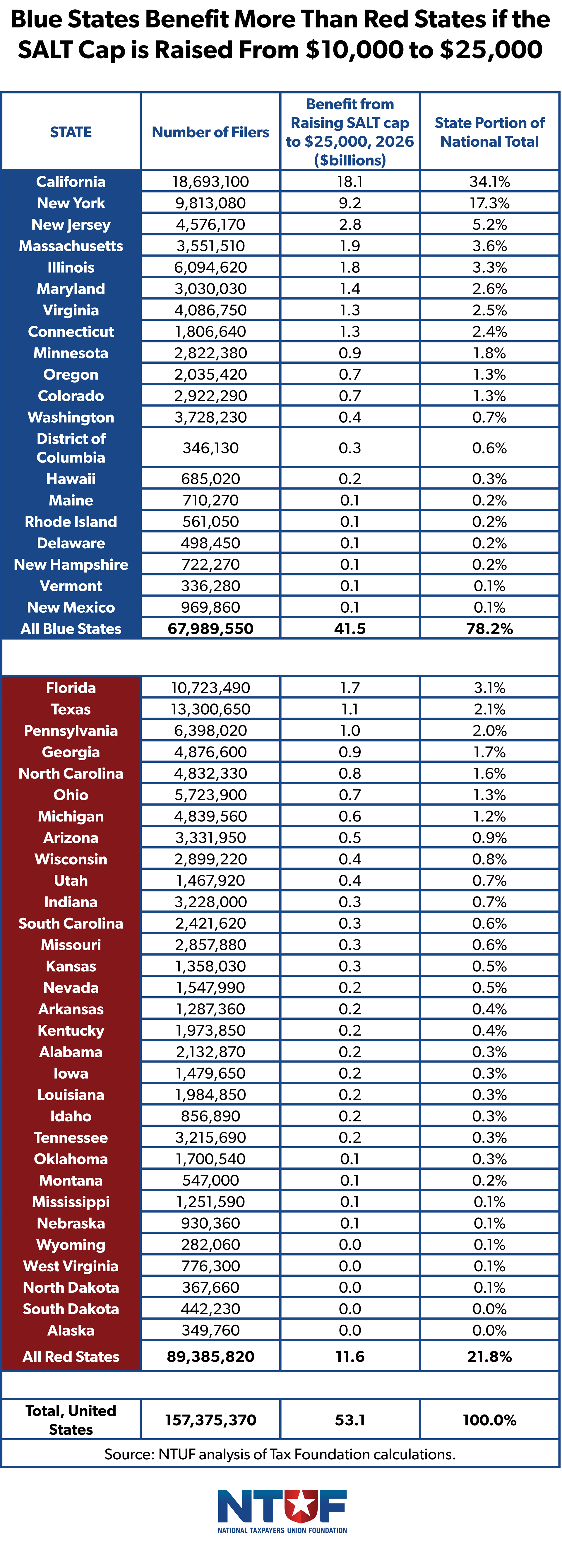

California, New York, and New Jersey would receive a majority (53%) of the benefits of raising the State and Local Tax (SALT) cap—the amount of state and local taxes that itemizing taxpayers can deduct—as we noted in our recent analysis of state-by-state impacts of TCJA expiration analyzing Tax Foundation estimates of raising the cap from $10,000 to $25,000.

In fact, all blue states together (according to the 2024 presidential election) would receive 78.2% of the benefits of raising the SALT cap; red states would receive just 21.8% of the benefit. In other words, taxpayers in blue states could get almost four times more than red states if a handful of representatives from high-tax states get their way.

Congressional negotiations over how much to increase the SALT cap have hit a standstill, according to media reports. Five House Republicans in high-income, high-tax states—Reps. Andrew Garbarino (NY), Tom Kean (NJ), Young Kim (CA), Nick LaLota (NY), and Mike Lawler (NY)—have not made clear what they want, although they have rejected more than doubling the cap to $25,000 as inadequate.

Under the Tax Cuts and Jobs Act (TCJA) of 2017, SALT is capped at $10,000 per filing couple. This cap replaced a pre-2017 complex interaction of SALT, the Alternative Minimum Tax (AMT), and the Pease limit on itemized deductions, where SALT provided benefits to itemizers but the AMT and Pease took them away. Additionally, TCJA doubled the standard deduction level of tax-free income, and, as a result, the number of itemizing taxpayers has fallen from 30% to less than 10%. TCJA will expire after December 31, 2025, unless Congress enacts an extension.

Blue states, with 68 million tax filers, would receive $41.5 billion of the benefit of raising the SALT cap. Red states, with 89 million tax filers, would receive just $11.6 billion of the benefit of raising the SALT cap. This is not surprising given that SALT primarily benefits high-income people in high-tax states. Of course, most taxpayers would see no tax benefit at all from raising the SALT cap: 90.1% of tax filers (150.3 million) do not itemize and thus don’t take the SALT deduction. If the SALT cap were repealed entirely, 93% of the benefits would be received by those making over $200,000 a year.

While proponents argue easing the SALT cap provides relief from excessive state and local taxation, this raises the question of why federal policy should shield residents from the consequences of their own state and local governments' tax decisions. As Congress weighs potential solutions, policymakers will need to balance equity considerations, regional disparities, and revenue implications to achieve a fair and fiscally responsible outcome.