cuts to mandatory spending.

Many categories of mandatory spending – accounting for the majority of overall federal spending – are exempt from the cuts. This includes, but is not limited to: Social Security spending; Medicaid; some low-income subsidies under Medicare; unemployment insurance; refundable tax credits like the Additional Child Tax Credit (ACTC) and Earned Income Tax Credit (EITC); and net interest on the debt.

The BCA sequester meanwhile, is a holdover from a law (the Budget Control Act) that has mostly faded from Congressional memory. The headline features of the BCA, negotiated between Republicans in Congress and the Obama administration in 2011, were 1) discretionary spending caps that were in effect from FYs 2012 through 2021 and 2) a bipartisan “supercommittee” tasked with achieving hundreds of billions of dollars of deficit reduction.

However, the BCA also included a mandatory sequester, in the event the supercommittee failed to achieve a deficit reduction agreement that could pass Congress and be signed into law by then-President Obama. Fail theydid, and the mandatory sequester went into effect.

Mandatory sequester rules in the BCA are similar (but not identical) to the rules under Statutory PAYGO, with similar programs exempt from the across-the-board cuts. One important difference is that Medicare cuts are capped differently under each law: no more than two percent of Medicare spending can be cut under the BCA sequester, while no more than four percent of Medicare spending can be cut under Statutory PAYGO.

Unfortunately, Congress discovered during the Obama and Trump administrations that extending the BCA’s mandatory sequester was a convenient way to claim they were ‘paying for’ new government spending in the short term. This has been the Congressional equivalent of saying, ‘I would gladly pay you nine or ten years from now for a hamburger today.’

Extending the BCA sequester became a favorite budget gimmick of lawmakers in both parties, and the Biden administration’s OMB notes the BCA mandatory sequester has “been extended several times” since 2013:

“...[the BCA] originally required reductions only through 2021. The mandatory sequestration provisions have been extended several times: through 2023 by the Bipartisan Budget Act (BBA) of 2013 (Public Law 113-67); through 2024 by the Military Retired Pay Restoration Act (Public Law 113-82); through 2025 by the BBA of 2015 (Public Law 114-74); through 2027 by the BBA of 2018 (Public Law 115-123); through 2029 by the BBA of 2019 (Public Law 116-37); through 2030 by the CARES Act (Public Law 116-136); and through 2031 by the Infrastructure Investment and Jobs Act (Public Law 117-58). The Protecting Medicare and American Farmers from Sequester Cuts Act (Public Law 117-71) and Public Law 117-58 modified the sequestration percentages for Medicare for 2030 and 2031, respectively.”

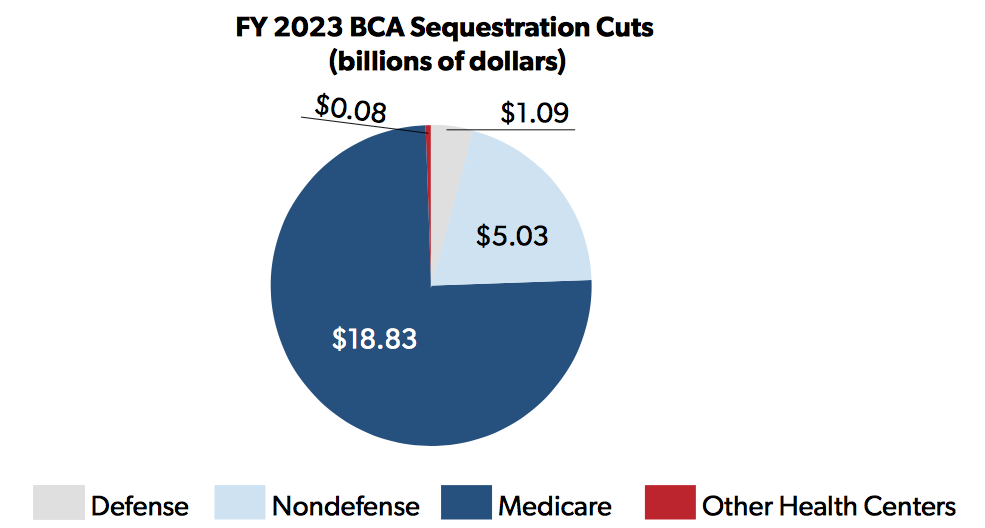

As noted in the introduction, cuts under the Statutory PAYGO Act have actually never taken effect. Cuts under the BCA mandatory sequester have been in effect at various times since FY 2013, though Congress suspended sequestration cuts for Medicare for more than a year during the COVID-19 pandemic. For the current fiscal year, FY 2023, BCA sequestration cuts total $25 billion according to OMB:

