(pdf)

Introduction

New tax migration data from the Internal Revenue Service (IRS) shows that thousands of taxpayers have fled high-tax states for states with more hospitable rates. While taxes are not the only factor in location decisions, the IRS data shows a strong relationship between tax burdens and migration patterns.

The ten states with the highest state and local effective tax rates saw over 232,000 taxpayers move to other states in 2019, taking with them a net Adjusted Gross Income (AGI) of $31.2 billion. The top ten destination states of taxpayer migration had effective tax rates lower than the national average, four of which have no state income tax at all, including the two states topping the list, Florida and Texas. All told, these ten states saw an influx of 283,000 taxpayers with a total AGI of 37.8 billion.

The data also calls into question the state and local tax deduction expansion contemplated in the “Build Back Better” (BBB) reconciliation package. The counties that benefited most from the state and local tax deduction prior to enactment of the Tax Cuts and Jobs Act (which capped it at $10,000) saw a net loss of nearly 36,000 taxpayers and $10.4 billion in wealth. The BBB would increase the cap, thereby allowing these localities to maintain their high taxes and effectively shifting the cost onto federal taxes.

High-tax states and counties risk driving away taxpayers and considerable wealth. Given the technological developments that enable a more mobile workforce and greater employment opportunities, this trend is likely to continue going forward.

Methodology & Findings

The IRS data used below shows the net change in residence from one state to another (excluding international migration) reported by filers from 2018 to 2019. This information was matched up with each state’s (and Washington, D.C.’s) top income tax rate and also the combined state and local effective tax rate for 2019 as compiled by the Tax Foundation.

23 states had a net influx of nearly 324,000 taxpayers bringing with them $42.6 billion in wealth. On average, these states had a top income tax rate of 4.3 percent and combined effective state and local tax burdens of 9.2 percent. The 28 states (including D.C.) that saw a net outflow of taxpayers had an average top income tax rate of 6.5 percent and an effective tax rate of 10.6 percent.

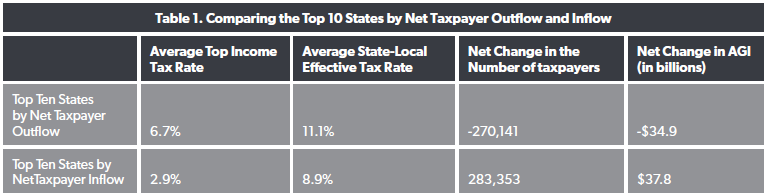

Table 1 below compares the average tax rates of the 10 states that saw the biggest departure of taxpayers versus the 10 states that had the largest inflow. States that grew their tax base because of migration typically had lower tax rates than the states with out-migration.

