Five House Republicans—Reps. Andrew Garbarino (NY), Tom Kean (NJ), Young Kim (CA), Nick LaLota (NY), and Mike Lawler (NY)—are negotiating with Speaker Mike Johnson, insisting that he support increases to the cap on the State and Local Tax (SALT) deduction as their price for allowing the House to move forward on a tax bill. The enormity of what they are demanding cannot be understated. They are trying to add hundreds of billions of dollars to the size of the package—most of which would benefit a very narrow band of taxpayers who primarily reside in the states they represent.

The Tax Cuts & Jobs Act of 2017 imposed a $10,000 cap on the SALT deduction, replacing the previous complicated system where taxpayers could take unlimited amounts of SALT deduction but had it partly taken away by the Alternative Minimum Tax (AMT) and the Pease limitation on itemized deductions. The proposed bill draft by the U.S. House of Representatives would (1) raise the SALT cap from $10,000 to $30,000; (2) limit the benefit of that increased amount for taxpayers who earn more than $400,000; and (3) close state-level “SALT workaround” laws that allow some taxpayers to take larger SALT deductions through business deductions.

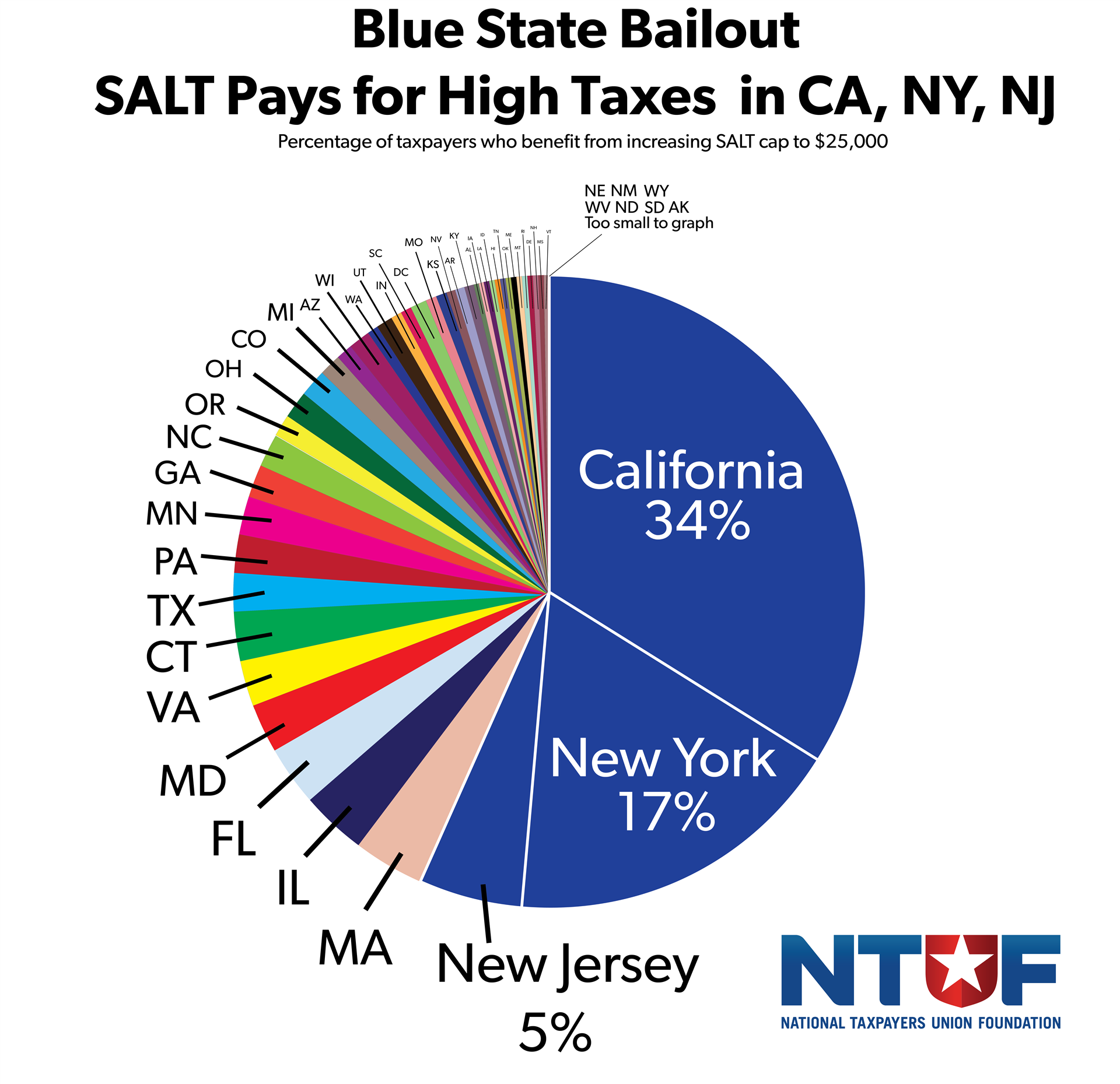

The Ways & Means proposal would cut taxes by $174 billion over ten years compared to current policy, according to calculations by the Tax Foundation. As we have noted, the benefit of this reduction would accrue primarily to high-income taxpayers in high-tax states, with a majority of the benefit flowing to just three states (New York, California, and New Jersey). However, the holdout members of Congress have rejected the Ways & Means proposal and want something more generous. This is the case even though, as Ryan Ellis pointed out, the concessions they have already secured mean a tax cut for 93% to 97% of their constituents.

