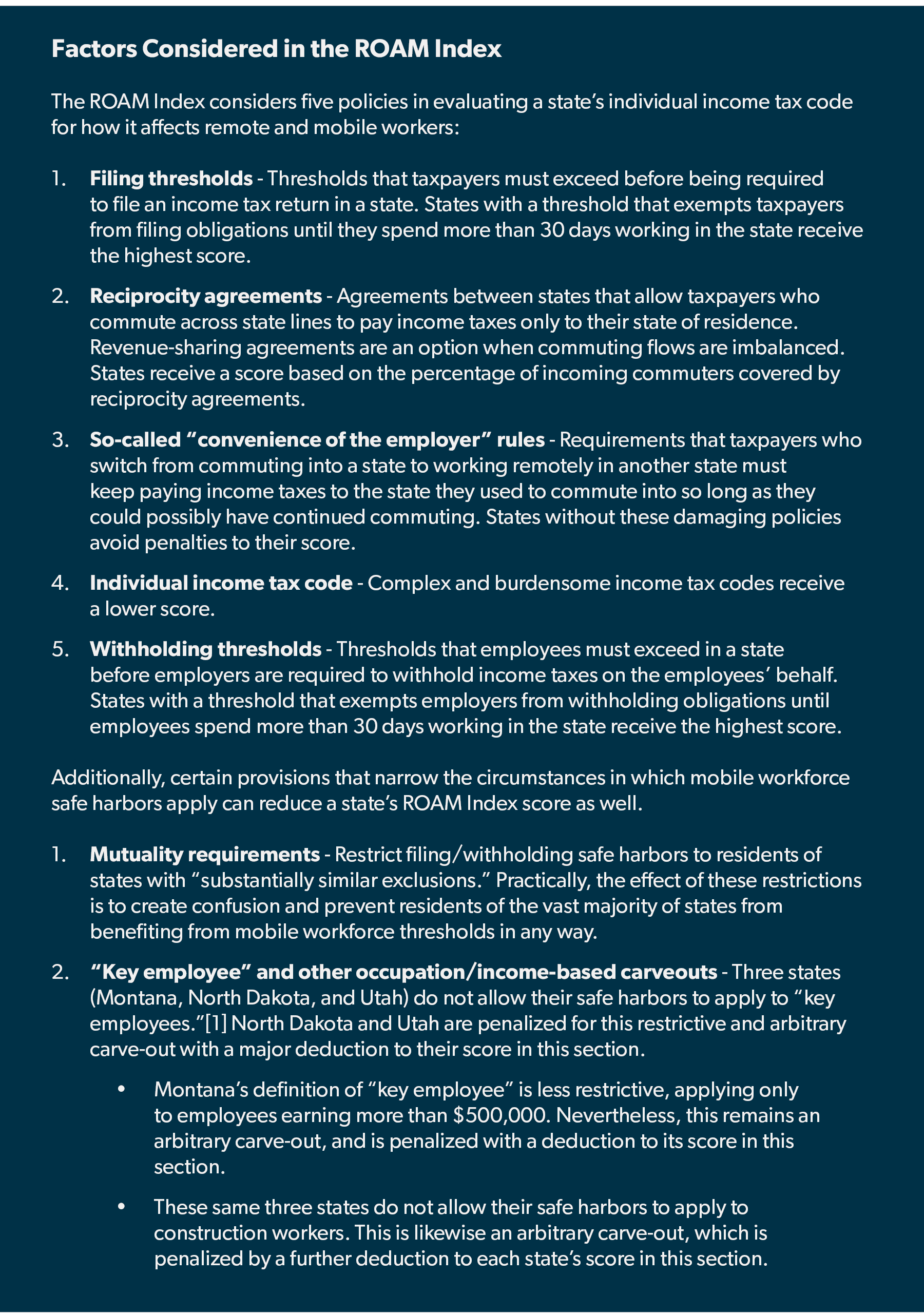

Key Facts:

