Tax season will officially begin on January 26 this year with most tax returns due on April 15. Taxpayers can expect welcome continuity as the One Big Beautiful Bill Act (OBBBA) permanently extends several important tax policies while introducing new deductions that millions of taxpayers may be eligible to claim.

OBBBA prevents a tax increase for nearly 80% of taxpayers by locking in the lower tax rates and higher standard deduction from the Tax Cuts and Jobs Act of 2017 that were due to expire at the end of 2025. The law also creates new tax deductions targeted at working families, further reducing taxes for millions of households. These changes deliver an average tax cut of more than $3,700 per taxpayer this year.

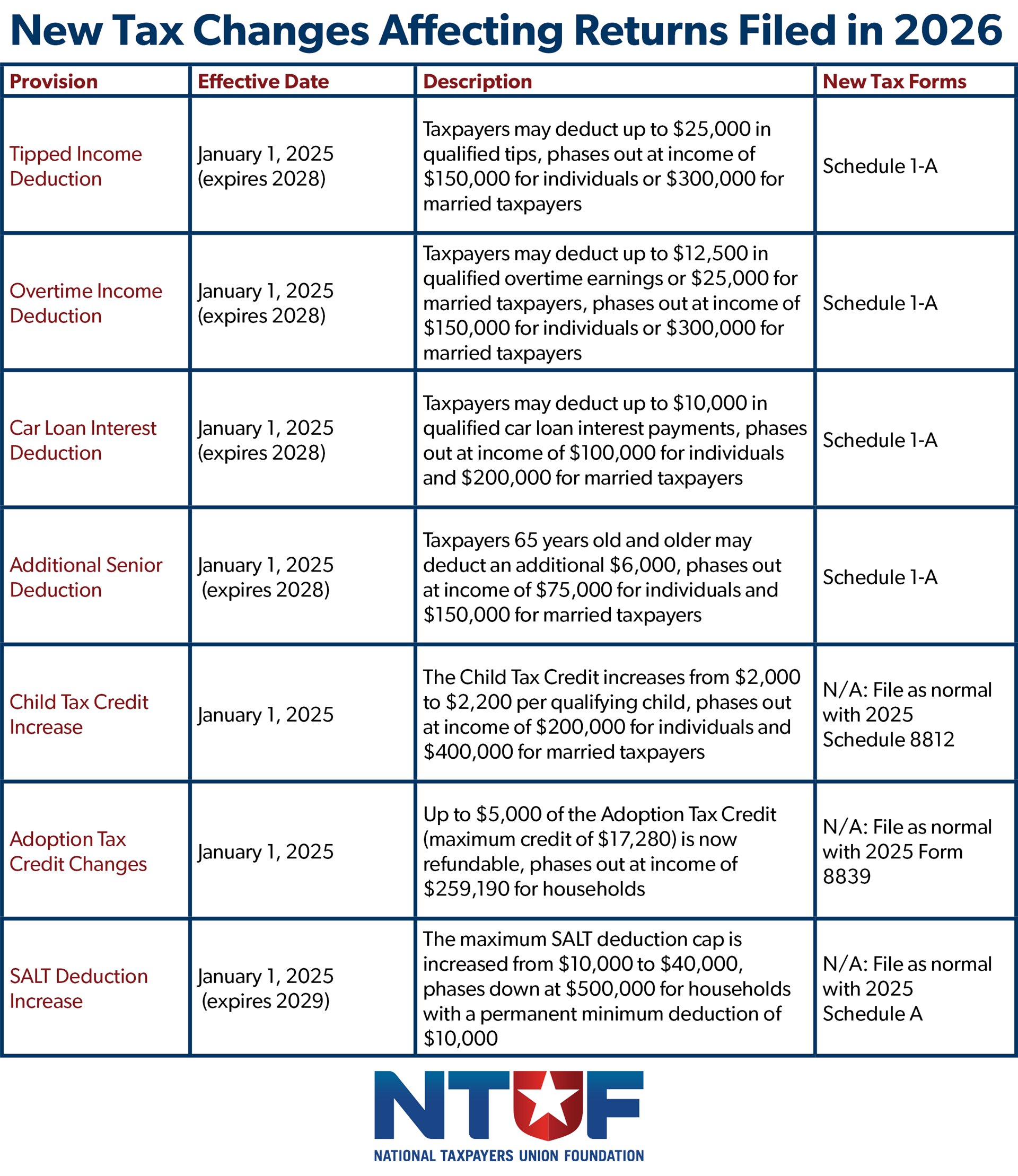

Importantly, OBBBA’s new individual tax deductions were enacted retroactively, meaning that taxpayers can claim these deductions for all 2025 earnings. Most of OBBBA’s provisions affecting individuals took effect in 2025, but some changes begin in 2026 and will require recordkeeping for 2027 tax returns.

As the IRS continues to release guidance on the implementation of OBBBA, there is already enough information available for taxpayers to confidently file their tax returns on January 26 when filing season begins. Taxpayers should keep in mind the following information:

- Free File, a long-standing public-private partnership between the IRS and private tax software providers, is available as a free tax filing option for taxpayers with adjusted gross income of $89,000 or less. After careful consideration, the IRS has ended its duplicative and costly in-house tax filing software Direct File.

- The IRS is phasing out paper checks for individual taxpayers, so taxpayers should use direct deposit for any refunds and pay tax due online.

- Schedule 1-A is the newly created form taxpayers must use to claim the deductions for tips, overtime, car loan interest, and the additional senior deduction.

- Limitations apply to the new deductions. For example, no tax on tips may only be applicable to tips received through approximately 70 occupations, no tax on overtime only applies to W-2 employees and those classified as non-exempt under the Fair Labor Standards Act (FLSA), and no tax on car loan interest only applies to new vehicles made in the United States.

- State income tax and other federal taxes may still apply despite new federal tax deductions. For example, employees must pay payroll taxes on all tip and overtime income regardless of the deduction.

