Key Facts:

- The South Dakota v. Wayfair decision lets states require sales tax collection by out-of-state sellers, and has resulted in additional sales tax revenue for states. But it has increased sales tax compliance costs, especially for small businesses.

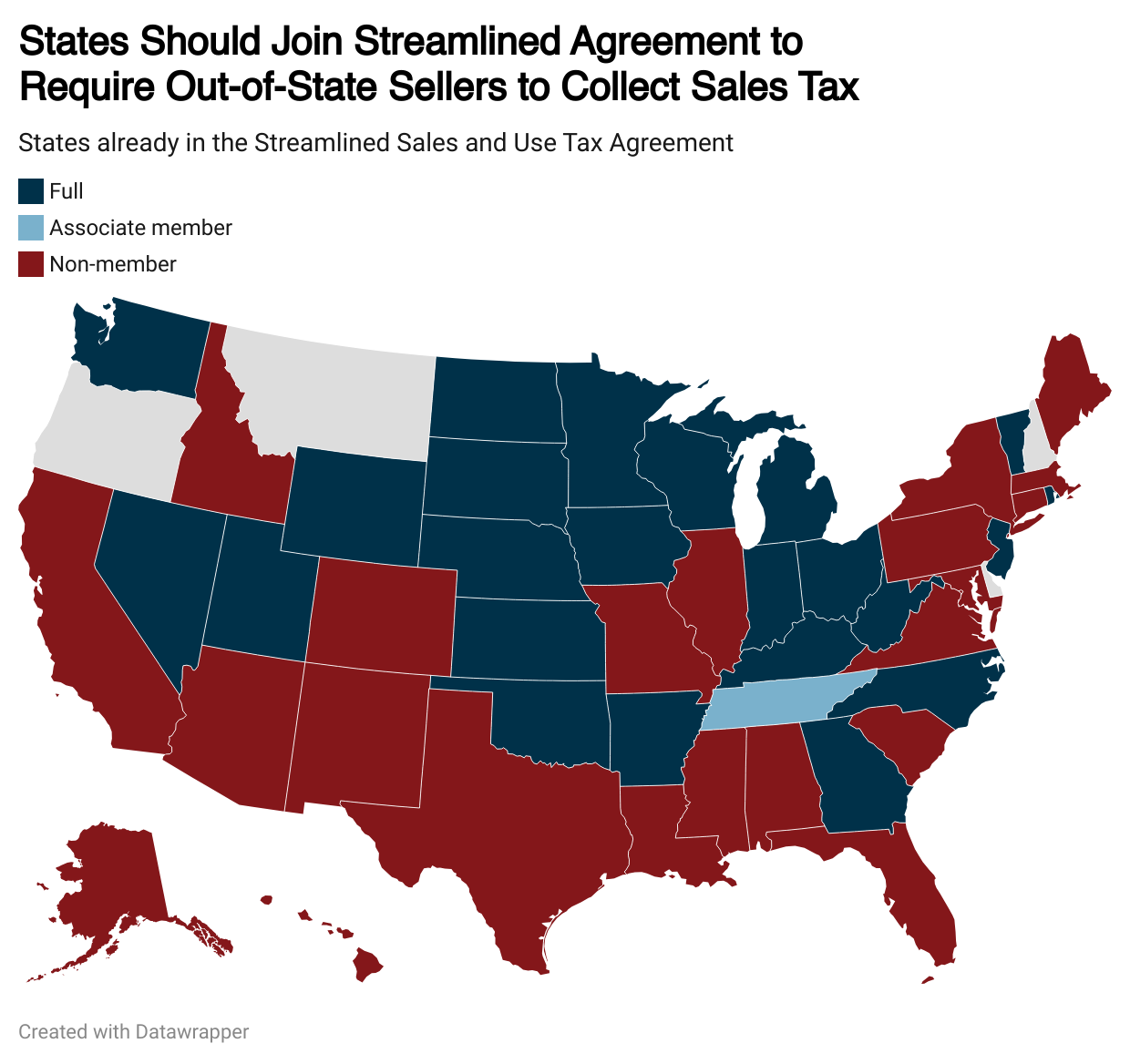

- Still just 23 states have joined the Streamlined agreement, including none of the 6 largest state economies — states seeking to tax remote sellers should do so.

- States have been making progress on rationalizing safe harbor thresholds, such as by eliminating 200-transaction thresholds (which 29 states have done) and not counting wholesale sales (18 states + DC) or marketplace sales (19 states) towards safe harbors; those states that have not yet made these reforms should.

- Other common-sense safe harbor reforms consist of expanding thresholds for states with significantly larger economies than South Dakota, ensuring progress is measured in sales during a calendar year, and allowing reasonable grace periods to begin collecting and remitting sales tax.

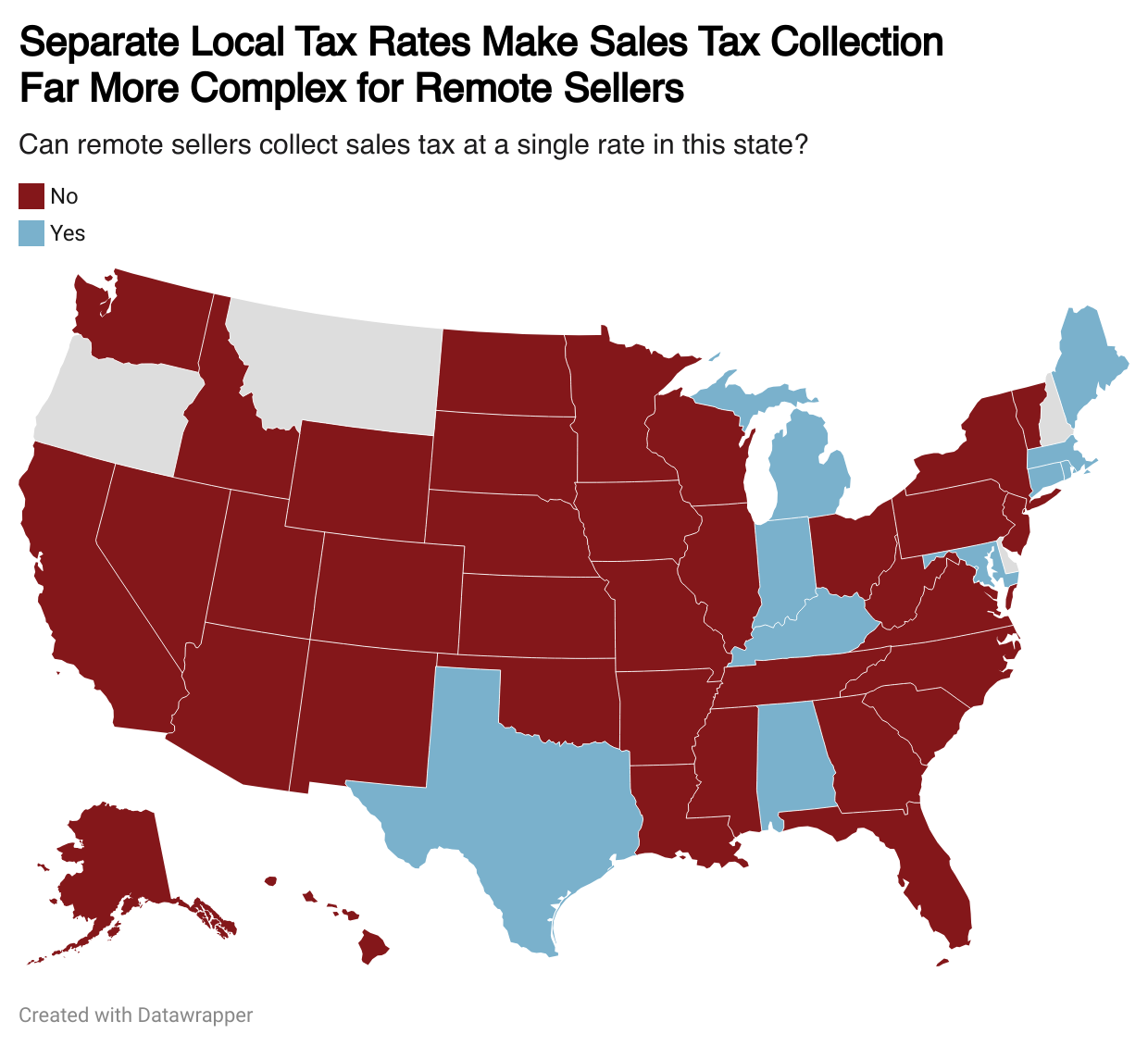

- Finally, states should seek to make local sales taxes manageable for remote sellers, ensuring a single point of contact at the state level and offering the option for out-of-state sellers to collect at a single, statewide rate, such as Texas and Alabama have done.

Introduction

Ever since the Supreme Court’s 2018 decision in South Dakota v. Wayfair, states can require sales tax collection by out-of-state businesses that lack any physical presence in that state. With the “physical presence” constraint removed, states have been able to gain some additional sales revenue from e-retail, but at the cost of substantial and often overwhelming increases in tax compliance burdens for small online businesses.

Normally, when we think about tax burdens that make it too expensive and difficult for businesses to stay afloat, we are thinking about the tax obligations themselves: the dollars and cents that are being levied as taxes. But, when it comes to businesses struggling with sales tax burdens from these new “economic nexus” obligations, the taxes themselves are not the main concern. Rather, it is the cost, in both time and money, of making sure they are collecting sales taxes from customers at the proper rates and submitting them to the proper jurisdictions in the proper intervals — in short, tax compliance.

While large retailers have physical presence all over the country, most small businesses do not. Small online businesses based in one of the four states with no sales tax often had no experience with sales tax compliance at all. When Wayfair happened, all these smaller businesses without experience in multistate sales tax collection, let alone the fully-staffed state and local tax departments that exist in established multistate businesses, had to become compliant with different sales tax regimes all around the country.

