(pdf)

Introduction

Last year, a last-minute administrative change saved taxpayers from an enormous tax compliance headache. But that bureaucratic band-aid did not solve the problem, only punting it a year down the line. Unless Congress acts to create a more permanent fix, millions of taxpayers casually selling goods online could be expected to report that income to the IRS — a deluge of information the IRS seems to be ill-prepared to handle.

As a result of the American Rescue Plan Act of 2021 (ARPA), third-party payment vendors will be required to report information to the Internal Revenue Service (IRS) for gross transactions of at least $600 — information that taxpayers will also be required to report on their individual income tax returns. Before ARPA, the threshold for having to file a 1099-K form was much higher, requiring at least 200 transactions and $20,000 in gross value of sales.

If the proposal is left in place, people who sell casually online or use services like Venmo could be in for a taxing surprise at the end of the year, even though the financial transaction data reported on the 1099-K is not necessarily taxable. Many more people will potentially be impacted than the IRS is counting on, which would leave the agency blindsided by the cascade of forms describing transactions that have no implications for an individual’s taxes. Taxpayers and the IRS need relief from the outsized burdens imposed by this "Rescue Plan Act" provision.

Projections

ARPA set January 1, 2023 as the effective date for third-party settlement organizations being required to generate 1099-K forms for taxpayers who received more than $600 in a calendar year. However, on December 23, 2022, the IRS announced it would delay implementation, citing the need to smooth the transition and ensure clarity for taxpayers, tax professionals, and businesses. As it now stands, the lower threshold is now in effect for transactions occurring in 2023, and will result in a significant increase in the projected numbers of 1099-K forms starting in 2024 (when taxes for 2023 are filed).

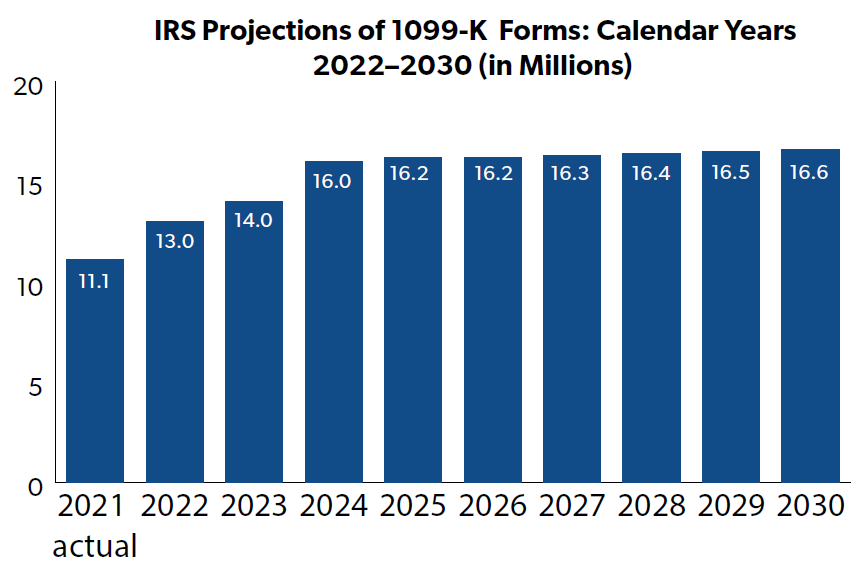

In Publication 6961, the IRS projects the number of various forms it expects to receive over the next decade. The data for Form 1099-K shows that the IRS received 11,088,745 in 2021 and 12,980,900 1099-Ks in 2022.

The IRS projects the number of 1099-K Forms filed will increase to 14 million in 2023 and 16 million in 2024, a jump of 23 percent in just two years. From 2025 through 2030, increases are projected to average 1 percent per year.

It is highly likely that the IRS is underestimating. Consider that eBay has over 18 million active sellers, Etsy has nearly 6 million, and over 78 million people use Venmo, in addition to other third-party payment networks. In our review of the potential paperwork burdens associated with the lowered reporting requirement, we warned:

With the lower threshold, it is easily conceivable that tens of millions of new 1099-K forms will be reported this year. This will increase compliance burdens and cause a great deal of unnecessary confusion for an as-yet countless number of taxpayers, many of whom stand to receive the forms from multiple vendors.

Other tax and industry experts concur:

Glenn Harper, owner of Harper & Company CPAs in Columbus, Ohio: “The amount of paperwork that's going to fly from these companies to all the millions of people that do this is going to be astronomical. Is it an accounting nightmare for people? Yeah, because nobody reported this income before.”

Kelley R. Taylor, Senior Tax Editor of Kiplinger.com: " ... [U]nless Congress takes action, millions of people who sell goods or services online should prepare now for the new reporting requirement."