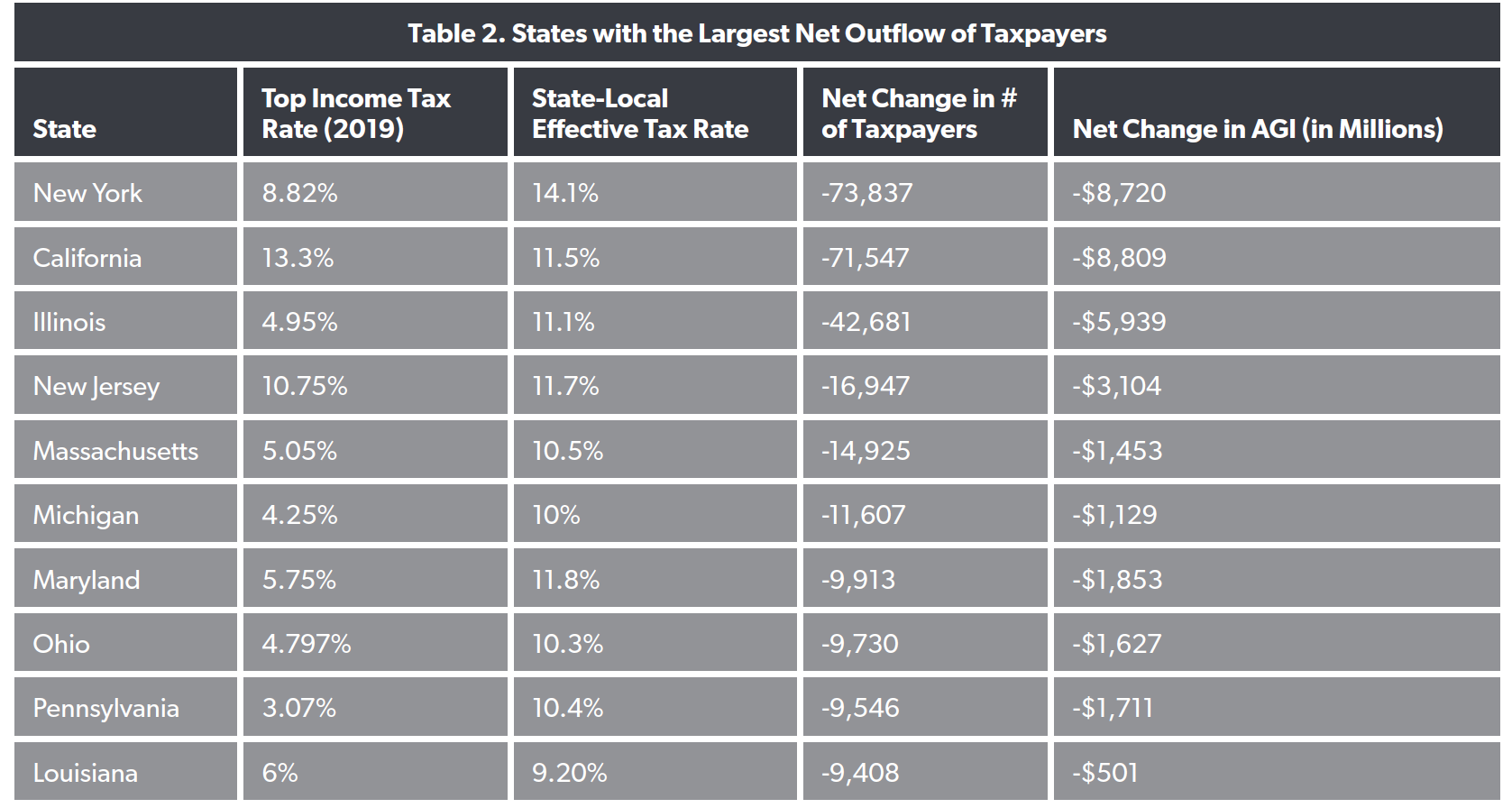

Table 2 breaks out the top ten states by net outflow of taxpayers.

New York had the highest state-local effective tax rate, and it also had the largest outflow of taxpayers who fled, taking with them nearly $9 billion in wealth.

California saw a net loss of nearly 72,000 taxpayers and $8.8 billion in wealth. The Golden State had the highest top income tax rate and was 8th on the Tax Foundation's ranking of state-local effective tax rates.

Pennsylvania rounded out the top ten states experiencing taxpayer flight. Though it has a low income tax of a flat 3.07 percent, that is outweighed by other levies, leaving it in the top third of states ranked by state-local effective tax rates.

