(pdf)

Introduction

Without a course correction, the budget of the federal government is hurtling toward disaster. In Fiscal Year (FY) 2023, the federal government collected $4.4 trillion in tax revenues, representing 16.5 percent of Gross Domestic Product (GDP). However, this was not enough to finance the entirety of the government’s $6.1 trillion spending, resulting in $1.7 trillion in new debt and bringing the publicly-held debt up to $26.2 trillion — equivalent to 97 percent of GDP. Under current law, the size of the debt is on track to surpass GDP next year and rise to 116 percent of GDP by 2034.

Thankfully, the House Budget Committee (HBC) has put forward an alternative path. The FY 2025 concurrent budget resolution crafted by Chairman Jodey Arrington (R- TX) would balance the budget over the next decade while locking in place the expiring provisions of the Tax Cuts and Jobs Act (TCJA) of 2017.

Spending Under the HBC’s Plan

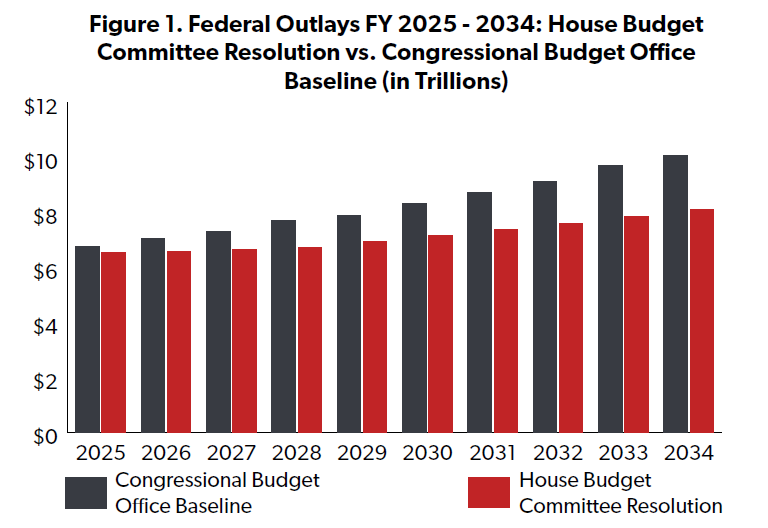

Under current law, the most recent Congressional Budget Office (CBO) budget baseline projects that the government is on track to spend $82.7 trillion over the next decade — $20 trillion more than expected tax revenues. Spending is expected to grow by 4.6 percent per year through 2034.

The HBC's budget resolution would slow the annual growth in spending to 2.4 percent per year. Over the decade this would result in a savings of $11.1 trillion relative to the CBO baseline.

The resolution would contain spending by reducing fraud, waste, and improper payments; repealing spending from the Inflation Reduction Act; and rolling back Affordable Care Act (Obamacare) health care subsidies for wealthy individuals.

Revenues in the House Budget Resolution

The budget resolution adopts the revenues included in CBO’s baseline projection ($62.6 trillion over the decade). But while CBO’s projection assumes the expiration of several parts of the TCJA after 2025, the HBC resolution would lock them in place. Notably, the resolution projects a GDP growth rate of 3 percent per year, compared to the CBO's forecast of 2 percent, underpinned by policies aimed at embracing the free market and fostering economic expansion.

The resolution outlines a strategy to “embrace the free market and encourage economic growth” by expanding energy production, reducing regulatory millstones, promoting trade, and reducing deficits. Preserving the TCJA’s full-expensing provisions, one of the most pro-growth provisions in the tax reform law, would go a long way toward investment and job creation, returning to the robust gains in new jobs and wages before the pandemic took its toll.

