(pdf)

Introduction

The Internal Revenue Service (IRS) collects almost $5 trillion in individual income, corporate income, and payroll taxes each year, but the burden of our tax system is much more than that. As painful as it can be to have to cut a check to the IRS every April, the process is much more arduous and confusing than it should be. This report, NTUF’s annual study of the tax system, finds that compliance burdens are increasing for the second consecutive year.

For starters, taxpayers spend $104 billion a year on out-of-pocket expenses associated with preparing and submitting tax forms. Some entail basic costs such as making copies of financial statements, receipts, or forms. But that is just a drop in the bucket compared to other related expenses. The complexity of the tax laws, a lack of clarity in instructions and regulatory guidance, the inability to get basic questions answered by IRS agents, the worry of missing out on a credit or deduction, and the fear of making an audit-triggering mistake mean that more and more taxpayers turn to software or professional tax preparers every year.

In addition to monetary expenses, Americans also spend an estimated 6.55 billion hours complying with the tax laws. Taxpayers must gather the necessary receipts, statements, and records, and try to make sense of and fill out the IRS’s tax forms. This imposes a huge opportunity cost on individuals, businesses, and the economy because time is money. And with inflation, people’s time has become more valuable. We can calculate the value of this burden using average private sector labor costs – which rose by 5.6 percent since a year ago – as a $260 billion per year time drain.

Altogether, this year’s tax complexity burden is $364 billion – $25 billion (7.4 percent) more than a year ago. This estimate is likely an understatement because the IRS has not been able to estimate expenses associated with many of its forms even though they are legally required to do so. This estimate also does not attempt to put a dollar value on the confusion, headaches, and stress that tax filing burdens impose on millions of people each year.

More headaches are on the way for taxpayers in the coming years. Over the last several months, the IRS has touted how it is using the $80 billion provided to it through the Inflation Reduction Act (IRA) to improve taxpayer services, but just $3 billion of that pot of money is dedicated for that purpose. The IRS plans to burn through that funding in the next few years, before the 10-year spend period for the $80 billion in funding is up. The $46 billion in new enforcement funding is intended to subject more taxpayers to audits (and more scrutinous and time-consuming audits). This could lead to more compliance costs before and after Tax Day.

The Tax Code’s Increasing Complexity and Compliance Burden

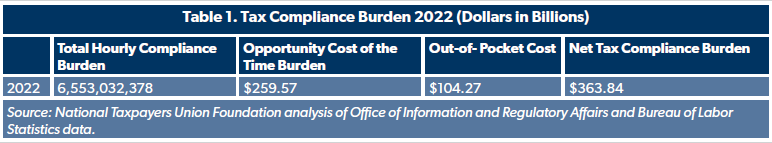

Time and Cost Burdens Increased Again in 2022

This annual NTUF estimate of tax complexity uses analysis of data and supporting documentation that the Internal Revenue Service (IRS) files with the Office of Information and Regulatory Affairs (OIRA), and finds that complying with the tax code in 2022 consumed 6.55 billion hours for recordkeeping, learning about the law, filling out the required forms and schedules, and submitting information to the IRS.[1]

We calculate an estimate of the value of this time burden using private sector labor costs. According to the Bureau of Labor Statistics (BLS), U.S. non-federal civilian employers spent an average of $40.23 per hour worked by their employees in December 2022. This includes all wages, salaries and benefits provided.[2] Because of inflationary pressures, the cost of labor was up 5.6 percent from 2021 ($38.07).

The opportunity cost of the billions of hours spent on taxes is equivalent to $260 billion in labor – valuable time that could have been devoted to more productive or pleasant pursuits but was instead lost to tax code compliance. Add to that the $104 billion in estimated out-of-pocket costs taxpayers spent on software, professional preparation services, or other filing expenses, and the total economic value of the compliance burden imposed by the tax code can be calculated at $364 billion.

To put this figure into context, if you were to count to $364 billion at a rate of $1 per second, it would take you over 11,500 years. It is more than Amazon’s sales in North America in 2022.[3] The tax compliance burden is six percent of total federal outlays in 2022 ($6.3 trillion) and amounts to $1,076 per U.S. citizen in 2022.

Meanwhile, the cumulative time spent each year on taxes stretches out to over 747,000 years. With the average 77-year life expectancy of an American, the amount of time devoted to tax compliance this year alone would consume 9,700 human lifetimes. The first Homo Sapiens appeared around 300,000 years ago, so. 747,000 years is more than double the amount of time our species has been on the planet.