The Sales Tax Landscape for Remote Sellers

There are over 12,000 sales tax jurisdictions in the United States,[1] in the 45 states and DC that impose sales taxes at the state level (plus Alaska, where localities impose sales taxes even as the state government does not). Each separate jurisdiction can involve another set of rules, definitions, exemptions, and rates, as well as another potential audit. The research project of becoming familiar with all of these moving parts does not end, as revenue departments can change these rules at any time without adequate notice to affected taxpayers. For small businesses that are lucky to have a single employee dedicated full-time to tax compliance, this is a daunting task. Reliable software remains too expensive for many small businesses, and except for service providers certified by the Streamlined Sales Tax Project, liability remains with the seller for mistakes made by unreliable software.

Consequently, many small businesses are still not in full compliance with Wayfair, either out of ignorance or sheer inability to manage all these moving parts. Five years after the Wayfair decision, an Avalara poll found that just half of all small businesses self-reported being in full compliance with their remote sales tax obligations, and just 60% of larger businesses.[2] These figures do not account for respondent overconfidence and past noncompliance that could potentially be dug up by state revenue departments down the line.

Noncompliance at this scale means that tens of thousands of businesses could have revenue officials knocking on their doors demanding money they never collected from consumers. States are also missing out on that revenue. The best way to encourage voluntary tax compliance is to simplify the system. In short, the status quo of sales tax compliance is benefiting no one — not businesses, not states, and certainly not taxpayers.

State-Level Solutions

While efforts to provide a set of ground rules at the federal level remain under consideration,[3] there remain plenty of ways that states can act to simplify sales tax compliance for out-of-state retailers.

Join the Streamlined Sales and Use Tax Agreement

The Streamlined Sales and Use Tax Agreement (SST) is a multilateral agreement in which member states agree to abide by uniform product definitions and classifications, participate in a single, centralized filing portal that allows sellers to remit sales tax to all member states, and provide free access to certified tax software with liability protection for software errors for sellers that use it, among other provisions. A key factor in the Supreme Court’s decision to side with South Dakota and its efforts to impose sales tax collection obligations on out-of-state businesses was South Dakota’s membership in the SST.

SST does not eliminate compliance burdens entirely, but it makes tax compliance far more manageable for sellers selling into these states. At the same time, participating states retain significant latitude to direct their own sovereign tax policies by setting their own sales tax rates and exemptions.

Unfortunately, while South Dakota’s membership in SST was a major consideration for the Supreme Court in siding with the state, no new states have felt the need to join SST since 2014. Just 23 states are full SST member states,[4] while not a single one of the six largest states by GDP are in SST. While the vast majority of sales tax compliance issues would be solved if each state was in SST, holdout states have limited its ability to ameliorate compliance burdens. States that have not yet joined SST should do so — and courts should begin considering it a precondition for imposing economic nexus obligations.

Improve Safe Harbor Thresholds

With the brief exception of Kansas for a couple of years,[5] every state with a sales tax offers a safe harbor threshold that exempts out-of-state small sellers from sales tax compliance obligations if they do not exceed certain levels of economic activity in that state. These de minimis thresholds go a long way toward protecting small businesses from tax obligations in states where they lack substantial nexus, as well as helping out revenue departments by allowing them to direct administrative energy away from small potatoes.

Nevertheless, there are best practices that states should follow on safe harbors. Nearly all states with a sales tax could improve how they design their safe harbor thresholds in at least one way. These include:

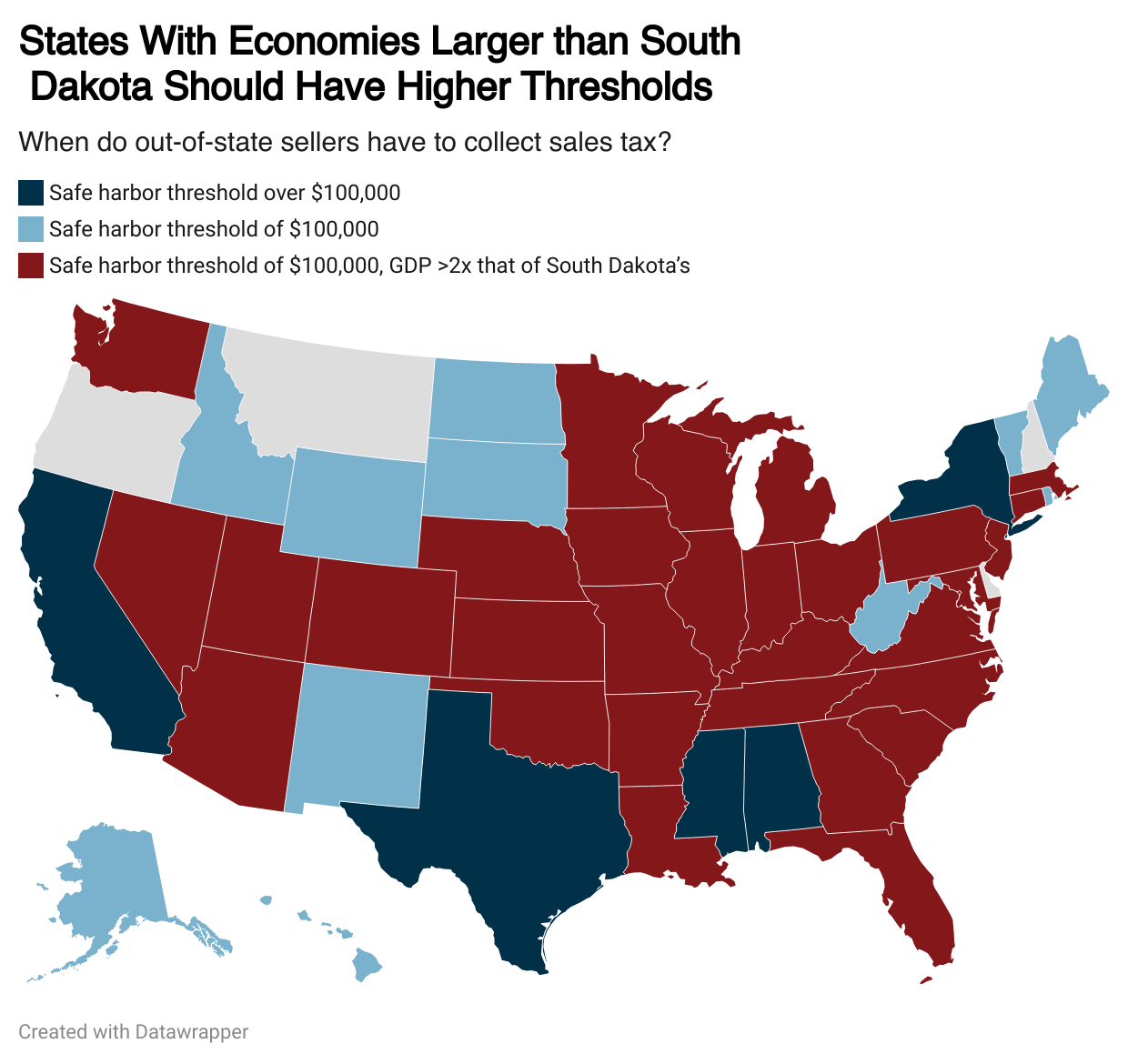

States with Economies Larger Than South Dakota’s Should Have a Higher Safe Harbor Threshold

The South Dakota law at issue under Wayfair included a safe harbor exempting sellers with fewer than $100,000 in sales and 200 transactions within the state of South Dakota. Despite the fact that South Dakota is one of the smallest states in the country by both GDP and population, most states have simply copied these thresholds. Yet $100,000 in sales into Illinois is a far less substantial metric to reach than $100,000 in sales into South Dakota.

While all states should consider increasing their thresholds, especially the 35 states with economies more than double the size of South Dakota’s that retain $100,000 safe harbor thresholds should do so. The map below shows states with safe harbor thresholds above $100,000, states with $100,000 thresholds with GDPs below 200% of South Dakota’s, and states with $100,000 thresholds with GDPs above 200% of South Dakota’s.