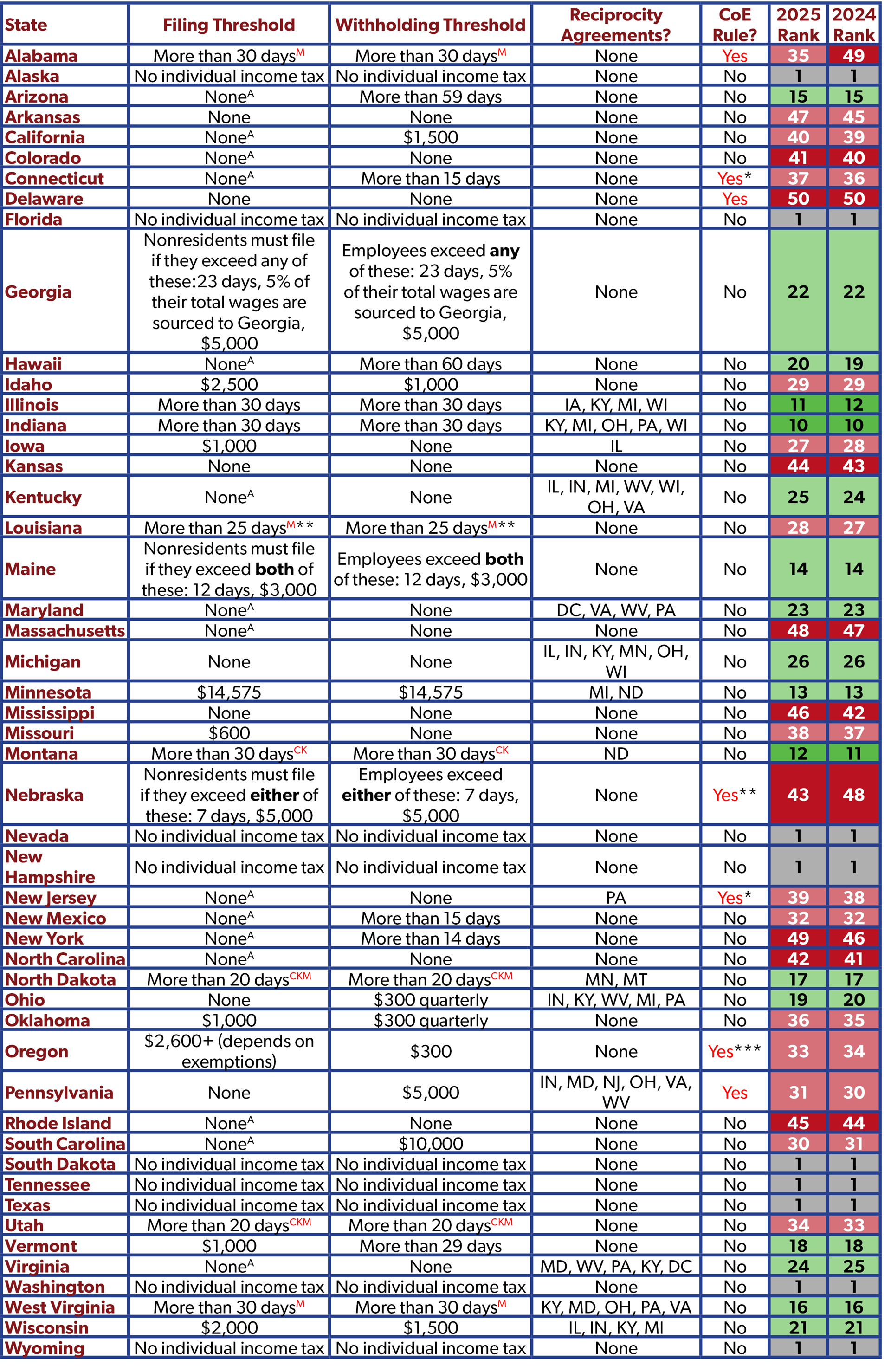

- The ROAM Index ranks states based on how burdensome their tax code is to remote and mobile workers.

- The best three states that limit compliance burdens on remote and mobile workers are Indiana, Illinois, and Montana, while Delaware, New York, and Massachusetts create the most unnecessary hassle.

- States seeking to improve on the ROAM Index and become more attractive to new economy workers should adopt 30-day safe harbors for short-term work, enter into reciprocity agreements, and repeal convenience of the employer rules if they have them.

The Remote Obligations and Mobility (ROAM) Index is NTUF’s metric of how burdensome each state’s tax compliance obligations are for nonresident workers. Since last year, two states (Alabama and Nebraska) have passed legislation that improves their tax treatment of nonresident workers, allowing them to increase their ROAM Index ranking. The top-ranking state with an income tax is Indiana, followed by Illinois, Montana, Minnesota, and Maine, while the lowest-ranking state is Delaware, followed by New York, Massachusetts, Arkansas, and Mississippi.

