Key Facts

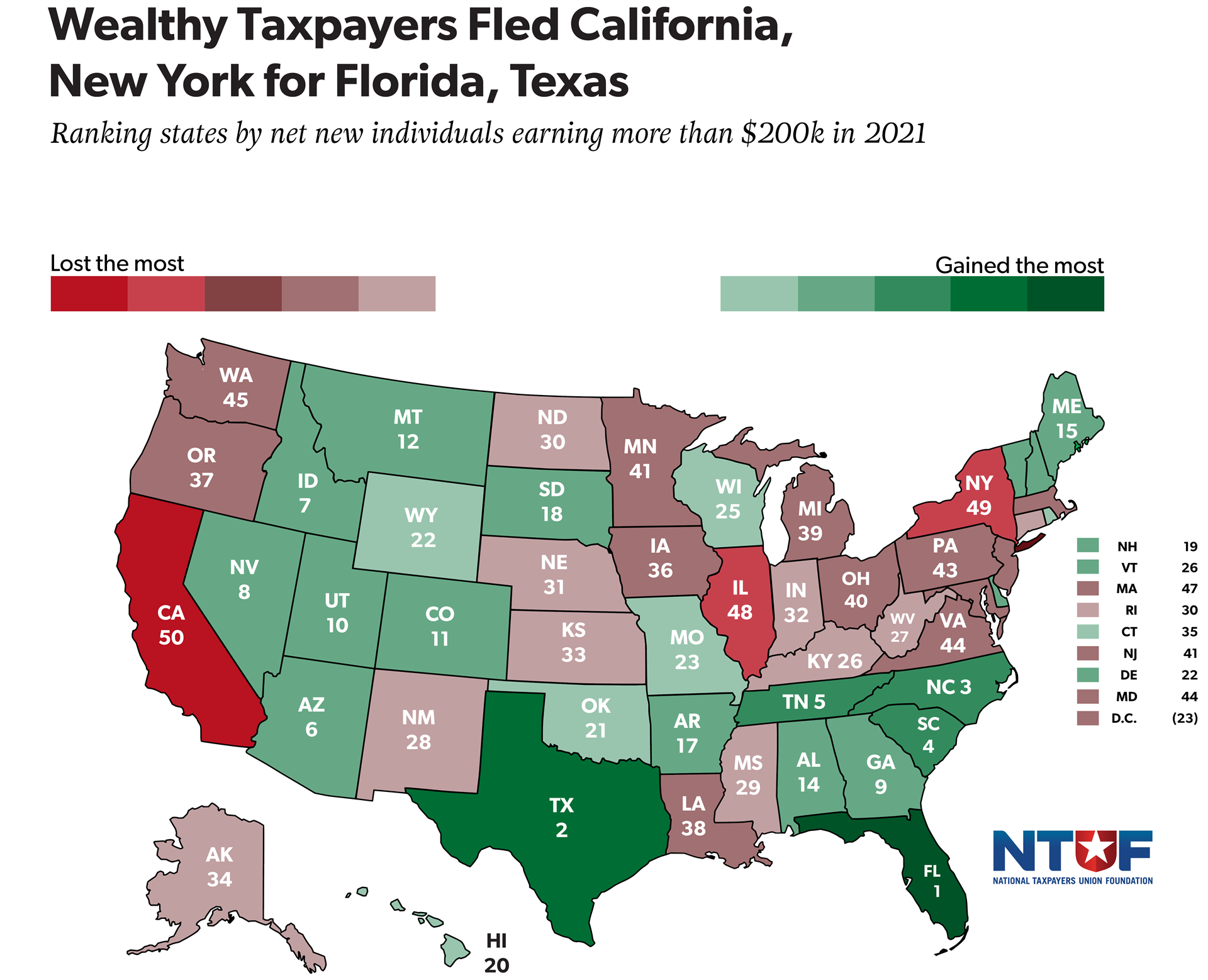

Florida, Texas, and North Carolina gained the most wealthy taxpayers from other states in the most recent IRS data, while California, New York, and Illinois lost the most.

Adjusting for population, Utah and Wyoming also did well attracting wealthy taxpayers, while taxpayers have fled Washington state at alarming rates in the wake of the state’s persistent tax hikes.

All the states that lowered taxes on high-income taxpayers in the past few years gained more wealthy taxpayers from interstate migration than the four states (and D.C.) that raised their top bracket in that time.

While the wealthy are frequently the target of politicians’ invective, there are few better cures for declining government revenues than an influx of wealthy taxpayers. Not only do they help address budget woes by paying far more in taxes than they receive in government services, they represent every legislator’s favorite kind of revenue source — the kind that does not require them to vote to raise taxes on anyone else.