The potential combination of Statutory PAYGO Act sequestration and BCA sequestration in January 2023 could cause confusion in Congress, at OMB, and elsewhere, given nothing in current law governs how the cuts required by these two laws should interact with each other. The Congressional Research Service recently wrote, regarding Medicare cuts under the two laws:

“If a PAYGO sequester were to be triggered in 2023 or another future fiscal year, neither the Statutory PAYGO Act nor the Budget Control Act include any explicit directions as to how the two sequesters would be implemented alongside each other.”

Congress should sort out this confusion in the process of allowing Statutory PAYGO to take effect in 2023.

Scheduled Cuts for January 2023

There is some uncertainty over just how Statutory PAYGO cuts would take effect in January, in part because Statutory PAYGO has never taken effect and in part because neither Congress nor OMB has sorted out how the Statutory PAYGO sequester or the BCA mandatory sequester are to interact with each other.

Both the Heritage Foundation’s Matthew Dickerson and Piper Sandler analysts Andy Laperriere and Don Schneider estimate sequestration cuts will total $132 billion in January. These are reasonable and sensible predictions based on the information policy analysts have at hand about sequestrable resources and each law’s rules and limitations.

However, a range of sequestration cuts are possible under Statutory PAYGO and the BCA mandatory sequester come January 2023, based on the budgetary baseline OMB operates from and how the agency decides to interpret the two laws.

Given the different options, total Medicare sequestration cuts (from BCA and Statutory PAYGO) could range from $37.4 billion to $56.7 billion. The potential cuts to non-Medicare programs (from BCA and Statutory PAYGO) would likely total around $101.4 billion.

Therefore, we estimate the total range of BCA plus Statutory PAYGO cuts for FY 2023 is $138.8 billion to $158.2 billion, depending on a number of assumptions. Subtract the $25 billion in already-scheduled BCA cuts, and the amount of new cuts from Statutory PAYGO in January 2023 totals between $113.8 billion and $133.2 billion.

Sequester Reforms for the 118th Congress

Even if the Statutory PAYGO sequester goes forward in 2023 – for the first time in the 13-year-old law’s history – it’s clear that reforms to the law are necessary so that Congress is not regularly tempted to simply waive the law’s effects over and over again when lawmakers make poor fiscal decisions.

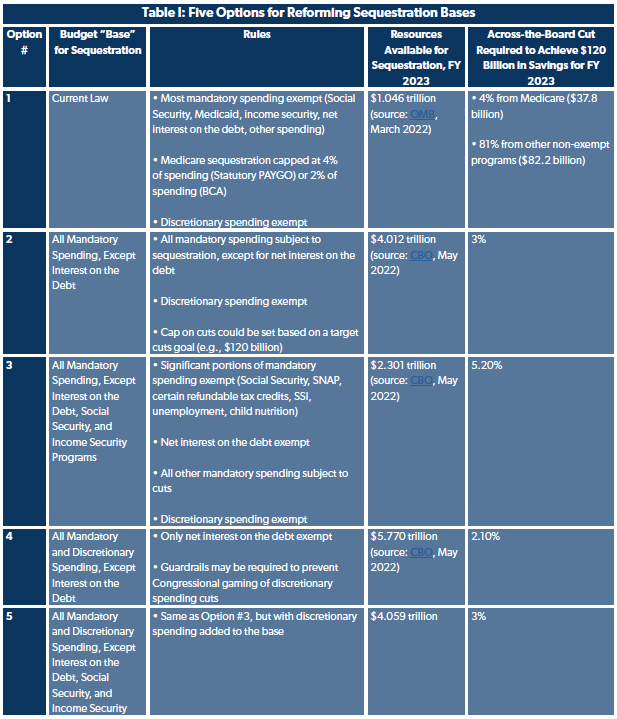

NTUF outlines four potential reforms below – some of which are mutually exclusive with others and would require Congress to choose between one option and another. We conclude that a fifth option, an intentional and bipartisan deficit reduction package, is better than any of the cuts required under PAYGO.