As more states address their treatment of nonresident taxpayers, states that have yet to do so increasingly stand out in a negative way. Arkansas and Mississippi entered the ranks of the five lowest-scoring states this year not through any negative changes they made, but because Alabama and Nebraska passed legislation that improved their rank.

On the other hand, relatively simple changes can shoot a state rapidly up the ranks. Nonresidents are still technically obligated to file a nonresident tax return from the very first day that they earn income in a majority of states, and just a fifth of all states have entered into any income tax reciprocity agreements at all with other states.

States should seek to reduce unnecessary compliance burdens on nonresident workers and out-of-state businesses by waiving tax compliance obligations for nonresidents who only work briefly in-state as well as those nonresidents’ employers. They should also seek to enter into income tax reciprocity agreements that minimize the number of state tax codes with which commuters have to comply.

Introduction

Since the pandemic, Americans have, by and large, adjusted to remote work arrangements becoming more normal. Gone are the days of the early pandemic when most Americans who could do their jobs from home did so. Rates of fully remote work have dropped from 70% of Americans capable of working remotely in the early days of the pandemic to 26% at the end of 2024, according to Gallup. But that does not mean that the days of nine to fives in the office five days a week being the standard work schedule have returned.

Instead, the most common work arrangement for Americans whose jobs can be done remotely has become hybrid work, where they work from home some days and in the office others. This is the case for 55% of those Americans, leaving just 19% of remote-capable employees working fully in-person.

While that has implications for share values of video conferencing apps and home office supply companies, it also has an impact on taxes—one of which many affected Americans may not even be aware. That is because Americans physically working in a state other than that of their employer can expose them—and their employers—to additional tax obligations.

Adding to the confusion is that the rules for when these additional tax obligations kick in vary wildly by state. While, in some states, a taxpayer is required to file a tax return after working a single day in that state, others have enacted sensible thresholds to protect taxpayers from wasting time filing additional state tax returns over trivial obligations. Other states have entered into agreements with each other to treat all income earned by a taxpayer in either state as only taxable in their home states in an effort to simplify tax filing.

These thresholds and agreements are important, pro-taxpayer efforts to take some of the unnecessary nuisance and confusion out of state income taxes in an increasingly mobile economy. Unfortunately, many states lack them, and it can be hard for taxpayers—and policymakers—to find out what the rules are in each state and how they can be improved.

The ROAM Index is NTUF’s metric illustrating not only which rules each state has, but how good of a job they each do at minimizing these unnecessary burdens on taxpayers. While a highly-ranked state has made significant efforts to limit the amount of extra complexity working in that state can create, lower-ranked states have done little to protect taxpayers unfortunate enough to spend time there from nuisance tax obligations. The lowest-ranked states have passed laws or implemented rules that actively complicate the tax returns of remote-working taxpayers.

It is also important to note what the ROAM Index is not. The ROAM Index is not meant to be a ranking of state tax levels, but rather a ranking of state tax compliance burdens for remote and mobile workers. States’ tax rates are included in ROAM rankings, but only to differentiate between otherwise equally burdensome states. That being said, the nine states with no income tax are all tied for first place in ROAM Index rankings, as a state with no income tax imposes no special obligations on a taxpayer spending time working in that state.

But, while tax brackets and rates are extremely important for states seeking to make themselves more competitive and attractive destinations for taxpayers more broadly, adjustments to the policies scored on the ROAM Index can provide a more budget-friendly way for states to attract workers in the new economy and the businesses that employ them.

[%interactivemap%]

Legislative Updates

Alabama

Back in May, Alabama Governor Kay Ivey signed H.B. 379, legislation that institutes new 30-day filing and withholding safe harbor thresholds before nonresidents earning income in Alabama incur paperwork obligations. Prior to the passage of H.B. 379, Alabama had no thresholds at all, meaning that it required nonresidents to file or withhold income tax from the very first day they earned income in Alabama.

H.B. 379 was not perfect, however. It included a mutuality requirement, or a stipulation that the 30-day thresholds only apply to residents of states without individual income taxes or that offer “substantially similar exclusions.” Alabama borders or is near three states without an income tax (Florida, Tennessee, and Texas), so some nonresidents will be able to benefit, but many nonresidents will still be subject to the old obligations that kick in on day one.

Part of the problem with these mutuality requirements is that what qualifies as a “substantially similar exclusion” is unclear. For example, nearby Louisiana offers 25-day filing and withholding safe harbor thresholds, likewise with a mutuality requirement. Is 25 days “substantially similar” to 30 days? Answering that question definitively would take significant effort and initiative on the part of the taxpayer, effort that would frustrate the intended goal of simplification that mobile workforce laws are supposed to achieve.

