(pdf)

Introduction

This week, the Trump Administration completed the rollout of its full budget proposal for FY 2020 through 2029. On paper the President’s budget would shrink deficits to less than one percent of GDP in 10 years and would be balanced in 15 years. While it is laudable that the Administration has set forth a blueprint with achievable spending reductions – while also locking in the individual income and estate tax reforms and reductions enacted in the 2017 Tax Cuts and Jobs Act – there are potential pitfalls along the path to balance.

The budget blueprint relies on very optimistic economic assumptions of annual growth. A dip in performance could reduce tax receipts which would widen the deficit without further spending reforms. While there are noteworthy reforms to discretionary and mandatory spending programs included in the budget, there are also some gimmicks, such as bulking up the defense budget outside of statutory spending caps.

Another challenge to getting to a balanced budget is that spending is set to grow over the short-term with reforms kicking in later in the budget windows. Recent history shows that the will to adhere to spending restraints weakens over time, so it is better to lock in budgetary savings sooner rather than later. Moreover, additional reforms are needed in advance of Social Security’s looming insolvency in 2034.

Deficit Reduction and Spending Reforms

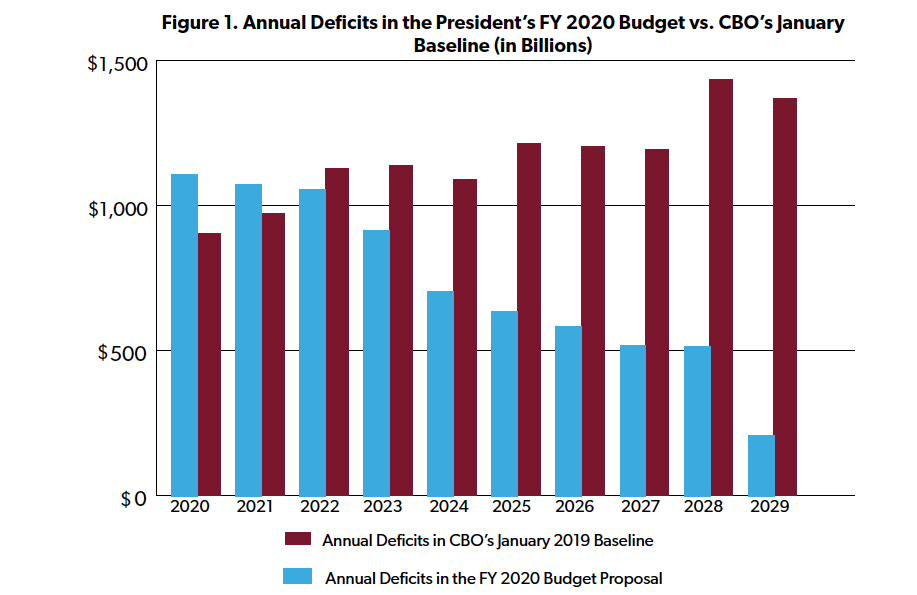

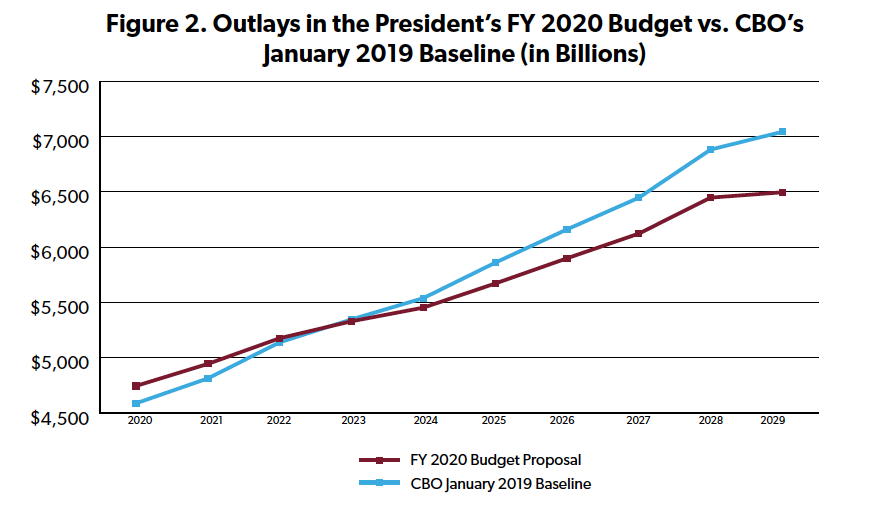

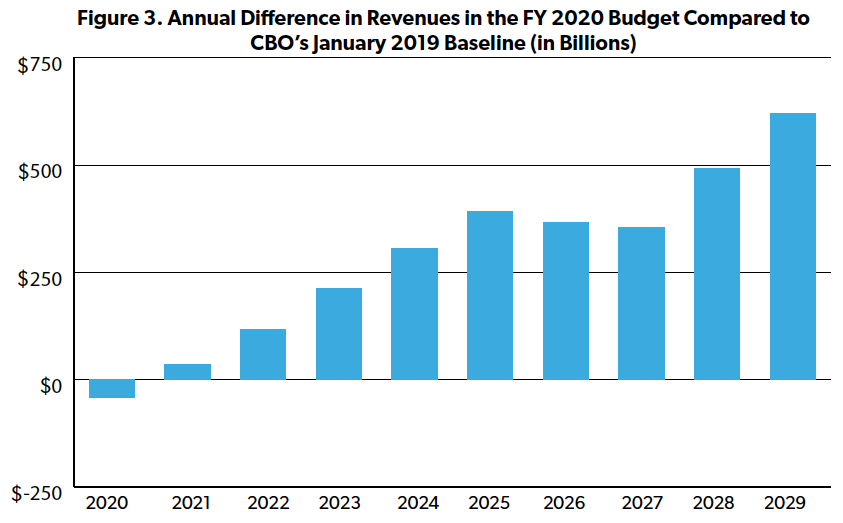

In January the Congressional Budget Office (CBO) released its ten-year budget baseline that projected that annual deficits would top $1 trillion starting in FY 2022 and adding a total of $11.6 trillion to the national debt over the decade. CBO is required to make these projections using current law