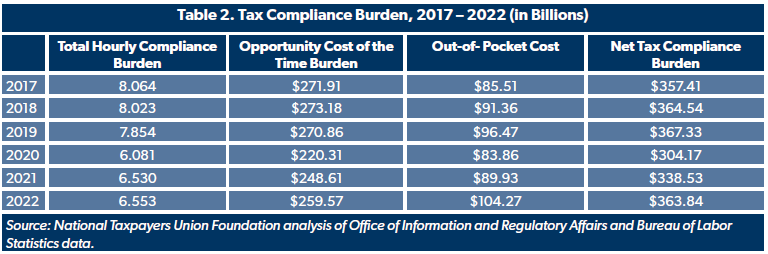

Down and Up: A Look at Recent Tax Compliance Burdens Trends

In 2017 the hourly tax complexity burden stood at 8.06 billion hours. The next three years saw burdens ease. Much of this was due to the reforms enacted in the Tax Cuts and Jobs Act (TCJA) of 2017. The law went into effect for 2018 and simplified compliance burdens for many filers by reducing the number of people who would need to file taxes and shortening the 1040 Form. The TCJA also increased the standard deduction, meaning much less time lost to paperwork on itemized deductions, and reduced the double-filing burden of the Alternative Minimum Tax.

As NTUF noted in a previous report, a recorded drop in tax compliance burdens in 2020 was due to the IRS revising their methodology for business tax compliance.[4] Years earlier, the agency realized that it had significantly overestimated the time it takes for businesses to fill out paperwork. They decided to wait to implement that for a few years in order to see how the TCJA changes would otherwise impact burdens before implementing the methodology revision.

This year marks the second consecutive year that compliance burdens have resumed an upward march, taking up more time and imposing higher out-of-pocket expenses.

Calculating the Compliance Burden

Any time any federal agency requires the public to fill out any sort of form, it is called an “information collection.” Every agency that issues a form is required under the Paperwork Reduction Act to estimate how long each respondent will take to fill it out, as well as any potential out-of-pocket expenses incurred as a result, and it must get approval from the Office of Management and Budget. In general, federal agencies must get each collection re-approved on a three-year cycle, but most collections under the Internal Revenue Code are reviewed every year. Approved burdens are posted on a website managed by the OMB’s Office of Information and Regulatory Affairs along with Supporting Statements prepared by each federal agency. NTUF tallies up the burdens for 465 IRS information collections (many of which consist of multiple forms or schedules).

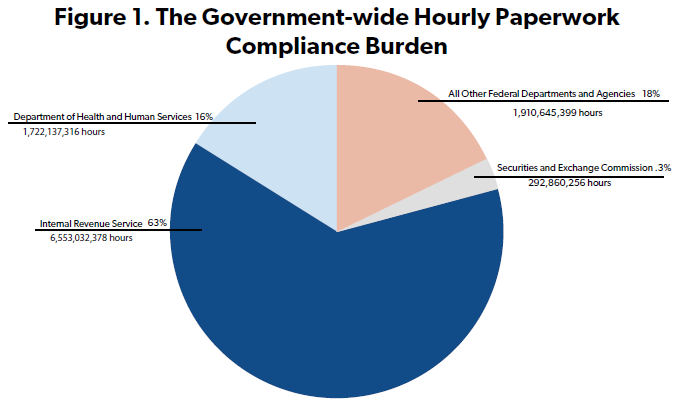

Tax Forms Dominate the Government-wide Paperwork Burden

It is probably no surprise that IRS forms make up the majority of total federal government paperwork burdens. Currently there are 10,180 different information collections across all the various federal departments, agencies, and commissions. While the IRS’s various forms comprise less than five percent of this total, they are nearly two-thirds of the 10.5-billion-hour paperwork burden imposed across all government agencies. The next largest source of paperwork is the Department of Health and Human Services, imposing 1.7 billion hours. The Security and Exchange Commission imposes 293 million hours complying with forms.

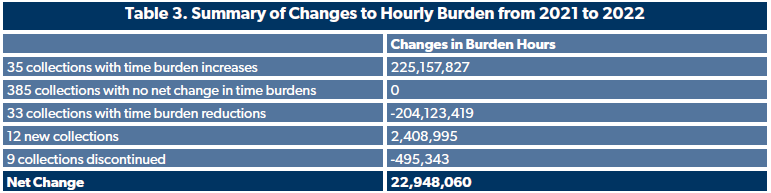

Table 3 provides a summary of the changes in tax time burden estimates from 2021 to 2022. Nearly 83 percent of the information collections were re-approved with no change. Nine forms were discontinued since last year, trimming over 495,000 hours off the total, and 12 new collections added 2.4 million hours. Several of the new forms implement additional reporting requirements pursuant to changes in the law for tax year 2022 including the No Surprises Act (related to independent dispute resolutions) and the IRA’s Advanced Manufacturing Production Credit.