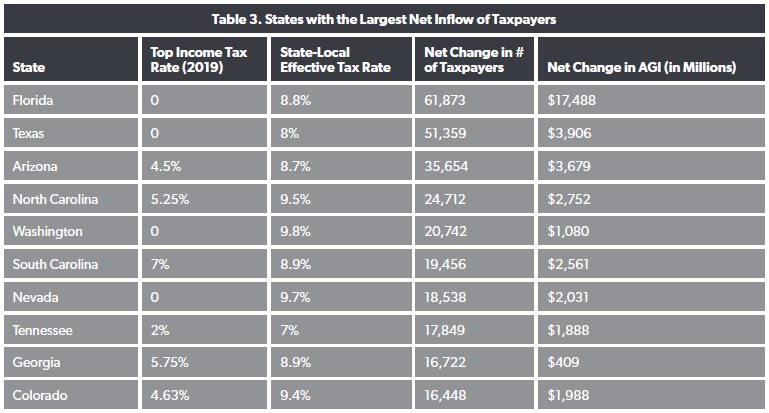

Table 3 shows the states with the largest influx of taxpayers from other states. The top two destination states (Florida and Texas) have no income tax. Neither do Washington and Nevada. Also included was Tennessee which has no broad-based tax for wage income but at the time was in the process of phasing out its tax on income from certain investments, reducing it 1 percent per year until its elimination this year. South Carolina had a top income tax rate higher than the national average, but a combined state-local effective tax rate of just 8.9 percent, which places it 40th in the U.S.

The State and Local Tax Deduction

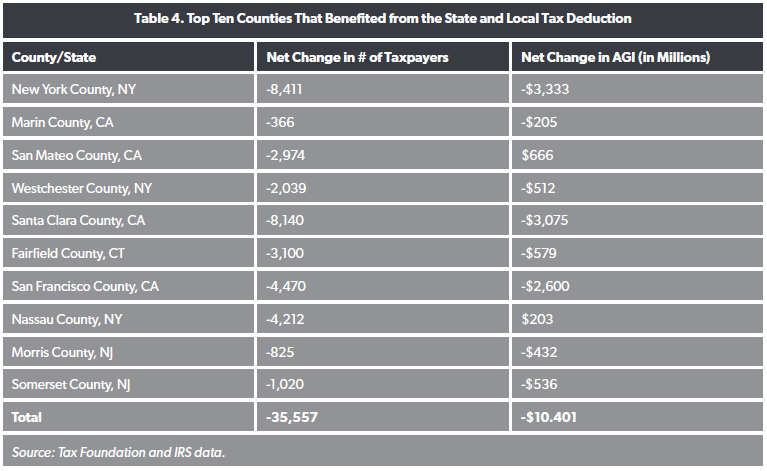

The IRS data also captures migration in and out of counties across the country. Table 4 shows the top ten counties that benefited from the state and local tax (SALT) deduction, as compiled by the Tax Foundation in 2018. Through this tax provision, filers can deduct certain taxes at the state and local level from their federal income tax bill. The Tax Cuts and Jobs Act of 2017 capped the amount that could be deducted at $10,000, a tradeoff for lowering federal tax rates across-the-board and nearly doubling the standard deduction.

One of the concerns about the deduction is that the benefits primarily flow to wealthy individuals. For example, in 2015, over 84 percent of the benefit went towards those with incomes above $100,000. The deduction also primarily aids residents in high tax areas, which are able to maintain higher state and local tax rates due to the federal deduction’s offsetting impact.

The ten counties come from just four states with high tax burdens. Collectively, these counties saw a net loss of nearly 36,000 taxpayers, taking $10.4 billion in wealth to greener pastures.

Through the reconciliation package, Democrats hope to increase the SALT deduction to $80,000 through 2030, after which it would reset to $10,000. As before, the benefits would mostly flow to the well-to-do in high tax jurisdictions, easing pressure in those areas to implement needed reform in their taxing and spending policies. As remote work options continue to proliferate and housing costs continue to shut many out of major metropolitan areas, the trend of outflow from high-tax areas is likely to continue.

Conclusion

Many taxpayers are effectively voting with their feet and resettling from high-tax states to states with lower taxes. This contributes to shrinking tax bases in high-tax jurisdictions and significant shifts in political power that are reshaping Congress and the nation. States and localities with high tax burdens would be wise to reform their codes to attract and retain businesses and individuals, instead of pushing them out.