which gives the appearance of producing less red ink than is likely. Under the President’s budget, annual deficits would exceed CBO’s baseline over the first two years, from a net of $5 billion lower projected tax receipts and $288 billion in higher spending. Over the rest of the budget window, the budget projects receipts growing faster and spending growing slower, adding $7.3 trillion to the debt, $4.4 trillion less than CBO’s baseline.

The centerpiece of the budget’s spending reform is a “two-penny plan” of annual two percent cuts to non-defense discretionary spending, saving $1.1 trillion over ten years. This would keep these outlays below the Budget Control Act’s (BCA) spending caps. This would also further facilitate the elimination of wasteful and duplicative programs. As the Government Accountability Office’s (GAO) latest annual report on waste shows, this remains a problem. More specifically, the budget’s Major Savings and Reforms document lays out a list of reforms with detailed justifications including 67 discretionary programs whose elimination would save $28 billion, plus $20.8 billion in reductions and reforms to another 34 programs.

The budget includes additional reforms that merit bipartisan consideration to help rein in spending and protect taxpayers:

Agricultural reform: The budget would protect taxpayers by reducing the average premium subsidy for crop insurance from 62 percent to 48 percent, saving $2.2 billion per year. Limits on payments and closing loopholes in commodity payment programs would save an additional $135 million per year. These and additional reforms to limit crop insurance eligibility to farmers with incomes below $500,000 and limiting subsidies to crop insurance companies would cut wasteful spending, limit taxpayer exposure to risk, and reduce the prevalence of crony capitalism.