As always, NTUF only gives states with mobile workforce mutuality requirements credit for incoming commuters who are clearly and unquestionably able to benefit from filing and withholding safe harbor thresholds. Using the most recent American Community Survey commuting flows data, this means that around 41% of nonresidents commuting into Alabama will benefit from these protections.

H.B. 379 also seemingly failed to address one of the most glaring issues the state has when it comes to its treatment of remote and mobile workers—its convenience of the employer rule. This rule pushes employers away from wanting to set up shop in Alabama, since any nonresidents working remotely for an Alabama-based business run the risk of double taxation.

Alabama does manage to move out of the ranks of the worst-scoring states on the ROAM Index as a result of H.B. 379. However, it only moves up from being ranked 49th to 35th, leaving plenty of room to improve. The good news is that two simple changes—eliminating the convenience of the employer rule and mutuality requirement—would launch Alabama all the way up to 12th, or 3rd-highest among states with an individual income tax.

H.B. 379 will be effective October 1, 2025, so its changes will be reflected in this year’s rankings. However, taxpayers should be aware that the change is not effective until that date.

Louisiana

Louisiana H.B. 567 would initially have made a minor change increasing the state’s safe harbor thresholds for filing and withholding from 25 days to 30 days. This is a positive change, as 25 days was an arbitrary amount that no other state followed. 30 days, on the other hand, is in line with NTUF’s gold standard.

By the time H.B. 567 made it to the Senate, however, it included an even more significant improvement—the elimination of the state’s mutuality requirement.

Currently, Louisiana’s mutuality requirement means that less than half of incoming commuters benefit from the state’s mobile workforce safe harbor. It also creates confusion that mobile workforce safe harbors are intended to address—for instance, is Alabama’s newly-created 30-day threshold “substantially similar” to Louisiana’s current 25-day threshold? Eliminating the mutuality requirement makes esoteric questions like this moot and gives clarity to nonresidents and their employers, while also ensuring that Louisiana’s safe harbors make tax compliance for short-term work simple no matter what state a nonresident is coming from.

This change goes into effect at the beginning of 2026, and so will not be included in this year’s rankings. However, Louisiana will rise to 12th place at the beginning of 2026, joining Indiana and Illinois as one of only three states with an individual income tax that receives a perfect score on the ROAM Index for filing and withholding safe harbor thresholds.

Nebraska

Another legislative change affecting filing and withholding safe harbor thresholds took place in Nebraska, where LB1023 made very minor improvements to the state’s extremely restrictive remote work regime. Nebraska previously had no filing or withholding safe harbor threshold and also enforced a convenience of the employer rule, factors that led the state to be ranked third-lowest on the ROAM Index. Under LB1023, which was signed into law in April 2024 and went into effect at the beginning of 2025, the state instituted a new filing and withholding safe harbor threshold.

However, the version that was enacted into law was a far cry from the gold-standard 30-day threshold initially proposed under LB173. Instead, the state created a filing and withholding safe harbor for taxpayers who work seven or fewer days in the state and earn less than $5,000 in Nebraska-sourced income.

This combined day/wage-based threshold is worse for taxpayers than either provision would be separately. Nonresidents must stay below both thresholds, meaning that the main selling point for a day-based threshold—the fact that days worked in a state can be tracked more intuitively than wages earned—does not apply. At the same time, the threshold remains more restrictive than a simple $5,000 wage threshold would be, as a nonresident earning less than $5,000 in Nebraska-sourced income over the course of eight or more days would not be able to benefit from it. Consequently, NTUF scores Nebraska’s new safe harbor thresholds lower than it would a $5,000 wage threshold alone on the ROAM Index.

LB1023 also applied this exclusion to the state’s convenience of the employer rule. Nonresident remote workers now must physically work in the state for more than 7 days or earn more than $5,000 working physically in the state before the convenience of the employer rule applies to them. While far from a complete repeal of the convenience of the employer rule, it does at least help workers who are fully remote or who only come into their Nebraska office for one or two days a year.

This does have the perverse effect of actively discouraging remote workers from traveling to their Nebraska office. A hybrid worker who previously worked 4 days a week from home in Iowa and traveled into Nebraska once a week now has a strong incentive to switch to a fully-remote schedule, lest he be subject to double taxation on 80% of his salary.

