(pdf)

Introduction

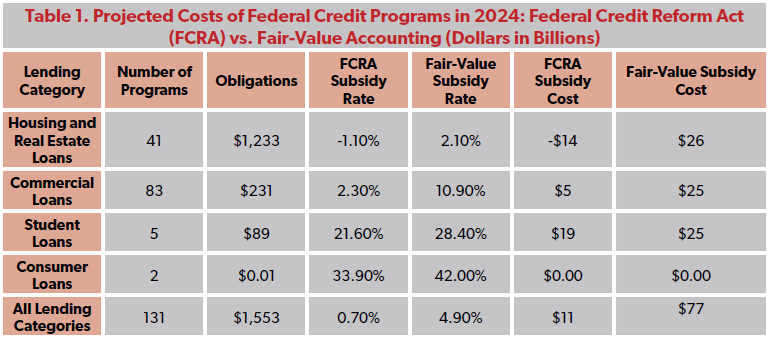

In addition to spending taxpayer dollars on thousands of programs, the federal government obligates and puts taxpayer dollars at risk through 131 different credit assistance programs that lend money or provide taxpayer guarantees of loans. The Congressional Budget Office (CBO) projects that, in 2024, these federal programs will issue a total of $1.6 trillion in either direct loans or loan guarantees.

These loans and loan guarantees leave taxpayers on the hook in the event that borrowers default and fail to pay back what was borrowed. The government’s current accounting rules estimate that credit assistance allotted in 2024 will cost taxpayers $10.9 billion over the lifetime of the loans and guarantees, but this does not fully capture the risk of default. Fortunately, the CBO provides an alternative analysis of these credit programs, using what’s called fair-value accounting to shed more light on the true liability risk to taxpayers. Under fair-value accounting, which takes a more comprehensive approach to accounting for the market risk of default, the cost of these credit activities is revealed to be closer to $76.7 billion — or seven times higher than the official accounting method.

Reform proposals have been introduced in Congress to make fair-value accounting the standard for evaluating federal credit programs for a more accurate assessment of the risk to taxpayers.

Background on Scoring Federal Credit Programs

The relevant current rules for federal government loans and loan guarantees were set in place by the Federal Credit Reform Act (FCRA) of 1990. This uses an accrual method to project the lifetime costs of loans. A rate of interest, or discount rate, is used to translate future cash flows into current dollars. Under FCRA, the discount rate is based on projected yields of Treasury securities with the same term to maturity as the given loan. Since Treasury securities are backed by the full faith and credit of the federal government, they are considered “risk-free” from default (though budget brinkmanship, soaring debt, and rising interest rates has led Fitch Ratings and Moody’s Investors Service to downgrade the U.S.’s credit rating and outlook) but still include risks tied to rising interest rates.

FCRA does not adequately account for market risk of default, and fair-value accounting can fill in this analytical gap. Fair-value accounting estimates based on the market rate of interest that an investor would require for taking on the risks associated with the loan. In its report, CBO’s produces side-by-side analyses of the government’s credit programs using both methods, and notes:

In CBO’s view, fair-value estimates are a more comprehensive measure than FCRA estimates of the costs of federal credit programs, and thus they help lawmakers better understand the advantages and drawbacks of various policies.

CBO’s Analysis of Federal Credit Programs in 2024

Table 1 shows the number of credit assistance programs by lending category, the total amount of obligations projected for FY 2024, and the subsidy rates under the two different accounting methods. The subsidy rate reflects whether or not the loans are expected to generate receipts or end up as a loss. The fair-value method finds that subsidy rates for all of the programs are 4.2 percent higher, on average, compared to FCRA. Housing and real estate credit programs appear to generate $14 billion in revenues, but these vanish under fair-value, instead imposing a cost of $26 billion on taxpayers. CBO also reports that weighted by the dollar size of each programs’ credit, the average subsidy rate is 0.7 percent under FCRA and 4.9 percent under fair-value.