There were 33 collections with lower time estimates, saving filers 204 million hours, most of which (186 million hours) was due to a revision in hours complying with Business Income Tax Returns despite an uptick in the number of expected filers (discussed below).

The biggest changes the IRS made were increased time burden estimates for 35 information collections by a total of 225 million hours. Nearly three-quarters of the change here was due to a revision of burden estimates under forms for Individual Income Tax Returns, also discussed below. Other notable burden hikes impacted U.S. Income Tax Return for Estates and Trusts by 26 million hours and U.S. Tax-Exempt Income Tax Returns by 15 million hours.

Elements of Complexity

Length of the Code

One reason for the complexity and confusion around tax compliance is the sheer size of the tax code. The income tax was originally enacted in 1913 at just 27 pages long. Amendments, regulations, and judicial rulings shortly after passage grew the code to 400 pages.[5] Over the course of the past century, lawmakers steadily introduced new provisions into the tax system, necessitating the creation of corresponding regulations. This expansion has ultimately resulted in a complex and labyrinthine tax system we have today.

Reports on the size of the tax code can vary widely depending on the formatting of columns, page widths, font, or margins in the documents. To standardize year-to-year comparisons, NTUF copies the texts of the tax code into Microsoft Word and uses that program’s word count feature. The results may not be perfect given the number of cross-references to various sections of law through the code, but it provides a consistent methodology, and was also used in the past by the Office of the Taxpayer Advocate to find that in 2017 the code had 4 million words.

After passage of the TCJA, the number of words began to fall, receding to 3.96 million by 2020. But the tax code is again expanding, ticking up to 4,085,524 words in the version published on the House of Representatives’ website in 2022.[6] The current version as of April 12, 2023 measures 4,138,788. However, the website notes that this release point excludes two bills from last year, both of which made a few revisions to the Internal Revenue Code, the James M. Inhofe National Defense Authorization Act for Fiscal Year 2023 and H.R.5961, which appears to have made some technical changes.

Frequent Changes to the Laws

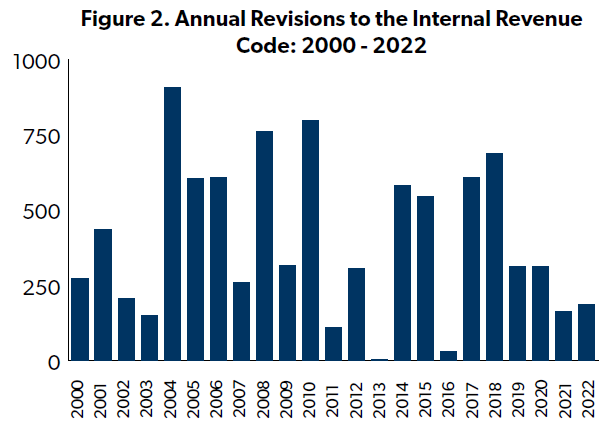

Lawmakers also make frequent revisions and additions to tax laws. From 2000 through 2022, Congress enacted, on average, 399 changes to the tax code each year (see Figure 2), ranging from just three in 2013 to 797 in 2010.[7] 187 changes were made to tax laws in 2022. It should be noted that frequent major changes to the tax code hamper administration of the code as well as compliance. While some enacted changes are more significant than others, they all generally require the IRS to update forms or instructions, information on its website, and in its various databases and case management systems. Additionally, this requires practitioners and filers to stay abreast of current information to be aware of changes that might impact their tax obligations or planning.

Regulation and Guidance

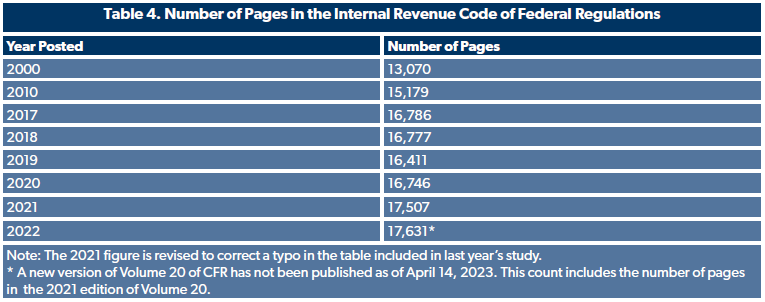

To interpret and implement all of these changes to tax laws, the Department of Treasury develops and publishes regulations across 22 volumes of the Code of Federal Regulations (CFR). The most recently available complete version of tax regulations, published online with revisions through April 2023, comprises a length of 17,631 pages (including tables of contents and additional introductory prefaces in each volume).[8]

In addition to issuing all these regulations, the IRS also releases regular guidance, notices, announcements, private letter rulings, and technical advice memorandums in response to various issues that arise.[9] Some of these pertain to individual cases and have limited scope, others may involve substantive interpretations of tax laws. For taxpayers with complicated finances, that is a lot of information to keep track of to ensure a proper understanding of applicable tax laws, regulations, and rulings.