Coalition for 1099-K Fairness: "The coalition estimates that as many as 40 million Americans will get one of these forms in January ahead of the filing deadline for 2022 taxes."

The Lower Threshold Sows Complexity and Confusion

The previous 200/$20,000 threshold provided a predictable safe harbor for people who sell online or only make occasional and primarily non-taxable sales. Taxpayers could easily exceed the new threshold by holding a garage sale, selling their used college textbooks online, or by using smartphone apps to transfer money to family and friends. Even though selling used personal goods for less than they were purchased for, or sending money to friends to reimburse them for concert tickets are not taxable events, the IRS and the taxpayer would still get a 1099-K at the end of the year. Many taxpayers will be misled into thinking they have a tax obligation or lack the substantiation to prove to the IRS that the full amount should be not be taxable

Even though the implementation of the new, lower threshold was delayed, it is still creating confusion and complications:

Jennifer Galstad-Lee, a senior manager in the tax group at GRF CPAs & Advisors in Bethesda, Maryland: “When [sellers] do small-dollar-amount sales, and it's a side gig, it becomes more difficult to show the basis. For the general public, who are not in the business and just happen to do small sales here and there, and they suddenly receive something like this, I think it can add more difficulty on them."

Adam Markowitz, an enrolled agent and vice president at Luminary Tax Advisors in Windermere, Florida: "Many parents don’t realize teens need to report [Peer-to-Peer] income [from side hustles] at tax time. I can’t even count how many times I’ve had to deal with that. And the 1099-K situation is going to make that harder.”

Steven J. Weil of RMS Accounting: "When this plan is fully implemented, I would bet that many will be unprepared to prove to the IRS that the $500.00 received from a friend was for their share of the football tickets bought so they could go to the game with you, or that the money you got from other PTA moms for giving their kid the lunch money that was left at home."

Carol Roth, a small business advocate: "This impacts hobbyists, moms and anyone using technology to receive payments, all who now have to run their life as a business. It shifts additional record keeping work and other time burdens on to the average American."

Commenter on an eCommerceBytes.com article on the new threshold: "If you're holding a garage sale, whether in your yard or online, should you really have to try to figure out what your cost was for each item? Last year I sold about 150 items on eBay, as a hobbyist, not a business, mostly obtained in the 1970s. There were a few things for which I had a record of the price, but mostly I had to put down my cost as 0, because the IRS doesn't like sellers to guess. So I paid tax I really shouldn't have had to, in addition to it being time-consuming, i.e., painful, to do the 8949 [IRS form for Miscellaneous Determination Requests]."

Taxpayers will be confused by the receipt of 1099-K forms and end up overreporting their income. Many taxpayers receiving a 1099-K for these hobby transactions may be receiving it for the first time, and therefore unaware that it can describe transactions that are non-taxable. This could lead to taxpayers reporting the entire contents of the form as taxable income on their income tax return.

Even when taxpayers understand the basics of the 1099-K form, they may still end up overreporting income on the specifics. For example, the gross dollar amount reported in the 1099-K could include costs for postage and shipping. These funds do not remain with the seller, yet they will be shared with the IRS, increasing complexity and headaches for the sellers.

The IRS has published guidance that is supposed to explain what information that appears in a 1099-K form will be taxable or not, and how to report that. But the guidance, already updated once, is not clear to ordinary taxpayers. IRS spokesperson Eric Smith told AARP:

We have been meeting with, and soliciting input from, interested stakeholder groups and that consultation process will influence what reporting guidelines will look like on next year’s return. It’s possible that our guidelines may evolve or be refined as the year goes by, based on public input and other factors, but at this point, this is what they are.

The IRS is also supposed to comply with the Paperwork Reduction Act (PRA) by estimating the number of forms that will be sent out and the time burden imposed on the taxpayers. This information is published by the Office of Management and Budget's Office of Information and Regulatory Affairs (OIRA). We noted last year that the IRS had not updated its official estimate in accordance with the lower ARPA threshold. Even after the delay of implementation, the IRS has still not updated this estimate. Another agency, the Office of Management & Budget shows that for PRA compliance, the IRS had estimated that it would receive 9.4 million 1099-K forms. When the estimate was updated earlier this year, the IRS wrote, "It is anticipated that there will be 10,400,000 respondents annually and the per response time would be 28 minutes per respondent." In other words, the IRS is estimating 10.4 million returns in one place and over 14 million returns in another. It is unclear why there is a discrepancy between the IRS estimates available on OIRA's database versus its Publication 6961.