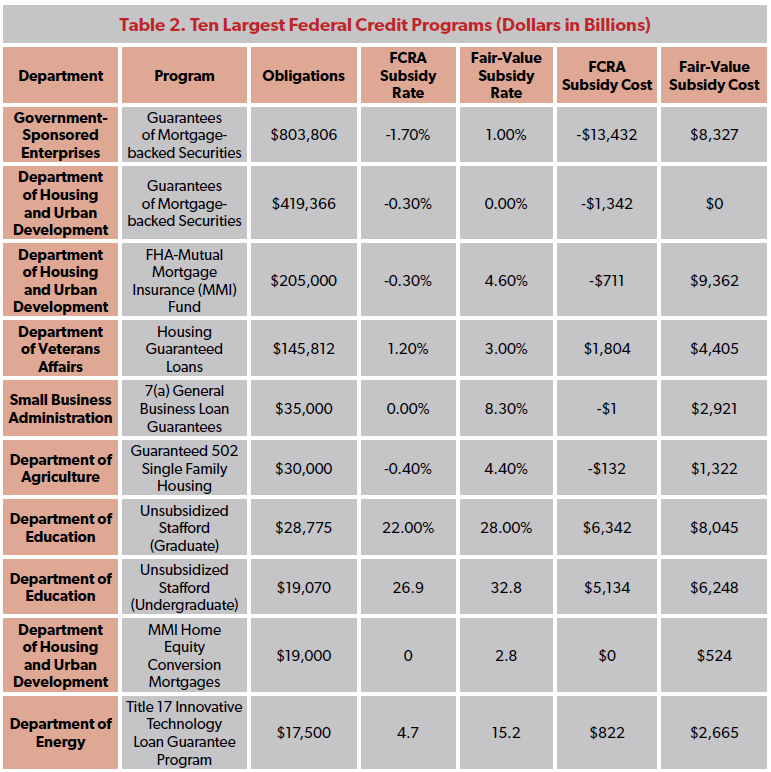

By far the largest obligations are through housing and real estate credit programs (see Table 2). These are included as six of the 10 largest credit programs. The single largest credit program is run by Fannie Mae and Freddie Mac, the government-sponsored enterprises (GSEs) that guarantee mortgage-backed securities. After the economic crisis of 2008, the federal government bailed out the GSEs and put them under a federal conservatorship. Because this remains the status quo, CBO treats the GSEs as government entities and includes their portfolios in budget estimates.

The federal government also provides loans and guarantees to businesses through 83 different credit programs. The total obligations range from $3 million for Bureau of Indian Affairs-insured loan programs to $35 billion for the Small Business Administration’s 7(a) loan guarantees. The $25 billion fair-value estimate of the subsidy cost is five times higher than the FCRA estimate.

CBO projects that five different student loan programs will obligate $89 billion in 2024. While this amount is a lot smaller than that of the housing and business credit programs are projected to distribute, the subsidy rate is much higher for student loans under both accounting methods. While FCRA finds a subsidy rate of 22 percent and a $19 billion cost, these figures rise to 28 percent and $25 billion under fair-value accounting.

Efforts from the administration and some in Congress to forgive student loans may create moral hazards that drive subsidy rates higher as students are incentivized to take larger loans and delay paying them back in the hope that politicians will relieve them of their debt. The Biden administration has sought to transfer hundreds of billions of student loan debt from borrowers to the national debt.

The government has long underestimated the true cost of student loans to taxpayers. In 2022, the Government Accountability Office (GAO) conducted a review of the growth in student loan programs. The Department of Education had originally estimated that the student loans issued over the past 25 years would generate $114 billion in revenues for the federal government. GAO found that instead of a deficit-reduction windfall, the loans actually cost the government $197 billion — a $311 billion swing from the Department of Education’s estimate.

There are just two credit programs designated for consumers. The Department of State’s Repatriation Loan program provides emergency loans to eligible citizens and their dependents that need to be returned to the U.S. from abroad (for example, due to a health emergency). This program has a high subsidy rate (54 percent under FCRA and 68 percent under fair-value) but the obligation total is relatively low, at $3 million in 2024. The Vocational Rehabilitation program for Native American veterans is projected to obligate $2 million.