In short, LB1023 was a step in the right direction, but a very small one. Nebraska raised itself from 48th to 43rd with the passage of LB1023, but more meaningful progress will require a true repeal of the state’s convenience of the employer rule and less restrictive filing and withholding safe harbor thresholds.

Wisconsin

Wisconsin passed Act 147, a bill that convenes a study on the impacts of income tax reciprocity between Wisconsin and Minnesota. Both states technically extend an offer to exempt residents of other states from income tax liability so long as those states extend the same treatment to their residents. However, the Minnesota Department of Revenue terminated the four decade-long agreement between the two states beginning in 2010.

While reciprocity agreements greatly simplify tax compliance for residents who commute across state lines, they do have revenue implications when there is a significant disparity between commuting flows in either direction. In the case of Minnesota and Wisconsin, significantly more Wisconsinites commuted to Minnesota than vice-versa. This meant that reciprocity lost Minnesota revenue and gained Wisconsin revenue. To address this issue, Wisconsin and Minnesota maintained a revenue-sharing agreement under which Wisconsin compensated Minnesota for lost revenue, but Minnesota cancelled the agreement because it wanted Wisconsin to transfer the compensatory revenue faster than it did.

While Act 147 would not reinstate the reciprocity agreement on its own, it represents at least one side returning to the table after a decade and a half. Fundamentally, reciprocity between the two states is a no-brainer, particularly given Wisconsin’s willingness to participate in a mechanism to make the agreement revenue-neutral for both states. The ball is now in Minnesota’s court to take action on bringing the benefits of reciprocity back to Wisconsin and Minnesota taxpayers.

Other Proposed State Legislation

Bills were introduced in other states that would have substantially impacted those states’ ranks had they been passed into law.

Oklahoma

Oklahoma S.B. 1500, introduced by Sen. Dave Rader, would have created 30-day filing and withholding safe harbor thresholds, the gold standard for both on the ROAM Index. Unfortunately, it also included a $20,000 wage threshold as well.

As with Nebraska, a dual wage- and day-based threshold is worse and more complicated for taxpayers than a day-based or even a wage-based threshold on its own. The benefit of a day-based threshold is simplicity—it is far easier and more intuitive to track whether you have spent 30 days working in a state than it is to know when you have earned $20,000 in a state. By the same token, with a $20,000 wage cap in place, adding a 30-day threshold on top does not simplify the threshold; rather it simply adds another way in which a taxpayer can exceed the threshold besides earning $20,000.

Even with these downsides, S.B. 1500 would have still represented a significant improvement upon its current minimal thresholds of $1,000 for filing and $300 quarterly for withholding. Though Oklahoma would have remained below states with true gold-standard 30-day thresholds, it would have raised Oklahoma’s current rank from 35th to 14th—though with a clear drop-off in score below Indiana, Illinois, and Montana. Were S.B. 1500 to be amended to maintain 30-day filing and withholding safe harbor thresholds but eliminate the $20,000 wage threshold, Oklahoma would become the third highest-ranked state with an income tax on the ROAM Index.

Kansas

H.B. 2420 would have established 30-day filing and withholding safe harbor thresholds, but included a mutuality requirement—only applying to residents of states without income taxes or with “substantially similar exclusions.” Unfortunately, this means that the nonresident safe harbor H.B. 2420 created would not have applied to residents of any of Kansas’s neighbors. Consequently, it would not have resulted in any significant change to Kansas’s rank on the ROAM Index.

Had H.B. 2420 not included this mutuality requirement, on the other hand, it would have positioned the state to jump up to third-highest among states with an individual income tax.

Minnesota

Minnesota ranks highly on the ROAM Index despite not having any day-based thresholds, though significantly below the states with 30-day filing and withholding safe harbor thresholds.

Minnesota does a few things better than most states, though nothing perfectly. The state has inflation-adjusted wage-based filing and withholding safe harbor thresholds of $14,575 for 2024, far higher than wage-based thresholds in other states. Day-based thresholds are preferable for certainty and simplicity, but Minnesota does get credit for setting its wage-based thresholds relatively high.

SF 46/HF 950, however, would have improved on these thresholds further by transitioning them into 30-day thresholds, the ROAM Index gold standard. This change would have enabled Minnesota to move ahead of Montana into third place among states with an individual income tax.

Arkansas

Arkansas continues to be one of the lowest-ranked states on the ROAM Index, coming in at 46th. Though not as far-reaching as some of the other bills on this list, H.B. 1116 would have represented a major incremental step toward pulling the state out of the basement.