- The IRS is providing employers with penalty relief for reporting on W-2 forms, so some taxpayers may need to rely on personal recordkeeping or payroll statements to determine eligible amounts of tip or overtime income.

Beyond major deduction, OBBBA includes other changes that may affect certain taxpayers this filing season.

Thanks to OBBBA, third-party service organizations are no longer required to send millions of taxpayers 1099-K forms. The American Rescue Plan Act of 2021 previously reduced the 1099-K threshold from 200 transactions and transaction value of $20,000 to a significantly lower transaction value of $600 with no minimum amount of transactions. Last year’s tax reform restores the original safe harbor threshold. Millions of taxpayers who may have seen confusing 1099-K forms for amounts that were not actually taxable income will be less likely to receive those forms this year.

OBBBA also makes important tax changes for telehealth services and education expenses. The law eliminates a previous rule that forced some taxpayers to choose between using telehealth services and contributing to their Health Savings Account (HSA). As of January 1, 2025, taxpayers can use telehealth services before meeting their high-deductible health plan (HDHP) deductible and still contribute to their HSA. For education, as of January 1, 2025, the definition of “qualified higher education expenses” is expanded to include new eligible expenses for purposes of 529 Account distributions.

Additionally, taxpayers expecting a tax credit for the purchase of an electric vehicle may no longer be eligible for those credits. OBBBA eliminated the Inflation Reduction Act’s electric vehicle tax credit for vehicles purchased after September 30, 2025. Vehicles purchased earlier in the year are still eligible for the credit.

Finally, parents with eligible children, especially those born in 2025, may open a Trump Account when filing their taxes, according to the government’s official website for the accounts. OBBBA created Trump Accounts as a form of tax-advantaged investment account for American children with a valid Social Security Number. The U.S. government will deposit $1,000 in each Trump Account for children born in 2025 through 2028.

As taxpayers approach the start of tax season on January 26, many can expect significant tax relief from OBBBA. The IRS is expected to continue to release guidance on both new tax laws and new procedures leading up to the tax filing season. Submitting detailed and accurate records in a good-faith effort to comply with the law will be crucial for taxpayers seeking to maximize their refunds and ensure compliance.