One option under consideration is a SALT cap of $40,000 for individuals and $80,000 for couples. This would be a $644 billion tax cut over ten years compared to current law, although including the income limit and SALT workaround closure from the Ways & Means bill would shave that amount to $356 billion. Current law is $10,000 and the SALT caucus earlier this week suggested $62,000 (single) and $124,000 (married), so $40,000 and $80,000, respectively, may be where they meet in the middle.

But $356 billion over ten years is a lot of money by any calculation, and certainly to secure the votes of five members of Congress.

What else could $356 billion buy?

Build 13 new aircraft carriers. The U.S. Navy has 11 aircraft carriers, with the current Gerald R. Ford-class nuclear-powered aircraft carrier program replacing retiring carriers. A brand new aircraft carrier costs $13 billion, according to a 2023 report by the Congressional Research Office. The cost of the aircraft onboard is about just as much, meaning $356 billion could buy 13 brand new aircraft carriers and a full complement of aircraft. We could even name five of them for the SALT holdouts: the U.S.S. Mike Lawler? Caution: major projects overseen by the Pentagon are plagued by cost overruns, delays, and poor performance, so members of Congress should be careful about lending their names to this exercise.

Gold plate all the roads in four congressional districts. Rep. Lawler’s 17th Congressional District in New York, which covers four suburban counties just north of New York City, has approximately 4,000 miles of roads. With 4,000 miles equaling 21.12 million feet, multiplied by an average of 24 feet wide multiplied by 1 micron thin decorative gold plating, 2,004,372 pounds of gold would be required, or 29,241,800 ounces. At the current price of gold of approximately $3,180 per troy ounce, the material cost to gold plate all the roads in Rep. Lawler’s district would be $93 billion.

Similar calculations for Rep. LaLota’s 1st New York district (approximately 2,800 miles of roads) equals $65 billion, for Rep. Kean’s 7th New Jersey district (approximately 4,000 miles of roads) equals $93 billion, for Rep. Kim’s 40th California district (approximately 3,500 miles of roads) equals $81 billion, for a grand total of $332 billion. (Rep. Garbarino’s district may have to wait.)

Buy every taxpayer in America a nice steak dinner in a fancy D.C. restaurant every year. There are 157,375,870 tax filers in the United States, and $356 billion divided equally is $2,262 over ten years, or $226 per year. I won’t name the restaurant, but a D.C. spot frequented by lawmakers and lobbyists lists the 32 oz. prime 35-day dry aged Porterhouse at $135 with bottles of wine starting at $70. Add the 10% DC restaurant tax and you are at exactly $225.50.

Build 435 state-of-the-art hospitals, 435 brand new universities, and 435 new seasons of the Andor television series. The average U.S. cost of building a 500,000 square foot modern hospital is $325 million, according to Scripps. The new University of Austin, a private higher education institution, opened last year after raising $200 million from donors. The second season of the Star Wars-related series Andor cost $291 million, according to Forbes. Providing this $816 million total package of amenities times 435 congressional districts would be $355 billion.

Build 1 million new homes. The median new home in the United States in April 2025 sold for $403,600, according to the Federal Reserve Bank of St. Louis. These costs are high in part due to regulatory costs on developers and builders that amount to about 23% of the final bill, according to the National Association of Home Builders. If those regulatory costs could be cut in half, a new home could be built for $357,186, and $356 billion could buy 996,679 new homes.

Buy Finland. Greenland may be more in the news, but Finland’s 5.6 million people generate a Gross Domestic Product (GDP) of $366 billion in purchasing power terms in 2024.

Pay off some of the national debt, and avoid $67 billion in interest payments. The $36 trillion national debt will next year consume $1 trillion annually in interest payments to service the debt. This will be more than we spend on national defense, with national debt interest consuming 3.2% of the economy (U.S. GDP). An annual reduction of $35.6 billion in spending or debt would generate an estimated $67 billion in cumulative interest savings over the next decade, according to the Congressional Budget Office’s interactive workbook.

Enact permanent full expensing, doubling the bill’s GDP growth and creating 153,000 new jobs. Here is an option that Congress should take very seriously. The committee bill revives full expensing, also known as 100% bonus depreciation, a key policy enacted in 2017 and responsible for a sharp increase in investment in new equipment and job creation. However, the bill only reinstates the policy for four years due to revenue impact, with an estimated loss of $34 billion over ten years. Permanent full expensing would be a revenue loss of $398 billion, or a $364 billion difference. Even better: the growth impact of permanent full expensing is so strong, that it will generate dynamic revenue of $190 billion, cutting that number roughly in half. The Tax Foundation estimates that the House committee bill would boost GDP by 0.6%, but, with permanent full expensing added, it would boost GDP by 1.2%.

As Congress decides whether to raise the SALT cap and by how much, they should not lose sight of tradeoffs involved. While a higher cap would help high-income households in high-tax states, the same $356 billion could instead be used for initiatives with lasting, widespread benefit for the American people. Far ahead among these alternatives would be permanent, simple, pro-growth tax reforms that would create jobs and help families build wealth.