Currently, Arkansas has no filing or withholding safe harbors at all, meaning that nonresidents and their employers are subjected to income tax compliance obligations from the very first day that they work in Arkansas. H.B. 1116 would have changed that, introducing a $2,500 wage-based filing safe harbor threshold and a 15-day withholding safe harbor threshold. It also would have granted authority to the state Department of Finance and Administration to enter into reciprocity agreements with other states.

These changes would have propelled Arkansas up from 47th on this year’s ROAM Index all the way to 17th. H.B. 1116 would have represented a massive improvement that would set the groundwork for further advances down the road.

Federal Policy

Finally, it is worth noting the reintroduction of S.1443, the Mobile Workforce State Tax Simplification Act by Sens. John Thune (R-SD) and Catherine Cortez-Masto (D-NV). This bill would make 30-day thresholds for both filing and withholding the nationwide standard.

Ultimately, a federal solution is preferable to piecemeal state fixes, as it would provide taxpayers with a clear and easy-to-follow standard for when nonresident tax obligations come into effect that applies across every state. It also would make nonresident safe harbors nearly revenue-neutral across all states, as the revenues that states gain from short-term nonresident workers are offset in most cases by the need to credit their own residents for taxes paid to other states. When the Congressional Budget Office analyzed a similar bill back in 2017, it estimated that the total, nationwide revenue loss across all states would be between $55 to $100 million, with most states experiencing a negligible change in revenue.

Nevertheless, until Congress acts to pass S.1443 or similar legislation, states should continue trying to improve their policies affecting tax treatment of nonresidents.

Conclusion

As more mobile forms of work become increasingly prevalent, states are taking notice of the need to fix outdated rules that create unnecessary complexity for nonresidents and out-of-state businesses that might want to pursue economic opportunities in their states. This is reflected by the steady drumbeat of positive improvements that states seeking to set themselves up as leaders in the new economy are making.

Yet, as some states work to improve their tax codes, the ones that fail to do so will increasingly stick out as being uniquely unpleasant to work and do business in. That is not a distinction that any state should want, particularly not over the petty compliance burdens at issue.

States at the bottom of the ROAM Index should therefore take note, and take action to improve their ranking, while almost all other states with an income tax could do at least one thing to score better.

State policymakers seeking to make their states more attractive to remote and mobile workers

should follow the following principles:

- A 30-day filing safe harbor threshold of days worked in-state before taxpayers must file an individual income tax return.

- A 30-day withholding safe harbor threshold of days employees must work in-state before their employer is required to withhold income taxes on their behalf.

- Mutual reciprocity agreements with neighbors to provide certainty and simplicity to commuting taxpayers.

- No “convenience of the employer” rules that require taxpayers to pay income taxes to a state in which they do not physically work.

For state policymakers looking to improve their state’s tax treatment of nonresident workers and businesses, NTUF’s example legislative text provides a blueprint.

State-By-State Breakdown

Alabama: 35th

Recommended Legislative Improvements:

- Remove mutuality requirement (language restricting eligibility of filing/withholding safe harbor to residents of states with “substantially similar exclusions”).

- Overrule judicially-created “convenience of the employer” rule by passing language clarifying that wage income is only taxable when earned by an employee who is physically located in the state at the time.

- Enable and promote the formation of reciprocity agreements with other states.

Alaska: Tied for 1st (no state individual income tax)

Arizona: 15th

Recommended Legislative Improvements:

- Apply the existing withholding safe harbor to individual filing obligations.

- Enable and promote the formation of reciprocity agreements with other states.

Arkansas: 47th

Recommended Legislative Improvements:

- Create new filing and withholding safe harbors with thresholds of at least 30 days.

- Enable and promote the formation of reciprocity agreements with other states.

California: 40th

Recommended Legislative Improvements:

- Create a new filing safe harbor with a threshold of at least 30 days.

- Increase the existing $1,500 wage-based withholding safe harbor threshold to 30 days.

- Enable and promote the formation of reciprocity agreements with other states.

Colorado: 41st

Recommended Legislative Improvements:

- Create new filing and withholding safe harbors with thresholds of at least 30 days.

- Enable and promote the formation of reciprocity agreements with other states.

Connecticut: 37th

Recommended Legislative Improvements:

- Increase the existing withholding safe harbor threshold of 15 days to at least 30 days and apply it to individual filing obligations as well.

- Enable and promote the formation of reciprocity agreements with other states.

