Every fall, the Internal Revenue Service adjusts the federal income tax brackets, the standard deduction, and other thresholds of the tax code for inflation.

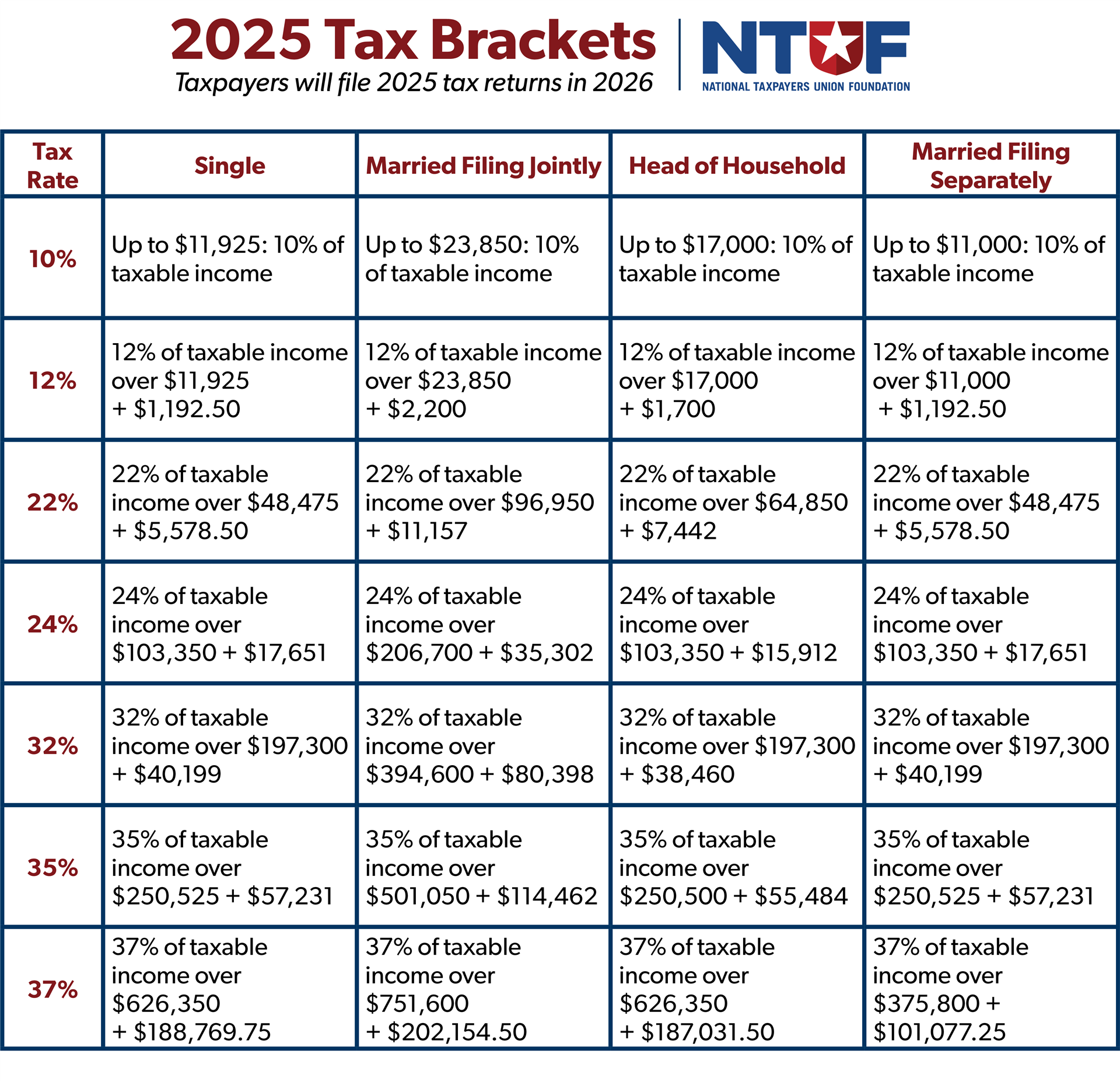

Below are the tax brackets for income earned in 2025, which taxpayers file a return for in 2026. Taxable income equals adjusted gross income minus deductions or exemptions. One common deduction taken by most taxpayers is the standard deduction, which, in 2025, is $15,750 for single filers and married filing separately, $31,500 for married filing jointly, and $23,625 for head of household filers. (The amounts originally were going to be $15,000 for single filers and married filing separately, $30,000 for married filing jointly, and $22,500 for heads of household filers, but these were changed by the One Big Beautiful Bill (OBBB) Act signed into law on July 4, 2025.)

Other key adjustments for tax year 2025 include:

- Flexible Spending Account (FSA) contribution limit is $3,300, and maximum carryover amount is $660.

Health Spending Account (HSA) contribution limit is $4,300 for self-only and $8,550 for family.

Alternative Minimum Tax (AMT) exemption amount is $88,100 ($137,000 for married filing jointly) and begins to phase out at $626,350 ($1,252,700 for married filing jointly).

Earned Income Tax Credit (EITC) maximum amount is $8,046.

Qualified Transportation Fringe amount is $325 per month.

Foreign earned income exclusion is $130,000.

