(pdf)

With many of the individual income tax reforms included in the 2017 Tax Cuts and Jobs Act (TCJA) set to sunset over the next few years, taxes are back on legislators’ minds. But while the conversation should be geared towards figuring out how to preserve these important pro-growth tax cuts for American taxpayers in a fiscally responsible manner, the pending expiration of one of the TCJA’s biggest changes has emboldened legislators in high-tax states.

Background

The state and local tax (SALT) deduction allows taxpayers to deduct the value of state and local taxes paid against their federal income tax liability if they itemize their deductions. Only certain types of state and local taxes can be deducted under SALT, including property taxes, income taxes, and sales taxes. Taxpayers cannot claim a deduction for both their state income and sales taxes at the same time.

As part of the TCJA, Congress capped the SALT deduction. Individual taxpayers can now only deduct up to $10,000 worth of state and local taxes paid against their federal income tax liability.

While this capped the value of a deduction available to taxpayers, the majority of taxpayers were not affected by this change. The SALT deduction is available only to taxpayers who itemize their deductions instead of taking the standard deduction. Even before the TCJA, only about 30 percent of taxpayers itemized.

A key focus of the TCJA was on simplifying the tax code, in part by making the alternative to itemizing more attractive. The TCJA doubled the standard deduction, allowing many more taxpayers to enjoy the relative simplicity of avoiding itemizing while still getting the maximum possible benefit.

In the first year that the TCJA went into effect, the percentage of taxpayers itemizing their deductions dropped all the way to about 10 percent. Only among taxpayers in the top 10 percent of income earners do a majority still itemize their deductions.

Meanwhile, the impact of capping the TCJA was clearly focused on the wealthiest taxpayers. Even with the SALT cap in place, the top 40 percent of taxpayers receive nearly 94 percent of the total benefit of the deduction. Repealing the cap would only make this divide more extreme.

Who Wants to Repeal the SALT Deduction Cap?

Earlier this year, a group of legislators in Congress refounded the “SALT Caucus.” The common theme among its founding 32 members: they all represent either California, Connecticut, Illinois, Maryland, Minnesota, New Jersey, or New York. Five of those seven states ranked among the ten highest-taxed states on the Tax Foundation’s 2022 State-Local Tax Burden rankings, while the remaining two fell among the top 20.

But while it primarily impacts wealthier taxpayers, the SALT deduction has become a key buttress for states determined to maintain high levels of taxation. The SALT deduction, by allowing wealthy taxpayers to deduct their state and local taxes on their federal income tax return, effectively provides a substantial cushion against the impact of high state and local tax burdens. That’s because, without the SALT cap, higher state and local taxes mean a proportionally larger SALT deduction at the federal level.

This doesn’t mean taxpayers benefit from higher state and local taxes, but instead that they do not feel the full impact of tax increases. Under an uncapped SALT deduction, a taxpayer in the top federal tax bracket facing an additional $100,000 in state and local tax liability after a tax increase pays $37,000 less in federal taxes. That taxpayer is still worse off than if their state did not increase taxes at all, but their total state-federal tax liability increases by $63,000, not $100,000.

The cap on the SALT deduction removes most of this cushion, causing taxpayers to feel the full brunt of their state’s tax policies. Legislators concerned about their residents’ high tax bills in the absence of this cushion ignore the obvious culprit — their home state’s bloated and punitive tax code — in favor of a regressive and unfair tax deduction that should never have been in the tax code in the first place.

Excessively taxing taxpayers does have consequences, particularly in the context of states that taxpayers can pack up and leave relatively easily. The states represented by the SALT caucus’s founding members are those that are feeling these consequences the most.

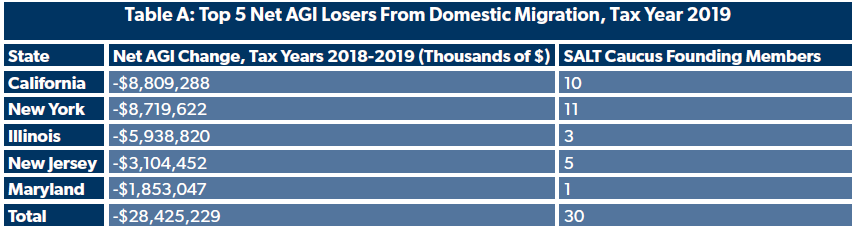

All but one of those 32 SALT Caucus founding members represent states that were among the top 10 net AGI losers from state-to-state migration in tax year 2019, the last year before the pandemic. The remaining member, Rep. Dean Phillips, represents Minnesota — the 11th-biggest loser from state-to-state migration. Thirty of the 32 SALT caucus members represent states in the top 5 AGI losers from domestic migration in tax year 2019.