- Repeal retaliatory convenience of the employer rule.

Delaware: 50th

Recommended Legislative Improvements:

- Create new filing and withholding safe harbors with thresholds of at least 30 days.

- Enable and promote the formation of reciprocity agreements with other states.

- Repeal the convenience of the employer rule by passing language clarifying that wage income is only taxable when earned by an employee who is physically located in the state at the time.

Florida: Tied for 1st (no state individual income tax)

Georgia: 22nd

Recommended Legislative Improvements:

- Amend existing complicated filing and withholding safe harbor thresholds to exempt nonresidents working for 30 days or fewer from filing and withholding obligations.

- Enable and promote the formation of reciprocity agreements with other states.

Hawaii: 20th

Recommended Legislative Improvements:

- Apply the existing withholding safe harbor to individual filing obligations.

- Enable and promote the formation of reciprocity agreements with other states.

Idaho: 29th

Recommended Legislative Improvements:

- Replace existing wage-based safe harbor thresholds with day-based thresholds of at least 30 days.

- Enable and promote the formation of reciprocity agreements with other states.

Illinois: 11th

Recommended Legislative Improvements:

- Promote the formation of additional reciprocity agreements, particularly with Indiana.

Indiana: 10th

Recommended Legislative Improvements:

- Promote the formation of additional reciprocity agreements, particularly with Illinois.

Iowa: 27th

Recommended Legislative Improvements:

- Increase the existing $1,000 wage-based individual filing safe harbor threshold to 30 days.

- Create a new withholding safe harbor with a threshold of at least 30 days.

- Promote the formation of additional reciprocity agreements, particularly with Minnesota and Wisconsin.

Kansas: 44th

Recommended Legislative Improvements:

- Create new filing and withholding safe harbors with thresholds of at least 30 days.

- Enable and promote the formation of reciprocity agreements with other states.

Kentucky: 25th

Recommended Legislative Improvements:

- Create new filing and withholding safe harbors with thresholds of at least 30 days.

- Promote the formation of additional reciprocity agreements, such as with Missouri.

Louisiana: 28th

Recommended Legislative Improvements:

- Legislative changes going into effect next year will substantially increase Louisiana’s ROAM Index rank (if changes were in effect today, Louisiana would be 12th).

- Enable and promote the formation of reciprocity agreements with other states.

Maine: 14th

Recommended Legislative Improvements:

- Replace existing hybrid wage-and-day-based safe harbor thresholds with solely day-based thresholds of at least 30 days.

- Enable and promote the formation of reciprocity agreements with other states.

Maryland: 23rd

Recommended Legislative Improvements:

- Create new filing and withholding safe harbors with thresholds of at least 30 days.

- Promote the formation of additional reciprocity agreements, particularly with New Jersey.

Massachusetts: 48th

Recommended Legislative Improvements:

- Create new filing and withholding safe harbors with thresholds of at least 30 days.

- Enable and promote the formation of reciprocity agreements with other states.

- Massachusetts had a convenience of the employer rule in effect during the pandemic, though it allowed it to expire. Prevent this from occurring in the future by passing language clarifying that wage income is only taxable when earned by an employee who is physically located in the state at the time.

Michigan: 26th

Recommended Legislative Improvements:

- Create new filing and withholding safe harbors with thresholds of at least 30 days.

- Promote the formation of additional reciprocity agreements.

Minnesota: 13th

Recommended Legislative Improvements:

- Replace existing wage-based safe harbor thresholds with day-based thresholds of at least 30 days, as SF46 and HF950 would have done this year.

- Promote the formation of additional reciprocity agreements, particularly with Wisconsin.

Mississippi: 46th

Recommended Legislative Improvements:

- Create new filing and withholding safe harbors with thresholds of at least 30 days.

- Enable and promote the formation of reciprocity agreements with other states.

Missouri: 38th

Recommended Legislative Improvements:

- Create new filing and withholding safe harbors with thresholds of at least 30 days.

- Enable and promote the formation of reciprocity agreements with other states. Three of Missouri’s neighbors have at least one reciprocity agreement with another state.

Montana: 12th

Recommended Legislative Improvements:

- Eliminate construction worker/key employee exemptions from existing mobile workforce safe harbors.

- Promote the formation of reciprocity agreements with additional states.

Nebraska: 43rd

Recommended Legislative Improvements:

- Remove wage threshold and increase day-based safe harbor threshold from 7 days to 30 days.