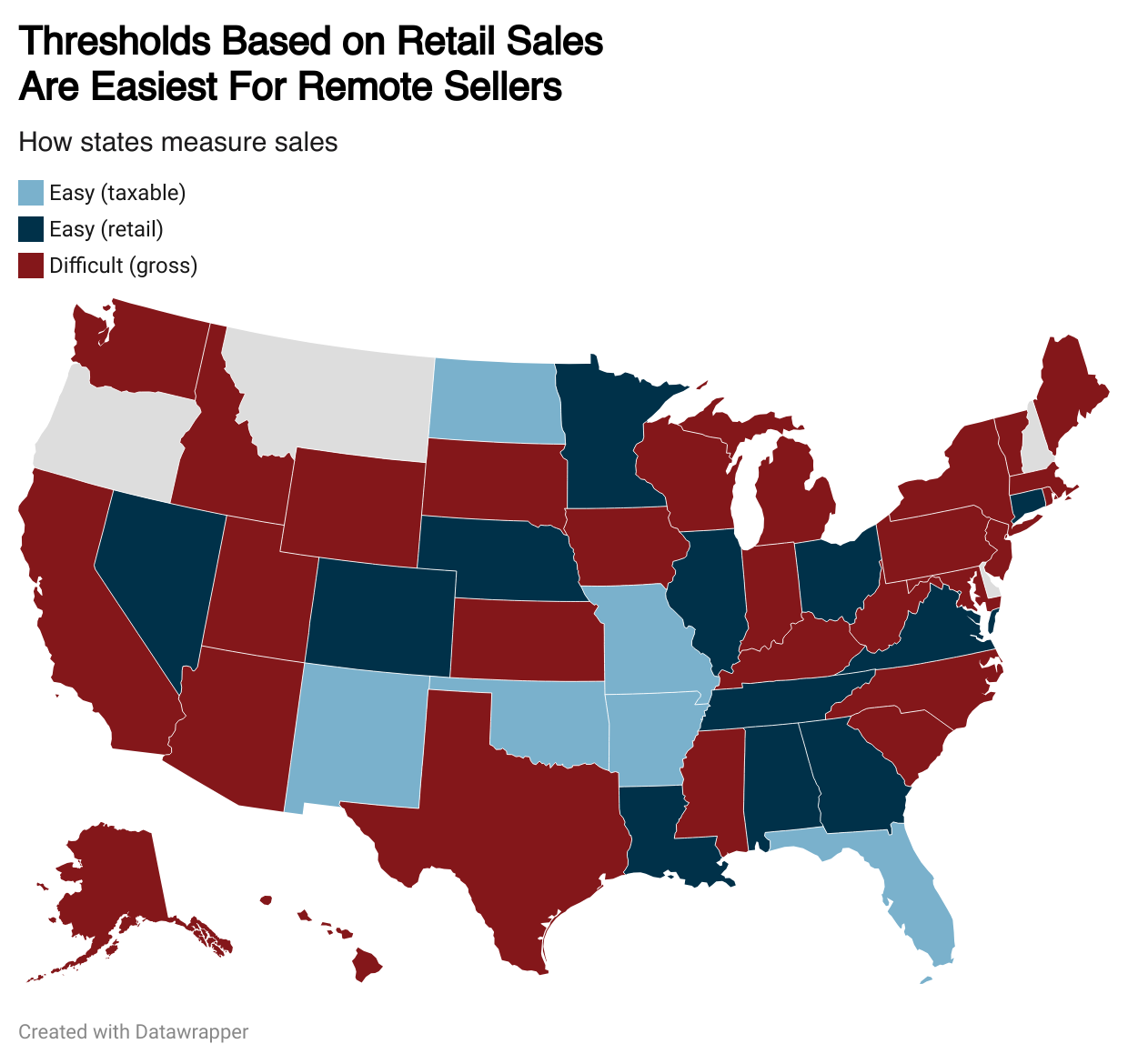

Safe Harbor Thresholds Should Be Based on Retail Sales, Not Gross Sales

Safe Harbor Thresholds Should Be Based on Retail Sales, Not Gross Sales

In determining what kinds of sales count toward the $100,000/200 sale thresholds, states should consider only retail sales. However, 28 states continue to use gross sales-based thresholds, meaning that wholesale sales count toward the safe harbor threshold. It makes little sense to count non-retail transactions toward a safe harbor for a tax that only applies to retail sales. The consequence is that small, out-of-state wholesale sellers often end up having to file sales tax returns in states where they have little to no tax to remit — a waste of time for everyone involved.

Six states use a safe harbor threshold that is instead based upon taxable sales. On its face, this is logical — why count tax-exempt retail sales toward a safe harbor threshold? But the downside of this method is that, to determine whether sales into a state are tax-exempt, businesses have to determine what sales are taxable in that state. This defeats some of the purpose of safe harbors: protecting businesses without substantial economic presence in a state from having to familiarize themselves with that state’s sales tax laws.

So, while retail sales-based safe harbor thresholds end up generally being simpler for businesses than those based on taxable sales, both methods are far better and more logical than safe harbor thresholds based on gross sales.

Triggers Based on the Number of Transactions Should Be Removed from Safe Harbor Thresholds

Triggers Based on the Number of Transactions Should Be Removed from Safe Harbor Thresholds

South Dakota’s initial economic nexus law required remote sellers to collect and remit sales taxes if they exceeded either $100,000 in sales or 200 transactions in South Dakota. While many states initially copied this formula, in recent years, states have begun to recognize that there is little reason to base a safe harbor on the actual number of transactions.

The 200-transaction trigger punishes businesses with inexpensive products. It makes little sense for safe harbors to protect a remote seller with a single transaction in the state worth $90,000 while a remote seller with 200 transactions worth $1 each must comply with sales tax obligations. The concern of the state is ensuring that it is not missing out on substantial amounts of sales tax revenue, and the number of distinct transactions is far less relevant than the dollar value of the sales taking place within the state. Additionally, determining what qualifies as a “distinct transaction” when considering bundled transactions subscriptions, and so on can also be a source of headaches and confusion for sellers.

Consequently, many states that originally had 200-transaction triggers have since moved away from them, including South Dakota itself.[6] Just 17 states and DC continue to enforce these low thresholds.[7]

Marketplace Sales Should Be Exempted from Counting toward Safe Harbor Thresholds

Marketplace Sales Should Be Exempted from Counting toward Safe Harbor Thresholds

Each state with a sales tax also applies economic nexus-based tax obligations to marketplace facilitators that host third-party sellers, such as eBay, Facebook Marketplace, and Etsy. Sales tax compliance obligations for third-party sales made through these marketplace platforms are the responsibility of the marketplace facilitator, not the third-party seller.

Yet, in 27 states and DC, sales made by third parties through marketplace platforms still count toward the individual seller’s safe harbor. This becomes a problem for small sellers that operate their own website-based sales platforms, but do the bulk of their sales through marketplaces. For example, a remote seller based in Nevada with $150,000 in sales on Amazon in California must collect and remit sales taxes to California on even one sale to a Californian made on his own platform.

Marketplace facilitator laws ensure that states receive sales tax revenue from marketplace sales. States should not “double-dip” and count marketplace sales toward an individual seller’s safe harbor, as this undermines the purpose of safe harbors — protecting small sellers and revenue departments from the paperwork burden of processing returns containing minimal amounts of tax.

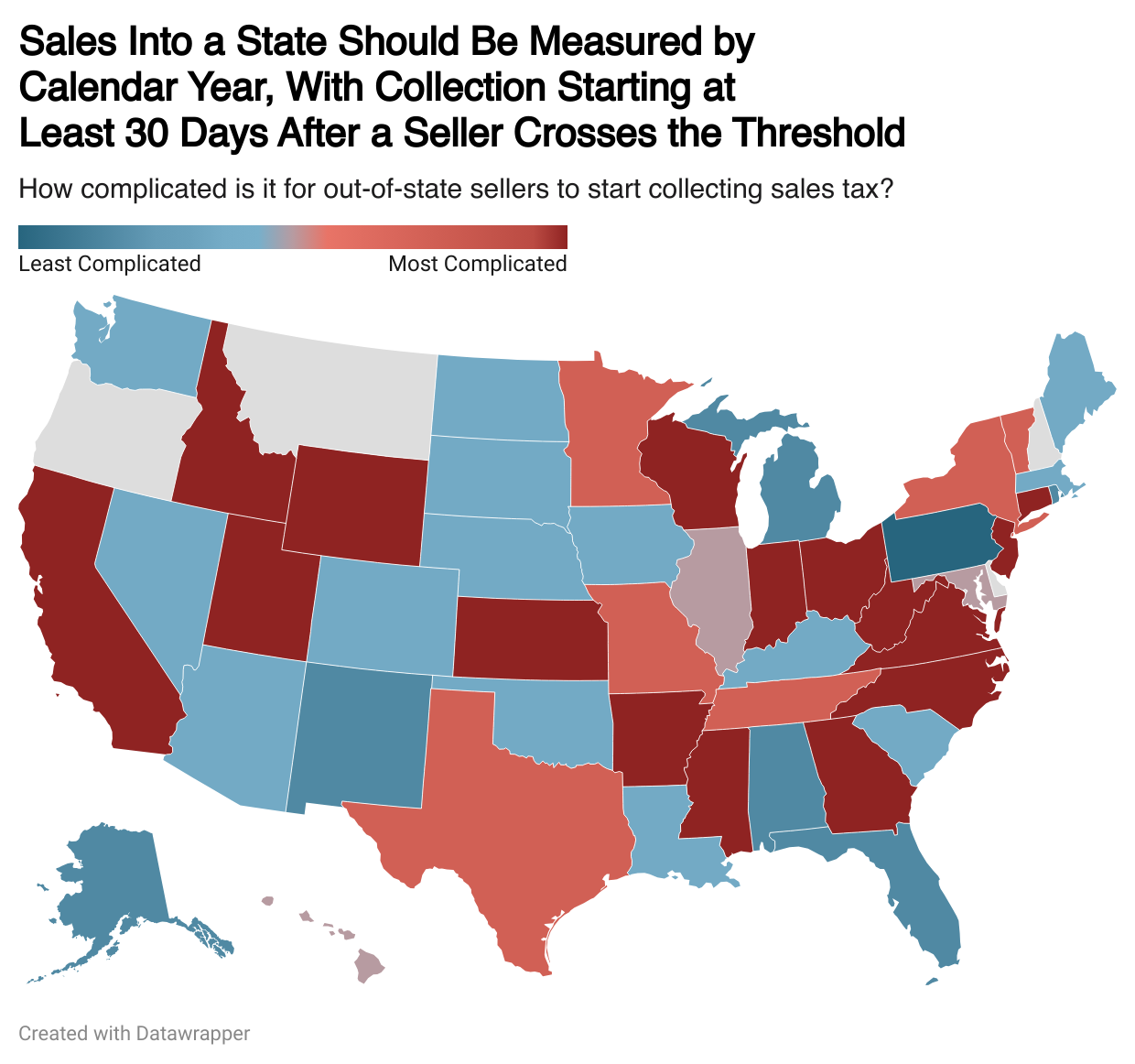

States Should Use calendar years to Measure Progress toward Safe Harbor Thresholds, Offer Reasonable Grace Periods After Businesses Exceed Thresholds

Economic nexus laws and safe harbors mean that businesses are now responsible for tracking their progress toward safe harbors in each state. That would be a far more manageable responsibility if states used the same periods of time to measure progress toward safe harbor thresholds. Unfortunately, they do not.

Ideally, states should measure progress toward safe harbor thresholds based entirely on sales made the previous year. This would allow business owners to assess which states they will need to collect and remit sales taxes in for the following year in November or December of each year, and prepare accordingly. But only seven states currently do this.

Most states (30 in total plus DC) measure progress toward thresholds on sales during the previous or current calendar year. By requiring sales tax compliance if business owners exceed thresholds in the current year, states turn what is otherwise an annual review of sales metrics into each state into a year-round activity. Businesses must constantly track their sales into each state and be prepared to comply with additional state sales tax regimes if a spike in sales pushes them above the thresholds in that state.