Substandard Taxpayer Services

Getting direct assistance from the IRS can be difficult. The Taxpayer Advocate noted earlier this year that during the pandemic in 2021, only 11 percent of taxpayers calling the IRS were able to reach a live agent. Only minimal improvement was seen post-pandemic. There were 173.3 million call attempts to the IRS in 2022 with just 21.7 million – 13 percent – reaching a live assistor.[10]

After this year's filing season started up, the IRS claimed that it was achieving an 88.6 percent level of service rate.[11] However, there are some caveats regarding how this statistic reflects actual taxpayer experience when calling the IRS for assistance or information. As former Taxpayer Advocate Nina Olson explained in an online “Tax Chat!” panel discussion on April 13 organized by her current organization, the Center for Taxpayer Rights, the measure the IRS uses is the number of calls that were assisted by a live assistor divided by the number of calls that the phone system gated to a live assistor.[12] This means that the denominator is a subset of total calls and is not an adequate measure of the level of service for all incoming calls. The statistic raises many questions regarding whether the taxpayer received the information they wanted, whether they had other questions which would require calling back, or whether they had wanted to speak to a live assistor. The IRS's automated phone system no longer includes an option to be connected with an IRS agent.

Regardless, getting through to a live assistor is no guarantee that a taxpayer will get the hoped for assistance. One issue is that the agency has declared over 130 areas of the tax code as “out of scope” for telephone assistance.[13] The guidance means that IRS agents cannot answer questions about these specified areas of the tax laws. Similarly, IRS tax preparation assistance programs like the Volunteer Income Tax Assistance and Tax Counseling for the Elderly also cannot provide assistance or can only provide limited assistance for certain topics.[14]

Another issue related to getting through to a live assistor is that the agent who answers the phone might not be able to help a taxpayer because of the 60 different legacy case management systems run by the IRS. The agent on the other end of the phone might not be able to access the caller’s specific information. After decades of multiple attempts and billions of dollars spent to modernize the IRS information technology, its core program, the Individual Master File (IMF), is still based on 1960s-era assembly computer programming. In January, the Government Accountability Office noted that in 2021 the IRS had set a 2030 target date to replace the IMF but since then, IRS resources were shifted to other priorities. GAO determined that the schedule for completing the project was indeterminate as a result, and warned, “This will lead to mounting challenges in continuing to rely on a critical system with software written in an archaic language requiring specialized skills.”[15]

The new strategic plan from the IRS regarding its objectives for use of the IRA funding has set an ambitious goal of completing a replacement of the IMF in 2025.[16] The odds are stacked against that important goal being achieved given the rocky history of the IRS’s modernization efforts, and the limited funds available for that business system modernization in IRA – just $4.8 billion of the $80 billion plus-up to the IRS.

A lot of work is also needed to continue to improve taxpayer services to make it easier for filers to comply with the laws and get needed assistance. During the economic shutdown IRS agents, like many other workers, were not able to report to work. This led to a massive backlog of correspondence.

Over recent months, the IRS has been making steady progress to catch up on the stacks of letters and parcels that had piled up, but one action that it took during the shutdown made it easier for taxpayers to get information to the IRS by increasing the number of forms that could be submitted electronically rather than via snail mail. E-filing is easier for taxpayers and reduces the time and cost overheads that the IRS otherwise spends handling paper documents.

The IRS and Taxpayer Privacy: Persistent Security Risks Amidst Growing Data Collection

However, there is a threat to taxpayer privacy with the amount of data the IRS collects. In 2021, there was a serious breach of confidential taxpayer information to the media outlet ProPublica. It’s been nearly two years and the source of the leak has yet to be publicly identified.

A March 2023 report from the Treasury Inspector General for Tax Administration, following up on previous reports, warns that security risks persist in the IRS’s case management system. Among the issues raised are that activity logs need to be better monitored to see who is accessing and modifying data, and inactive accounts need to be deactivated on a stepped-up timetable to restrict unauthorized access.[17]

Yet, despite these risks, the IRS is vacuuming up more and more data. The agency gathers income information on taxpayers from employers, banks, and other third parties. The IRS uses this information to verify data included in tax returns from filers.