Postal reform: The budget proposes $98 billion in savings to the United States Postal Service (USPS). With losses totaling nearly $70 billion since 2000 and unfunded liabilities amounting $120 billion, the USPS is included in GAO’s “high risk” list of federal programs in need of reform. The changes are based on recommendations to restore solvency from the President’s Task Force on the United States Postal System.

Administrative reform: Last year, the White House introduced an ambitious plan to reorganize the federal bureaucracy employing ideas and solutions from the private sector to reduce overlap and improve performance. This would include efforts to evaluate federal programs to determine whether they are effectively achieving their goals, something that has not been comprehensively done since President George W. Bush’s “Program Assessment Rating Tool” project. This also includes reforms to improve government acquisition and contracts and to address the findings of the first ever audit of the Department of Defense (another GAO high-risk area) and take corrective action to address the financial control problems.

Slowing the growth in health care programs: The budget would seek to replace the Affordable Care Act with the Graham-Cassidy-Heller-Johnson bill proposed in September 2017. Starting in 2021, a new Market-Based Health Care Grant Program would replace the ACA’s exchange subsidies. Both this new program and Medicaid outlays would be capped to grow at the rate of the Consumer Price Index. Medicare’s Graduate Medical Education and uncompensated care programs would be converted into grant programs. The budget would also address problems in 340B drug discount program where there are concerns that the intended savings are not being passed along to patients.

Budget reform: The budget would seek to limit the use of budgetary gimmicks to offset spending in legislation. Last year the President offered a rescissions package that would have cancelled out $15 billion in expired authorizations most of which could no longer even be spent. CBO determined that the rescissions would lead to just $1.3 billion in actual spending cuts. The package was ultimately defeated in the Senate, but the rescissions were used to mask higher spending in a subsequent appropriations bill. The President’s budget would limit use of these phony “offsets” against discretionary spending. The budget also encourages lawmakers to use fair-value analysis to more accurately account for market risk in federal credit programs.

With these reforms, non-defense discretionary spending would grow to $700 billion in FY 2020, up $15 billion over this year’s projected level, and then shrink to $511 billion in 2029. Medicaid spending would dip from $419 billion to $418 billion from 2019 to 2020 but would grow to $602 billion in 2029. Otherwise, net spending would increase from year to year, but at a slower rate relative to the baseline.

Potential Pitfalls in the Budget

Spend now, save later: Although the budget does call for ambitious and much needed reforms, they come later in the budget window and are preceded by hikes in spending and the deficit over the first two years. The history of recent budget reforms such as the Budget Control Act of 2011 shows that lawmakers will gradually erode caps and spending restraints over time. Congress has already overridden the BCA caps to allow for $439 billion in higher spending. This shows it is important to front-load spending reforms before future policymakers walk them back.

Defense spending: The budget would also seek to skirt the budget caps on defense spending with “an enormous boost” in Overseas Contingency Operations (OCO) account spending, from $69 billion in FY 2019 to $165 billion for FY 2020. Such a boost would lead to calls from lawmakers for complimentary spending hikes in other programs.

At $726 billion in FY 2020, defense would see a nearly 8 percent boost over 2019. This includes $306 million in startup funds for three new military programs: a U.S. Space Force, a Space Development Agency, and U.S. Space Command. The idea is to consolidate overlapping projects taking place across Defense Department but runs the risk of growing into another unwieldy military bureaucracy. A long-term budget outlook for the new programs is not yet available, but initial reports after the President first announced the Space Force last summer pegged the five-year cost at $2 billion, including 15,000 personnel.

Extend savings that have already been overridden: The budget would extend mandatory sequestration for another two years through 2029, for a net savings of $50.2 billion. As noted above, Congress has already raised the BCA caps multiple times in order to prevent sequestration spending cuts from taking place.