Reduce the Number of Exempt Programs

The list of exempt programs under the Statutory PAYGO and BCA sequesters is literally pages long, and covers the vast majority of mandatory spending each year. Even though CBO projects the government will spend over $4 trillion in mandatory categories in FY 2023, only about a quarter of this total ($1.05 trillion) is sequestrable under the two laws.

Making all mandatory spending subject to sequestration under Statutory PAYGO would reduce the disproportionate effects the current law has on Medicare and on other non-exempt programs.

To ensure that sequestration does not cause drastic and destabilizing cuts to key mandatory programs, such as Social Security or the Supplemental Nutrition Assistance Program (SNAP), lawmakers could pair a reduction in exempt programs with a percentage cap on all programs. A three-percent cap, for example, would reduce spending by around $120 billion in FY 2023 (around the midpoint of our estimates for current FY 2023 sequester cuts) while reducing scheduled cuts to Medicare and preventing the government from having to completely defund 250 non-exempt programs under Statutory PAYGO.

If lawmakers are hesitant to make across-the-board cuts to Social Security and to other income security programs (like SNAP, unemployment, and refundable tax credits), which serve some of society’s most vulnerable, they could still significantly expand the sequestrable base from current law by including othermandatory spending. Including all mandatory spending other than Social Security and income security programs still increases the sequestrable base from $1.05 trillion to $2.30 trillion.

Congress could achieve $120 billion in cuts under this reduced base with a five-percent sequestration cap. This would be more difficult for programs to achieve than the three-percent cap suggested above, but would still obviate the need under current law to completely eliminate 250-plus non-exempt programs under Statutory PAYGO.

Expand the Sequester to Discretionary Spending

Congress could reduce the sequester’s impact on mandatory programs even further if it were to expand the sequestrable base to discretionary spending. CBO projects discretionary spending will total $1.80 trillion in FY 2023. Applying discretionary spending to Statutory PAYGO would increase the sequestrable base for FY 2023 from around $4 trillion to $5.77 trillion.

Achieving a similar level of Statutory PAYGO cuts under current law (around $120 billion) would require only two-percent across the board cuts with a $5.77 trillion base, instead of three percent as outlined above with only mandatory spending (an around $4 trillion base).

Alternatively, a base with mandatory and discretionary spending, minusincome security programs as outlined above, would require three-percent across the board cuts, much lower than the five-percent cuts if only mandatory spending (minus Social Security and income security) were included in the sequestrable base.

If lawmakers were to go with this option, they would need to ponder guardrails that prevent Congress from simply backfilling sequestration cuts in the next fiscal year’s discretionary budget – or, worse yet, anticipating a future sequestration order and preemptively adding funds to the discretionary budget as a hedge against sequestration.

One category of spending that should not be on the table for the sequestrable base: net interest on the debt, around $400 billion per year at the moment and rising. Policymakers should not give America’s creditors, present and future, any reason to doubt the full faith and credit of the United States government. On the contrary, sequestration should be treated as sending a positive signal to investors that federal policymakers take unsustainable debt loads seriously.

Set an End Date for the BCA Sequester

Congress should stop playing budget gimmicks and games with the BCA’s mandatory sequester and set a firm end date for FY 2031. While continuing the sequester years into the future does offer the promise of real, future savings for taxpayers, lawmakers in practice only extend the BCA sequester to avoid making hard choices when it comes to paying for new spending.

Since mandatory spending is projected to grow exponentially in the coming years and decades, extending the BCA mandatory sequester will also become an increasingly tempting offset for new spending today. For example, extending the mandatory sequester to FY 2032 could save the federal government more than $30 billion – money Congress will claim they can comfortably spend today.

The flip side of this coin is that the larger BCA sequestration cuts grow in scale, the more tempting it will be for lawmakers to cancel sequestration cuts in the future. It is easy to imagine a bipartisan deal coming together in future years to simply cancel whatever years remain of BCA sequestration, since Congress will have already ‘paid for’ their new spending on paper.

Congress should keep the BCA sequestration through FY 2031, its current end date, and commit to not extending it as a budget gimmick any further.