Nine states make things more complicated by measuring threshold progress based on something other than calendar years. Idaho, Minnesota, Mississippi, Tennessee, and Texas measure based on the previous 12-month period; Missouri, New York, and Vermont measure based on sales made during the previous four quarters; and Connecticut looks at sales made in the period between October 1 of the previous year and September 30. Needless to say, when the period of time thresholds apply to isn’t consistent between states, measuring progress toward them is far more confusing.

The other aspect of this reform is that states should recognize that integrating another state’s sales tax rules into whatever accounting or tax compliance software the business uses is not something that happens overnight, and accordingly allow a reasonable grace period to come into compliance after safe harbor thresholds are exceeded.

This means that states should not require businesses to begin collecting sales tax on the transaction that immediately follows the safe harbor being exceeded, as 15 states and DC do. At a minimum, states should not require remote businesses to begin collecting sales tax until the first of the month beginning at least 30 days after the safe harbor was exceeded (i.e. if threshold is exceeded October 17th, collection should not be required until at least December 1st). This guarantees businesses at least a month of preparation before being required to collect sales tax.[8]

Five states (Hawaii, Illinois, Louisiana, Maryland, and Oklahoma) that base thresholds on the current calendar year require collection to take place at the beginning of the month immediately following a seller exceeding safe harbor thresholds, without guaranteeing at least 30 days of grace. This means that a seller that happens to exceed safe harbor thresholds on an unfortunate day of the month may end up being required to collect on the very next day.

Six states (Alabama, Alaska, Florida, Michigan, New Mexico, and Rhode Island) measure thresholds based on the previous calendar year and then require collection beginning January 1 of the year after thresholds are exceeded. While this could result in a seller having to collect on the next day if they exceed safe harbor thresholds on December 31, this is far less likely and easier to anticipate than potentially having to collect beginning the first day of the next month during the current calendar year. Nevertheless, these states should allow remote sellers to begin collecting on February 1 of the following year if they exceed safe harbor thresholds in December of the previous year.

These two elements of a well-designed safe harbor threshold — measurement period and compliance deadline — are interconnected, and the map below illustrates how easy each state makes determining the need to comply and coming into compliance when considering both of these two factors.

Make Local Sales Taxes More Manageable for Remote Sellers

One more frequent source of headaches for remote sellers is selling into the 33 states with local sales taxes. Even when local taxing jurisdictions conform to the state’s sales tax code, local sales tax jurisdictions require remote sellers to collect at more different sales tax rates. In some states, it remains difficult to determine what rate applies to each address — and, in some cases, a 5-digit zip code is insufficient to do so.

While states have embarked on efforts to make determining state plus local sales tax rates easier, the best solution is to simply take the problem off sellers’ plates. All remote sellers should be able to collect sales taxes at just a single rate per state that they sell into.

This need not involve any violation of local autonomy. Texas has devised an ingenious method by which remote sellers have the option of collecting at either a weighted-average statewide rate, or at each individual local rate if they prefer to do so. The state then handles distribution of the revenue to localities proportionally, ensuring that they retain the ability to effect their own sales tax policy. At the same time, out-of-state businesses have the option to collect at the specific local tax rate they are selling into if they prefer, but also have access to a far simpler system.

This need not involve any violation of local autonomy. Texas has devised an ingenious method by which remote sellers have the option of collecting at either a weighted-average statewide rate, or at each individual local rate if they prefer to do so. The state then handles distribution of the revenue to localities proportionally, ensuring that they retain the ability to effect their own sales tax policy. At the same time, out-of-state businesses have the option to collect at the specific local tax rate they are selling into if they prefer, but also have access to a far simpler system.

Added complexity comes into play in states where local jurisdictions not only set their own sales tax rates, but have their own separate sales tax codes, including their own definitions, exemptions, and rules. All but one of these states has set up state-level collection and simplification programs for remote sellers that localities must participate in, but Colorado’s remains voluntary. If one sales tax rate per state is the gold standard, one set of sales tax rules should be the bare minimum.

Conclusion

While states continue to benefit from additional sales tax revenue in the wake of Wayfair, that does not mean that they should consider remote sales tax to be a settled issue. Not only is it detrimental to the broader economy to saddle small businesses with unreasonable tax compliance obligations, the sheer complexity of multistate sales tax compliance means that voluntary compliance is lower than it should be and unintentional errors are high.

In short: complexity is costing states money, both in the cost of conducting additional audits and in the revenue that goes uncollected from non-compliant sellers. Tax compliance is never simple or easy, but the above list of recommendations provides common-sense ways that states can help out overwhelmed small businesses and ensure that sales tax compliance is at least manageable for Mom & Pop, and not just the Fortune 500.

Recommended Legislative Improvements

Alabama

- Join the Streamlined Sales and Use Tax Agreement - The Streamlined Sales and Use Tax Agreement is an agreement between 23 states to make it easier for remote sellers to collect sales taxes in member states by promoting simplification and uniformity. Joining Streamlined not only makes compliance easier and less costly for remote sellers selling into the state, doing so can result in increased sales tax revenue for member states through increased voluntary compliance rates.

- Allow remote sellers who exceed safe harbor thresholds in December of the previous year to begin collecting sales tax starting February 1 - Allowing businesses that exceed thresholds in December until February 1 to begin collecting sales tax guarantees a reasonable grace period of at least a month to implement another state’s sales tax rules into their sales tax compliance infrastructure.

Alaska

- Join the Streamlined Sales and Use Tax Agreement - The Streamlined Sales and Use Tax Agreement is an agreement between 23 states to make it easier for remote sellers to collect sales taxes in member states by promoting simplification and uniformity. Joining Streamlined not only makes compliance easier and less costly for remote sellers selling into the state, doing so can result in increased sales tax revenue for member states through increased voluntary compliance rates.

- Change safe harbor thresholds to be based on retail sales rather than gross sales - In this state, progress toward safe harbor thresholds currently is based on gross sales volume. This means that wholesale sales count toward safe harbor thresholds, even though they are between businesses and nontaxable. A threshold based on retail sales ensures that businesses do not need to collect sales tax unless they have a high enough volume of sales to end consumers — ultimately, the types of sales that are relevant for tax purposes.

- Exclude sales made on a marketplace platform from counting toward an individual remote seller’s safe harbor threshold - When sales are made by individual sellers through online marketplaces (such as eBay or Etsy), the marketplace is responsible for collecting sales tax and remitting it to the state. These sales should not also count toward an individual seller’s safe harbor.

- Allow remote sellers who exceed safe harbor thresholds in December of the previous year to begin collecting sales tax starting February 1 - Allowing businesses that exceed thresholds in December until February 1 to begin collecting sales tax guarantees a reasonable grace period of at least a month to implement another state’s sales tax rules into their sales tax compliance infrastructure.

- Allow remote sellers the option to collect at a single statewide rate - Collecting sales tax at many different local rates adds a great deal to the complexity of collecting sales tax for out-of-state sellers. Alabama and Texas allow remote sellers the option to collect at a single, statewide weighted average sales tax rate, then handle disbursement of the funds on the back end. This allows a balance between preserving localities’ ability to set tax rates based on their revenue needs and greatly simplifying compliance for remote sellers.

Arizona

- Join the Streamlined Sales and Use Tax Agreement - The Streamlined Sales and Use Tax Agreement is an agreement between 23 states to make it easier for remote sellers to collect sales taxes in member states by promoting simplification and uniformity. Joining Streamlined not only makes compliance easier and less costly for remote sellers selling into the state, doing so can result in increased sales tax revenue for member states through increased voluntary compliance rates.

- Raise the safe harbor threshold to reflect the fact that Arizona is a larger economy than South Dakota - The $100,000 sales threshold before a remote seller must collect sales tax is taken from South Dakota’s threshold in the Wayfair case. A higher threshold should be enacted to reflect the difference in size between the state and South Dakota.

- Change safe harbor thresholds to be based on retail sales rather than gross sales - In this state, progress toward safe harbor thresholds currently is based on gross sales volume. This means that wholesale sales count toward safe harbor thresholds, even though they are between businesses and nontaxable. A threshold based on retail sales ensures that businesses do not need to collect sales tax unless they have a high enough volume of sales to end consumers — ultimately, the types of sales that are relevant for tax purposes.

- Allow remote sellers the option to collect at a single statewide rate - Collecting sales tax at many different local rates adds a great deal to the complexity of collecting sales tax for out-of-state sellers. Alabama and Texas allow remote sellers the option to collect at a single, statewide weighted average sales tax rate, then handle disbursement of the funds on the back end. This allows a balance between preserving localities’ ability to set tax rates based on their revenue needs and greatly simplifying compliance for remote sellers.

Arkansas

- Raise the safe harbor threshold to reflect the fact that Arkansas is a larger economy than South Dakota - The $100,000 sales threshold before a remote seller must collect sales tax is taken from South Dakota’s threshold in the Wayfair case. A higher threshold should be enacted to reflect the difference in size between the state and South Dakota.

- Change safe harbor thresholds to be based on retail sales rather than taxable sales - In this state, progress toward safe harbor thresholds currently is based on taxable sales volume. While this is intended to help businesses by excluding tax-exempt sales, in practice it requires businesses to familiarize themselves with the state’s sales tax code in order to determine which transactions are taxable — defeating the purpose of safe harbors. A threshold based on retail sales still excludes wholesale transactions, but is easier to track than one based on taxable transactions.

- Eliminate the 200-transaction based threshold trigger - Currently, sellers exceeding 200 transactions are required to collect sales tax, regardless of the dollar value of those sales. This arbitrarily punishes sellers with a large number of low-value transactions, when the number of transactions has no bearing on the amount of sales tax that would be collected.

- Allow sellers to begin collecting sales tax on the first of the month beginning at least 30 days after the safe harbor threshold is exceeded - Adding another state into sales tax compliance infrastructure, regardless of what tools the seller uses to do so, is often a complicated and time-consuming process. Sellers should be guaranteed a minimum of 30 days to prepare to begin collecting sales tax in an additional state.

