The IRS will not move ahead (for another year) with requiring third-party payment processor 1099-K tax forms for everyone with $600+ in transactions in a year, they announced today in some welcome news for taxpayers just before Thanksgiving.

This would have impacted users of eBay, Venmo, PayPal, Apple/Google Pay, StubHub, etc. Before 2021, the law required reporting from those and other third-party payment processors for users that have at least 200 transactions worth $20,000 in a year. It was lowered by the American Rescue Plan Act (ARPA) to $600 with no minimum transaction number, effective with the 2022 tax year (and later postponed to 2023). The IRS originally estimated a modest increase in forms, from 14 million to 16 million.

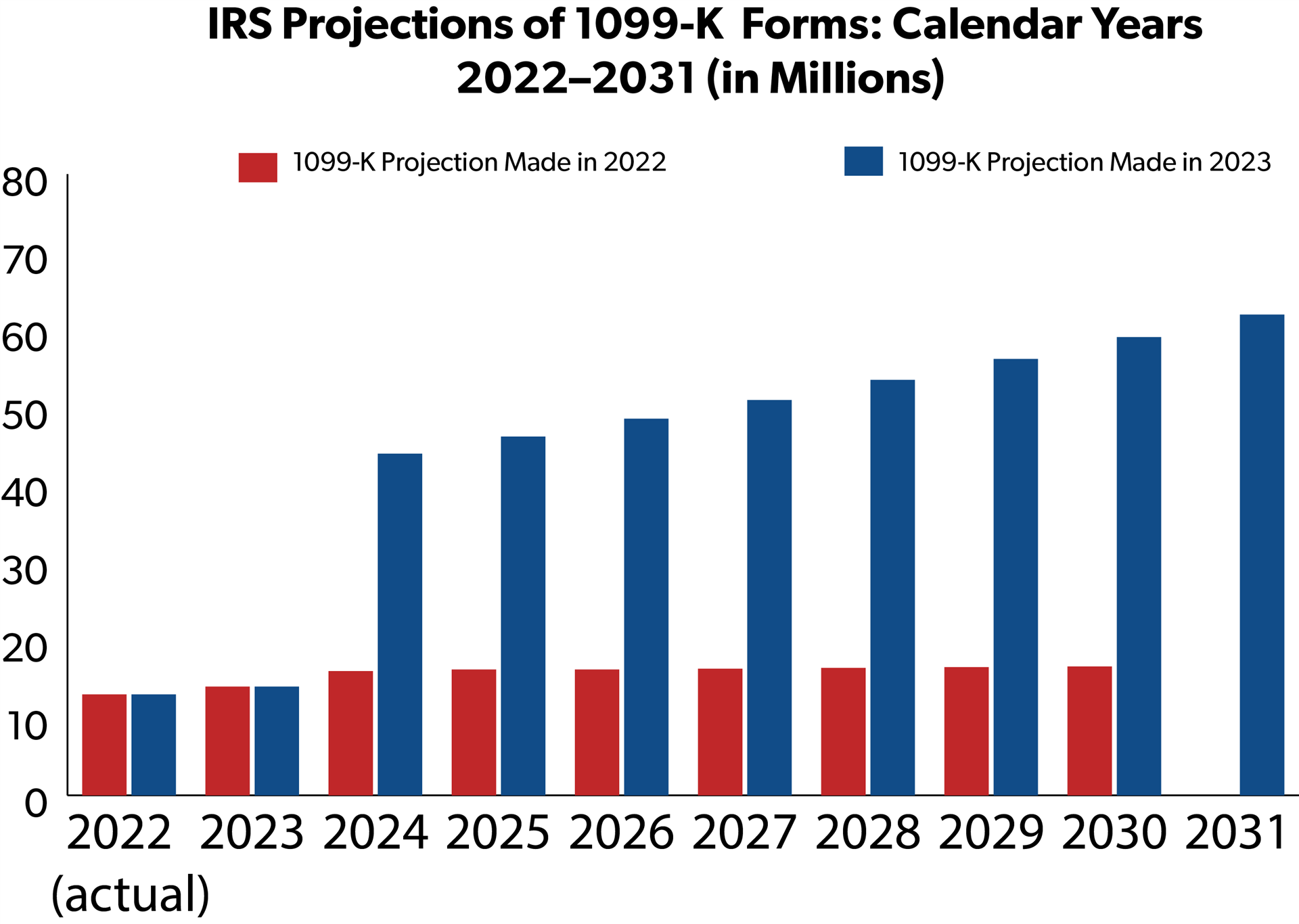

We at NTUF have repeatedly warned this dramatically undercounted the increase, and predicted taxpayer confusion that would lead people to pay more in taxes than they actually owe. The forms would report gross amounts and nontaxable transactions, leaving it to taxpayers to understand the information and determine what is taxable. The IRS did later revise their forms number to 44 million, and the Government Accountability Office recently confirmed that the number would be higher.

The 2023 threshold will now remain at $20,000 and 200 transactions. For 2024, it will be $5,000, a transitional level that was also announced today by the IRS. ARPA’s threshold was originally supposed to have gone into effect for tax year 2022 but was delayed because of compliance and administrative concerns. All of the problems and concerns that led the IRS to delay implementing it a year ago remain in place today, which is why it is a relief for taxpayers that it has been delayed for another year.

It is good that the IRS is responding to the warnings from GAO and NTUF and others. There are cross-partisan bills pending in Congress to either keep the $20,000/200 threshold or adopt a number and amount above one transaction and $600. While the threshold change was a law passed by Congress, every expert (including those charged with administering it) is saying that lowered threshold is unworkable. Hopefully it is revisited.