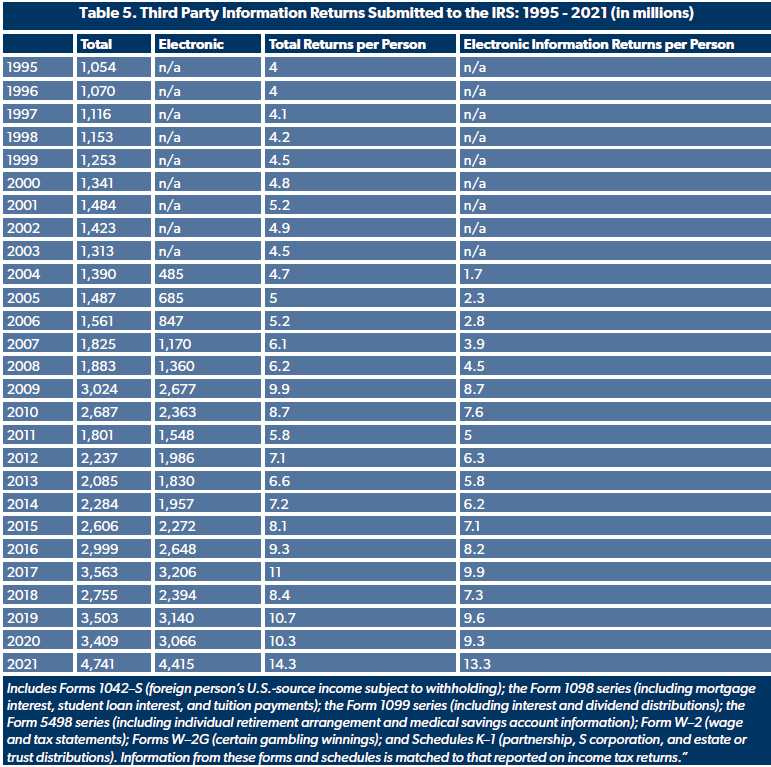

Table 5 shows the volume of total third-party information returns since 1995 and the growth in e-filing of these forms starting in 1995. The IRS now collects an average of 14 third party forms for every person in the country.

There are frequent proposals to have the IRS to collect even more data on taxpayers. The original version of the Build Back Better Act (which eventually became the IRA) proposed that every financial institution report to the IRS on accounts with net annual inflows and outflows of greater than just $600 per year, an extremely broad threshold that would have sent a torrent of additional information to the IRS on nearly everyone with a bank account. After pushback regarding the privacy concerns with this proposal and the costs of the reporting mandates on financial institutions, the administration scaled back the proposal, suggesting a $10,000 threshold while exempting payroll deposits (and spending up to the level of payroll deposits). Even so, this new threshold could still have captured data on the vast majority of Americans.[18]

Ultimately, this financial surveillance scheme was left out of the final version of the IRA. In addition to the security risks, the proposals also raised questions on whether the IRS could even handle this enormous flood of data, given the state of its information technology.

The Complexity Burden of Sections of the Tax Code

Overview of Tax Forms

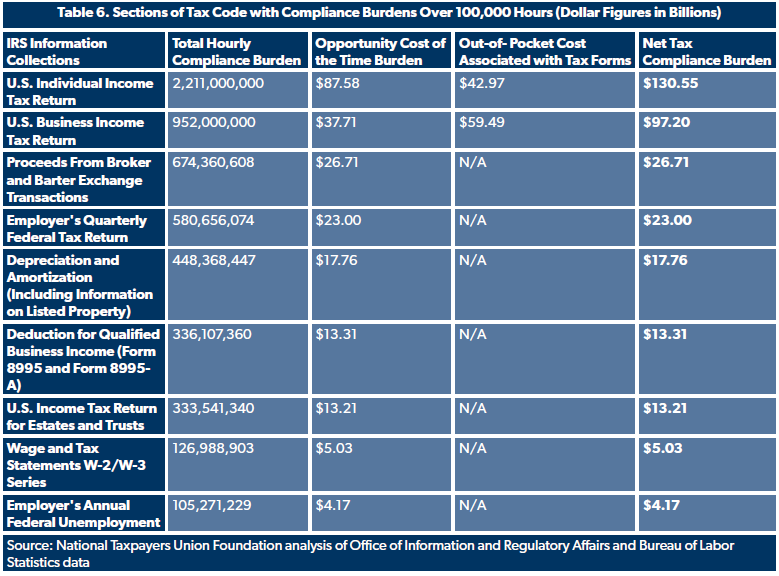

Table 6 breaks out the latest data on compliance burdens for the nine information collections with an annual compliance burden in excess of 100,000 hours. The top two areas, the individual and business tax forms, are discussed below.

The third area concerns forms for Proceeds from Broker and Barter Exchange Transactions. The notorious Form 1099-B, for brokers to report capital gains and losses, takes up over 674 million hours of compliance. It is astonishing that the IRS expects to receive 1.4 billion submissions of this form, nearly 4 filings for every person in the country. Tax preparers have long ranked it as the worst tax form of all.

As noted, the IRS has only estimated the out-of-pocket expenses for two of these information collections. Out of the 465 collections in the IRS’s inventory, just 18 include an associated out-of-pocket cost estimate.