Estate tax exclusion amount is $13,990,000.

The gift tax exclusion is $19,000.

401(k) contribution limit is $23,500 for employee contributions. Catch-up contribution limit for age 50 or over is $7,500.

The deadline for filing 2025 taxes, paying any tax owed, or requesting an extension is Wednesday, April 15, 2026.

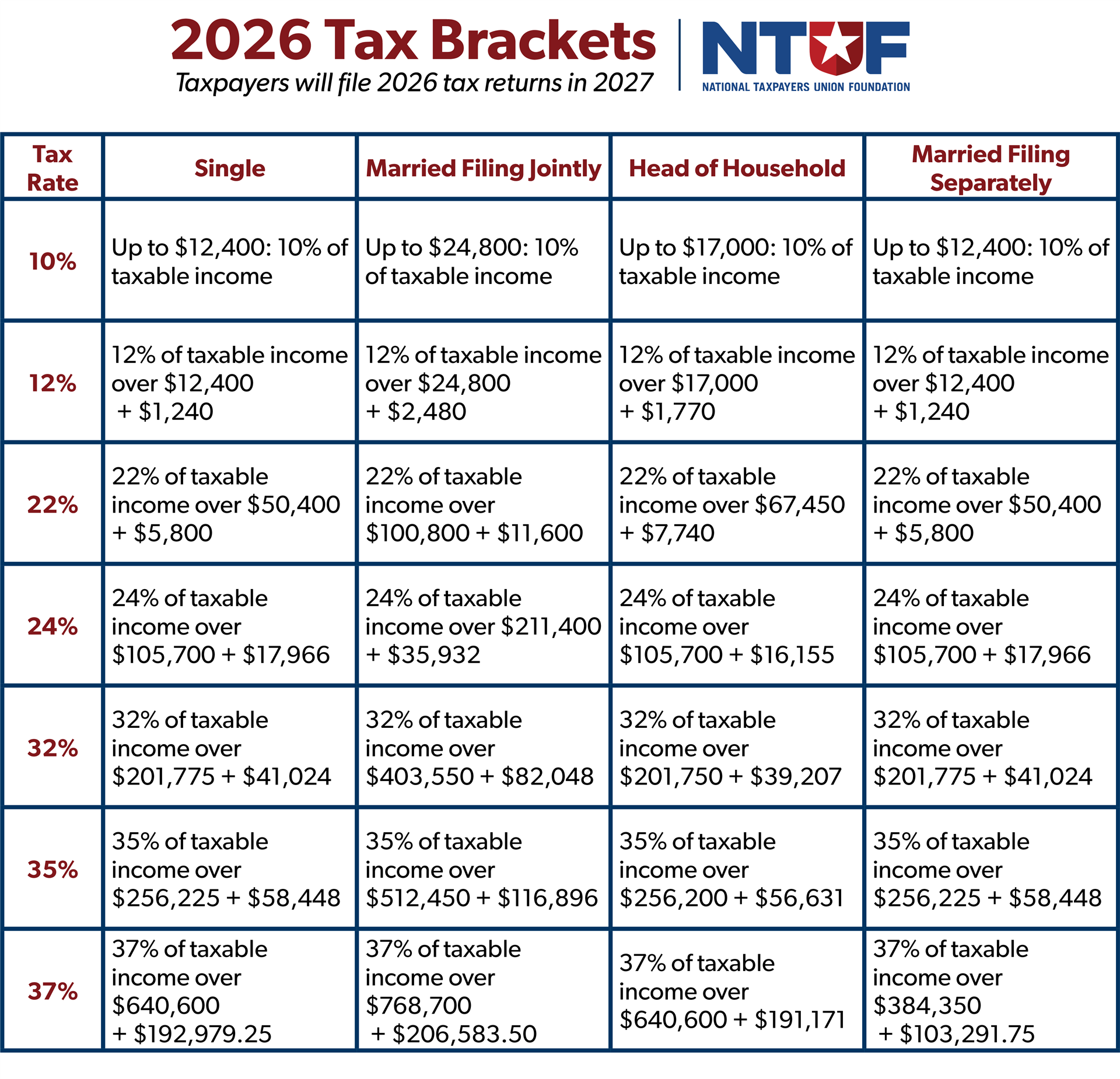

The 2026 standard deduction will rise to $16,100 for single filers and married filing separately, $32,200 for married filing jointly, and $24,150 for heads of household filers.

Other key adjustments for tax year 2026 include:

Flexible Spending Account (FSA) contribution limit is $3,400, and maximum carryover amount is $680.

Health Spending Account (HSA) contribution limit is $4,400 for self-only and $8,750 for family.

Alternative Minimum Tax (AMT) exemption amount is $90,100 ($140,200 for married filing jointly) and begins to phase out at $500,000 ($1,000,000 for married filing jointly).

Earned Income Tax Credit (EITC) maximum amount is $8,231.

Qualified Transportation Fringe amount is $340 per month.

Foreign earned income exclusion is $132,900.

Estate tax exclusion amount is $15,000,000.

The gift tax exclusion is $19,000 (no change).

The 401(k) contribution limit is $24,500 for employee contributions. Catch-up contribution limit for age 50 or over is $8,000.