But, while the rich can be an enormous boon, they are also particularly sensitive to the competitiveness of a state’s tax code. While taxpayers of all income levels respond to tax changes to some degree, wealthy Americans tend to be particularly aware of tax changes, and have more resources and opportunities to relocate to a more competitive tax environment.

The responsiveness of wealthy taxpayers to tax policy is intuitively understood by government officials in all states. This is obvious enough in states with more tax-competitive states, where the ability to attract and retain wealthy residents is an acknowledged goal of keeping tax rates low.

But legislators in high-tax states also plainly understand that high enough taxes will cause their wealthy residents to flee for greener pastures. After all, this is the reason that normally progressive states have fought so hard to reinstate the highly regressive state and local tax (SALT) deduction at the federal level — the SALT deduction blunts the impact of higher state taxes for wealthier taxpayers by allowing them to write off the higher tax payments at the federal level.

But just how much impact do the movements of the wealthy have on how a state fares from interstate migration? The IRS’s interstate migration data releases break down the impact of domestic interstate migration on each state by income level. The latest release covers changes in residency from calendar year 2020 and calendar year 2021.

The map breaks down interstate migration results for the top income bracket reported by the IRS — taxpayers with $200,000 or more in adjusted gross income (AGI). Click to see states sorted by net AGI among taxpayers in that top income bracket. Total net figures for all income levels are also shown to illustrate the disproportionate impact of the wealthiest Americans moving to different states.

The impact of domestic migration on states is primarily driven by the movements of the highest-earning taxpayers. There is a great deal of overlap between the states that gained the most net individuals overall and the states that gained the most net wealthy individuals.

There are some obvious outliers. Colorado, Utah, and Hawaii stand out as attracting a greater share of wealthier taxpayers than the general population. While Hawaii can probably thank its warm climate and abundance of beachfront property, Colorado and Utah have neither of those things. They do, however, have low flat income taxes and low property taxes.

On the other hand, some states are having less success attracting wealthier residents than middle-income taxpayers. Alabama, Oklahoma, and Kentucky stand out in this regard. However, this should not be understood to mean that these states are the least favorable destinations for the wealthy — instead, the bottom 10 to 15 states are simply ranked just as poorly regardless of whether one sorts by wealthy residents or the general population.

More residents are good, and more wealthy residents are better, but there is a lot of variety among taxpayers making more than $200,000 a year (unfortunately the highest categorization the IRS provides). The net AGI impact of movements by wealthier taxpayers paints a greater picture in this sense.

Georgia is by far the oddest result — despite gaining $716 million in net AGI among all taxpayers, it actually lost $518 million in AGI among the highest-earning taxpayers. The fact that the state still gained over a thousand taxpayers earning $200,000 or more in AGI on net suggests that this is more of a fluke driven by a few wealthy individuals moving to other states than the beginning of a trend.