- Allow remote sellers the option to collect at a single statewide rate - Collecting sales tax at many different local rates adds a great deal to the complexity of collecting sales tax for out-of-state sellers. Alabama and Texas allow remote sellers the option to collect at a single, statewide weighted average sales tax rate, then handle disbursement of the funds on the back end. This allows a balance between preserving localities’ ability to set tax rates based on their revenue needs and greatly simplifying compliance for remote sellers.

California

- Join the Streamlined Sales and Use Tax Agreement - The Streamlined Sales and Use Tax Agreement is an agreement between 23 states to make it easier for remote sellers to collect sales taxes in member states by promoting simplification and uniformity. Joining Streamlined not only makes compliance easier and less costly for remote sellers selling into the state, doing so can result in increased sales tax revenue for member states through increased voluntary compliance rates.

- Change safe harbor thresholds to be based on retail sales rather than gross sales - In this state, progress toward safe harbor thresholds currently is based on gross sales volume. This means that wholesale sales count toward safe harbor thresholds, even though they are between businesses and nontaxable. A threshold based on retail sales ensures that businesses do not need to collect sales tax unless they have a high enough volume of sales to end consumers — ultimately, the types of sales that are relevant for tax purposes.

- Exclude sales made on a marketplace platform from counting toward an individual remote seller’s safe harbor threshold - When sales are made by individual sellers through online marketplaces (such as eBay or Etsy), the marketplace is responsible for collecting sales tax and remitting it to the state. These sales should not also count toward an individual seller’s safe harbor.

- Allow sellers to begin collecting sales tax on the first of the month beginning at least 30 days after the safe harbor threshold is exceeded - Adding another state into sales tax compliance infrastructure, regardless of what tools the seller uses to do so, is often a complicated and time-consuming process. Sellers should be guaranteed a minimum of 30 days to prepare to begin collecting sales tax in an additional state.

- Allow remote sellers the option to collect at a single statewide rate - Collecting sales tax at many different local rates adds a great deal to the complexity of collecting sales tax for out-of-state sellers. Alabama and Texas allow remote sellers the option to collect at a single, statewide weighted average sales tax rate, then handle disbursement of the funds on the back end. This allows a balance between preserving localities’ ability to set tax rates based on their revenue needs and greatly simplifying compliance for remote sellers.

Colorado

- Join the Streamlined Sales and Use Tax Agreement - The Streamlined Sales and Use Tax Agreement is an agreement between 23 states to make it easier for remote sellers to collect sales taxes in member states by promoting simplification and uniformity. Joining Streamlined not only makes compliance easier and less costly for remote sellers selling into the state, doing so can result in increased sales tax revenue for member states through increased voluntary compliance rates.

- Raise the safe harbor threshold to reflect the fact that Colorado is a larger economy than South Dakota - The $100,000 sales threshold before a remote seller must collect sales tax is taken from South Dakota’s threshold in the Wayfair case. A higher threshold should be enacted to reflect the difference in size between the state and South Dakota.

- Make participation in the Sales and Use Tax System (SUTS) mandatory for localities to collect sales tax revenue from remote sellers - Colorado remains the only state that allows localities to administer sales tax collection on out-of-state sellers. The SUTS system was created at the state level to simplify compliance for out-of-state sellers, offering a single portal to register, remit taxes, and look up rates, exemptions, and so on. However, SUTS remains voluntary for Colorado localities to participate in, and two jurisdictions remain outside the system, while others could choose to leave at any time.

- Allow remote sellers the option to collect at a single statewide rate - Collecting sales tax at many different local rates adds a great deal to the complexity of collecting sales tax for out-of-state sellers. Alabama and Texas allow remote sellers the option to collect at a single, statewide weighted average sales tax rate, then handle disbursement of the funds on the back end. This allows a balance between preserving localities’ ability to set tax rates based on their revenue needs and greatly simplifying compliance for remote sellers.

Connecticut

Join the Streamlined Sales and Use Tax Agreement - The Streamlined Sales and Use Tax Agreement is an agreement between 23 states to make it easier for remote sellers to collect sales taxes in member states by promoting simplification and uniformity. Joining Streamlined not only makes compliance easier and less costly for remote sellers selling into the state, doing so can result in increased sales tax revenue for member states through increased voluntary compliance rates.

Raise the safe harbor threshold to reflect the fact that Connecticut is a larger economy than South Dakota - The $100,000 sales threshold before a remote seller must collect sales tax is taken from South Dakota’s threshold in the Wayfair case. A higher threshold should be enacted to reflect the difference in size between the state and South Dakota.

- Exclude sales made on a marketplace platform from counting toward an individual remote seller’s safe harbor threshold - When sales are made by individual sellers through online marketplaces (such as eBay or Etsy), the marketplace is responsible for collecting sales tax and remitting it to the state. These sales should not also count toward an individual seller’s safe harbor.

- Measure safe harbor threshold progress based on calendar years, not October 1 - September 30 - Since the vast majority of states measure sales volume based on sales taking place in a calendar year, states using any other measurement period represent a unique headache. Using calendar years to measure threshold progress is not only easier for remote sellers, it also minimizes errors that revenue officials have to navigate and correct.

- Allow sellers to begin collecting sales tax on the first of the month beginning at least 30 days after the safe harbor threshold is exceeded - Adding another state into sales tax compliance infrastructure, regardless of what tools the seller uses to do so, is often a complicated and time-consuming process. Sellers should be guaranteed a minimum of 30 days to prepare to begin collecting sales tax in an additional state.

DC

- Join the Streamlined Sales and Use Tax Agreement - The Streamlined Sales and Use Tax Agreement is an agreement between 23 states to make it easier for remote sellers to collect sales taxes in member states by promoting simplification and uniformity. Joining Streamlined not only makes compliance easier and less costly for remote sellers selling into the state, doing so can result in increased sales tax revenue for member states through increased voluntary compliance rates.

- Raise the safe harbor threshold to reflect the fact that DC is a larger economy than South Dakota - The $100,000 sales threshold before a remote seller must collect sales tax is taken from South Dakota’s threshold in the Wayfair case. A higher threshold should be enacted to reflect the difference in size between the District and South Dakota.

- Eliminate the 200-transaction based threshold trigger - Currently, sellers exceeding 200 transactions are required to collect sales tax, regardless of the dollar value of those sales. This arbitrarily punishes sellers with a large number of low-value transactions, when the number of transactions has no bearing on the amount of sales tax that would be collected.

- Exclude sales made on a marketplace platform from counting toward an individual remote seller’s safe harbor threshold - When sales are made by individual sellers through online marketplaces (such as eBay or Etsy), the marketplace is responsible for collecting sales tax and remitting it to the state. These sales should not also count toward an individual seller’s safe harbor.

- Allow sellers to begin collecting sales tax on the first of the month beginning at least 30 days after the safe harbor threshold is exceeded - Adding another state into sales tax compliance infrastructure, regardless of what tools the seller uses to do so, is often a complicated and time-consuming process. Sellers should be guaranteed a minimum of 30 days to prepare to begin collecting sales tax in an additional state.

Florida

- Join the Streamlined Sales and Use Tax Agreement - The Streamlined Sales and Use Tax Agreement is an agreement between 23 states to make it easier for remote sellers to collect sales taxes in member states by promoting simplification and uniformity. Joining Streamlined not only makes compliance easier and less costly for remote sellers selling into the state, doing so can result in increased sales tax revenue for member states through increased voluntary compliance rates.

- Raise the safe harbor threshold to reflect the fact that Florida is a larger economy than South Dakota - The $100,000 sales threshold before a remote seller must collect sales tax is taken from South Dakota’s threshold in the Wayfair case. A higher threshold should be enacted to reflect the difference in size between the state and South Dakota.

- Change safe harbor thresholds to be based on retail sales rather than taxable sales - In this state, progress toward safe harbor thresholds currently is based on taxable sales volume. While this is intended to help businesses by excluding tax-exempt sales, in practice it requires businesses to familiarize themselves with the state’s sales tax code in order to determine which transactions are taxable — defeating the purpose of safe harbors. A threshold based on retail sales still excludes wholesale transactions, but is easier to track than one based on taxable transactions.

- Allow remote sellers who exceed safe harbor thresholds in December of the previous year to begin collecting sales tax starting February 1 - Allowing businesses that exceed thresholds in December until February 1 to begin collecting sales tax guarantees a reasonable grace period of at least a month to implement another state’s sales tax rules into their sales tax compliance infrastructure.

- Allow remote sellers the option to collect at a single statewide rate - Collecting sales tax at many different local rates adds a great deal to the complexity of collecting sales tax for out-of-state sellers. Alabama and Texas allow remote sellers the option to collect at a single, statewide weighted average sales tax rate, then handle disbursement of the funds on the back end. This allows a balance between preserving localities’ ability to set tax rates based on their revenue needs and greatly simplifying compliance for remote sellers.

Georgia

- Raise the safe harbor threshold to reflect the fact that Georgia is a larger economy than South Dakota - The $100,000 sales threshold before a remote seller must collect sales tax is taken from South Dakota’s threshold in the Wayfair case. A higher threshold should be enacted to reflect the difference in size between the state and South Dakota.

- Eliminate the 200-transaction based threshold trigger - Currently, sellers exceeding 200 transactions are required to collect sales tax, regardless of the dollar value of those sales. This arbitrarily punishes sellers with a large number of low-value transactions, when the number of transactions has no bearing on the amount of sales tax that would be collected.

- Allow sellers to begin collecting sales tax on the first of the month beginning at least 30 days after the safe harbor threshold is exceeded - Adding another state into sales tax compliance infrastructure, regardless of what tools the seller uses to do so, is often a complicated and time-consuming process. Sellers should be guaranteed a minimum of 30 days to prepare to begin collecting sales tax in an additional state.