Importantly, the time burden reported above only applies to the third-party vendors responsible for generating those 1099-Ks. The estimate does not calculate the impact on taxpayers, many of whom are likely to receive 1099-Ks from multiple vendors. Paperwork burdens of the federal government's forms are supposed to take into account the amount of time spent gathering receipts, making sense of the tax laws and forms, filling out the forms, and submitting them to the IRS. None of that is accounted for in the burdens reported directly with the 1099-K form. There is also no indication that the IRS has accounted for the 1099-K's impacts on taxpayers in its paperwork burden associated with the individual income tax, which already imposes over 2.2 billion compliance hours.

Not only has the IRS underestimated the sheer volume of 1099-K forms set for release later this year, it has not adequately accounted for the time burdens imposed on taxpayers. Getting these calculations is important so that policymakers can make sure that the costs imposed by tax laws are not disproportionate to the revenues the government hopes to collect.

Administrative Headaches

The confusion and complexity doesn't just impact taxpayers and preparers, but also the IRS itself. IRS Commissioner Daniel L. Werfel testified before the Senate Finance Committee on April 19, 2023 and noted that ARPA's 1099-K threshold was paused because the agency was "not ready to administer in a way that provides taxpayers the clarity they need." He also noted that it is complicated to administer.

When asked by Representative Carol Miller (R-WV) if the IRS would welcome the return to the previous threshold, Werfel replied:

I cannot opine on the wisdom or the preference of a particular policy outcome, but I will share that a change in the threshold would be easier to administer and so at my seat of the table I’d say the IRS would have an easier time of administering it.

Not moving forward with the lower $600 threshold would reduce the volume of forms going out, thereby reducing confusion and paperwork hassles for taxpayers while also reducing IRS's administrative complexities associated with 1099-K.

Reform Options

There is bipartisan support to address this problem, but currently there is a difference on exactly how. For example, there are several Republican proposals to repeal the ARPA threshold level:

Rep. Carol Miller (R-WV) has introduced the Saving Gig Economy Taxpayers Act (H.R. 190);

Sen. Rick Scott (R-FL) has introduced the Blocking the Adverse and Dramatic Increased Reliance on Surveillance (BAD IRS) Activities Act (S. 123);

Rep. Michelle Steel (R-CA) and Sen. Bill Hagerty (R-TN) have introduced the Stop the Nosy Obsession with Online Payments (SNOOP) Act of 2023, (H.R. 488/S. 26);

House Ways and Means Chair Jason Smith (R- MO) has introduced the Small Business Jobs Act (H.R. 3937).

Rep. Chris Pappas (D-NH) introduced the Cut Red Tape For Online Sales Act (H.R. 3530), which would raise the threshold for reporting to $5,000 and have the IRS clarify when sellers need to file the 1099-K form. In the previous Session of Congress, Sen. Maggie Hassan (D-NH) introduced companion legislation in the Senate as S. 3840, but it has not yet been introduced in the current Congress.

Another promising bipartisan option from Senate Banking Committee Chair, Sen. Sherrod Brown (D-OH) and Senate Health, Education, Labor, and Pensions Committee Ranking Member Bill Cassidy (R-LA) is the Red Tape Reduction Act (S. 1761), which would raise the threshold to $10,000 and 50 transactions Sen. Brown stated, “By raising the threshold, we can prevent the IRS from interfering with minor transactions and cut down on excessive paperwork.”

While these proposals vary on the exact threshold, they all would provide meaningful relief to taxpayers, protecting individuals with very minimal levels of online sales from unnecessary tax compliance burdens.

Smith’s Small Business Jobs Act, which also includes additional tax reforms such as increasing immediate expensing for small businesses, was passed by Ways and Means in June. Regarding the 1099-K provision, Smith stated, “The last thing Americans want is a government crackdown on selling a used couch, concert tickets, or paying your neighbor’s kid to mow the lawn.”The House is expected to take up the package later in July.

The Congressional Budget Office analysis of the bill estimates that a return to the previous 200/$20,000 threshold for the 1099-K would provide $882 million in average annual tax relief through 2033. An estimate for Rep. Pappas’s proposal is not currently available.

Conclusion

The IRS paused the implementation of ARPA’s dramatically lower $600 threshold last December because of the confusion and complexity looming over taxpayers. Earlier this year, the IRS’s Commissioner Werfel warned that the current statutory threshold also presents serious administrative challenges.

We are now halfway through 2023 and all of these concerns remain unaddressed. Despite IRS attempts at providing guidance, there is still a lack of clarity on how this provision will be fairly implemented to protect unwitting taxpayers from overreporting their income and paying more taxes than they should.

As it stands, huge paperwork burdens will be imposed on taxpayers to prove which transactions reported to the IRS on the 1099-K are not actually taxable income — and on the IRS to trawl through mountains of often-irrelevant tax forms. Lawmakers should re-establish a meaningful safe harbor to provide relief for taxpayers from onerous paperwork burdens.