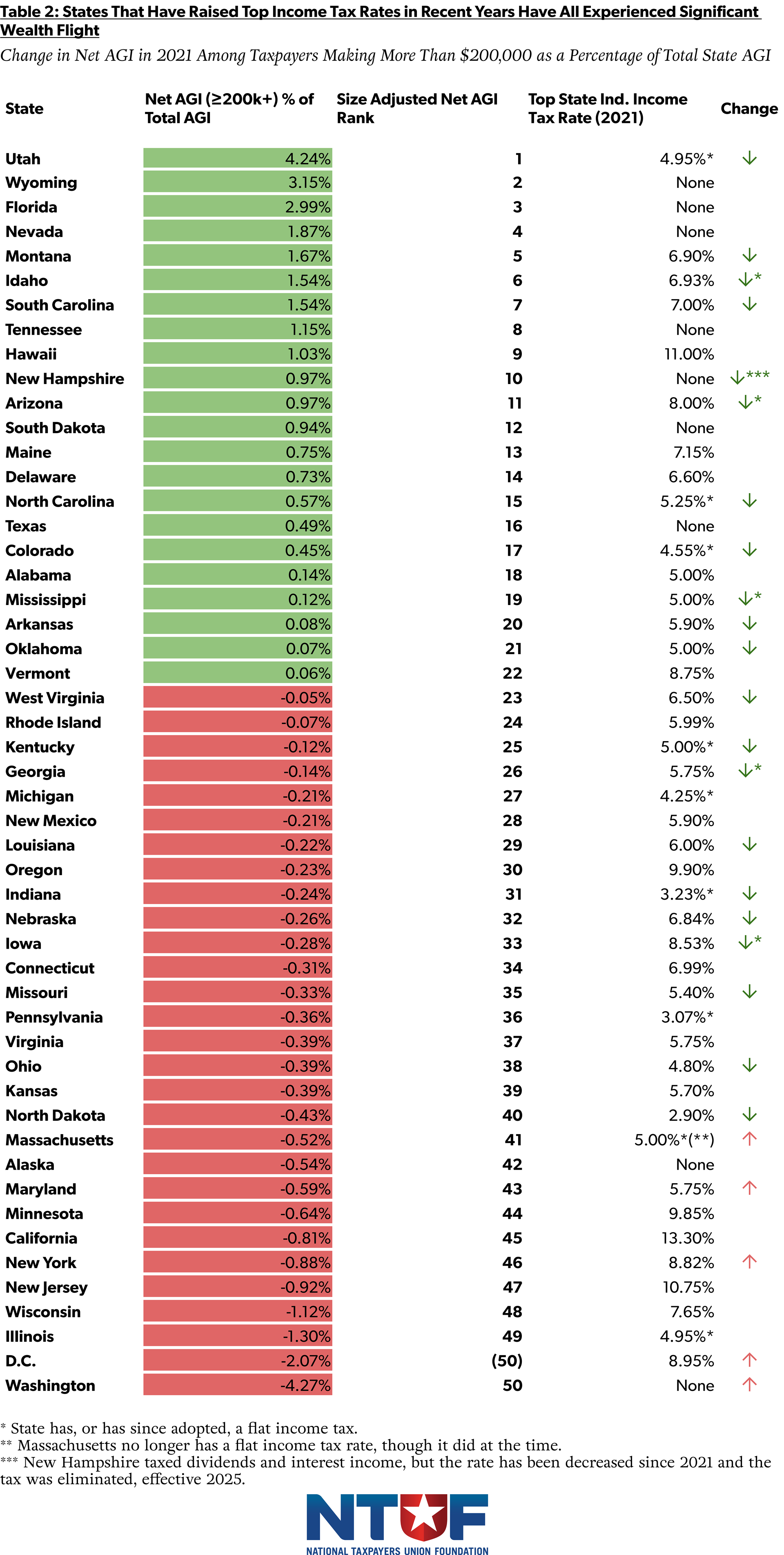

To adjust for the size of states, map 2 shows states ranked by the net AGI impact of residency changes in each state attributable to individuals with AGIs of $200,000 or more as a percentage of the state’s total AGI — in other words, the AGI impact of net migration among the wealthy as a percentage of total state AGI. It also includes the state’s top individual income tax bracket in 2021, as well as whether that top rate has increased or decreased in subsequent years.

Adjusting for the size of a state’s economy shows more clearly just how much smaller states like Utah, Wyoming, Nevada, and Montana have benefited from interstate migration. At the same time, the big-state headliners on either end of the spectrum remain clearly impacted by interstate migration by the wealthy, with Florida at number 3 and California and New York remaining in the bottom 6 states.

Not a single state that has increased tax rates since 2021 ranks higher than a state that has cut taxes since 2021. What’s more, many of the states that perform well in high income-earner interstate migration that had higher top tax rates in 2021 have since significantly cut rates, indicating either that wealthier individuals anticipated tax cuts or that states have sought to keep their new arrivals by reducing tax burdens.

With the exception of Hawaii, each state with an income tax ranking in the top 10 size-adjusted destinations for wealthy individuals has since cut its income tax. Utah’s flat rate has dropped to 4.55%, Montana’s has decreased by a full percentage point to 5.9%, Idaho has enacted a flat rate of 5.695%, and South Carolina’s rate is now 6.2%. Just outside the top 10, Arizona has slashed its top rate from 8% and now has a 2.5% flat tax. Other states like Mississippi, Georgia, and Iowa have since adopted flat taxes as well.

On the other hand, all the states that have raised top income tax rates are in the bottom 10 size-adjusted destinations for wealthy individuals. Adjusting for the size of a state’s economy does not save California, New York, and Illinois from remaining deep in the red, but it does highlight just how much Washington has been hurt by enacting a capital gains tax under a bill signed May 4, 2021, despite the state constitution prohibiting taxation of income. Worst of all — this data only shows moves through the end of 2021, and Jeff Bezos left the state for Florida in 2023.

Conclusion

It is intuitive enough that the movements of the wealthiest Americans are the most impactful when it comes to the effect on states’ economies, but this data underlines just how impactful those movements are. States that manage to set themselves up as preferred destinations for wealthier Americans will benefit, while states that are blithely accepting the out-migration of the wealthy as an unfortunate byproduct of higher taxes are steadily undermining their tax bases.

The relationship between a state’s top tax rate and its attractiveness to wealthy taxpayers is also clear. Few things guarantee an exodus of taxable income from a state quite like increasing taxes on the wealthiest taxpayers, while a more favorable tax environment can prove a powerful tool for a state seeking to enlarge its tax base.