- Allow remote sellers the option to collect at a single statewide rate - Collecting sales tax at many different local rates adds a great deal to the complexity of collecting sales tax for out-of-state sellers. Alabama and Texas allow remote sellers the option to collect at a single, statewide weighted average sales tax rate, then handle disbursement of the funds on the back end. This allows a balance between preserving localities’ ability to set tax rates based on their revenue needs and greatly simplifying compliance for remote sellers.

Hawaii

Join the Streamlined Sales and Use Tax Agreement - The Streamlined Sales and Use Tax Agreement is an agreement between 23 states to make it easier for remote sellers to collect sales taxes in member states by promoting simplification and uniformity. Joining Streamlined not only makes compliance easier and less costly for remote sellers selling into the state, doing so can result in increased sales tax revenue for member states through increased voluntary compliance rates.

- Change safe harbor thresholds to be based on retail sales rather than gross sales - In this state, progress toward safe harbor thresholds currently is based on gross sales volume. This means that wholesale sales count toward safe harbor thresholds, even though they are between businesses and nontaxable. A threshold based on retail sales ensures that businesses do not need to collect sales tax unless they have a high enough volume of sales to end consumers — ultimately, the types of sales that are relevant for tax purposes.

- Eliminate the 200-transaction based threshold trigger - Currently, sellers exceeding 200 transactions are required to collect sales tax, regardless of the dollar value of those sales. This arbitrarily punishes sellers with a large number of low-value transactions, when the number of transactions has no bearing on the amount of sales tax that would be collected.

- Exclude sales made on a marketplace platform from counting toward an individual remote seller’s safe harbor threshold - When sales are made by individual sellers through online marketplaces (such as eBay or Etsy), the marketplace is responsible for collecting sales tax and remitting it to the state. These sales should not also count toward an individual seller’s safe harbor.

- Allow sellers to begin collecting sales tax on the first of the month beginning at least 30 days after the safe harbor threshold is exceeded - Adding another state into sales tax compliance infrastructure, regardless of what tools the seller uses to do so, is often a complicated and time-consuming process. Sellers should be guaranteed a minimum of 30 days to prepare to begin collecting sales tax in an additional state.

- Allow remote sellers the option to collect at a single statewide rate - Collecting sales tax at many different local rates adds a great deal to the complexity of collecting sales tax for out-of-state sellers. Alabama and Texas allow remote sellers the option to collect at a single, statewide weighted average sales tax rate, then handle disbursement of the funds on the back end. This allows a balance between preserving localities’ ability to set tax rates based on their revenue needs and greatly simplifying compliance for remote sellers.

Idaho

Join the Streamlined Sales and Use Tax Agreement - The Streamlined Sales and Use Tax Agreement is an agreement between 23 states to make it easier for remote sellers to collect sales taxes in member states by promoting simplification and uniformity. Joining Streamlined not only makes compliance easier and less costly for remote sellers selling into the state, doing so can result in increased sales tax revenue for member states through increased voluntary compliance rates.

Change safe harbor thresholds to be based on retail sales rather than gross sales - In this state, progress toward safe harbor thresholds currently is based on gross sales volume. This means that wholesale sales count toward safe harbor thresholds, even though they are between businesses and nontaxable. A threshold based on retail sales ensures that businesses do not need to collect sales tax unless they have a high enough volume of sales to end consumers — ultimately, the types of sales that are relevant for tax purposes.

- Exclude sales made on a marketplace platform from counting toward an individual remote seller’s safe harbor threshold - When sales are made by individual sellers through online marketplaces (such as eBay or Etsy), the marketplace is responsible for collecting sales tax and remitting it to the state. These sales should not also count toward an individual seller’s safe harbor.

- Measure safe harbor threshold progress based on calendar years, not the preceding 12-month period - Since the vast majority of states measure sales volume based on sales taking place in a calendar year, states using any other measurement period represent a unique headache. Using calendar years to measure threshold progress is not only easier for remote sellers, it also minimizes errors that revenue officials have to navigate and correct.

- Allow sellers to begin collecting sales tax on the first of the month beginning at least 30 days after the safe harbor threshold is exceeded - Adding another state into sales tax compliance infrastructure, regardless of what tools the seller uses to do so, is often a complicated and time-consuming process. Sellers should be guaranteed a minimum of 30 days to prepare to begin collecting sales tax in an additional state.

- Allow remote sellers the option to collect at a single statewide rate - Collecting sales tax at many different local rates adds a great deal to the complexity of collecting sales tax for out-of-state sellers. Alabama and Texas allow remote sellers the option to collect at a single, statewide weighted average sales tax rate, then handle disbursement of the funds on the back end. This allows a balance between preserving localities’ ability to set tax rates based on their revenue needs and greatly simplifying compliance for remote sellers.

Illinois

Join the Streamlined Sales and Use Tax Agreement - The Streamlined Sales and Use Tax Agreement is an agreement between 23 states to make it easier for remote sellers to collect sales taxes in member states by promoting simplification and uniformity. Joining Streamlined not only makes compliance easier and less costly for remote sellers selling into the state, doing so can result in increased sales tax revenue for member states through increased voluntary compliance rates.

Raise the safe harbor threshold to reflect the fact that Illinois is a larger economy than South Dakota - The $100,000 sales threshold before a remote seller must collect sales tax is taken from South Dakota’s threshold in the Wayfair case. A higher threshold should be enacted to reflect the difference in size between the state and South Dakota.

- Allow sellers to begin collecting sales tax on the first of the month beginning at least 30 days after the safe harbor threshold is exceeded - Adding another state into sales tax compliance infrastructure, regardless of what tools the seller uses to do so, is often a complicated and time-consuming process. Sellers should be guaranteed a minimum of 30 days to prepare to begin collecting sales tax in an additional state.

- Allow remote sellers the option to collect at a single statewide rate - Collecting sales tax at many different local rates adds a great deal to the complexity of collecting sales tax for out-of-state sellers. Alabama and Texas allow remote sellers the option to collect at a single, statewide weighted average sales tax rate, then handle disbursement of the funds on the back end. This allows a balance between preserving localities’ ability to set tax rates based on their revenue needs and greatly simplifying compliance for remote sellers.

Indiana

- Raise the safe harbor threshold to reflect the fact that Indiana is a larger economy than South Dakota - The $100,000 sales threshold before a remote seller must collect sales tax is taken from South Dakota’s threshold in the Wayfair case. A higher threshold should be enacted to reflect the difference in size between the state and South Dakota.

- Change safe harbor thresholds to be based on retail sales rather than gross sales - In this state, progress toward safe harbor thresholds currently is based on gross sales volume. This means that wholesale sales count toward safe harbor thresholds, even though they are between businesses and nontaxable. A threshold based on retail sales ensures that businesses do not need to collect sales tax unless they have a high enough volume of sales to end consumers — ultimately, the types of sales that are relevant for tax purposes.

- Allow sellers to begin collecting sales tax on the first of the month beginning at least 30 days after the safe harbor threshold is exceeded - Adding another state into sales tax compliance infrastructure, regardless of what tools the seller uses to do so, is often a complicated and time-consuming process. Sellers should be guaranteed a minimum of 30 days to prepare to begin collecting sales tax in an additional state.

Iowa

- Raise the safe harbor threshold to reflect the fact that Iowa is a larger economy than South Dakota - The $100,000 sales threshold before a remote seller must collect sales tax is taken from South Dakota’s threshold in the Wayfair case. A higher threshold should be enacted to reflect the difference in size between the state and South Dakota.

- Change safe harbor thresholds to be based on retail sales rather than gross sales - In this state, progress toward safe harbor thresholds currently is based on gross sales volume. This means that wholesale sales count toward safe harbor thresholds, even though they are between businesses and nontaxable. A threshold based on retail sales ensures that businesses do not need to collect sales tax unless they have a high enough volume of sales to end consumers — ultimately, the types of sales that are relevant for tax purposes.

- Exclude sales made on a marketplace platform from counting toward an individual remote seller’s safe harbor threshold - When sales are made by individual sellers through online marketplaces (such as eBay or Etsy), the marketplace is responsible for collecting sales tax and remitting it to the state. These sales should not also count toward an individual seller’s safe harbor.

- Allow remote sellers the option to collect at a single statewide rate - Collecting sales tax at many different local rates adds a great deal to the complexity of collecting sales tax for out-of-state sellers. Alabama and Texas allow remote sellers the option to collect at a single, statewide weighted average sales tax rate, then handle disbursement of the funds on the back end. This allows a balance between preserving localities’ ability to set tax rates based on their revenue needs and greatly simplifying compliance for remote sellers.

Kansas

- Raise the safe harbor threshold to reflect the fact that Kansas is a larger economy than South Dakota - The $100,000 sales threshold before a remote seller must collect sales tax is taken from South Dakota’s threshold in the Wayfair case. A higher threshold should be enacted to reflect the difference in size between the state and South Dakota.

- Change safe harbor thresholds to be based on retail sales rather than gross sales - In this state, progress toward safe harbor thresholds currently is based on gross sales volume. This means that wholesale sales count toward safe harbor thresholds, even though they are between businesses and nontaxable. A threshold based on retail sales ensures that businesses do not need to collect sales tax unless they have a high enough volume of sales to end consumers — ultimately, the types of sales that are relevant for tax purposes.

- Exclude sales made on a marketplace platform from counting toward an individual remote seller’s safe harbor threshold - When sales are made by individual sellers through online marketplaces (such as eBay or Etsy), the marketplace is responsible for collecting sales tax and remitting it to the state. These sales should not also count toward an individual seller’s safe harbor.

- Allow remote sellers the option to collect at a single statewide rate - Collecting sales tax at many different local rates adds a great deal to the complexity of collecting sales tax for out-of-state sellers. Alabama and Texas allow remote sellers the option to collect at a single, statewide weighted average sales tax rate, then handle disbursement of the funds on the back end. This allows a balance between preserving localities’ ability to set tax rates based on their revenue needs and greatly simplifying compliance for remote sellers.

