Introduction

NTUF’s recent studies on tax code complexity highlight gaps in the IRS’s estimates of the out-of-pocket costs associated with certain tax forms for complicated parts of the tax system. However, the problem is even more widespread than previously understood.

While the IRS produces cost estimates for 28 information collections totaling $148 billion in compliance burdens, 392 others are listed as having zero cost. A thorough review shows that only 63 of these collections—just 16%—appear to genuinely have no out-of-pocket cost, and 39 (10%) are described as imposing only a nominal or minimal cost. For the large majority of the remaining forms, the IRS acknowledges that cost estimates are either unavailable or still being revised as part of an ongoing methodology update.

These findings indicate a widespread lack of transparency and consistency in how the IRS calculates and reports out-of-pocket costs.

Cost Reporting Under the Paperwork Reduction Act

The Paperwork Reduction Act (PRA) requires federal agencies to estimate and publicly disclose the time and cost burdens their forms impose on the public. The Office of Information and Regulatory Affairs (OIRA), housed within the White House Office of Management and Budget, oversees this process and maintains the public-facing database Reginfo.gov. This information is used in NTUF’s annual study of tax complexity. Earlier this year, we reported that Americans took 7.1 billion hours and incurred out-of-pocket costs of $148 billion to comply with federal individual and corporate income tax laws.

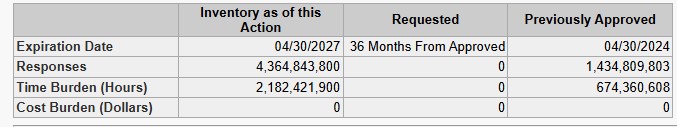

While many IRS information collections report no associated costs, this is often because compliance is relatively straightforward. For example, the W-2 is typically automated through payroll software. In contrast, more complex forms such as the 1099-B, used to report “Proceeds from Broker and Barter Exchange Transactions,” require significantly greater effort. Although the IRS estimates that it will receive nearly 4.4 billion copies of the form and that it imposed nearly 2.2 billion hours in compliance time, it is listed as having no associated cost burden.

However, the IRS’s supporting statement for the form acknowledges that the Service is still developing a methodology to assess and calculate the out-of-pocket costs:

This information collection will be included in the consolidated OMB submission for information returns currently being developed. IRS is working on the methodology for evaluating information return burden and cost; and will update the cost and burden estimates as part of the consolidation.

In the course of our research, NTUF noticed similar language included in other forms, and recommended that OIRA should also work with the IRS to distinguish between forms or information collections with truly zero out-of-pocket cost and those where cost estimates are incomplete or unavailable. This would provide a clearer picture of which parts of the tax code are in most need of simplification.

Major Gaps in IRS Compliance with the Paperwork Reduction Act

To determine how widespread the gaps in cost reporting are, NTUF reviewed all IRS information collections listed on Reginfo.gov as of July 8. We identified 392 supporting statements (SS) that show $0 compliance burdens in the public-facing database.

Our review found that about one-quarter of the forms have no cost or a minimal cost. Most of the statements noted that the information is unavailable or indicate that the methodology is still under development:

63 (16%) provided sufficient affirmative information to conclude that there were no out-of-pocket costs.

39 (10%) described the cost burdens as nominal, minimal, or negligible, without providing a dollar figure.

17 (4%) explicitly stated that cost estimate information is unknown or unavailable.

251 collections (64%) did not include an estimate and stated that the IRS is working on a revised methodology for estimating costs.

20 (5%) collections also did not include an estimate and noted that the information collection is being consolidated into another information collection, and a new methodology is in development.

1 supporting statement related to the Superfund excise tax was missing entirely.

Additionally, one statement included partial data that could be used to assess the total burden cost on respondents but fell short of providing a complete calculation. The IRS requires paid tax preparers and enrolled agents to obtain and annually renew a Preparer Tax Identification Number (PTIN). The supporting statement notes that the form will have 1.2 million respondents to request a PTIN and that the registration or renewal fee is $19.75 to acquire it. Either the IRS’s estimate is too high or many respondents do not get approved because, separately, the IRS reports that, as of July 1, 2025, 822,841 individuals have a PTIN for a net burden cost of over $16 million.

A full list of IRS forms reporting zero costs in OIRA’s database, with links to the supporting statements, associated IRS cost estimate information, and NTUF’s research notes, is available here.

Conclusion

The Merriam-Webster online dictionary defines zero as “the absence of all magnitude or quantity.” Based on this definition, at best roughly three-quarters of all IRS paperwork burden supporting statements listing a taxpayer compliance cost of zero are, in fact, not accurate. NTUF urges that OIRA work with the IRS to clearly distinguish between forms with truly no costs and those where estimates are missing or incomplete. Without this clarity, it is difficult for taxpayers, researchers, and policymakers to understand where the tax code imposes the greatest burdens—and where simplification efforts are most urgently needed.

Some of these forms may truly have no associated out-of-pocket costs, but the IRS needs to do a better job of documenting its analysis. There is a particular irony in the IRS requiring strict compliance with complex reporting rules from taxpayers, while the Service itself fails to fully comply with the Paperwork Reduction Act. If taxpayers are expected to follow the rules, the IRS should be held to the same standard when it comes to transparency and accountability in reporting the burdens it imposes.