- Completely repeal convenience of the employer rule.

- Enable and promote the formation of reciprocity agreements with other states.

Nevada: Tied for 1st (no state individual income tax)

New Hampshire: Tied for 1st (no state individual income tax)

New Jersey: 39th

Recommended Legislative Improvements:

- Create new filing and withholding safe harbors with thresholds of at least 30 days.

- Repeal retaliatory convenience of the employer rule.

- Promote the formation of additional reciprocity agreements with other states.

New Mexico: 32nd

Recommended Legislative Improvements:

- Increase the existing withholding safe harbor threshold of 15 days to at least 30 days and apply it to individual filing obligations as well.

- Enable and promote the formation of reciprocity agreements with other states.

New York: 49th

Recommended Legislative Improvements:

- Increase the existing withholding safe harbor threshold of 14 days to at least 30 days and apply it to individual filing obligations as well.

- Repeal convenience of the employer rule.

- Enable and promote the formation of reciprocity agreements with other states.

North Carolina: 42nd

Recommended Legislative Improvements:

- Create new filing and withholding safe harbors with thresholds of at least 30 days.

- Enable and promote the formation of reciprocity agreements with other states.

North Dakota: 17th

Recommended Legislative Improvements:

- Increase existing safe harbor thresholds from 20 days to 30 days.

- Eliminate mutuality requirement, key employee exemption, and construction worker exemption.

- Promote the formation of additional reciprocity agreements with other states.

Ohio: 19th

Recommended Legislative Improvements:

- Create a new individual filing safe harbor threshold of at least 30 days.

- Increase the existing $300 quarterly wage-based withholding safe harbor threshold to 30 days.

- Promote the formation of additional reciprocity agreements with additional states.

Oklahoma: 36th

Recommended Legislative Improvements:

- Increase the existing $1,000 wage-based individual filing safe harbor threshold to 30 days.

- Increase the existing $300 quarterly wage-based withholding safe harbor threshold to 30 days.

- Enable and promote the formation of reciprocity agreements with other states.

Oregon: 33rd

Recommended Legislative Improvements:

- Increase the existing exemption-dependent, wage-based individual filing safe harbor threshold to 30 days.

- Increase the existing $300 wage-based withholding safe harbor threshold to 30 days.

- Enable and promote the formation of reciprocity agreements with other states.

- Repeal existing convenience of the employer rule for managers.

Pennsylvania: 31st

Recommended Legislative Improvements:

- Create a new individual filing safe harbor threshold of at least 30 days.

- Increase the existing $5,000 wage-based withholding safe harbor threshold to 30 days.

- Repeal existing convenience of the employer rule.

- Promote the formation of additional reciprocity agreements with other states.

Rhode Island: 45th

Recommended Legislative Improvements:

- Create new filing and withholding safe harbors with thresholds of at least 30 days.

- Enable and promote the formation of reciprocity agreements with other states.

South Carolina: 30th

Recommended Legislative Improvements:

- Create a new individual filing safe harbor threshold of at least 30 days.

- Increase the existing $10,000 wage-based withholding safe harbor threshold to 30 days.

- Enable and promote the formation of reciprocity agreements with other states.

South Dakota: Tied for 1st (no state individual income tax)

Tennessee: Tied for 1st (no state individual income tax)

Texas: Tied for 1st (no state individual income tax)

Utah: 34th

Recommended Legislative Improvements:

- Increase existing safe harbor thresholds from 20 days to 30 days.

- Eliminate mutuality requirement, key employee exemption, and construction worker exemption.

- Enable and promote the formation of reciprocity agreements with other states.

Vermont: 18th

Recommended Legislative Improvements:

- Increase the existing $1,000 wage-based individual filing safe harbor threshold to 30 days.

- Increase the existing 29-day withholding safe harbor threshold to 30 days to bring it in line with other states.

Virginia: 24th

Recommended Legislative Improvements:

- Create new filing and withholding safe harbors with thresholds of at least 30 days.

- Promote the formation of reciprocity agreements with other states.

Washington: Tied for 1st (no state individual income tax)

West Virginia: 16th

Recommended Legislative Improvements:

- Eliminate mutuality requirement from filing and withholding safe harbors.

- Promote the formation of reciprocity agreements with other states.

Wisconsin: 21st

Recommended Legislative Improvements:

- Increase the existing $2,000 wage-based individual filing safe harbor threshold to 30 days.

- Increase the existing $1,500 wage-based withholding safe harbor threshold to 30 days.