|

|

|

May through early June is the peak of the horse racing season. For over a century now, Americans have been following the Triple Crown of Thoroughbred Racing. Last week’s Kentucky Derby drew a crowd of over 164,000 spectators and 15.3 million TV viewers, who watched California Chrome win the race and take home $1.4 million out of the $2 million purse.The series will continue next week at the Preakness Stakes in Baltimore and in Belmont, NY three weeks after that. The Triple Crown represents big money for owners and advertisers alike: the combined purse for all three races this year is over $5 million, and some estimates project that Churchill Downs -- the track that hosts the Kentucky Derby -- could pull in $100 million in revenue from this year’s race; meanwhile, NBC just extended its $5 million per year contract with the track for exclusive broadcast rights. The sport, and horse safety in general, has also attracted the interest of some lawmakers of Congress. Earlier in the Congress, we wrote about legislation in the House to expand the U.S. Anti-Doping Agency’s authority to include horse racing. Additional bills have been introduced to address the safety of horses and their riders, and others to address tax-related issues.

The Bill: H.R. 4552, the Christen O'Donnell Equestrian Helmet Safety Act of 2013 Cost Per Year: "No Cost" -- Below Budgetary Threshold

The Bill: H.R. 2966/S. 1176 (112), the American Horse Slaughter Prevention Act Cost Per Year: $4 million ($20 million over five years)

NTUF covered the bill in an October 2011 edition of The Taxpayer’s Tab, where it was featured as a “Most Friended” bill for obtaining 77 House cosponsors and 24 in the Senate. To date, the legislation has not been reintroduced in the current Congress; a related pair of bills, H.R. 1094 and S. 541, the Safeguard American Food Exports Act, would prohibit the export and interstate sale or transport of horses for purposes of slaughtering for human consumption.

The Bill: H.R. 4440/S. 1459, the Horse Transportation Safety Act of 2014 Cost Per Year: "No Cost" -- Regulation

The Bills: Cost Per Year: Unknown Two sets of bills would seek to strengthen the protection of horses that participate in shows and exhibitions or are put on sale at auctions from a practice known as soring. Soring is a training technique in which pain is intentionally inflicted on a horse to modify its gait. The practice was determined to be abusive and even though it was outlawed by the Horse Protection Act of 1970, it is still practiced. In 2012, an undercover report by ABC News exposed footage of a trainer beating a horse. One pair of bills, the Horse Protection Amendments Act, would require the Secretary of the Department of Agriculture to establish and appoint members to a new Horse Industry Organization that would “appoint inspectors to conduct inspections at each such show, exhibition, and sale or auction.” The second pair of bills, the PAST Act, would impose stricter regulations. The Agriculture Department would directly “license, train, assign, and oversee persons qualified to detect and diagnose a horse that is sore or to otherwise inspect horses.” It would also increase the penalty for soring from the current maximum of a $3,000 fine and up to one year in jail to a $5,000 fine and a potential for a five-year sentence. A violator could also be permanently disqualified from participating in any future shows or sales. It is unknown at this time what the possible administrative costs to the federal government might be under either of these competing proposals. However, on April 9, 2014, the Senate Committee on Commerce, Science, and Transportation ordered the PAST Act to be reported which means that a Congressional Budget Office cost estimate could be forthcoming.

The Bill: H.R. 126, the Corolla Wild Horses Protection Act Cost Per Year: “No Cost” -- Below Budgetary Threshold

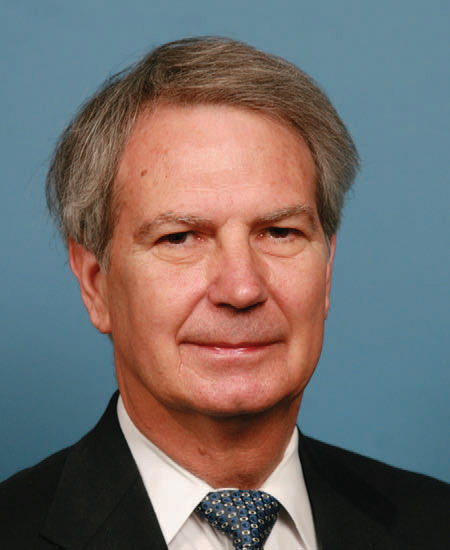

The horses are managed through an agreement between the U.S. Fish and Wildlife Service (FWS) and a local nonprofit organization known as the Corolla Wild Horse Fund. However the last management plan, approved in 2007, has expired. Sponsored by Congressman Walter Jones (R-NC), H.R. 126 would require the Fund to maintain a herd of between 120 and 130 horses. It is not expected that the legislation would impact federal spending at all unless the population of horses exceeds the maximum level. According to the Congressional Budget Office (CBO), if it does, the FWS could incur costs totaling $200,000 per year to manage the horses. CBO did not specify what the funds would be used for but the House Committee report on the bill noted that there could be a one-time cost: “$186,000 for a new barn and corral for the horses, $54,000 for a new boat and trailer, pickup truck and utility vehicle, and $26,000 for wild herd examinations.” The bill was approved by the House last June and awaits action in the Senate. A previous version of the bill was also approved by the House in the 112th Congress.

The Bill: H.R. 998, a bill to amend the Internal Revenue Code of 1986 to reduce the holding period used to determine whether horses are section 1231 assets to 12 months Cost Per Year: “No Cost” -- Revenue

However, horses only qualify as long-term capital assets if held for 24 months or more, meaning that owners who sell their horses before then are subject to a higher tax rate. Congressman Andy Barr (R-KY)* introduced H.R. 998 to rewrite the Internal Revenue Code and make horses eligible for the long-term capital gains rate after 12 months, mirroring how sales of other business assets are treated. The American Horse Council has argued that the current Code is unfair to horse owners and the industry, and changing the law would offer owners “more flexibility to sell and market their horses.” The Bill: H.R. 2212, the Race Horse Cost Recovery Act of 2013 Cost Per Year: “No Cost” -- Revenue

Among the extenders being considered this year is one pertaining to the depreciation allowance for race horses. Prior to temporary provisions passed in 2008, a race horse was deemed to have a “useful life” of seven years, meaning its value would gradually decline over that time. The value of horses “placed in service” -- or initiated into training -- after the age of two could be depreciated over three years instead. A shorter depreciation schedule allows owners to reduce their tax liability and recover the horse’s cost more quickly, as it becomes less valuable (from a business perspective) in a shorter amount of time. Congressman Andy Barr (R-KY)* introduced H.R. 2212 in order to make the 3-year depreciation window permanent for horses of any age. The provision has been included as a temporary measure in S. 2260, the Expiring Provisions Improvement, Reform, and Efficiency (EXPIRE) Act, which would also renew dozens of other tax extenders. The Senate Committee on Finance noted that the horse industry “is important to a number of State and local economies,” and recommended the 3-year depreciation window be extended. The Joint Committee on Taxation estimated that it would reduce revenues by $117 million over the 2014-2019 timeframe, and by $9 million through 2024 (the provision would expire again at the end of 2015). This is wholly a revenue estimate and so will not be counted under BillTally methodology. * NTUF does not have a BillTally report for Congressman Barr because he is a freshman Representative.

|

|

The Federal Tax Code allows the sale of depreciable property held for more than a year and used in a trade or business, including horses and livestock, to be taxed according to the long-term capital gains rate. By filing those sales at the long-term capital gains rate (a

The Federal Tax Code allows the sale of depreciable property held for more than a year and used in a trade or business, including horses and livestock, to be taxed according to the long-term capital gains rate. By filing those sales at the long-term capital gains rate (a