Kentucky

- Raise the safe harbor threshold to reflect the fact that Kentucky is a larger economy than South Dakota - The $100,000 sales threshold before a remote seller must collect sales tax is taken from South Dakota’s threshold in the Wayfair case. A higher threshold should be enacted to reflect the difference in size between the state and South Dakota.

- Change safe harbor thresholds to be based on retail sales rather than gross sales - In this state, progress toward safe harbor thresholds currently is based on gross sales volume. This means that wholesale sales count toward safe harbor thresholds, even though they are between businesses and nontaxable. A threshold based on retail sales ensures that businesses do not need to collect sales tax unless they have a high enough volume of sales to end consumers — ultimately, the types of sales that are relevant for tax purposes.

- Eliminate the 200-transaction based threshold trigger - Currently, sellers exceeding 200 transactions are required to collect sales tax, regardless of the dollar value of those sales. This arbitrarily punishes sellers with a large number of low-value transactions, when the number of transactions has no bearing on the amount of sales tax that would be collected.

- Exclude sales made on a marketplace platform from counting toward an individual remote seller’s safe harbor threshold - When sales are made by individual sellers through online marketplaces (such as eBay or Etsy), the marketplace is responsible for collecting sales tax and remitting it to the state. These sales should not also count toward an individual seller’s safe harbor.

- Allow remote sellers the option to collect at a single statewide rate - Collecting sales tax at many different local rates adds a great deal to the complexity of collecting sales tax for out-of-state sellers. Alabama and Texas allow remote sellers the option to collect at a single, statewide weighted average sales tax rate, then handle disbursement of the funds on the back end. This allows a balance between preserving localities’ ability to set tax rates based on their revenue needs and greatly simplifying compliance for remote sellers.

Louisiana

- Join the Streamlined Sales and Use Tax Agreement - The Streamlined Sales and Use Tax Agreement is an agreement between 23 states to make it easier for remote sellers to collect sales taxes in member states by promoting simplification and uniformity. Joining Streamlined not only makes compliance easier and less costly for remote sellers selling into the state, doing so can result in increased sales tax revenue for member states through increased voluntary compliance rates.

- Raise the safe harbor threshold to reflect the fact that Louisiana is a larger economy than South Dakota - The $100,000 sales threshold before a remote seller must collect sales tax is taken from South Dakota’s threshold in the Wayfair case. A higher threshold should be enacted to reflect the difference in size between the state and South Dakota.

- Allow sellers to begin collecting sales tax on the first of the month beginning at least 30 days after the safe harbor threshold is exceeded - Adding another state into sales tax compliance infrastructure, regardless of what tools the seller uses to do so, is often a complicated and time-consuming process. Sellers should be guaranteed a minimum of 30 days to prepare to begin collecting sales tax in an additional state.

- Allow remote sellers the option to collect at a single statewide rate - Collecting sales tax at many different local rates adds a great deal to the complexity of collecting sales tax for out-of-state sellers. Alabama and Texas allow remote sellers the option to collect at a single, statewide weighted average sales tax rate, then handle disbursement of the funds on the back end. This allows a balance between preserving localities’ ability to set tax rates based on their revenue needs and greatly simplifying compliance for remote sellers.

Maine

- Join the Streamlined Sales and Use Tax Agreement - The Streamlined Sales and Use Tax Agreement is an agreement between 23 states to make it easier for remote sellers to collect sales taxes in member states by promoting simplification and uniformity. Joining Streamlined not only makes compliance easier and less costly for remote sellers selling into the state, doing so can result in increased sales tax revenue for member states through increased voluntary compliance rates.

- Change safe harbor thresholds to be based on retail sales rather than gross sales - In this state, progress toward safe harbor thresholds currently is based on gross sales volume. This means that wholesale sales count toward safe harbor thresholds, even though they are between businesses and nontaxable. A threshold based on retail sales ensures that businesses do not need to collect sales tax unless they have a high enough volume of sales to end consumers, ultimately, the types of sales that are relevant for tax purposes.

Maryland

- Join the Streamlined Sales and Use Tax Agreement - The Streamlined Sales and Use Tax Agreement is an agreement between 23 states to make it easier for remote sellers to collect sales taxes in member states by promoting simplification and uniformity. Joining Streamlined not only makes compliance easier and less costly for remote sellers selling into the state, doing so can result in increased sales tax revenue for member states through increased voluntary compliance rates.

- Raise the safe harbor threshold to reflect the fact that Maryland is a larger economy than South Dakota - The $100,000 sales threshold before a remote seller must collect sales tax is taken from South Dakota’s threshold in the Wayfair case. A higher threshold should be enacted to reflect the difference in size between the state and South Dakota.

- Change safe harbor thresholds to be based on retail sales rather than gross sales - In this state, progress toward safe harbor thresholds currently is based on gross sales volume. This means that wholesale sales count toward safe harbor thresholds, even though they are between businesses and nontaxable. A threshold based on retail sales ensures that businesses do not need to collect sales tax unless they have a high enough volume of sales to end consumers — ultimately, the types of sales that are relevant for tax purposes.

- Eliminate the 200-transaction based threshold trigger - Currently, sellers exceeding 200 transactions are required to collect sales tax, regardless of the dollar value of those sales. This arbitrarily punishes sellers with a large number of low-value transactions, when the number of transactions has no bearing on the amount of sales tax that would be collected.

- Exclude sales made on a marketplace platform from counting toward an individual remote seller’s safe harbor threshold - When sales are made by individual sellers through online marketplaces (such as eBay or Etsy), the marketplace is responsible for collecting sales tax and remitting it to the state. These sales should not also count toward an individual seller’s safe harbor.

- Allow sellers to begin collecting sales tax on the first of the month beginning at least 30 days after the safe harbor threshold is exceeded - Adding another state into sales tax compliance infrastructure, regardless of what tools the seller uses to do so, is often a complicated and time-consuming process. Sellers should be guaranteed a minimum of 30 days to prepare to begin collecting sales tax in an additional state.

- Allow remote sellers the option to collect at a single statewide rate - Collecting sales tax at many different local rates adds a great deal to the complexity of collecting sales tax for out-of-state sellers. Alabama and Texas allow remote sellers the option to collect at a single, statewide weighted average sales tax rate, then handle disbursement of the funds on the back end. This allows a balance between preserving localities’ ability to set tax rates based on their revenue needs and greatly simplifying compliance for remote sellers.

Massachusetts

- Join the Streamlined Sales and Use Tax Agreement - The Streamlined Sales and Use Tax Agreement is an agreement between 23 states to make it easier for remote sellers to collect sales taxes in member states by promoting simplification and uniformity. Joining Streamlined not only makes compliance easier and less costly for remote sellers selling into the state, doing so can result in increased sales tax revenue for member states through increased voluntary compliance rates.

- Raise the safe harbor threshold to reflect the fact that Massachusetts is a larger economy than South Dakota - The $100,000 sales threshold before a remote seller must collect sales tax is taken from South Dakota’s threshold in the Wayfair case. A higher threshold should be enacted to reflect the difference in size between the state and South Dakota.

- Change safe harbor thresholds to be based on retail sales rather than gross sales - In this state, progress toward safe harbor thresholds currently is based on gross sales volume. This means that wholesale sales count toward safe harbor thresholds, even though they are between businesses and nontaxable. A threshold based on retail sales ensures that businesses do not need to collect sales tax unless they have a high enough volume of sales to end consumers — ultimately, the types of sales that are relevant for tax purposes.

- Allow remote sellers the option to collect at a single statewide rate - Collecting sales tax at many different local rates adds a great deal to the complexity of collecting sales tax for out-of-state sellers. Alabama and Texas allow remote sellers the option to collect at a single, statewide weighted average sales tax rate, then handle disbursement of the funds on the back end. This allows a balance between preserving localities’ ability to set tax rates based on their revenue needs and greatly simplifying compliance for remote sellers.

Michigan

- Raise the safe harbor threshold to reflect the fact that Michigan is a larger economy than South Dakota - The $100,000 sales threshold before a remote seller must collect sales tax is taken from South Dakota’s threshold in the Wayfair case. A higher threshold should be enacted to reflect the difference in size between the state and South Dakota.

- Change safe harbor thresholds to be based on retail sales rather than gross sales - In this state, progress toward safe harbor thresholds currently is based on gross sales volume. This means that wholesale sales count toward safe harbor thresholds, even though they are between businesses and nontaxable. A threshold based on retail sales ensures that businesses do not need to collect sales tax unless they have a high enough volume of sales to end consumers — ultimately, the types of sales that are relevant for tax purposes.

- Eliminate the 200-transaction based threshold trigger - Currently, sellers exceeding 200 transactions are required to collect sales tax, regardless of the dollar value of those sales. This arbitrarily punishes sellers with a large number of low-value transactions, when the number of transactions has no bearing on the amount of sales tax that would be collected.

- Exclude sales made on a marketplace platform from counting toward an individual remote seller’s safe harbor threshold - When sales are made by individual sellers through online marketplaces (such as eBay or Etsy), the marketplace is responsible for collecting sales tax and remitting it to the state. These sales should not also count toward an individual seller’s safe harbor.

- Allow remote sellers who exceed safe harbor thresholds in December of the previous year to begin collecting sales tax starting February 1 - Allowing businesses that exceed thresholds in December until February 1 to begin collecting sales tax guarantees a reasonable grace period of at least a month to implement another state’s sales tax rules into their sales tax compliance infrastructure.

Minnesota

- Raise the safe harbor threshold to reflect the fact that Minnesota is a larger economy than South Dakota - The $100,000 sales threshold before a remote seller must collect sales tax is taken from South Dakota’s threshold in the Wayfair case. A higher threshold should be enacted to reflect the difference in size between the state and South Dakota.

- Eliminate the 200-transaction based threshold trigger - Currently, sellers exceeding 200 transactions are required to collect sales tax, regardless of the dollar value of those sales. This arbitrarily punishes sellers with a large number of low-value transactions, when the number of transactions has no bearing on the amount of sales tax that would be collected.