A much larger risk is the implicit subsidy to Fannie Mae and Freddie Mac, the government-sponsored enterprises (GSEs) the federal government took control of in 2008. They still remain a moral hazard, putting taxpayers on the hook for mortgage loans as they back approximately 70 percent of the mortgage market. The Federal Housing Finance Agency reports that Fannie Mae’s mortgage portfolio amounts to $4.1 trillion and Freddie Mac’s is $3.4 trillion. CBO projects that the GSEs will provide $804 billion in new guarantees in 2024. Under FCRA’s negative subsidy rate, these are projected to generate revenues of $13.4 billion, but fair-value accounting finds that taxpayers could be exposed to a cost of up to $8.3 billion.

Congress Creating More Credit Programs, Costs Are Increasing

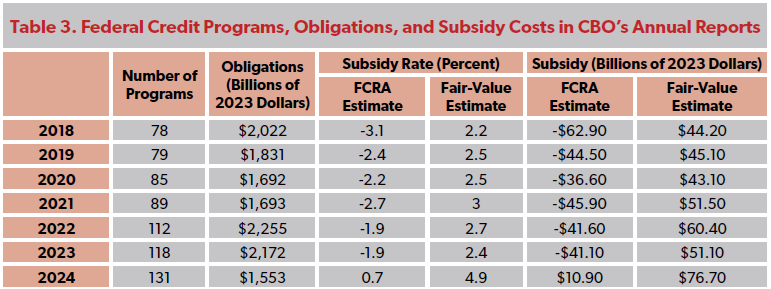

Since 2018, CBO has produced annual reports with detailed spreadsheets on federal credit programs that compare the risks projected under both fair-value and FCRA methods. CBO tracked 131 credit programs in 2023 compared to 78 in 2018. The number of federal credit programs has grown over the years, but CBO has also been more thorough in tracking them. In a review of data from the Office of Management and Budget, we find that 23 of the credit programs listed in the most recent CBO list that were not in the 2018 list, had prior statutory authority. Six of those programs from 2018 are no longer in operation. In net, 36 programs have been established since 2018.

The key takeaway is that even though the amount projected to be obligated in 2024 for credit programs is $469 million, or 23 percent, lower than the 2018 level in constant 2023 dollars, the subsidy costs have increased significantly since then under both FCRA and fair-value accounting.

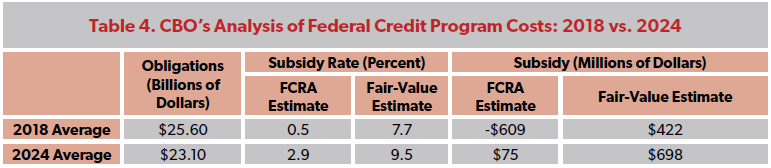

Table 4 shows the average obligation level and subsidy rates for the credit programs included in CBO’s 2018 report that are also still included in CBO’s projection for 2024. The subsidy risks have increased for these programs.

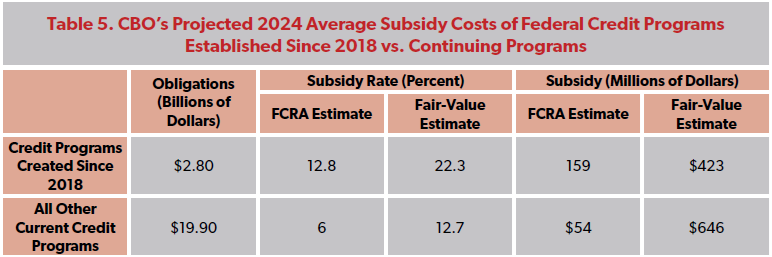

Table 5 is based on CBO’s 2024 projection of subsidy programs and compares the 36 credit programs that were added since 2018 with all of the other continuing credit programs. CBO expects the new programs will obligate $2.8 billion in taxpayer dollars, but these programs have much higher subsidy rates than the established programs.