New entitlement program: The budget proposes a new national paid leave program. The benefits would cost $20.5 billion over ten years, half of which would be offset with reforms to the Unemployment Insurance program. A Democratic alternative introduced in Congress as the Family and Medical Insurance Leave Act was estimated to cost from $27 billion up to $997 billion per year. Other competing family leave proposals would provide tax credits to encourage employers to offer paid leave, or would allow workers to collect future Social Security benefits early in exchange for delaying retirement eligibility dates for Social Security.

Rosy economic assumptions: The Administration’s tax reform and deregulatory policies have contributed to a growing economy. The budget projects robust performance continuing over the next decade, with 3 percent growth in the real annual GDP boosting revenues $2.9 trillion higher than CBO’s projection. These assumptions play a large part in the Administration’s deficit reduction plans. Left out of the budget is extension of the full expensing allowed under the TCJA. Making this permanent would have a strong impact on economic growth.

However, the budget also includes the revenues from several Affordable Care Act taxes that the Administration has supported repealing. The Administration’s tax projections, which only show data over the next five years, include receipts form the Medical Device Tax ($13.3 billion), the Excise Tax on High Cost Employer-Sponsored Plans ($13.6 billion), and the Fee on Health Insurance Providers ($84.4 billion). The budget also includes a legislative proposal “Empowering States and Consumers to Reform Healthcare” which reduces revenues by $12.8 billion, but it is unclear what exactly this does.

The budget also pumps up the Internal Revenue Service’s enforcement budget and imposes additional fees and oversight on tax preparers. Taxpayers already face an uphill battle in challenging the IRS’s determinations in tax disputes. There are too many previous examples of the IRS’s abuse of power. As NTU President Pete Sepp has stated, “the threat to taxpayers doesn’t rise and fall in a linear fashion with IRS’s enforcement budget. There is plenty to be worried about, but it’s more about poor procedures and lack of protections for taxpayers than raw enforcement dollars.” Taxpayer rights should be commensurately bolstered, and the IRS’s appeal processes should be improved to strengthen protections.

Tariffs: One large threat to continued economic progress is the administration’s pursuit of tariffs. CBO has found that the tariffs initiated by the administration have already weakened the economy. The Trump administration also has threatened to impose additional $90 billion worth of tariffs on imports. If implemented, the direct impact and the resulting uncertainty will further increase the hit to consumers’ wallets, the economy, and projected tax revenues.

Long-term Social Security insolvency unaddressed: The Social Security Trustees warn that the program faces insolvency in 2034. Social Security last faced insolvency in the early 80s. Congress responded by granting authority for Social Security to temporarily borrow $581 million from the Disability Insurance and Medicare Hospital Insurance Trust Funds (the funds were paid back with interest by 1986). This gave lawmakers time to draft and enact the Social Security Amendments of 1983 which accelerated a previously-enacted payroll tax hike and gradually raised the retirement age from 65 to 67 from 2000 through 2022. These reforms shored up the program and lead to surpluses, which, under law are transferred into special interest-bearing bonds issued by the Treasury. But in 2018, when Social Security outlays exceeded its revenues meaning that the first time since 1982, it had to start cashing in its IOUs from Treasury. The problem remains unaddressed in the budget, but the sooner that reforms are implemented to shore up the program, the less costly they will be.

Congress: The most difficult challenge to the proposal is getting Congress on board. All but three of the program eliminations in the budget’s Major Savings and Reforms were not also included in last year’s budget. As NTUF noted on Trump’s first budget, many of these reform proposals were familiar hand-me-downs from previous administrations that Congress failed to act on.

Conclusion

President Trump’s blueprint includes many reform proposals that lawmakers ought to consider to check the growth in spending and set a path towards balance. However, they should also be mindful of pitfalls along the way and avoid gimmicks such as the OCO slush fund for defense spending. Drafting budget proposals and defining priorities is an important part of the policy process, but the tricky part is getting reforms enacted. Finding common ground on budget reforms, and the will to adhere to limits over the long-term, remains a top challenge in the Capitol.