- Exclude sales made on a marketplace platform from counting toward an individual remote seller’s safe harbor threshold - When sales are made by individual sellers through online marketplaces (such as eBay or Etsy), the marketplace is responsible for collecting sales tax and remitting it to the state. These sales should not also count toward an individual seller’s safe harbor.

- Measure safe harbor threshold progress based on calendar years, not the preceding 12-month period - Since the vast majority of states measure sales volume based on sales taking place in a calendar year, states using any other measurement period represent a unique headache. Using calendar years to measure threshold progress is not only easier for remote sellers, it also minimizes errors that revenue officials have to navigate and correct.

- Allow remote sellers the option to collect at a single statewide rate - Collecting sales tax at many different local rates adds a great deal to the complexity of collecting sales tax for out-of-state sellers. Alabama and Texas allow remote sellers the option to collect at a single, statewide weighted average sales tax rate, then handle disbursement of the funds on the back end. This allows a balance between preserving localities’ ability to set tax rates based on their revenue needs and greatly simplifying compliance for remote sellers.

Mississippi

- Join the Streamlined Sales and Use Tax Agreement - The Streamlined Sales and Use Tax Agreement is an agreement between 23 states to make it easier for remote sellers to collect sales taxes in member states by promoting simplification and uniformity. Joining Streamlined not only makes compliance easier and less costly for remote sellers selling into the state, doing so can result in increased sales tax revenue for member states through increased voluntary compliance rates.

- Change safe harbor thresholds to be based on retail sales rather than gross sales - In this state, progress toward safe harbor thresholds currently is based on gross sales volume. This means that wholesale sales count toward safe harbor thresholds, even though they are between businesses and nontaxable. A threshold based on retail sales ensures that businesses do not need to collect sales tax unless they have a high enough volume of sales to end consumers — ultimately, the types of sales that are relevant for tax purposes.

- Measure safe harbor threshold progress based on calendar years, not the preceding 12-month period - Since the vast majority of states measure sales volume based on sales taking place in a calendar year, states using any other measurement period represent a unique headache. Using calendar years to measure threshold progress is not only easier for remote sellers, it also minimizes errors that revenue officials have to navigate and correct.

- Allow sellers to begin collecting sales tax on the first of the month beginning at least 30 days after the safe harbor threshold is exceeded - Adding another state into sales tax compliance infrastructure, regardless of what tools the seller uses to do so, is often a complicated and time-consuming process. Sellers should be guaranteed a minimum of 30 days to prepare to begin collecting sales tax in an additional state.

- Allow remote sellers the option to collect at a single statewide rate - Collecting sales tax at many different local rates adds a great deal to the complexity of collecting sales tax for out-of-state sellers. Alabama and Texas allow remote sellers the option to collect at a single, statewide weighted average sales tax rate, then handle disbursement of the funds on the back end. This allows a balance between preserving localities’ ability to set tax rates based on their revenue needs and greatly simplifying compliance for remote sellers.

Missouri

- Join the Streamlined Sales and Use Tax Agreement - The Streamlined Sales and Use Tax Agreement is an agreement between 23 states to make it easier for remote sellers to collect sales taxes in member states by promoting simplification and uniformity. Joining Streamlined not only makes compliance easier and less costly for remote sellers selling into the state, doing so can result in increased sales tax revenue for member states through increased voluntary compliance rates.

- Raise the safe harbor threshold to reflect the fact that Missouri is a larger economy than South Dakota - The $100,000 sales threshold before a remote seller must collect sales tax is taken from South Dakota’s threshold in the Wayfair case. A higher threshold should be enacted to reflect the difference in size between the state and South Dakota.

- Change safe harbor thresholds to be based on retail sales rather than taxable sales - In this state, progress toward safe harbor thresholds currently is based on taxable sales volume. While this is intended to help businesses by excluding tax-exempt sales, in practice it requires businesses to familiarize themselves with the state’s sales tax code in order to determine which transactions are taxable — defeating the purpose of safe harbors. A threshold based on retail sales still excludes wholesale transactions, but is easier to track than one based on taxable transactions.

- Exclude sales made on a marketplace platform from counting toward an individual remote seller’s safe harbor threshold - When sales are made by individual sellers through online marketplaces (such as eBay or Etsy), the marketplace is responsible for collecting sales tax and remitting it to the state. These sales should not also count toward an individual seller’s safe harbor.

- Measure safe harbor threshold progress based on calendar years, not the preceding four quarters - Since the vast majority of states measure sales volume based on sales taking place in a calendar year, states using any other measurement period represent a unique headache. Using calendar years to measure threshold progress is not only easier for remote sellers, it also minimizes errors that revenue officials have to navigate and correct.

- Allow remote sellers the option to collect at a single statewide rate - Collecting sales tax at many different local rates adds a great deal to the complexity of collecting sales tax for out-of-state sellers. Alabama and Texas allow remote sellers the option to collect at a single, statewide weighted average sales tax rate, then handle disbursement of the funds on the back end. This allows a balance between preserving localities’ ability to set tax rates based on their revenue needs and greatly simplifying compliance for remote sellers.

Nebraska

- Raise the safe harbor threshold to reflect the fact that Nebraska is a larger economy than South Dakota - The $100,000 sales threshold before a remote seller must collect sales tax is taken from South Dakota’s threshold in the Wayfair case. A higher threshold should be enacted to reflect the difference in size between the state and South Dakota.

- Eliminate the 200-transaction based threshold trigger - Currently, sellers exceeding 200 transactions are required to collect sales tax, regardless of the dollar value of those sales. This arbitrarily punishes sellers with a large number of low-value transactions, when the number of transactions has no bearing on the amount of sales tax that would be collected.

- Exclude sales made on a marketplace platform from counting toward an individual remote seller’s safe harbor threshold - When sales are made by individual sellers through online marketplaces (such as eBay or Etsy), the marketplace is responsible for collecting sales tax and remitting it to the state. These sales should not also count toward an individual seller’s safe harbor.

- Allow remote sellers the option to collect at a single statewide rate - Collecting sales tax at many different local rates adds a great deal to the complexity of collecting sales tax for out-of-state sellers. Alabama and Texas allow remote sellers the option to collect at a single, statewide weighted average sales tax rate, then handle disbursement of the funds on the back end. This allows a balance between preserving localities’ ability to set tax rates based on their revenue needs and greatly simplifying compliance for remote sellers.

Nevada

- Raise the safe harbor threshold to reflect the fact that Nevada is a larger economy than South Dakota - The $100,000 sales threshold before a remote seller must collect sales tax is taken from South Dakota’s threshold in the Wayfair case. A higher threshold should be enacted to reflect the difference in size between the state and South Dakota.

- Eliminate the 200-transaction based threshold trigger - Currently, sellers exceeding 200 transactions are required to collect sales tax, regardless of the dollar value of those sales. This arbitrarily punishes sellers with a large number of low-value transactions, when the number of transactions has no bearing on the amount of sales tax that would be collected.

- Exclude sales made on a marketplace platform from counting toward an individual remote seller’s safe harbor threshold - When sales are made by individual sellers through online marketplaces (such as eBay or Etsy), the marketplace is responsible for collecting sales tax and remitting it to the state. These sales should not also count toward an individual seller’s safe harbor.

- Allow remote sellers the option to collect at a single statewide rate - Collecting sales tax at many different local rates adds a great deal to the complexity of collecting sales tax for out-of-state sellers. Alabama and Texas allow remote sellers the option to collect at a single, statewide weighted average sales tax rate, then handle disbursement of the funds on the back end. This allows a balance between preserving localities’ ability to set tax rates based on their revenue needs and greatly simplifying compliance for remote sellers.

New Jersey

- Raise the safe harbor threshold to reflect the fact that New Jersey is a larger economy than South Dakota - The $100,000 sales threshold before a remote seller must collect sales tax is taken from South Dakota’s threshold in the Wayfair case. A higher threshold should be enacted to reflect the difference in size between the state and South Dakota.

- Change safe harbor thresholds to be based on retail sales rather than gross sales - In this state, progress toward safe harbor thresholds currently is based on gross sales volume. This means that wholesale sales count toward safe harbor thresholds, even though they are between businesses and nontaxable. A threshold based on retail sales ensures that businesses do not need to collect sales tax unless they have a high enough volume of sales to end consumers — ultimately, the types of sales that are relevant for tax purposes.

- Eliminate the 200-transaction based threshold trigger - Currently, sellers exceeding 200 transactions are required to collect sales tax, regardless of the dollar value of those sales. This arbitrarily punishes sellers with a large number of low-value transactions, when the number of transactions has no bearing on the amount of sales tax that would be collected.

- Exclude sales made on a marketplace platform from counting toward an individual remote seller’s safe harbor threshold - When sales are made by individual sellers through online marketplaces (such as eBay or Etsy), the marketplace is responsible for collecting sales tax and remitting it to the state. These sales should not also count toward an individual seller’s safe harbor.

- Allow sellers to begin collecting sales tax on the first of the month beginning at least 30 days after the safe harbor threshold is exceeded - Adding another state into sales tax compliance infrastructure, regardless of what tools the seller uses to do so, is often a complicated and time-consuming process. Sellers should be guaranteed a minimum of 30 days to prepare to begin collecting sales tax in an additional state.

- Allow remote sellers the option to collect at a single statewide rate - Collecting sales tax at many different local rates adds a great deal to the complexity of collecting sales tax for out-of-state sellers. Alabama and Texas allow remote sellers the option to collect at a single, statewide weighted average sales tax rate, then handle disbursement of the funds on the back end. This allows a balance between preserving localities’ ability to set tax rates based on their revenue needs and greatly simplifying compliance for remote sellers.

New Mexico

- Join the Streamlined Sales and Use Tax Agreement - The Streamlined Sales and Use Tax Agreement is an agreement between 23 states to make it easier for remote sellers to collect sales taxes in member states by promoting simplification and uniformity. Joining Streamlined not only makes compliance easier and less costly for remote sellers selling into the state, doing so can result in increased sales tax revenue for member states through increased voluntary compliance rates.