For some of the 447 information collections showing no expenses, the cost is undoubtedly minimal, especially in cases where there is very little time involved with filling out the form. For example, W-2 forms are quick to fill out. There are also some forms with very few users. For example, the IRS estimates that just one filer uses TD 9199 - Diesel Fuel and Kerosene Excise Tax; Dye Injection and that it takes one minute to complete. The collection was added in 2005, at the time there were 1000 respondents, up to 1667 in 2008, then dropped to 667 in 2012, then down to 12 in 2019.

But having just a few users of a form doesn’t necessarily mean that there is no associated out of pocket expense. The IRS expects just one filer to submit a Return by a Shareholder Making Certain Late Elections To End Treatment as a Passive Foreign Investment Company.[19] The IRS estimates it will take 79 hours but has not estimated the out-of-pocket costs associated with it. They use the stock language:

To ensure more accuracy and consistency across its information collections, IRS is currently in the process of revising the methodology it uses to estimate burden and costs. Once this methodology is complete, IRS will update this information collection to reflect a more precise estimate of burden and costs.

One wonders if they tried to ask this unique filer about the related expenses. Somehow, the supporting statement calculates that the Annual Cost to the Federal Government for this form is $25,237.

There are numerous Supporting Statements that use the same stock language noted above. The IRS conducts surveys of taxpayers to gather data on time burdens and expenses. Collections are also posted for public comment in the Federal Register.

By taking some extra time to provide feedback to the IRS through its surveys and requests for feedback, taxpayers could do themselves a favor down the road. With better data, the IRS and policymakers will have a better idea of problem areas of the tax code, those which impose undue time and expense burdens relative to the amount of taxes they collect.

The IRS should also explore ways to raise awareness of these surveys and to improve its compliance with the Paperwork Reduction Act. IRS officials and researchers participate in many symposiums with scholars and think tanks that focus on ways to improve tax compliance. The missing out-of-pocket expenses should be included in those discussions. This information is also important for lawmakers to identify particularly problematic areas of the tax code where the associated financial and time burdens are excessive.

The Overall Individual Income Tax Compliance Burden

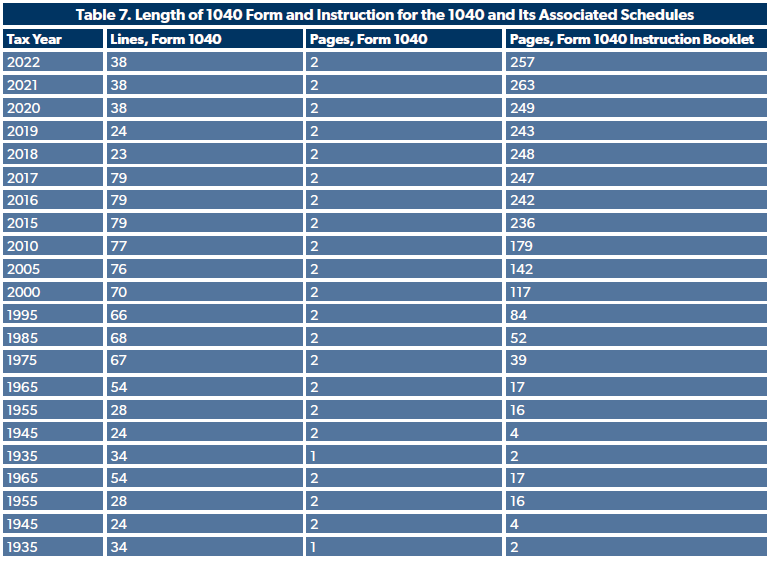

The part of the tax code that most Americans are familiar with is the Form 1040 and its associated schedules and filings under the individual income tax. Filers had fewer pages of instructions to wade through this year as the basic form instructions were one page shorter and the instructions for three of the 1040 schedules were shorter than a year ago.