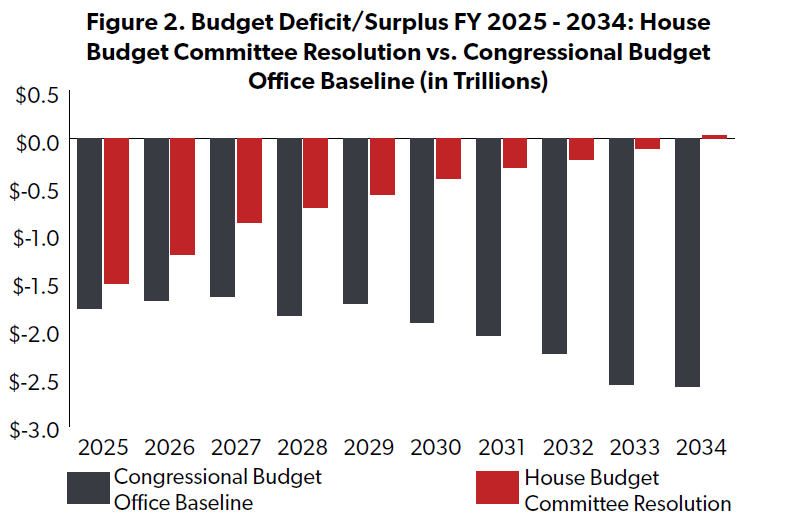

The House Budget Resolution Would Lead to Balance, Surpluses

Under CBO’s baseline, annual deficits would steadily increase over the second half of the decade, topping $2.5 trillion in 2034. The House Budget resolution continues Arrington's theme since taking the reins of the HBC to "reverse the curse" of debt. By slowing the growth of spending per year and growing the economy, the budget resolution would produce a federal budget surplus by 2034. The total deficit impact under the resolution would save $14 trillion relative to CBO’s baseline, demonstrating a commitment to long-term fiscal sustainability.

The House Budget Resolution and President Biden’s Budget

In addition to providing for a balanced budget, the HBC and its Chairman Arrington deserve credit for producing a budget resolution in a timely manner. Under the Congressional Budget Act of 1974, the White House is supposed to deliver its budget proposal to Congress no later than the first Monday in February. Traditionally there has been some delay in introducing a budget proposal by incoming administrations during their first year, but this year, the Biden administration did not introduce its budget proposal until March 11. According to Chairman Arrington, this was the second time that the HBC marked up its budget resolution before the president introduced a budget.

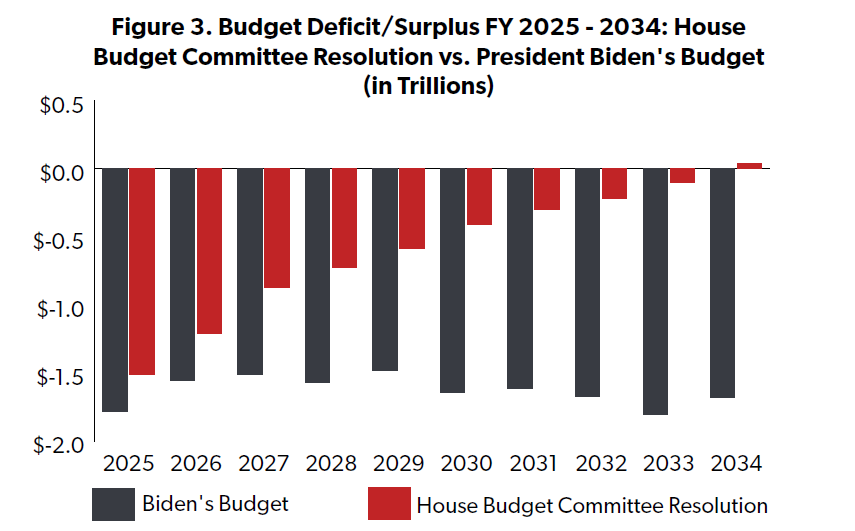

The President’s FY 2025 budget blueprint presents a contrasting vision to the HBC’s budget resolution, with spending amounting to $4 trillion more than in CBO’s baseline, and $15 trillion higher than in HBC’s budget resolution. Biden’s plan would see average annual deficits of $1.6 trillion throughout the decade. While this is $4 trillion lower than CBO’s projection, it allows for perpetual fiscal imbalances.

Enforcement Reforms in the House Budget Committee’s Resolution

The HBC budget resolution also includes important enforcement reforms to address various loopholes and budget gimmicks that have historically undermined budget integrity and fiscal responsibility:

It would establish a new procedural point of order if CBO determines that a bill being considered would increase direct spending by over $2.5 trillion in any ten-year period over the next forty years.

It would impose a tighter limit and a new point of order regarding the use of the “changes in mandatory spending” budget gimmick whereby authorizations of prior spending are repealed in order to provide “offsets” for higher outlays in spending bills.

It would limit the use of advance appropriations that are frequently used to circumvent limits on discretionary spending.

It requires CBO to include debt interest impacts in cost estimates of legislation that impact mandatory spending. This would help shed greater transparency on the true fiscal impact of these proposals.

It would address shortcomings in the budgetary scorekeeping of federal credit programs. The current method that CBO is required to use does not capture the full risk of the government’s 131 different loan and loan guarantee programs. The resolution would have CBO include fair value estimates, which provides for a more comprehensive assessment of the market risk, for federal credit programs in its baseline projection and to provide estimates of credit programs in legislation. These estimates could be used for enforcement purposes.

Conclusion

By charting a course toward fiscal responsibility and long-term sustainability, the resolution sets forth a roadmap for promoting economic growth and achieving a balanced budget. By contrast, President Biden’s budgets have abandoned the goal of balancing, allowing for deficits over $1 trillion per year indefinitely. It is easy to lay out a plan on paper to balance the budget; the far harder part is to work through the budget process. Nevertheless, the first step in balancing the budget is to set the goal, and then commit to the necessary measures to achieve it.