The Infrastructure Investment and Jobs Act of 2021 established 7 new federal credit programs. CBO estimates that these will obligate $60.9 billion in FY 2024. On average their subsidy rates/costs will be 5.5 percent and $3.2 billion under FCRA and 18 percent and $10.6 billion under fair-value.

The Inflation Reduction Act of 2022 added another 6 loan programs that will obligate a total of $8.7 billion in FY 2024. These include 3 rural electrification and telecommunications loans distributing $7.9 billion with an average subsidy rate of 33 percent under both accounting methods for a projected net cost of $2 billion. The other 3 are green retrofitting loan programs. The smallest will obligate $23 million and has a negative subsidy rate under both methods. The other two will distribute a combined $711 million and have an average subsidy rate of 42 percent under FCRA and 45 percent under fair-value, each costing taxpayers just under $300 million.

One concerning trend we are seeing is an expanded use of a little known agency: the Federal Financing Bank in the Department of the Treasury. Congress created the FFB in 1973 so that federal agencies that needed funds for cash flow would be able to borrow via the Treasury instead of through the private sector. As the Congressional Research Service wrote in 1975, “The Federal Financing Bank helps agencies avoid the costs of higher interest rates by purchasing their securities at a lower rate than they can receive in the financial markets.” Agencies would be able to get lower interest rates via Treasury-issued loans.

But in recent years, Congress and the White House have begun specifying that certain credit programs should be financed through the FFB, expanding its role beyond its original purpose. For example, in 2014, Treasury announced that the Department of Housing and Urban Development would be able to tap into the FFB to secure lower financing rates for the New York City Housing Development Corp. through a “risk-sharing agreement,” putting federal taxpayers at risk for a state-run program.

Four of the new programs since 2018 included in CBO's review of credit programs are linked to the FFB, including support for a Tribal Energy loan program, two Innovative Technology Loan Guarantee Programs, and a program to finance the construction of ships. Since 1972 the Maritime Administration (in the Department of Transportation) has offered a loan guarantee program to support private sector ship building projects that meet certain criteria. A 2019 law provided for the program to use the FFB and subsequent regulation made the FFB the preferred lender for the program. These four newer FFB-tied credit programs will obligate $24 billion in loans and guarantees in 2024, with an average subsidy rate of 4.4 percent under FCRA vs 15 percent under fair-value, and costs of $1.3 billion and $3.9 billion. If policy makers continue adding statutory uses for the FFB, they risk transforming it into a slush loan program for politicians' pet projects.

Legislative Reforms

The idea behind federal credit programs is that there are cases where the government should step in as the “lender of last resort” or guarantor for crucial projects that are unable to obtain private sector loans at a favorable rate. However, Congress is finding many new programs and projects that are deemed in need of federal lending. One problem that incentives this is that current accounting rules provide that these programs are scored more favorably than private sector loans would be. Another troubling trend is that policymakers have realized they can make the FFB the primary lender for favored projects.

The first step to reining in federal programs is to provide for more accurate accounting of the risk to taxpayers. Representatives Ralph Norman (R-SC) and Glenn Grothman (R-WI) introduced H.R. 5571, the Fair-Value Accounting and Budget Act, that would encourage transparency and accuracy in accounting to loan programs administered by the federal government. Adopting fair-value accounting principles provides a more comprehensive and accurate assessment of risk. CBO’s annual report on federal credit programs demonstrates that it has the capacity to easily and readily implement this reform.

Conclusion

Congress has been steadily increasing the number of federal credit programs and the volume of loans and guarantees that federal funds are used to back, exposing taxpayers to more and more risk. The risk factors are increasing with the combination of inflation and rising interest rates. The current statutory accounting method makes these programs look significantly less risky than they would under private sector accounting methods. This may also play a contributing role in the increasing number of federal credit programs and the higher amount of taxpayer dollars put at risk.

Fair-value reform is needed to shed better light on the risks imposed by the government's 131 different loan programs. CBO should get credit for re-analyzing these programs each year to show the higher subsidy rate under fair-value methodology, which takes better account of the market risk. This risk and the associated costs should be the statutory standard in official scores from CBO.