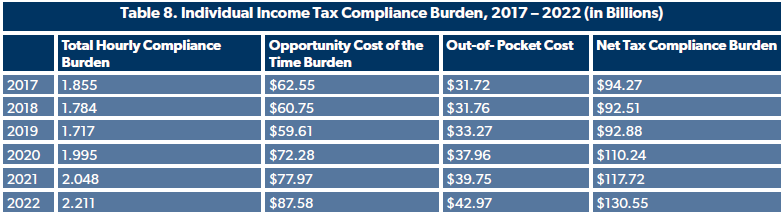

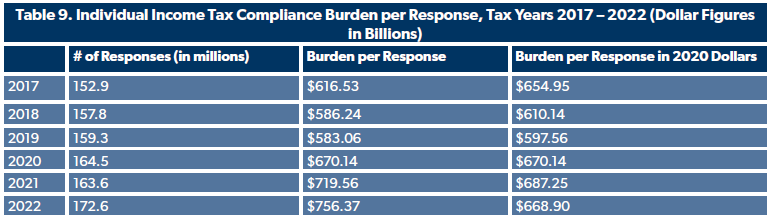

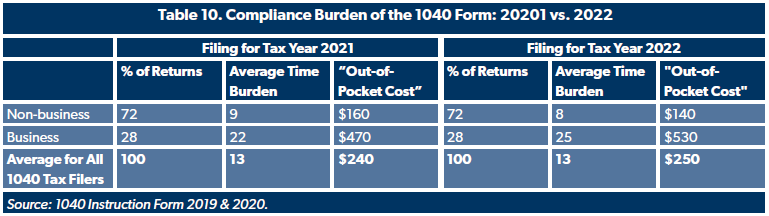

As shown in Tables 8 and 9, the number of respondents using the 1040 form this tax season is expected to grow significantly, reflective of the improved economy and more individuals returning to employment. As seen in Table 10, below, non-business filers using the 1040 spent one less hour preparing and filing their taxes and had lower out-of-pocket costs compared to last year. This is reflective of temporary changes enacted during the pandemic that have expired. Overall time burden and out-of-pocket expenses have increased but with the rise in the number of filers, the net tax compliance burden per taxpayer is down from last year in constant 2020 dollars.

It is also important to be aware that the experience of different taxpayers can vary greatly from the average time burden calculated by the IRS. Individuals have much lower time burdens (eight hours) than pass-through businesses (25 hours, three more than in 2021) that file individual income taxes. The out-of-pocket costs for business filers also increased by 13 percent to $530 per return.

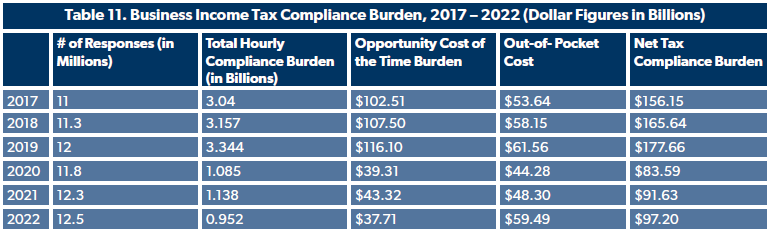

Business Income Tax Compliance Burden

Corporations and certain partnerships file taxes using Business Income Tax returns. The newest data shows that the number of filers ticked up, but the overall time burden and out-of-pocket expenses dropped. The IRS notes that there were no significant year over year adjustments in burdens due to legislative changes. Instead, the agency attributes the changes to technical adjustments in the model it uses to estimate taxpayer burdens. As noted above, the IRS uses survey information to assess the time and expenses involved in tax preparation, and there can be a lag in incorporating this information into its current model. The IRS explains:

The estimated change in burden is primarily due to the transition from tax year 2016 survey data and associated model to recently available 2019 survey data and associated model. The technical adjustment associated with the tax year 2019 model leads to an overall decrease in total monetized burden of 3.5% (-$3.828B). The overall change in burden between models is modest but there is a more significant change in the allocations of burden between its components (time and money). The tax year 2019 model allocates a larger share of total burden to money than the previous model. The updated survey data and a refinement to the allocation method resulted in this change.

As with the Individual Income Tax Returns, the averages are reflective of a wide-range in burdens imposed on different businesses. For example, large partnerships, with assets over $10 million, spend an average of 770 hours on taxes versus 65 hours for small partnerships.

Improving the IRS and the Tax Code

The IRS has been granted an infusion of $80 billion by the IRA, with nearly $46 billion locked in for enforcement. Given the current political divide in Congress, efforts to repeal this funding will likely be unsuccessful in the near future. But several non-partisan tax experts, including National Taxpayer Advocate Erin Collins, have called on Congress to re-allocate some of the $46 billion reserved in the law for tax enforcement to other areas. This money would be better spent on improving taxpayer services and helping the IRS achieve other operations goals such as replacing its legacy Individual Master File.

As noted, the IRS should also step up its efforts to comply with the Paperwork Reduction Act and calculate the costs associated with forms. More transparency regarding its taxpayer burden models could help improve the situation so that outside experts could review the process and suggest improvements.

One simple way to improve transparency would be to separate information collections that have no actual cost from those where the cost is indeterminate. This way, users of the data would not have to wade through successive pages and attached Supporting Statements to find that out. The information on OIRA’s paperwork burden database should specify that a cost is indeterminate instead of listing it as $0.