Clarify the Interaction Between the Two Sequesters

Given the lack of clarity around how the Statutory PAYGO sequester and the BCA sequester are supposed to interact, particularly as they pertain to caps on Medicare cuts under each sequester, Congress should step in and clarify the interaction between the two.

It is not impossible that the Biden administration could choose to interpret the two-percent BCA sequester as superseding the four-percent Statutory PAYGO sequester amid the confusion, in an effort to mitigate politically damaging Medicare cuts.

At minimum, Congress could clarify that the four-percent Statutory PAYGO sequester supersedes the two-percent BCA sequester, with a possible credit for amounts already sequestered in Medicare this fiscal year under the BCA.

Another option would be to apply the same cap to each law – NTUF would recommend four percent, as in Statutory PAYGO – but prevent the caps from adding on to one another. In other words, Congress could set one four-percent cap for Medicare sequestration and have only one of the caps apply, with the timing of the cap’s application dependent on whether BCA (start of the fiscal year) or Statutory PAYGO (start of the calendar year) kicks in first.

Congress could also apply the four-percent Statutory PAYGO cap on top ofthe two-percent BCA cap, while adjusting the sequestrable base for BCA cuts and/or applying a credit for BCA cuts to the Statutory PAYGO sequester amount.

Lawmakers should also give consideration to aligning the timelines for the Statutory PAYGO and BCA sequesters, to reduce some of the confusion and overlap between the two. Perhaps the easiest path forward is to adjust Statutory PAYGO sequesters to the fiscal year calendar. Two potential reforms:

- Congress could require OMB to tally up the Statutory PAYGO scorecard once per year upon the end of a fiscalyear, rather than the end of a calendaryear;

- Congress could keep the OMB requirement to tally up the Statutory PAYGO scorecard at the end of a session of Congress, but could apply Statutory PAYGO cuts to the start of the next fiscal year on October 1.

The Best Option: Intentional Deficit Reduction

Of course, Congress could obviate allof the painful cuts caused by Statutory PAYGO in this session – and by the BCA sequester over the next nine fiscal years – by engaging in an intentional, bipartisan deficit reduction package this fall. Such a deficit reduction package could:

- Replace the BCA sequester with $256 billion in deficit reductionto account for anticipated BCA sequestration cuts over the next 10 fiscal years; and

- Replace Statutory PAYGO cuts set to take effect in 2023 with deficit reduction totaling between $114 billion and $133 billion, the amount NTUF projects could be cut this January under the Statutory PAYGO sequester.

The total target deficit reduction would be between $370 billion and $389 billion over 10 years. CBO plans to introduce a package of deficit reduction options this December that could give lawmakers plenty of ideas.

Congress could also commit to 10 more years of discretionary spending caps. Rep. Jodey Arrington (R-TX) has a proposal to do just that, which would save taxpayers $466 billion over 10 years compared to CBO’s current discretionary spending baseline. This would more than cover the costs of repealing the BCA sequester and replacing the Statutory PAYGO cuts set to take effect in January.

Such cuts would also be an intentional act by Congress – less chaotic, more predictable, and more efficient than across-the-board cuts set to take effect under Statutory PAYGO.

Therein lies the best path forward for Congress: obviate Statutory PAYGO and even the BCA sequester by reaching a substantial, bipartisan deficit reduction agreement in the year-end session. The next best option, though, and an essential undertaking for the 118th Congress regardless of what happens at the end of 2022, is to reform Statutory PAYGO so it operates more efficiently and effectively – and without the waivers Congress has made time and time again since the law’s passage in 2010.

NTUF Vice President of Research Demian Brady contributed to this paper.

[1]Projected Medicare cuts to providers may total around $36 billion under Statutory PAYGO, a not insignificant sum but also a fraction of COVID-era federal support delivered to providers under the Provider Relief Fund (PRF) from mid-2020 through mid-2022. PRF spending had totaled $154.4 billion as of February 28, 2022, according to the Government Accountability Office, and the PRF was just one program among a variety of programs and policies designed by Congress to support providers through the COVID pandemic.

[2]Statutory PAYGO excludes emergency spending from the PAYGO scorecard. For example, recent spending on disaster relief or humanitarian assistance to Ukraine, designated as emergency spending by Congress, would not count towards the PAYGO scorecard for the 117th session of Congress.