Who Would Benefit From a Change to the SALT Deduction Cap?

The SALT deduction overwhelmingly benefits the wealthiest taxpayers. But some politicians who otherwise decry the supposed inequality of the tax code are nonetheless strongly supportive of SALT, framing the SALT cap as a “direct assault on hardworking men and women of labor” or “all about the middle class.”

In 2015, before the TCJA’s passage, 84 percent of SALT’s benefits went to taxpayers with incomes over $100,000, and a mere 3.5 percent went to those with incomes below $50,000. The top 3 percent of filers collected 38 percent of SALT benefits, while the bottom 50 percent collected just 15 percent of SALT benefits. Middle-income filers received a SALT benefit averaging $920.

Today the numbers are even starker. An analysis by the Tax Policy Center found that uncapping the SALT deduction would provide no benefit at all to 96 percent of middle-income households (and 91 percent of all households), with the remaining 4 percent receiving a modest average tax cut of just $400. For taxpayers making more than $1 million, the average tax cut would be $48,000.

Arguments that these national-level statistics are drastically different in the context of high-tax states’ costs of living likewise fall flat. Median household income in 2021 in the United States was $70,784, and even in New York City it was $84,435. The progressive Institute on Taxation and Economic Policy estimates that a solid majority of the benefit of uncapping the SALT deduction would go to households with an annual income above $200,000 in each of California, Illinois, New Jersey, and New York. Households at this income level make up less than 10 percent of the population in each of these states. Lifting the SALT cap would therefore not be particularly impactful for taxpayers making anywhere near an average income.

What’s more, many high-income taxpayers were not actually hurt by the TCJA due to the interaction of the then-existing Alternative Minimum Tax (AMT) which took away SALT benefits. The 2017 law capped SALT but also eliminated the AMT, as well as lowering tax rates and increasing the standard deduction. When these changes are taken as a whole, more than 80 percent of all taxpayers received a tax cut under the TCJA, while less than 5 percent received a tax increase.

Other Arguments in Favor of the SALT Deduction Are Unpersuasive

One common argument in favor of the SALT deduction is that it protects taxpayers from “double taxation,” but this misunderstands the term “double taxation.” Double taxation occurs when a taxpayer is taxed on the same income by the same entity in order to provide the same services. It does not refer to taxation by different levels of government.

For instance, when a taxpayer pays income taxes to their state and then to the federal government, they are receiving different services in return. While taxpayers might not always value the services they receive in return for their tax dollars as a fair trade, the fact is that the state services they receive and the federal services they receive are different. Calling this double taxation is akin to claiming your internet provider is double charging you because you also had to pay money for groceries.

Besides, if SALT advocates were truly concerned that the absence of the deduction represents double taxation, they are focused on a very small subset of taxpayers. Taxpayers who claim the standard deduction (the vast majority of taxpayers) receive no deduction whatsoever for their state and local taxes, yet SALT advocates never accuse their state governments of wronging taxpayers.

Likewise, arguments that the federal government has some sort of constitutional obligation to allow taxpayers to deduct their state and local taxes fall flat — and continue to do so in front of courts. Last year, the U.S. Supreme Court declined to hear a case brought by a group of high-tax states claiming that the cap on the SALT deduction was unconstitutional because it coerced states into lowering their taxes. Two federal courts had rejected these claims, which we analyzed and found to be “a political or legislative question, not a legal one.”

This argument was particularly ironic given that any “coercion” these states were feeling was little more than the consequences of their actions. Congress is in no way required to shield states from experiencing tax policy tradeoffs.

Conclusion

The SALT deduction is a favorite policy of many usually tax-happy progressives for a simple reason: it is a crutch that allows tax-and-spend states to continue taxing and spending as they please while allowing their overtaxed taxpayers to receive a discount on their tax bill at the federal level.

Defending the SALT deduction requires accepting some cognitive dissonance regardless of political persuasion. Progressives must find a way to reconcile their traditional distaste for tax breaks for the wealthy with the SALT deduction’s decidedly regressive impact, while conservatives have to advocate for a deduction that subsidizes high-tax states’ policies at the federal level.

Taxpayers should not be fooled. Not all tax deductions are created equal, and the focus of Congress should be on trying to get rid of the SALT deduction for good when the cap expires — not bringing it back to life.