With improved data, lawmakers could then review those areas of the code that impose excessive burdens and hassles on taxpayers. Additionally, as Congress considers new changes to the tax law, it should call on IRS experts who work on the taxpayer burden model to include the complexity impacts on taxpayers in their evaluation of proposed legislation.

Conclusion

This year’s rise in time spent on tax burdens was relatively small, but with the costs of goods and services increasing due to inflation, people’s time becomes increasingly valuable. The net tax compliance cost of $364 billion represents a drain of financial resources spent on tax preparation.

Looking ahead, taxpayer headaches can be expected to rise as a result of the IRA’s focus on enforcement over taxpayer service, and recent tax changes such as a lower threshold for reporting 1099-K forms (this was supposed to go into effect for this tax season but was administratively delayed for one year), a new corporate alternative minimum tax, and a stock buyback tax.

In the end, lawmakers bear responsibility for addressing the challenges posed by our convoluted and progressively intricate tax system. Simplification of tax laws will ease compliance burdens on taxpayers and reduce overhead costs of administering the tax system.

[1] Office of Information and Regulatory Affairs. “Inventory of Currently Approved Information Collections.” Retrieved on April 7, 2023 from https://www.reginfo.gov/public/do/PRAMain.

[2] Bureau of Labor Statistics. “Employer Costs for Employee Compensation – December 2022.” March 17, 2023. https://www.bls.gov/news.release/pdf/ecec.pdf.

[3] Amazon, Inc. Form 10-K For the Fiscal Year Ended December 31, 2022. 2023. https://d18rn0p25nwr6d.cloudfront.net/CIK-0001018724/d2fde7ee-05f7-419d-9ce8-186de4c96e25.pdf#page=23.

[4]Brady, Demian. Increasing Complexity Brings Back Bigger Compliance Burdens. National Taxpayers Union Foundation. April 18, 2022. https://www.ntu.org/library/doclib/2022/04/2022-tax-complexity.pdf.

[5] Wolters Kluwer, CCH. “Fact Sheet: 100-Year Tax History: The Length and Legacy of Tax Law.” 2013. Retrieved from: https://www.cch.com/wbot2013/factsheet.pdf.

[6] Office of the Law Revision Counsel. United States Code: Current Release Point. March 20, 2023. https://uscode.house.gov/download/download.shtml.

[7] Office of the Law Revision Counsel. United States Code Classification Tables. https://uscode.house.gov/classification/tables.shtml.

[8] U.S. Government Publishing Office. Code of Federal Regulations (Annual Edition). 2022. Retrieved from: https://www.govinfo.gov/app/collection/cfr/

[9] Internal Revenue Service. Understanding IRS Guidance – A Brief Primer. May 31, 2022. https://www.irs.gov/uac/understanding-irs-guidance-a-brief-primer.

[10] National Taxpayer Advocate. Annual Report to Congress 2022. January 11, 2023. https://www.taxpayeradvocate.irs.gov/reports/2022-annual-report-to-congress/full-report/.

[11] Bogage, Jacob. “IRS Clears Confusion over State Stimulus Payments in More than 20 States.” The Washington Post. February 10, 2023. https://www.washingtonpost.com/business/2023/02/10/irs-taxes-state-inflation.

[12] Center for Taxpayer Rights. “Tax Chat! The IRS Budget” April 13, 2023. https://taxpayer-rights.org/taxchat/.

[13] Internal Revenue Service. Accounts Management and Compliance Services Overview. July 27, 2022. https://www.irs.gov/irm/part21/irm_21-001-001.

[14] Internal Revenue Service. VITA/TCE Volunteer Resource Guide. October 2022. https://www.irs.gov/pub/irs-pdf/p4012.pdf.

[15] Government Accountability Office. Information Technology: IRS Needs to Complete Modernization Plans and Fully Address Cloud Computing Requirements. February 7, 2023. https://www.gao.gov/products/gao-23-104719.

[16] Internal Revenue Service. Internal Revenue Service Inflation Reduction Act Strategic Operating Plan: FY 2023 – 2031. April 5, 2023. https://www.irs.gov/pub/irs-pdf/p3744.pdf.

[17] Treasury Inspector General for Tax Administration. The Enterprise Case Management System Did Not Consistently Meet Cloud Security Requirements. March 27, 2023.

https://www.tigta.gov/sites/default/files/reports/2023-03/202320018fr.pdf.

[18] Wilford, Andrew and Brady, Demian. A Deeper Dive on IRS Snooping. October 27, 2021. https://www.ntu.org/foundation/detail/a-deeper-dive-on-irs-snooping.

[19]Internal Revenue Service. Supporting Statement: Return by a Shareholder Making Certain Late Elections To End Treatment as a Passive Foreign Investment Company. August 12, 2022.

https://www.reginfo.gov/public/do/PRAViewICR?ref_nbr=202206-1545-004.